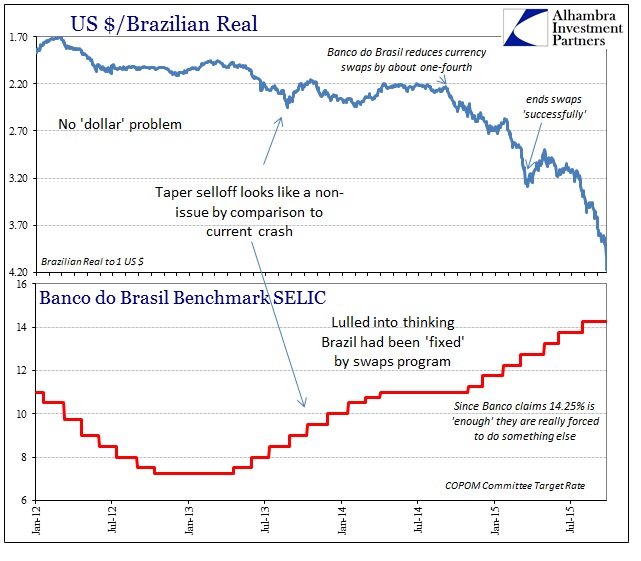

Janet Yellen wasn’t the only central banker boxed in by recent “dollar” strife. The Brazilian central bank sparked a counter rally in the real after it had crashed to an all-time low. After absorbing a relentless and devastating devaluation, Banco do Brasil had run itself out of further options. They had already claimed that raising the benchmark SELIC rate to 14.25% at the end of July would be “enough”, as the gathering Brazilian depression amidst surging “inflation” paralyzes all assumed flexibility. There is simply nothing left for them to do except further attempts at moral suasion no matter how ridiculous.

For one day, at least, it worked. The real, which had traded below 4.20 to the dollar yesterday, was back above 4.00 today.

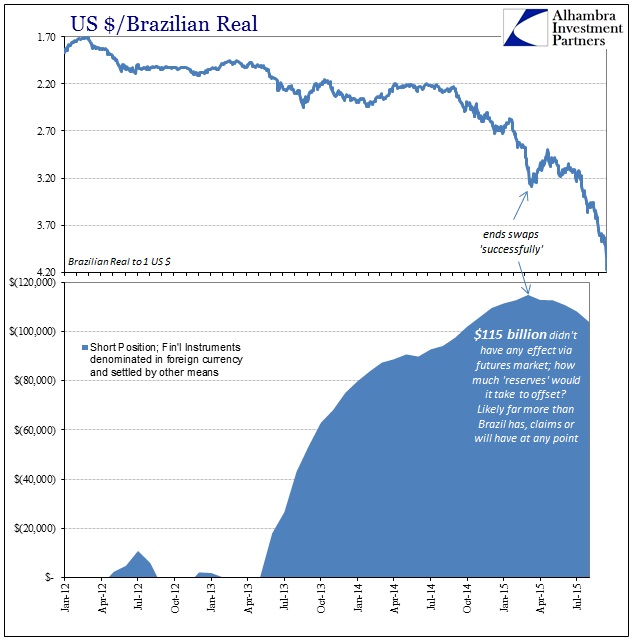

Brazil’s currency futures market, where volumes are nearly three times bigger than in the spot market, has led the slide and that is where policymakers are focusing their efforts – holding a series of auctions of currency swaps, dollar repurchase agreements and local debt, all of which helped reduce volatility in the local yield curve and the real.

The central bank has been able to carry out those operations without dipping into $371 billion of foreign reserves, but faces mounting calls to start selling some of those dollar stockpiles.

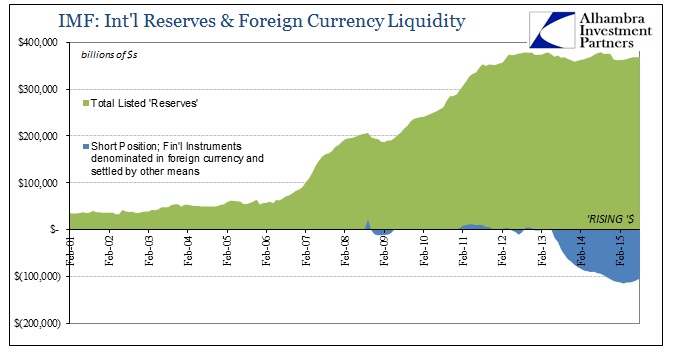

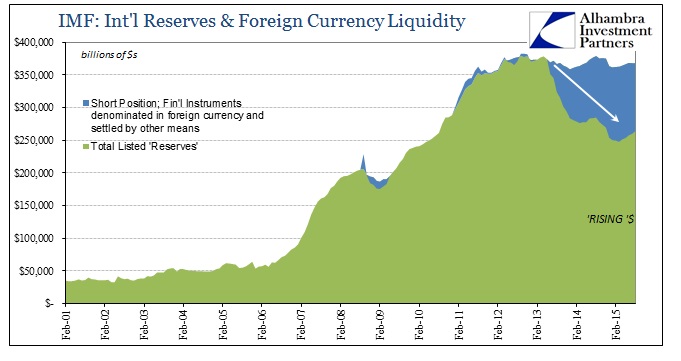

There are a couple of fatal problems with that view. First, it is repeated everywhere that Brazil holds $371 billion of “foreign reserves” and that is what is reported as a headline figure to the IMF. However, the composition of those reserves has to be taken into account, especially since it includes a remaining $104 billion short position in “financial instruments denominated in foreign currency and settled by other means.” That “short” is, of course, those prior “dollar” swaps Banco had been counting on to alleviate the real’s devaluation going back to the first “dollar” outbreak in the middle of 2013.

That is the second fatal flaw in the conventional outlook for Brazil and its “reserves.” Though it wasn’t outright selling, deploying these swaps as it did, and in the manner in which Brazil’s wholesale connection to the eurodollar market works, they have already “mobilized” the equivalent to more than one-fourth their total stated reserve balance and the real still crashed anyway! Worse, those swaps are maturing which means the private “dollar” market not only has to fund current rollovers but also make up for those maturities (perhaps that is why, since they ended the swaps back in March, the real has only accelerated into this crash). It is that part that prompted my reaction all the way back in August 2013 to claim Brazil as already toast by virtue of going down this road in the first place.

I know it’s only one day and a knee-jerk at that, but we again see the idiocy of “celebrating” central bank failure via central bank promises to do more of the same. The combination of 14.25% benchmark interest rates and $115 billion “reserves” workaround via cupom cambial interference amounted to the worst currency disaster in two decades (and the worst currently active in a world awash in currency distress). Would it have mattered at $200 billion and 20%? At some point, you have to realize it’s not the quantity (though central banks never submit on this point, no matter how much empirically moves against them).

By count of that currency trend, Brazil doesn’t have nearly enough resources to do much about the “dollar’s” continued disaster; realistically, they don’t have any actual influence regardless of whatever fight they put up. Money market support (globally) just isn’t there, amplified by the growing perceptions against “transitory” and thus global recession which is best exemplified at the moment in Brazil itself. It’s a tragic outcome for Brazilians, but the ultimate cost of building the country up in the 2000’s via the eurodollar (exactly and relatedly as China).

Since nothing has had even a minor effect to this point, and with the Brazilian economy unable to absorb anything more internally (SELIC), the latest central bank talk is unsurprising. Unfortunately, like broader eurodollar markets, talk is no longer near enough. I would even go so far as to claim action is no longer near enough. The only way to settle this once and for all is delivered efficacy. As I wrote at the end of August about China’s wholesale destruction, ““I don’t think it ends until a fundamental change is made; either the economy starts living up to the promises or liquidity subtracts until prices actually reflect that it won’t.” Given what Brazil has already done, the reflection upon what prices might be and the economy that would suffer them at that “it won’t” point is downright frightening. The true problem for Brazil and the rest of the financialized world is that the only way out (since nobody will undertake real, hard reform since that would mean throwing it, and them, all out and starting over) all hinges on an impossibility; the eurodollar system coming back together.

Stay In Touch