While the recovery narrative received a boost from only the seasonally adjusted retail sales data this week, the rest of the domestic economy, including and especially unadjusted retail sales, is still being marked down. First, the World Bank reduced its estimates for global growth to 2.8%, meaning that the promised annual recovery is now put off yet another year. Further, the World Bank singled out the Fed, putting the US on notice that not all of establishment economics is so optimistic.

Kaushik Basu, the World Bank’s chief economist, said the Federal Reserve should hold off on a rate hike until next year to avoid worsening exchange rate volatility and crimping global growth.

In its twice-yearly Global Economic Prospects report, the global development lender predicted the world economy would expand 2.8 percent this year, below its 3 percent prediction in January.

While the World Bank was focused more on the US as incorporated into the overall global framework, the OECD was far more specific. Their estimates show US GDP for 2015 falling behind even last year’s “anomaly.”

U.S. growth, which dipped notably in early 2015, is now seen at 2.0 percent for the year, marginally lower than last year’s 2.2 percent, before picking up to 2.8 percent in 2016.

How can this year be worse than last year? This was supposed to be the year in a way that all the prior claims of the same kind were not. There were low oil prices, the best jobs market in decades and a Federal Reserve “proving” its recovery scenario by how suicidal it repeatedly appears with threatening ZIRP – they would only do that, economists claim, if the economy was more than strong enough to take on the added financial burden of readjustment. For the World Bank and OECD to both render such negative verdicts on the 2015 version of recovery is more than disheartening; we are edging mercifully closer to disproving.

If that 2% GDP number were to prove accurate, then in reality that means the OECD’s orthodox models see extended weakness where the Fed’s apparently do not. In other words, as with last year, the Fed is counting on a rapid and sustained expansion that is not showing up in other models – and they openly claim that expectation, folly as all the rest have been. Part of the reason for that conspicuous pessimism on the OECD’s part, just in the US, is that their metrics continue to show declines and weakening not just around winter and weather but ahead.

The OECD’s monthly leading indicator, a measure designed to flag turning points in the international economy, showed dips for the United States and other key economies such as China and Brazil.

The indicator, a synthetic index where 100 is the long-term average, remained at 100.7 in the euro zone but eased to 99.5 from March’s 99.7 in the United States, having fallen below 100 in February. China’s reading declined to 97.5 from 97.7 and Brazil’s to 99.0 from 99.1.

In my view, all these models amount to garbage in/garbage out, and a 99.5 may not be all that much anyway, but it is noteworthy, I think, where they diverge systematically. In reality, the OECD’s models, likely DSGE, are not that different from ferbus and the rest at the Federal Reserve. For that reason, where they diverge is relevant to motivations behind top-down interpretations and unsupported forecasts. That cuts both ways, too, where it may suggest that the Fed is intentionally being over-optimistic to be consistent with both newly adulterated forward guidance as well as rational expectations; but it could also mean that the OECD (and World Bank to a lesser extent) is perhaps not eager for the Fed to be hasty.

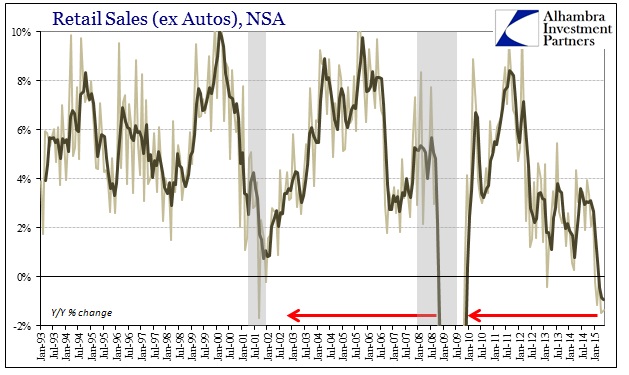

I think that is why context matters, which to me suggests the former far more than the latter. I’ll take retail sales, unadjusted, this week for any tiebreaker on whose models are most potentially dissembling.

Stay In Touch