The inventory component in GDP, change in private inventories, was revised upward yet again forming the basis for the upward shift to -0.2%. At a $110.7 billion increase, the last four quarters have seen inventory gain by a combined $399 billion. That is the largest nominal expansion in history, and the most gained in terms of final sales since the late 1990’s.

That provides another useful perspective on why capacity utilization has fallen off so quickly in 2015, as the combination of wretched sales and this inventory gain will certainly continue to idle capacity going forward. That should be a drag on GDP, for what it’s worth, but more so in real economic terms as businesses throughout the supply chain will have to reconcile the production imbalance (and the financing terms wrapped up in them).

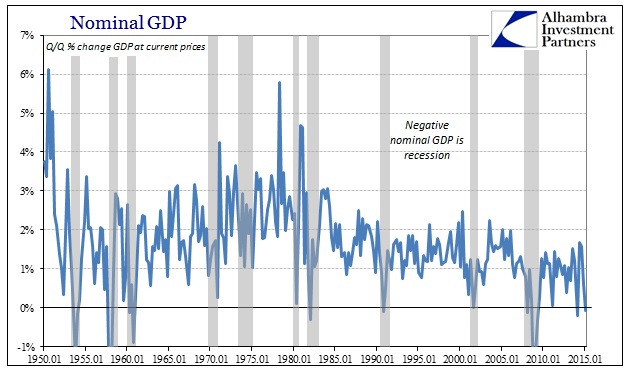

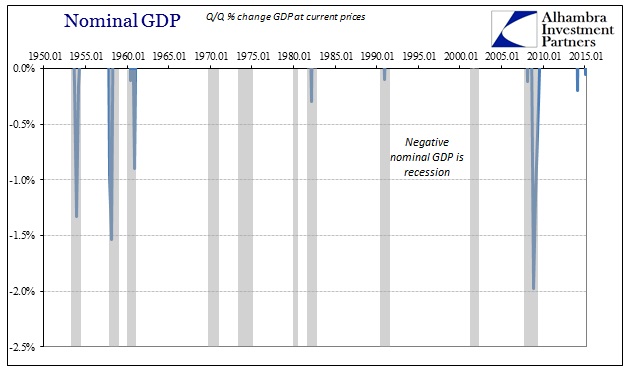

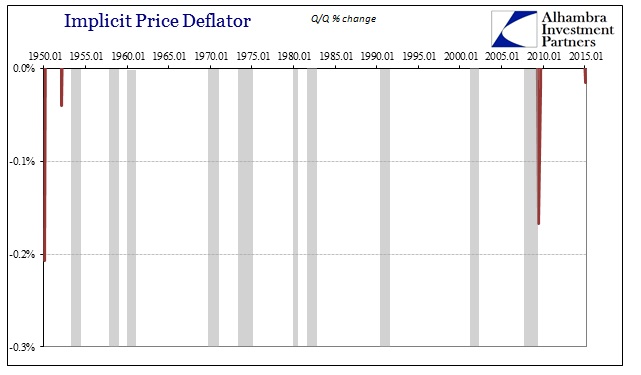

Beyond inventory, nominal GDP and the implicit price deflator were both negative in Q1, a highly unusual occurrence outside of recession (in fact, it has never happened before outside recession). That would suggest far more than seasonality in the current economy, as the implicit deflator has nothing to do with that factor. Regardless of any view on recession, seasonality or mainstream doctrine, the combination here is unquestionably atypical which more than suggests the current economy as at least that much.

Given the behavior of oil prices, in particular, in Q2 so far, this will not likely be repeated immediately but the overall assessment remains especially in light of the massive inventory accumulation. An odd GDP output plus multi-decade high in inventory is not going to produce the massive economic restart that economists still expect. If anything, the timing of the eventual inventory reversions matters almost exclusively to GDP and potential downward revisions, as the real economy itself is already handling (negatively) the consequences.

In other words, the “unusual” GDP report combinations, factoring especially that GDP itself is constructed to show the most charitable view on the economy, demonstrates the negative pressures from the top-down already in existence – that much we know as it corroborates both retail and wholesale sales contractions. The inventory expansion here also confirms the massive imbalance seen in the Census Bureau figures, both wholesale and retail, offering a similarly negative economic assessment.

The potential downside seems to be having a contrary effect, which isn’t unexpected. To the mainstream baseline narrative, the more that potential rises the more everything appears just perfect to it:

We continue to expect that the U.S. economy will expand at a rate of 3% or slightly higher over the remainder of 2015, once economic conditions recover from yet another harsh winter—and other transitory factors—that held back growth in the early part of 2015. This forecast matches the average growth rate over the past 50 years, and is based on contributions from consumer spending, business capital spending, and housing, which are poised to advance at historically average or better growth rates in 2015. Net exports and the government sector should trail be hind [SIC].

Overseas, ongoing quantitative easing (QE) by the European Central Bank (ECB) will help to anchor the nascent economic recovery in the Eurozone, while easing already put in place from the Bank of Japan (BOJ) should secure acceleration in Japan’s economy in the second half of the year. In China, growth has slowed from the unsustainable 10–12% pace seen in the first decade of the 2000s to around 7% this year, but we continue to expect Chinese policymakers to use all the tools in their toolbox (monetary, fiscal, and regulatory) to hit the 7% growth target.

From that view, there is nothing wrong anywhere. Like Janet Yellen’s admonishments according to the Yellen Doctrine, there is nothing to worry about since central banks are on the case everywhere. If you subtract all the past history of the past two decades, there really is nothing to worry about.

Stay In Touch