The Chinese yuan fell again in Monday Asian trading, breaking below 6.70 for the first time. Not surprisingly, the tone to broad early trading in Europe and the US was slightly negative on what would be negative “dollar” factors. I have surmised for some time that Japanese banks have been the primary “dollar” supply for Chinese “dollar” needs, so it was somewhat contradictory in this early trading; JPY was also down.

Over the past week since the relative burst of BoJ infatuation, CNY had found something of a feeble reprieve in JPY finding its QQE religion once again. The divergence started late last week, particularly Friday, suggesting that the relative direction of JPY isn’t necessarily an important indication so much as the intensity of that move. For CNY, at least, that meant more the beginning of last week than its end. JPY for only a few days dropped sharply, but much less so after that (with Friday’s close actually up).

The negative opening today in the West also found JPY moving upward, even if below Friday’s close. Then, suddenly, at around 9:40 am ET JPY was slammed lower by something and the rest of risk markets went with it – except oil.

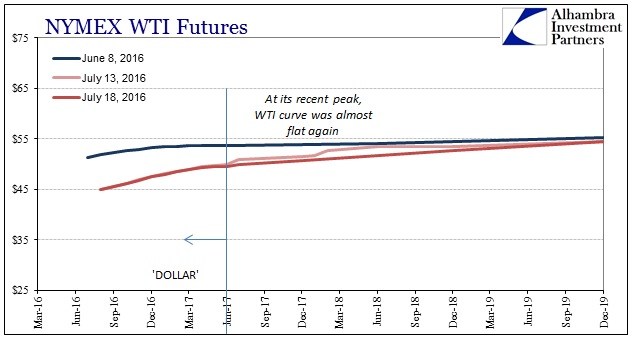

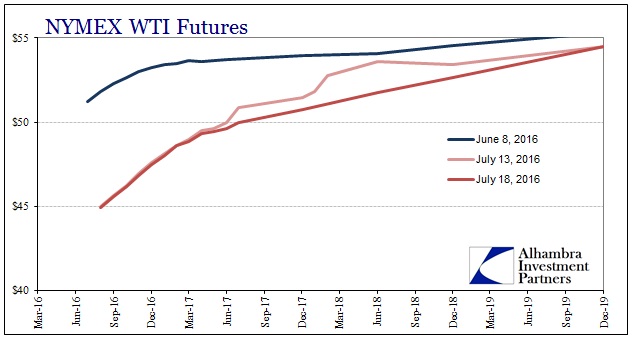

I find it very interesting that oil is responding less to JPY and perhaps more to CNY, meaning “dollar.” This is not to say that JPY isn’t showing us “dollar” factors, but perhaps those of more clouded or indirect associations. Maybe short run. Intraday, there was a very small move in WTI futures consistent with the jump in JPY, but it was minimal and didn’t last more than 30 minutes before reversing.

As a result, or in contrast to, the WTI curve is being pulled lower and more regularly than at the same point last week. In other words, as the front months dropped even though JPY was providing a positive risk emphasis, the back months so far look to be responding in CNY-driven fashion as the whole WTI curve starts to bend lower (to CNY).

I wrote Friday (subscription required) about the sudden “fickleness” of oil in sharp contrast to late January when there was much more direct correlation between JPY and WTI:

The one exception has been, of course, WTI and oil. This is not to say that there has been no discernable benefit to crude prices from less overt “dollar” pressure; unlike the end of January, however, the positive shift has been much smaller, amounting to less than $2 in price from the recent low on Monday. That may be due to increasing fundamental imbalances recognized in crude, including what may be the end of Chinese importation of African oil as conversions of past “dollar” lending, or it may just be the fickleness and unpredictability of “dollar” funding in general.

With CNY acting lower again today, as Friday, it may not be “unpredictability” so much as the possibility of less homogeneity in even the Asian “dollar” (heaven help us as more complexity we don’t need). Since we are still within the short run, there are innumerable factors that could explain the divergence; and may not require figuring out an actual specific case if it doesn’t last past the immediate term. My own view is that there is much less to this drop in JPY than may appear; illiquidity applies in both directions.

If I am right, that would (help) explain why CNY and WTI only partially responded (and CNY in only a pause rather than reverse) rather than more directly participated in the exuberance. It would further suggest that stocks especially here and Europe were not actually buoyed by “dollars” so much as sentiment (sentimentality, really). A (very) low intensity JPY reversal would account for the different WTI response to JPY this time as compared to January. Circling back to Friday’s thinking:

With JPY already suggesting that 105 may be the limit to this renewed faith in “stimulus”, it will be interesting to see how that carries into next week – at the very least what it implies about record high stock prices.

Stay In Touch