The market for bankers’ acceptances was one of the first tasks of the Federal Reserve. There was a flourishing financial trade in acceptances in sterling which was purely a matter of the British pound being something like the global reserve currency, at least for a vast portion of global geography. With the United States becoming an industrial and trading power, American interests in financing trade from the point of view of the dollar were relatively uncontroversial. The Fed’s role in acceptances was to provide liquidity as “needed”, as the Fed was authorized to buy them with some discretion.

The point of these debt instruments was to finance global trade between relatively unknown systems and the private parties within them. An American exporting firm wishing to sell goods in dollars to a Chinese importer for the first time might be hesitant to engage since payment would not be due until delivery of the goods. With a bankers’ acceptance, however, the bank stands in between the transaction by essentially guaranteeing that funds have been deposited and that they will be available at the time of completion.

Markets for acceptances were robust especially in the first half of the 20th century. An acceptance would trade at a discount since the holder of the instrument might sell it before maturity. With the Fed implicitly standing behind the dollar acceptance market, they were, in essence, a form of quasi-money but one that was front-facing.

In the latter half of the 20th century, the acceptance market did not disappear as it was simply supplanted by the eurodollar market. The difference was the form of availability in eventual payment. In the acceptance market, the drawer of the acceptance is required to post funds on an individual basis immediately that become the bank’s shared liability; in eurodollars it gets more complicated.

The wholesale international paradigm of trade finance is moved to a more active intermediary basis. Take the example of firms not connected at all to the dollar directly; one in Sweden exporting goods to another in Japan. The Swedish firm must be paid in kronor, so the Japanese firm would contract with a Japanese bank to buy kronor at some specified time, usually three months forward timed to the expected delivery of the goods. If the Japanese bank carried reserves of kronor, not likely, the bank would simply charge its commission and everyone would move on. Holding reserves of this kind, however, is inefficient and costly. Instead, the Japanese bank would intermediate through eurodollars: buy dollars for yen and then sell dollars for kronor.

While that describes the intended channel, in actual practice the Japanese bank would actually engage in eurodollar forwards (or swaps). The Japanese bank could instead more efficiently buy a eurodollar deposit maturing in three months and simultaneously sell forward those dollars into kronor. In terms of actual money or currency, delivery forward is no longer the responsibility of the Japanese bank nor of the Japanese importer; delivery rests upon the ability of the “market” to deliver on time in the form of another bank’s liability in “dollars.” If at maturity, that eurodollar bank doesn’t have “spare” dollars to place in the kronor account, that bank will simply “borrow” them elsewhere in the eurodollar market (if not simply create the requisite liability itself; but that is another story) because the “market” always has them (pre-August 2007).

The core difference between the acceptance mechanism for financial delivery and eurodollar form is striking if ultimately simple (and even elegant when viewed in pre-1995 form). It is the transformation of what was something like DVP (delivery-vs-payment) into another that is perpetually “short” the intermediating currency. Welcome to the global dollar short.

There are other complications, of course, arising from such a derivative form of financial currency; and I mean that in more than one dimension. One such problem that became apparent in the episode we know as the Asian flu were those perpetually damned “speculators.” Whether or not they even exist as central authorities like to claim is immaterial. In point of fact, it really doesn’t matter the motivation for someone trying to “short” your currency in the midst of turmoil as what might look like a speculative short may instead be a more fundamental element of the eurodollar/global trade format. The exits are what the exits are regardless of why they are being accessed; and the effect of central bank intervention is often to narrow the exits over time for the perceived benefit of reducing only immediate irregularity (short-term gain for long-term pain).

That was certainly how Thailand starting in 1997 would be categorized. The Bank of Thailand acted in orthodox fashion which eventually killed the economy and its markets.

In terms of the proximate currency problem in Thailand 1997, the Thai central bank did what the monetary textbook says to do. Unfortunately, economics and economists rarely understand finance, speculators in particular. To defend the baht, the Bank of Thailand sold dollars into the spot market and then engaged derivatives trades, dollar swaps, to protect their reserve stash. Swaps are off-balance sheet, so it appears as if the central bank action supplies needed dollars while keeping the local currency selling from hitting the market (and thus from pushing the value lower).

But swaps, particularly when engaged with the “market” instead of with another coordinating central bank, actually fuel the currency’s demise. Because of the leverage obtainable in currency speculation, the only real means to reduce speculative selling pressure is to make the currency more expensive to short (since it must be borrowed, reduce the availability). Engaging in swaps, which amount to forward selling of dollar reserves, reduce the pressure on interest rates in the short-term funding markets. It’s like sterilizing the impact of selling dollars in the spot market – the central bank selling dollars buys the local currency, making it less available and thus theoretically driving up the cost to borrow it. If you pair the spot intervention with a swap/forward, you’ve given speculators a huge alternative access point to borrow/short your currency.

For Thailand, the clock ran out just about three months after it deployed its wholesale mechanics. On May 14, 1997, Thailand was hit with another wave of “speculation” only this time it occurred while prior dollar forwards were maturing; the pressure upon the baht was then amplified by those prior intervening acts, or short-term gain that quickly disappeared into the intermediate-term nightmare. By July 2 that year, the baht broke its peg and devalued an enormous 16% that day alone. By early January 1998, the baht had been brought down by more than 50% and the Asian flu spread far across the Pacific.

Less appreciated, if not completely forgotten, was the full brunt of what happened thereafter. By the time the financial contagion spread to Japan it compelled a systemic dollar shortage; more specifically, the same kind of dollar “run” that we see too much of today. In November 1997, the Bank of Japan was forced to petition directly (read: beg) the Federal Reserve through FRBNY to open dollar swap lines to circumvent “market” dollar disruption. The Fed accommodated but, as always too late in central banking, the economic damage was done anyway.

Economists and policymakers took from that crisis only that countries needed to be less susceptible to being short the dollar; to accumulate massive quantities of forex dollar “reserves.” It was expected that those huge piles of dollar securities would be all the insurance necessary with which to safeguard against currency turmoil repeating (along with removing currency pegs and funding local debt more so in local currency terms rather than directly in dollars). Yet, here we are in 2016 visiting the same global types.

In recent days and weeks, the epicenter of that currency turmoil is not a small, relatively lacking Asian economy, it is China, the world’s second largest economy and the direct engine of so much global finance and trade. Because of that standing, however, it gets lost that the basis of that finance and trade is not yuan or even the dollar but the eurodollar. The trajectory of China’s financial and banking system, along with its currency, so eerily mirrors that of Thailand in 1997 – and for many of the same reasons. Primarily among them has been how the PBOC has attempted to dispel the “dollar” disruptions that are again systemic (including, quite alarmingly, more indications of Japan and Japanese banks).

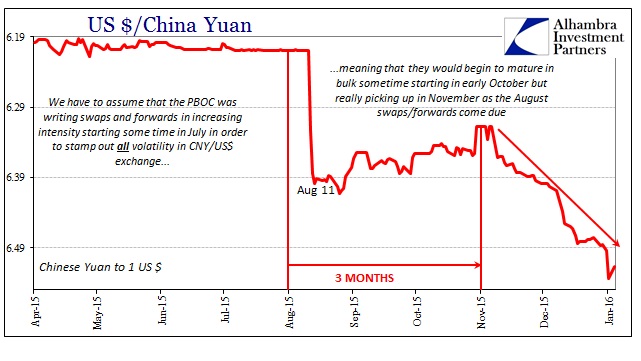

China did what it was supposed to do in accumulating, purportedly, the largest stockpile of forex “reserves” in human history. In fact, the Chinese made that forex the very basis (subscription required) for their internal financial mechanisms with regard to money and market liquidity. And yet, for “some” reason, China was subjected to great strain and even open disorder anyway; forex reserves don’t seem to have quite the effect or give quite the ability economists have expected for nearly the past two decades. Instead, to try and quell outright hysteria in August, and surely starting before it, the PBOC certainly resorted to swaps, forwards and likely an entire array of wholesale re-orientations. For a time, they, like Thailand in early 1997, appeared to work; it was certainly enough to fool economists.

The problem, as always, is the maturity. Engaging in swaps and forwards is not cost-free even for a central bank, and therefore there are very real and heavy limitations to them. This was the experience of Banco do Brasil as its swap regime (which weren’t really swaps in the same sense, but the “dollar short” was) seemed to hold so long as various maturities were rolled. The minute the central bank halted the rollovers, out of necessity, the real plunged as if on the same amplified trajectory as the Thai baht seventeen years before it.

Three months is the most common maturity in these kinds of interbank and wholesale “products” simply as the direct development of global trade finance from pre-modern times. It is convention for reasons of functional history, some of which remains relevant as not all direct economic contact has been removed from banking – a fact that applies perhaps to China more so than anywhere else in the wholesale world. In other words, with regard to China, it is very likely that the first run of forwards written by the PBOC as conditions really intensified in August started maturing around early November.

And that is exactly what we see in the CNY exchange, as whatever the PBOC was doing “bought” at least some time until those maturities. I am more convinced than ever that the reserve requirement that was instituted on October 15 for “dollar speculation” was in anticipation of this exact trajectory as then only a possibility (and a very likely one). As you can see plainly above, the “devaluation” in CNY since early November has already been nearly equal to the great break on August 10 and now Chinese markets have been lifted yet again to another instance of globally concerning disorder.

Worse, as noted yesterday, there is no end in sight for now either the currency (though it was fixed higher today) or potentially internal liquidity in the onshore markets (though offshore CNH has been consistent in suggesting artificiality there, too). Wholesale “solutions” are no such things, as the problem with the “dollar short” is the short; it is the nightmare scenario.

The reason I wanted to revisit the transition from bankers’ acceptances to eurodollars was to both highlight the nature of what really changed in raw money terms but perhaps more so to suggest that it isn’t “speculators” that are core component even of the currency debauchery. Chinese banks are desperate not out of a desire to make money on China’s difficulties, but out of necessity to carry out global trade that is even more basic. This may account for why Chinese imports have been so disastrous in 2015 and entering 2016, especially compared to exports, as the dollar funding mechanism to attain them has become the center-point of the financial controversy (more on that here; subscription required).

That was the lesson that should have been figured out in 1997 and 1998; it doesn’t matter currency pegs, stockpiles of “reserves”, active central banks with full flexibility and discretion, etc. None of those are solutions against the real problem which is the dollar short when the short part becomes too variable and difficult. That was a discrete issue in the Asian flu as it was then somewhat limited in its reach to just Asia, but in many respects it was a full rehearsal for 2008. The problem now is that the eurodollar “short” is no longer limited to temporary, individual outbreaks, even as intense and seemingly fulfilling like 2008, instead having been put on the much more concerning and dangerously unbroken and systemic retreat.

With that in mind, it is no wonder that central bank after central bank is shown powerless while economists remain completely mystified by it all to the point of general absurdity. The great monetary regimes of the world hold not the needed money; the core central bank tenet of currency elasticity practiced everywhere is short of (pun intended) the required currency.

Stay In Touch