To say that the “dollar” is a mess to begin the week is to state the obvious. The condition left at Friday’s close has persisted, with commodities and such being sold heavily from the outset. Japan’s renewed “recession” (I use quotes only in the conventional sense, given that the Japanese economy never truly left) hasn’t helped in that regard, but more so in the growing unease that the idea of “stimulus” is finally being revealed otherwise. In short, the world is economically and financially dangerous and there truly isn’t anything that may rescue the course.

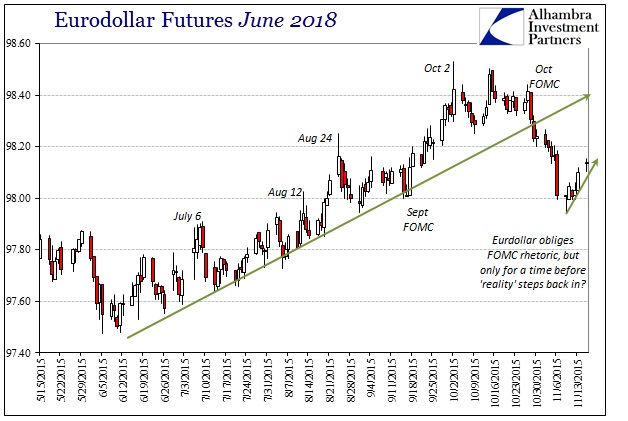

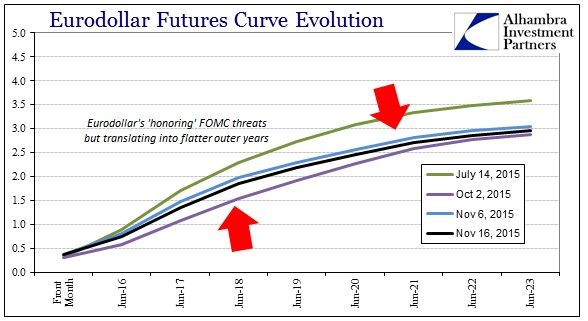

I think that much is being conveyed by the eurodollar curve to start with. Going back to the October FOMC “hawkishness”, eurodollar futures have, on their face, struck back from the highly destabilizing sustained bid in price (shriveling the curve) if only for a few weeks. Money markets still feel impelled to account for the possibility that the Fed can or may raise rates. However, even as the front of the curve was pushed up by at least the threat of policy, the back end remained flat if not significantly flatter for the effort.

In the past few days, the infatuation with “hawkishness” has run, possibly, its inevitable course as a countertrend appears in the works. Remarkably, the curve has only grown flatter in tandem. The June 2017 to June 2020 calendar spread was about 126 bps at the “dovish” FOMC meeting, and 120 bps at the awful September payrolls on October 2. By November 6, through all the supposed brightening and the switch in FOMC perceptions, that same calendar spread has fallen further to just 110 bps and is still at 110 bps this morning.

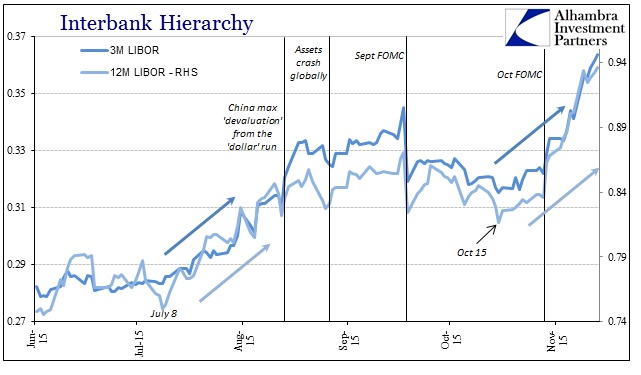

The rest of the money markets seem to be flowing from that consistent endeavor, one which seems to suggest an appreciation only for how the FOMC might make a steadily bad situation worse. LIBOR rates continue to appreciate well-above the September turmoil and in still the same narrow category or trend as preceded all that at the start of Q3.

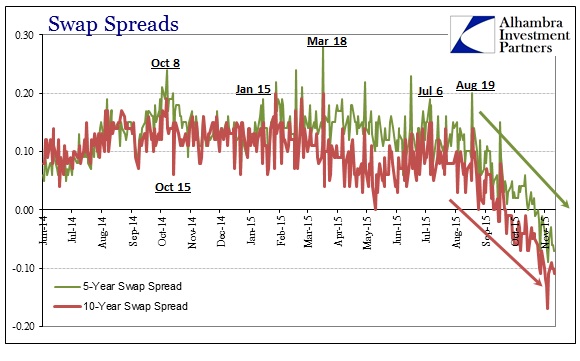

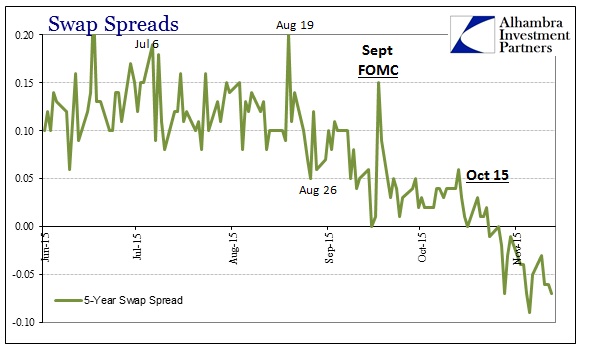

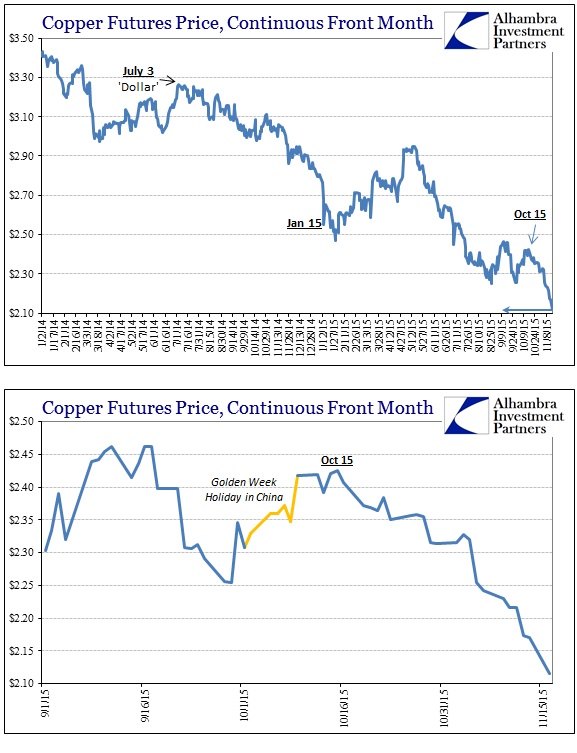

To have commodities selling off, dramatically, under such condition is no surprise. Almost every feature of the money markets is showing highly negative. Swap spreads continue to confound, indicating unrelenting destabilization across the deep dark leverage of bank balance sheet factors available as comprehensive “dollar” supply. Thus, copper trading soundly to a new low around $2.11 is fully unsurprising – a price not seen since the worst of 2009.

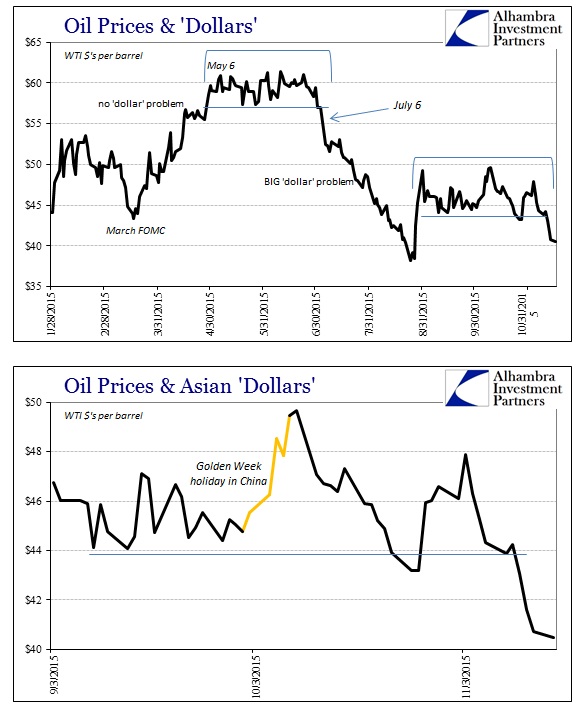

Crude prices, WTI, have likewise been threatening to revisit the $30’s despite having been more sideways or stable since the mid-August liquidations. Again, that suggests renewed funding disruption on par with that time period, or at least an amplified irregularity in “dollar” funding by comparison.

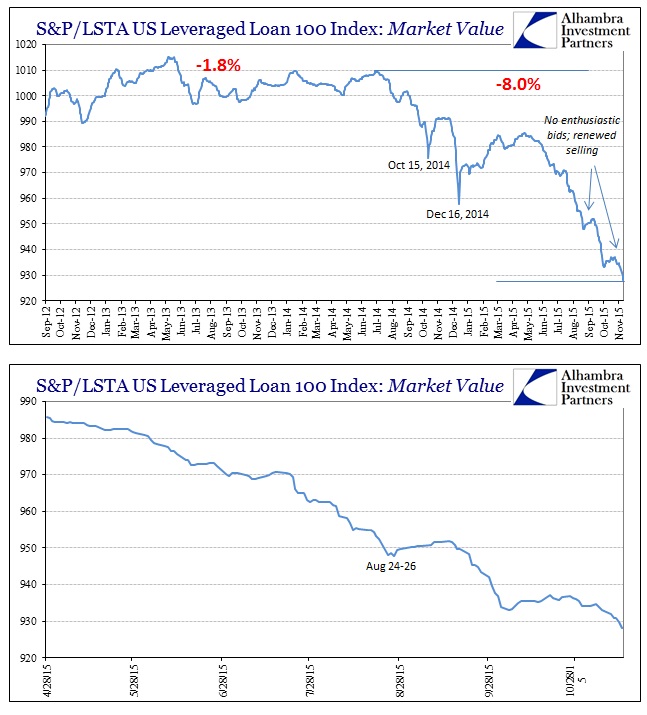

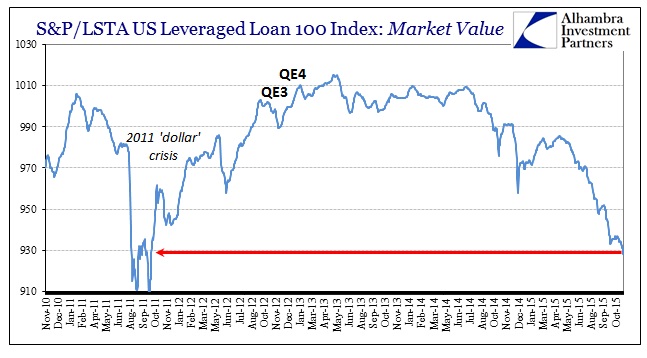

From there, it is almost exclusively downhill. The corporate bubble has been sold, with the market value component of the S&P/LSTA Leveraged Loan 100 sinking below 930 for the first time in more than four years. Because this market is mostly institutional and mostly illiquid, I don’t think it is appreciated for the turmoil that has taken over. The index price of 928.11 is equivalent to some of the worst days of July/August 2011; and it hasn’t been a straight-line crash to get there, either. Instead, it is the steady hand of persistent selling without so much as a sniff of interest in “bargains” to balance that out. This paradigm shift is absolutely striking and so easily visible in these market prices:

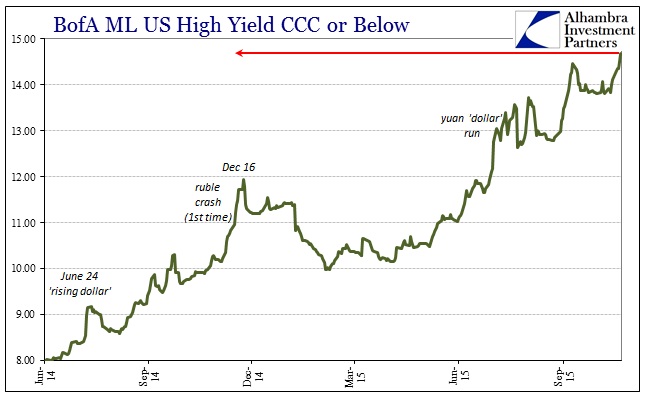

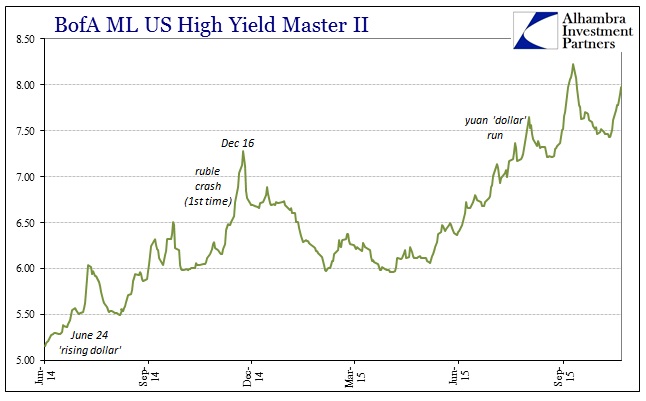

In 2011, there was much more the “crash” behavior which was received, eventually, as ignorable especially as central banks heavily “flooded” not long thereafter (particularly in September and December 2011). In 2014-15, there have certainly been serious episodes but more so in continuation so that the overriding trend may not so easily be dismissed. That is especially true as the natural short-term rebounding tendency has completely disappeared over time (sharp rebound after October 15, 2014; less so after December 16, 2014; now none whatsoever). That would tend to suggest, and highly so, a true paradigm alteration in stunningly visible sequence.

The more retail or open parts of the junk bubble are in complete agreement, as positions there in recent days have also been sold. Yields are either already well-above the August extremes or becoming quite and uncomfortably close.

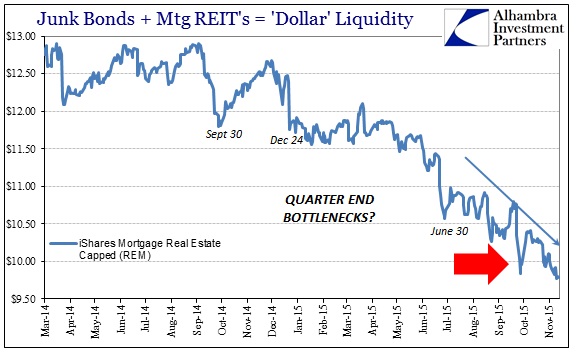

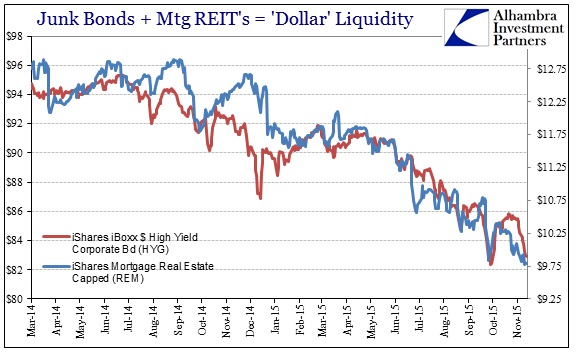

Even HYG, the retail junk version, has run aground on the same gathering mistrust and uncertainty. That negativity even in the retail ETF is traced to “dollar” liquidity, as represented here by the mortgage REIT “tracker” ETF REM. This view of the funding environment has also steadily worsened, not coincidentally, going back to the start of Q3.

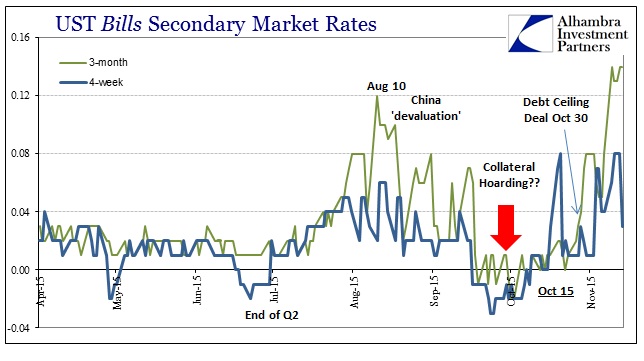

Even UST bills remain under “some” strain which is almost certainly the Asian “dollar’s” wholesale influence though the PBOC. With bill rates (discounts) behaving in this way, just as the rest of the eurodollar world signals dramatic “tightening” and drama, there is little else that might fall under suspicion to account for it.

I think it fair to conclude that heightened “dollar” turmoil again has been highly unfavorable in terms of at least general risk. The fact that there haven’t been open and dramatic liquidations apart from late August is, perhaps, an even more negative indication. A short and sharp “crash” might be forgiven, in some time, as idiosyncrasies converging in unique fashion; a slow and steady drain, punctuated by a liquidation or two, is something altogether more menacing. It is, again, undoubtedly a full paradigm shift that traces back to how the world is being viewed (darkly) and what might be done to reverse that (nothing; the “dollar” will not “allow” it). That leaves far more so the accumulating stain of inevitability and monetary policy increasingly out of the picture (accept to amplify the drain).

Stay In Touch