With stocks falling today continuing somewhat yesterday’s post-FOMC selloff there was going to be universal citation of monetary policy; or at least these new expectations of monetary policy coming supposedly for June. The dominant narrative remains in favor of Fed power where stocks don’t do well without it. So as the central bank removes so very slowly its “accommodation” we are led to believe that is the cause of equity price angst.

How this idea has survived the events of the past few years let alone since August 2007 is simply disgraceful. If there has been a “Greenspan put” all along how is it that the stock market crashed twice in the 2000’s? The four QE’s added up to $4.5 trillion on the asset side of the Federal Reserve balance sheet, but since June 2014 there have only been increasing and more intense indications of monetary shortage. The federal funds market is barely a market and in many ways ceased to exist in any meaningful fashion many years ago, yet the media treats a rise in the federal funds rate as synonymous with something relevant to actual markets.

On December 16, the day the FOMC voted for a “rate hike”, the CMT yield for the 2-year treasury note was 1.06%; for the benchmark 10-year it was 2.30%. As of today, including the bond market selloff of the past few days, the yield on the 2-year is 0.89% and just 1.85% for the 10s. Even taking into account one “rate hike” in between rates are across-the-board less now, and significantly so, than before it. I could go on in eurodollar futures and swap rates (and spreads).

Stocks around the world sold off on Thursday, while the U.S. dollar gained, pressuring oil and other commodities, as investors absorbed the possibility that the U.S. Federal Reserve will raise interest rates in the near term.

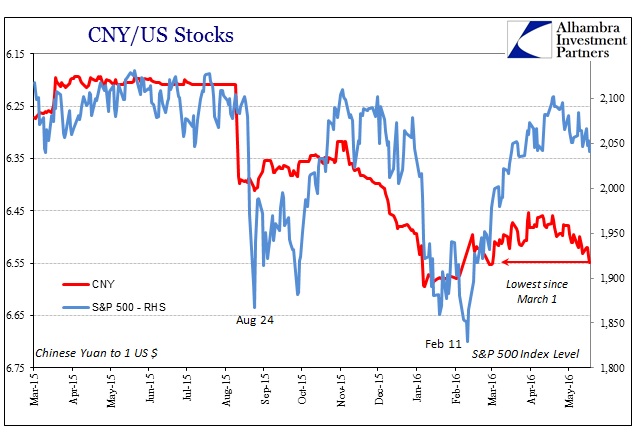

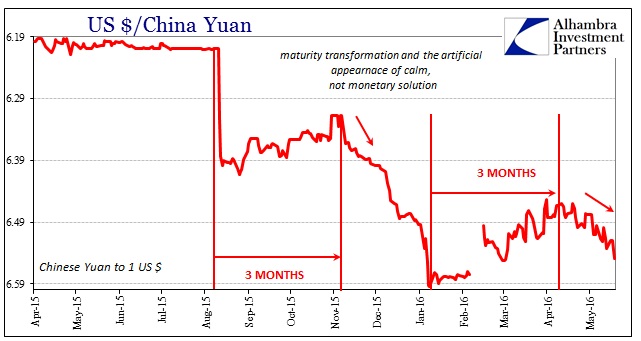

I highly doubt that investors in the core of the global system were at all bothered by the governmental show put on in Washington. It fills media content and may even make for good TV, but to believe anything more than that is defied by continuous observation spreading year after year after year. Rather than suggest that the Federal Reserve might be responsible for the recent inability of stocks to gain, it is much more likely that the dominant correlation across the world has reasserted itself. I don’t think it coincidence that markets struggled today of all days given that the PBOC fixed CNY to its lowest point since March 1. At just shy of 6.55, the exchange rate is threatening to press into the realm that has in the past proven beyond moderate global disruption.

Some might argue that the “rising dollar” against the yuan is itself due to this Federal Reserve dance, but as is plain on the chart above CNY has been turned lower and disruptive globally no matter which way the federal funds rate winds have blown. Last month, it was almost assuredly “dovish”; yet, CNY started downward anyway. This month, it is surprisingly hawkish; CNY only drops more.

Financial markets were adjusting to the minutes of the Fed April meeting, released on Wednesday, in which the U.S. central bank opened the door to a rate hike in June, catching investors off guard.

There is every reason to suspect that PBOC liquidity policy is every bit about eurodollar and its own “ticking clock” that seems to have struck zero more than a month ago. It is very difficult for many to comprehend how the Federal Reserve might be so irrelevant, especially as they have been trained for decades to view the central bank as if it were the singular power in the universe. All that does is demonstrate the clout of PR (Great “Moderation” being the single most effective psyops in history).

By actual count of markets and global market behavior, there can be no doubt otherwise. CNY is the great maker of correlation because global banks want less and less to do with the “dollar” system no matter how many times policymakers say that it is and will be only terrific.

Quiet trading floors are set to depress global investment banks’ second-quarter revenue 24 percent, with the underwriting and equities businesses facing the biggest drops, according to analysts at JPMorgan Chase & Co.

Equity-trading revenue will retreat 28 percent compared with the same period in 2015, while fixed income, currencies and commodities, or FICC, will drop 12 percent, analysts led by Kian Abouhossein said in a report Thursday.

The underwriting business might suffer under conditions of “global turmoil”, but money dealing is supposed to be a big money-maker during the most volatile of conditions. For years we have been told the big banks couldn’t make money because the FOMC and its multiple QE’s had depressed volatility so much (again the unearned deference). Now that volatility is back and in a big way they still can’t make any money as somehow trading floors are conspicuously “quiet.” Maybe, just maybe, it was never volatility or the Fed.

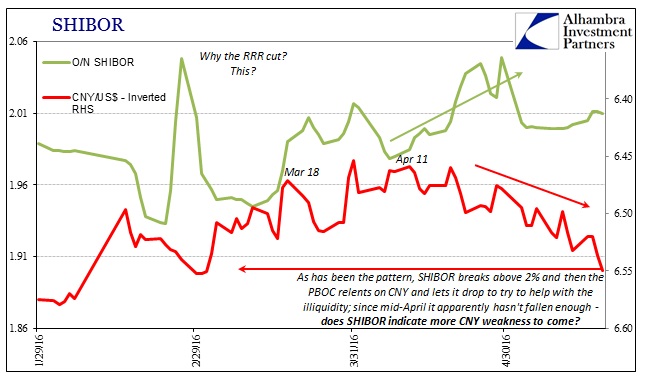

As for the Chinese struggling with this global “dollar” reality, they have their own circumstances that dictate exactly how this ongoing shortage will manifest globally. In short summation, external tightening leads to internal yuan tightening that after some point forces the PBOC to prioritize one over the other. When that happens the Chinese central bank must either continue “supplying dollars” where the private market will not or ditch the effort to offer more internal RMB. The overnight SHIBOR rate strongly indicates where CNY will be going (a discussion about why can be found here – subscription required).

It is, in the end, especially fitting that even US stocks would follow Chinese-borne “dollar” liquidity rather than constantly shifting narratives about whatever symbolic gesture might be provided by the twelve voting economists who actually think they control everything simply by meeting every six weeks. They still think another vote for increasing the federal funds rate would be another vote of confidence in the economy. For the past few years now the world has not been able to fathom what it is these economists have imagined for themselves about economic conditions. It is fantasy all the way around; from influence over stocks and bonds to a recovery that disappears more and more by the benchmark revision.

As noted yesterday, should CNY continue on this course it will undoubtedly turn the FOMC “dovish” again just in time for the June meeting. And to that the Committee will surely “specify” global turmoil without ever acknowledging (or even being aware) that US monetary policy is being set in China because of largely European and Asian banks. Once more, “dollar” not dollar.

Stay In Touch