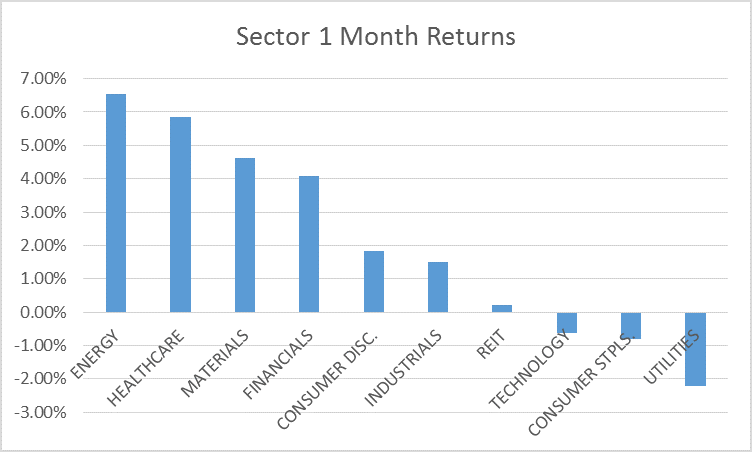

There has been some turnover in the short term leadership but energy and materials are still the leading sectors:

The newcomer moving up in the pack is healthcare which was at the bottom of the one month list last month. Defensive sectors had a bad month with utilities and staples bringing up the rear. Recession fears which were still prominent in last month’s sector post faded over the last month. Energy, materials, consumer discretionary and industrials are all economically sensitive and did well over the month. Healthcare is defensive but biotech is a high beta sector and represents 23% of the SPDR Healthcare ETF.

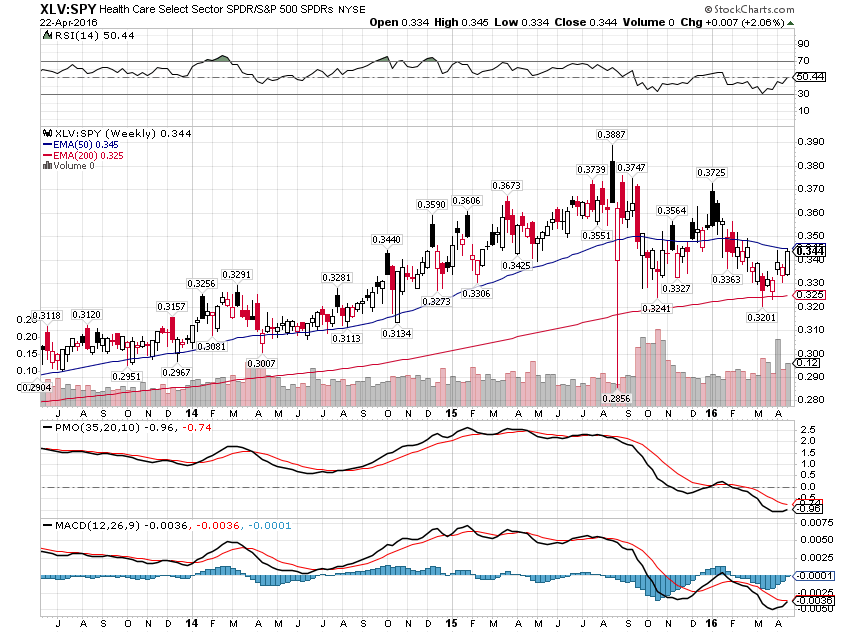

From a relative performance perspective, healthcare did outperform the market over the last month but healthcare appears to have peaked versus the S&P 500 last August after a big run that started way back in 2011. Fundamentally, the sector is more expensive than the market on a trailing earnings basis but a little cheaper on next year’s estimates if you are inclined to believe such crystal ball gazing.

Three month returns show most of the same sectors leading:

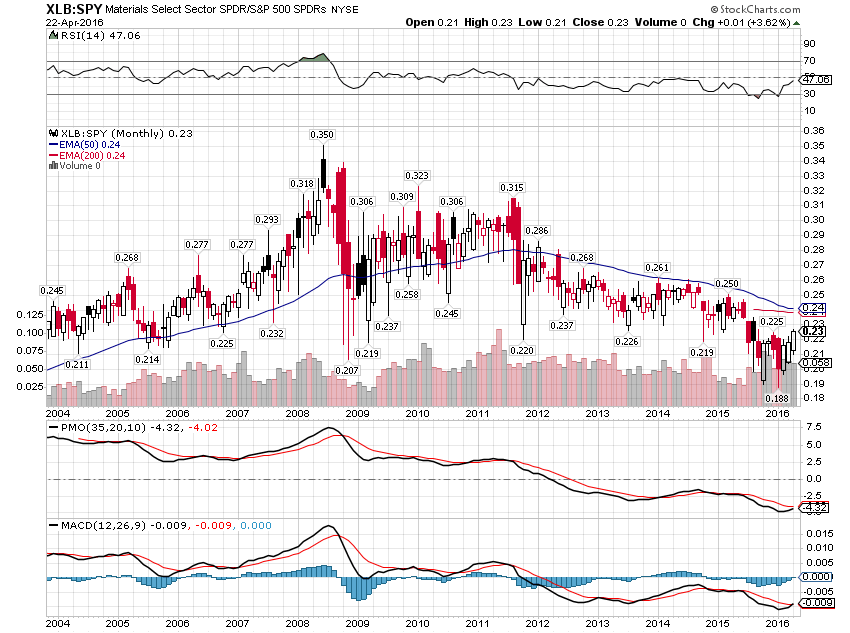

Materials (XLB) is potentially more interesting from a relative performance perspective. Long term momentum appears to be shifting and a buy signal is near if the sector can stay up the rest of the month.

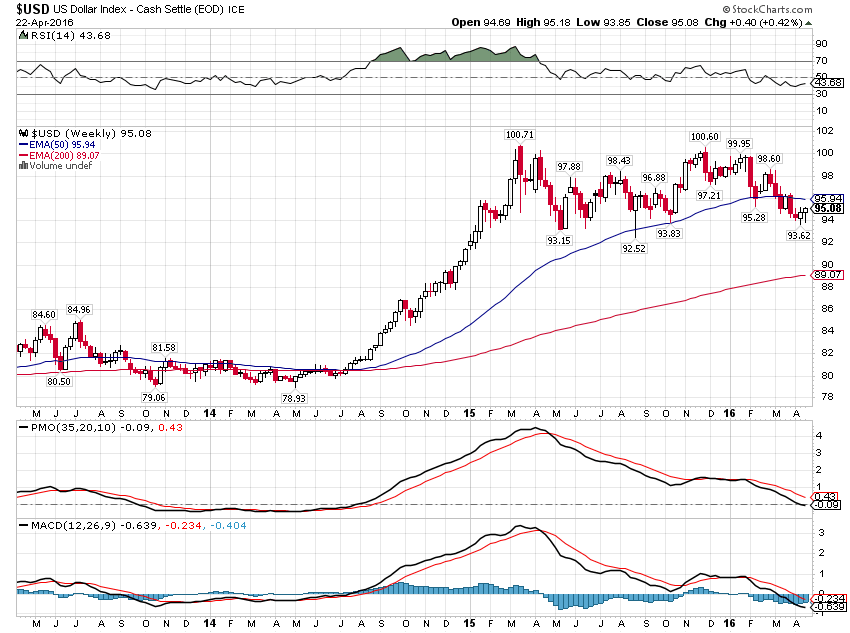

A lot of the energy and materials outperformance – and even industrial to some degree I’d say – is a function of the dollar coming off its highs. If these sectors are to continue leading, if materials are to outperform the market for any decent period of time, the dollar will probably need to break down. That hasn’t really happened yet and a countertrend move higher would not be much of a surprise. With real rates still negative though there is certainly reason to believe the dollar should continue to weaken:

For now I’d be careful getting too aggressive with the weak dollar plays until there is technical confirmation the dollar is headed lower.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or 786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch