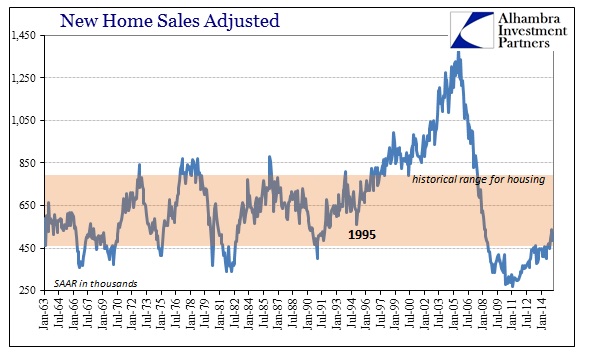

The San Francisco Fed just published a study in its Economic Letter that purports both that the housing bubble was exogenous and that the Fed would have had to crash the economy to a much greater extent than even the Great Recession to gain control of it somewhat pre-emptively. As you can easily surmise, there are a whole host of assumptions in that conclusion:

In our experiment, the rate would have been about 8 percentage points higher at the end of 2002, but would have ended at about the same level observed in June 2006. That is, preemptive interest rate policy would have been extraordinarily tight in 2002 then would have gradually abated to around the level eventually reached in June 2006. By our calculations, such a large increase in interest rates would have depressed output more than the Great Recession did, roughly speaking.

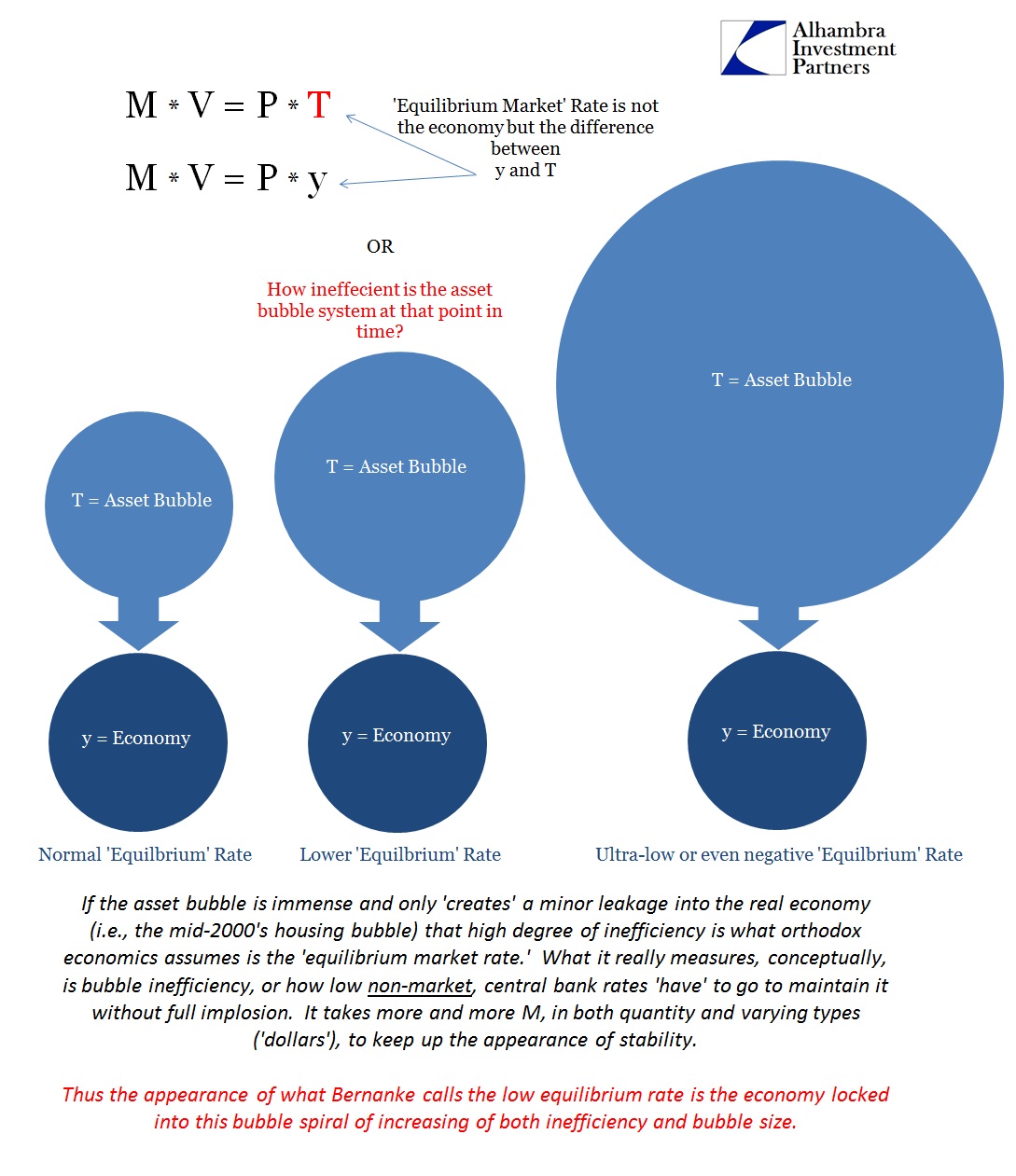

While others will undoubtedly correct FRBSF on the matter of where the housing bubble came from, I am not so sure that there will be enough attention paid to the central axis. Just as the FOMC once held out its interest rate lever as powerful and useful starting in September 2007, the basic assumption here is that a Fed rate increase would have such powerfully damping effects on the nascent housing bubble. In short, they continue to overestimate their 19th century model in both directions.

You would have thought by now, after all the ways in which QE underperformed, as well as seriously negatively performed, that traditional monetary intervention would at least undergo some deep soul searching. Interest rate targeting in 2007 did nothing, to the point they had to resort to monetary measures, QE, which only a few years before, in 2003, they were ridiculing the Bank of Japan about. Nothing has apparently changed the modality of monetary thinking.

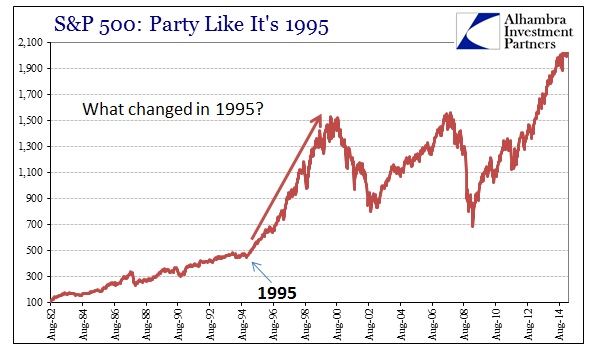

There was, after all, Greenspan’s “conundrum” and Bernanke’s pass-the-buck (pun intended) “global savings glut” during the height of the mania. As Greenspan attempted to actually increase interest rates, to prevent “overheating” of the economy and consumer prices, nothing really responded (including, remember, consumer prices). He started in June 2004 and nominal interest rates beyond the short-term (and even money spreads) acted opposite those intentions almost the entire time – that was his “conundrum.”

The Fed concocted the idea of “term premiums” and spreads as a way to mathematically argue that interest rate targeting had some intended effect that was just too hard to readily discern to the point of being invisible to common sense and actual reason. But that outward relationship remains clear to unadulterated sense of activity in the middle 2000’s – Greenspan attempted to raise rates and the “markets” ignored him.

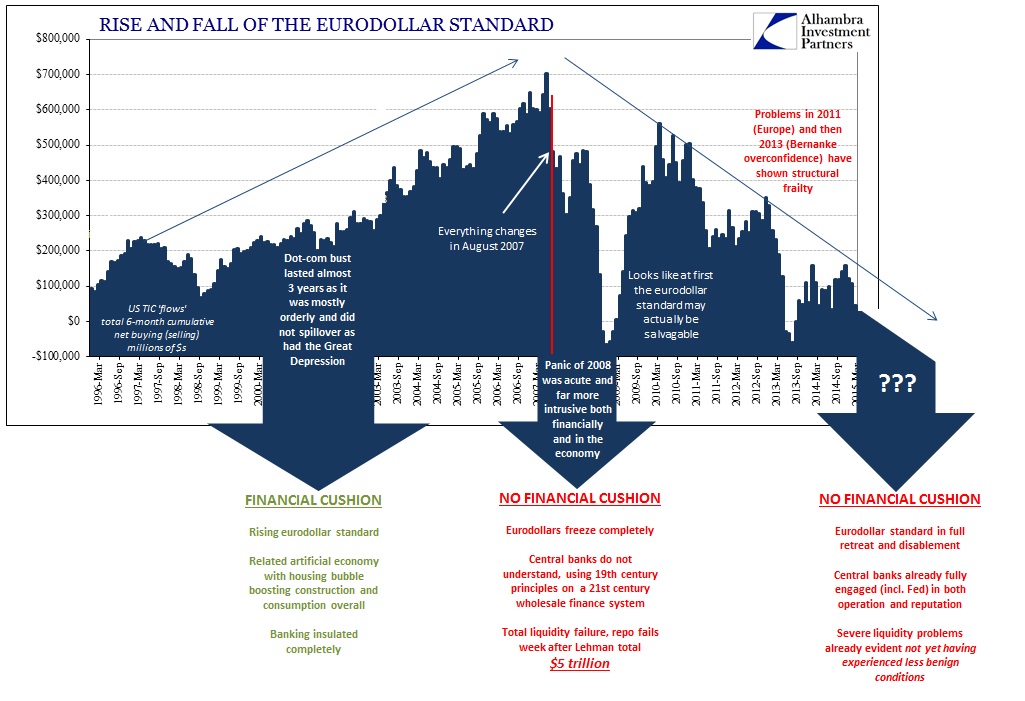

The same relationship has been witnessed more recently though for different but related reasons. The Fed intended in 2013 to spark recovery prices by first threatening to taper QE, then tapering and finally threatening ZIRP. Nominal interest rates and the treasury curve have resurrected again the “conundrum”, all of which suggesting the Fed doesn’t hold such assumed power. Indeed, in both instances that has proved correct; the Fed is far more secondary in terms of the true “printing press.”

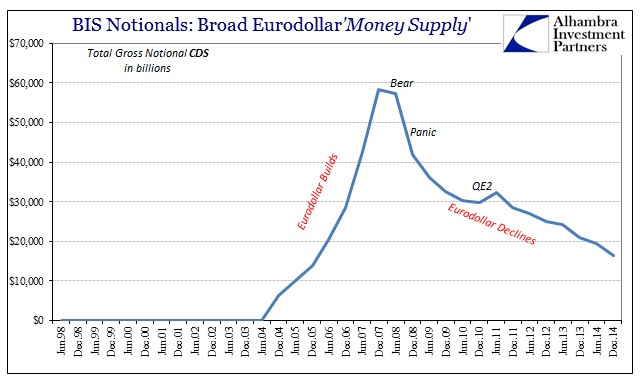

In short, FRBSF just assumed the Fed holds great authority when, in fact, such command has been continually disproven time and again. The fact that there was a full and global panic in 2008 should have ended this line of thinking entirely, but it persists because, as Upton Sinclair once wrote, “It is difficult to get a man to understand something when his salary depends on his not understanding it.” To those that suggest rising interest rates were enough of a cure, witness the rise of housing bubble “dark leverage” during exactly Greenspan’s conundrum:

You could make the case that the rise of CDS as the primary form of dark leverage during the mania was specifically to counter rising interest rates and, how it is properly viewed in this context, less certain funding conditions. Perhaps the Fed’s little rate switch would have made more of a difference in 2002 rather than 2004, but I suspect, strongly, that Wall Street would have moved up the date of raw initiation to coincide.

The power of the printing press under the eurodollar standard has been in global bank balance sheets of varying formats and expressions. The problem as far as the central bank goes is that it assumed itself a primary role that wasn’t real or appropriate. In other words, Greenspan supposed himself a genius, with the media enthusiastically parroting it, when in fact he was just taking credit for a saturation he neither appreciated nor well understood (thus the ridiculous idea of a “global savings glut”). The fact that the overflow of the eurodollar saturation leaked into GDP was that “genius.” So he sat by and attributed the Great “Moderation” to his central bank that was really powerless to do much to influence it – though it was most certainly his duty to do so, which meant understanding it enough to figure out where it was inevitably heading.

This focus purely on the interest rate lever is telling in that regard, as the Fed should have stopped focusing solely on depository banking and started to develop tools and responses to the wholesale model that had supplanted the prior regime decades before all that. It was, after all, the Fed’s responsibility to ensure the panic and Great Recession never happened as they violated, violently, both its “mandates” at the same time. To undercut the asset bubbles should have meant taking full account of the eurodollar standard and developing new ways to actually regulate it (which would have meant real responsibility rather than banks upon their pedestal); rather than just pretend that these economists had it all under control through the same tools developed in the early 1900’s.

The fact that the San Francisco branch is putting out this stuff is further evidence that “they” still don’t get it; and thus have continued to abdicate the full responsibilities they set for themselves. These economists claim they can and do influence the economy to the point of soft central planning, yet they are continually confounded by it to the point of two disasters so far. You would think they would be interested in avoiding future recurrences, but instead appear happy to still operate, in 2015, in ancient denial.

They still don’t know what they are doing.

Stay In Touch