The overnight rate in offshore renminbi liquidity surged over 4% today, the fifth such notable heave in this half of 2015. The rate had been under 2% for the six trading days before and including Friday, but overnight CNH HIBOR jumped from 1.7325% to 4.4525% over the weekend. The one-week maturity similarly spiked, moving from 2.796% at the end of last week to 4.3705% to start this one. Even the 3-month CNH rate, which is typically far, far more stable, increased by more than 60 bps to 4.257%.

Such dramatic moves have become more commonplace in Hong Kong trading of late, coinciding with the obvious travails of eurodollar function especially going back to the start of Q3 (July 6). In more recent weeks, there had been an acute correlation between offshore CNH liquidity and the “price” of “dollar” liquidity in China, as represented by the CNY/USD exchange rate. The PBOC had been involved in pushing that rate upward especially at the end of October after its rate cuts and reserve “release”, but the Chinese central bank has clearly relented on that count. After increasing the country’s official “middle rate” exchange (where the RMB band is anchored), the PBOC has allowed the middle rate to decline for nine straight days including today.

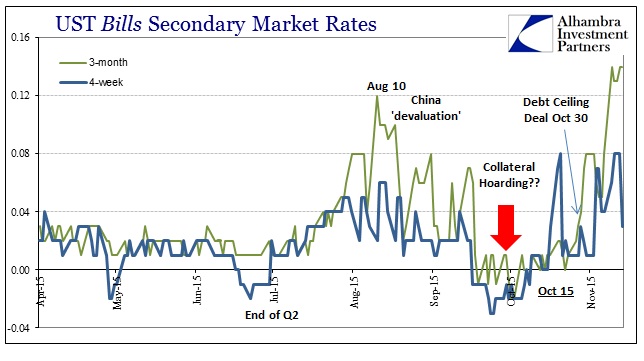

It is, however, interesting to note that the quoted CNY/USD exchange was up in trading this morning when the CNH “fix” was calculated. It might suggest private market function as opposed to strictly artificial imposition by the PBOC’s middle rate, but for whatever case the offshore “tightening” was pronounced – a fact that we can appreciate at least separately from the view of ongoing surliness in UST bills.

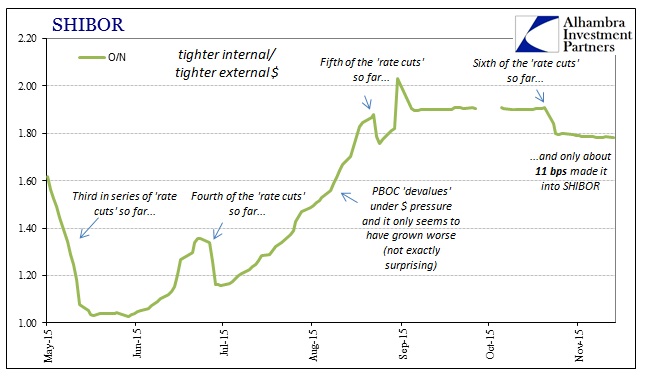

As O/N SHIBOR continues to be pinned (pegged) around 1.785%, the exact nature of “dollar” views from China and Hong Kong will be difficult and analysis truly suspect. I think it at least sets up an interesting experiment for the rest of the week, particularly in how the PBOC reacts with its middle rate fixing for tomorrow’s trading: do they continue to allow the band to trade downward (“devaluation”) slightly or will there be a heightened response to the offshore conditions of today?

With the “dollar” in general in disarray anyway this Asian “dollar” reaction might be just that; given how we have come to expect at least PBOC participation as a catalyst it is somewhat notable as a contrary indication, so it is open to interpretation as to whether “something” might have changed. Of course, it is dangerous to make too much of one day’s trading, as well as further unknowns about what the PBOC is surely doing hidden elsewhere, but the potential for flipping around cause and effect might (over-emphasize “might”) be a reproduction of the last quarter, too. In other words, if I were to generalize what has transpired since early July, it would be the eurodollar upset pushing the Asian “dollar” and then the PBOC’s RMB liquidity to a breaking point, thereby shifting “causation” toward the PBOC’s mis-drawn efforts at dealing with that “dollar” imbalance.

With the arrival of China’s Golden Week at the start of October, it seems as if that chain or relationship might have been somewhat altered, with the eurodollar taking back the marginal setting (particularly after October 15). With UST bill rates conspicuously high (and LIBOR) again in the last part of October and especially into November, it recalls that early August dynamic.

Stay In Touch