In April 2013, Janet Yellen gave a speech still as the Vice Chair of the Federal Reserve. Her topic was communication, fitting in that it was given to the Society of American Business Editors and Writers. She expressed the evolution in Fed policy as it had changed since the more direct if silent beginnings in the early 20th century. Not knowing quite what to make of the Great Inflation, orthodox economics settled on some form of “expectations” theory both as a cause for the massive malaise lasting a decade and a half and the total systemic reset of global monetary function as well as the opportunity for monetary control moving forward.

She doesn’t go through “rational expectations” as purely a mathematical existence, however, instead trying to transform that outlook from equations as if they exist in the world we all actually inhabit. In the narrowness of the Fed’s job, or any central bank for that matter, words not only matter they are actually all that matters to those writing and speaking them:

The crucial insight of that research was that what happens to the federal funds rate today or over the six weeks until the next FOMC meeting is relatively unimportant. What is important is the public’s expectation of how the FOMC will use the federal funds rate to influence economic conditions over the next few years.

For this reason, the Federal Reserve’s ability to influence economic conditions today depends critically on its ability to shape expectations of the future, specifically by helping the public understand how it intends to conduct policy over time, and what the likely implications of those actions will be for economic conditions. [emphasis in original transcript]

Perhaps fearing she was being too subtle in embracing the “logical” extremes of rational expectations, Janet Yellen later in that same speech stated it point blank:

Let’s pause here and note what this moment represented. For the first time, the Committee was using communication–mere words–as its primary monetary policy tool. Until then, it was probably common to think of communication about future policy as something that supplemented the setting of the federal funds rate. In this case, communication was an independent and effective tool for influencing the economy. The FOMC had journeyed from “never explain” to a point where sometimes the explanation is the policy. [emphasis in original transcript]

In referring to “this moment” she was highlighting the 2003 FOMC decision to state openly, for the first time, that the FOMC was willing to stay with its “ultra-low” policy rate for an extended period in response to what Yellen called a “stubbornly weak recovery.” From there, as you might expect, Vice Chair Yellen skips ahead to the post-crisis monetary response, somehow missing even if only in terms of timing that effort on the part of rational expectations in 2003 and what was actually unleashed.

There are any number of problems with rational expectations as a basis for the totality of monetary policy, particularly in combination with other assumptions about generic economic factors (aggregate demand primary among them). Taken to further extreme, rational expectations is essentially license to lie to the public, as if admitting reality would so offend intended expectations as to bring about the opposite result – that, I contend, is the current and stated FOMC policy for 2015, as 2014 and 2013, to simply declare that there is a recovery despite all and growing evidence otherwise in the theoretical belief that it will simply be so.

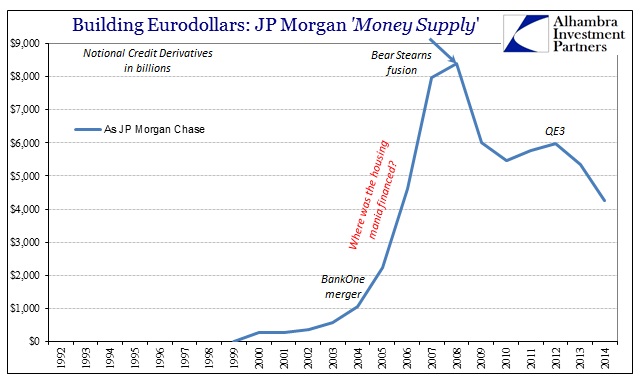

But while Yellen and her central bank counterparts around the world assume they are speaking to everyone and anyone with their policy “words”, that clearly is not the case. The audience for rational expectations-driven assertions may be thought to be as generic, but clearly there is nuance in the reception. We know that all-too-well as asset bubbles, especially that in the middle of the last decade that formed the housing deformity. As the true wholesale money supply surge of that time shows without ambiguity, especially in comparison to the stubbornly deficient recovery even after what Yellen characterizes as a victory of 2003 Greenspan-ism, the reception of those monetary commands was quite different by audience.

In March 2013, Benoît Cœuré, a member of the ECB’s Executive Board, spoke of the great task of redefining economic existence in Europe. While he claimed to be speaking for himself, given what has happened over the intervening two years we can reasonably assume that this was not idle chatter or unrelated wish fulfillment.

As I will strive to show, a redefinition of the social contract in Europe is essential if we are to restore the sustainability of public policies as well as trust in the state’s ability to positively influence economic outcomes. In other words, it is a matter of enhancing the sustainability of national social contracts in a reshaped European framework. Such an evolution will inevitably change the organisation and role of the state, as well as the institutional architecture of Economic and Monetary Union. But this does not mean moving away from the concept of the European social market economy. It means preserving it and consolidating it for the future…

In the crisis, the ECB’s continued commitment to price stability and the integrity of the euro has been one of the few elements of certainty in a highly volatile and uncertain environment. This commitment to monetary stability is not only grounded in its economic merits but is also a cornerstone of the social contract. It protects poorer households from the dire effects of inflation on purchasing power. It ensures that no redistribution of wealth takes place that is unsanctioned by democratic processes, which is exactly what inflation does. And it buttresses political stability by avoiding the social unrest that unchecked inflation can cause.

The first part of the quote goes to strengthen the second; there is a social duty, to these people, to “inevitably change” the “institutional architecture” of the whole of the European economy and financial system. The meat of that duty and target is, he says without presumably erupting in flames, “stability.”

What the ECB and the Fed do in the 21st century through words, often alone, is not in any way stability as anyone reasonable would understand the word. Semantic elasticity being the goal here, perhaps there should be some expected fluidity with fluency, but this strains all boundaries in that regard. For what a central bank aims to achieve is its own definition of stability in that whatever conditions predominate that allows it (or them) to continue its fundamental transformation into “fairness” and the modern, updated (top-down) social contract.

Stability under the gold standard was easy, it simply meant that currency was directly translatable into a specific quantity of gold. Thus, price behavior was honest as all economic agents knew directly and openly the terms of trade; that was the greatest benefit and why it lasted centuries and millennia as the cornerstone of economic progress. In the first socialist economic age, after WWI and before the Great Depression, monetarists decided that honest trade was an impediment to more “fair” redistribution – which is taken not to mean which system contributes most toward global economic advance and thus gets paid for it, but rather equality of result which is really just economic sclerosis and standstill.

Overcoming history and such positive, empirical “tradition” was left, after the Great Depression wrecked the first global fiat experiments, to Yellen’s generation in their newfound appreciation for regressions and the computer power that allowed such math and statistics to further penetrate economic toward projection. For them, what they “found” was enough to transform all monetary function, to gain enough pliability in “money” in order to better wield command, even if command was only words.

As I wrote about last week, the combination of these efforts was epitomized by Robert Merton, Nobel Laureate and entangler of LTCM with money and finance:

My decision to leave applied mathematics for economics was in part tied to the widely-held popular belief in the 1960s that macroeconomics had made fundamental inroads into controlling business cycles and stopping dysfunctional unemployment and inflation. Thus, I felt that working in economics could ‘really matter’ and that potentially one could affect millions of people.

In her scholarly past, Janet Yellen has referenced a similar desire and aspiration. Even Paul Krugman has expressed largely these very same sentiments:

I didn’t grow up wanting to be a square-jawed individualist or join a heroic quest; I grew up wanting to be Hari Seldon, using my understanding of the mathematics of human behaviour to save civilisation.

These people, indeed perhaps the whole generation (with a few notable exceptions, of course) has taken to this ancient ideal of enlightened Philosopher Kings bringing about a fairer, equitable and, I would assume in the end, far more harmonious world. In the case of all these economists, the assumptions are just too numerous to count, but chief among them is the idea that their view of “fair” is likewise universal. Second is that they can actually produce what they seek.

The means to try to do so has been first expressed in the orthodox desire to do away with the business cycle. That is, of course, only the first hurdle to be overcome as they all have much grander plans for where central planning, by words, can possibly lead over time; however, to get on the way toward that “fairer” future requires at least one demonstrable and replicable ability. That was the Great Moderation and why it was so hyped for so long, as it represented “proof” that social science was indeed science and monetarism through expectations management was the correct arrangement of terms.

As Brad DeLong, another of the 1960’s/1970’s Philosopher Kings, wrote in 1988,

That the business cycle consists of repeated transient and potentially avoidable lapses from sustainable levels of output is a major piece of the Keynesian view: there is often room for improvement, and good policy aims to fill in troughs without shaving off peaks. This Keynesian view stands in opposition to the natural rate view that the business cycle is due to expectational errors that alternately push the economy above and below its sustainable growth path.

Before the late 1990’s, Greenspan’s “maestro” age, generic expectations reception was at least plausible; the dot-com bubble and really its bust should have engendered or at least opened such “science” to the possibility of falsification. What the asset bubbles showed, as huge imbalances, is that monetarism and expectations are not applicable in generic terms – some audiences are more likely to respond, and more forcefully, than others. That is just basic common sense even in the most basic case; monetarism may seek to harmonize expectations through rising or falling interest rate mechanics, but those efforts are always going to be received differently by different interests.

In the case of asset prices, there really isn’t much mystery. If that wasn’t apparent enough by 2003, it should be so by now by “proof” of everywhere monetarism has been so deviously employed. From Europe to Japan to China and, yes, even the US, financial agents are far more sensitive and attentive to rational expectations chatter than overcoming very real impediments in the real economy. That is why, as noted earlier today, Greece is quite important in affecting, potentially, “rational” expectations moving forward, as clearly the asset prices were moved by the ECB but the economy, and especially as represented by the fiscal realities of the government, were undoubtedly not.

And so what central banks seek is, again, not stability but rather an intended form of controlled instability which it thinks, and its agents think, will best achieve those socialist agendas. In other words, stability is the result that conforms to fairness not, as is commonly and historically understood, in the means to get there; stability of dollar or money to gain honest trade and thus stable economy has been replaced by anything goes as a disruptive force so long as what comes out in the end is what was expected. That is why redistribution is the favored tool, on the financial end, which is itself anathema to stability. In the contributions, loosely categorized, of the math, controlled instability is consistent with fairness of result by means of subjective determinations of both inputs and outputs.

In that very important respect, the serial asset bubbles of the 21st century stand not only as impediments to those goals but more importantly actual falsification of them. The history of the evolution of wholesale finance exists as one failure after another; but instead of redesigning or even rethinking the means to those ends, what happened was simply more and bigger “controlled” instability.

Start with the S&L debacle. Convention holds that as the end of the traditional banking system, and it was, but that was not the cause or spread of the financial cancer. The S&L crisis began as the rising eurodollar age produced unavoidable pressures on banking and money.

Faced with so many arbitrary distinctions on activities, S&L’s did what financial institutions always do. Really there are only two choices in these circumstances, remove all risk and be even more vanilla since you can’t really get paid for it, or go completely insane and take on as much risk as possible to overcome statutory impediments. Many thrifts chose to be thrifts; many looked in that other direction.

Part of that latter process is certainly to cheapen as much as possible the liability side, which is what opened the door to the undeveloped repo market. According to the FDIC, by 1984 “thrifts with annual growth rates of less than 15 percent had more than 80 percent of their liabilities in traditional retail deposits (generally in accounts of less than $100,000), the comparable figure for thrifts growing at rates in excess of 50 percent per year was only 59 percent.” As the FDIC makes plain, that latter category taking on all these risks were funding them via large-denomination deposits (a notoriously unstable category of funding) and repos.

In other words, even according to the FDIC who had to clean up the mess, the S&L crisis was largely wholesale in character. Regulatory authority responded not as they had before, but instead in what would presage elements of TBTF. Greenspan and the Fed were primarily motivated by retaining banking capacity not because it was in “the people’s” best interests but rather because they saw “the people’s” best interest where the Fed could more readily control GDP – filling in the troughs without shaving off the peaks means banks and debt, debt and more debt. There is only one acceptable recovery to modern monetarism, and it has to be financial.

Stay In Touch