Where money markets seem to be regularly unsettled, credit markets are quite the opposite. Those two polar interpretations may, in fact, be quite related as credit markets are not really supposed to be so placid. Yet, here we find them again lacking much determination in any one direction.

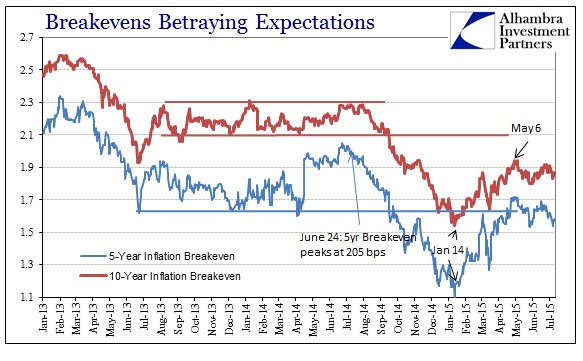

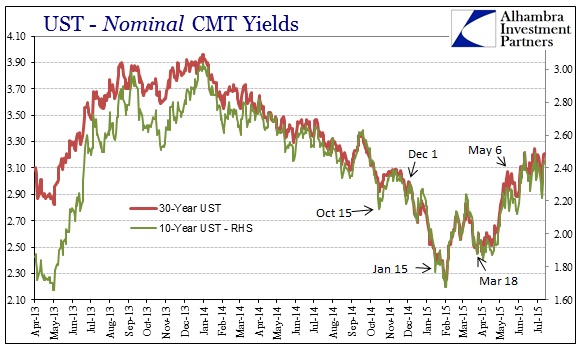

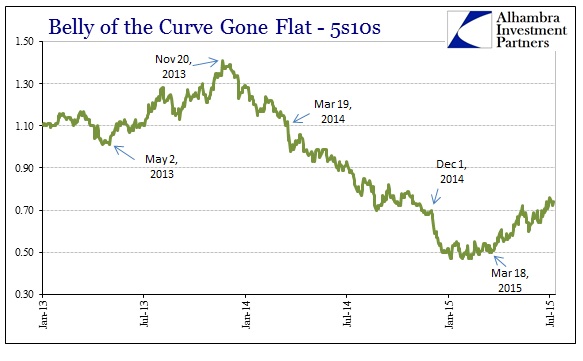

Inflation breakevens which were steadily rising from January 15 to May 6 (Yellen’s bubble speech) have instead gone sideways since. The same is largely true, though still with a slightly steepening bias, of the treasury curve which has clearly lost the sharp retracement that was traded immediately following the March 2015 FOMC meeting. In my view, credit is simply caught between too many conflicting (to the point of polar opposites) views and indications. There is Janet Yellen seemingly standing firm about ending ZIRP because of her still-coming robust recovery while at the same time liquidity and the actual economy (which economists are starting to come to terms with now) are unbending about the exact opposite.

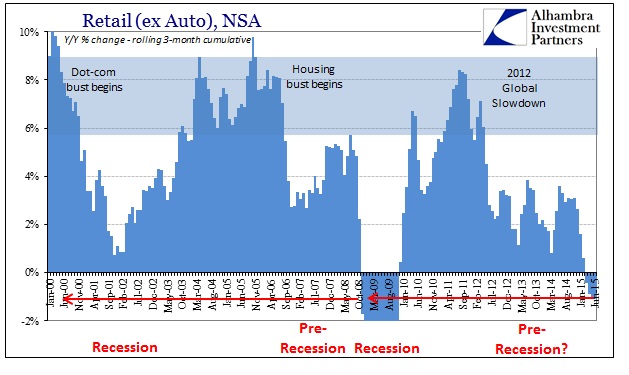

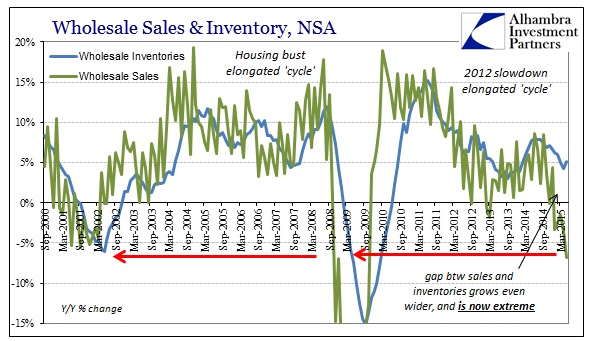

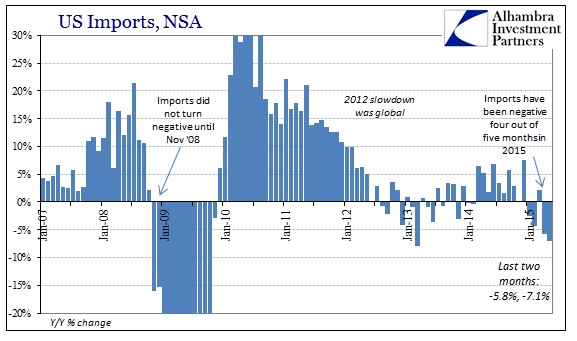

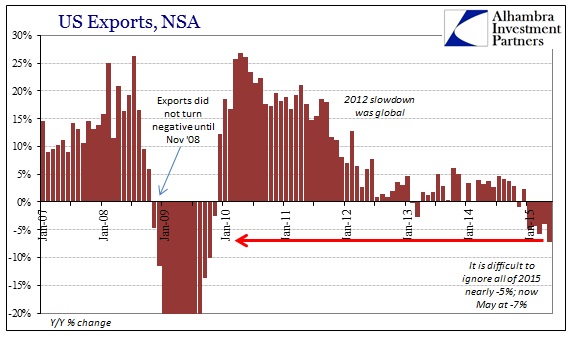

What may be significant about this turmoil of perception was just how much it was anticipated by the “dollar” and credit bearishness of last year. In other words, these markets, to all great and steady derision from economists, seem to have been quite correct about what is just now facing reality (not just in retail sales, but wholesale sales and global trade; pretty much the wider economy). The languishing now seems more about what comes next as maybe a smaller piece of policy expectations aside more hopeful expectations about maybe better economic performance if the Fed doesn’t interfere, balanced against (as 2013 and 2014) potentially further and yet more serious economic dwindling.

As I wrote earlier today, monetary policy can try to fake a recovery but it just doesn’t hold beyond asset bubbles and even then only temporarily (the yield curve history above shows how the yield curve has grown steeper under interest rate targeting soft central planning, but that does not translate into better economic fortune; indeed, the opposite seems to be the case where the steeper the yield curve the worse the economic run). Unfortunately, monetary policy has yet to be completely eradicated from market perception which is why it seems to matter at least in these shorter, discrete periods such as now.

Stay In Touch