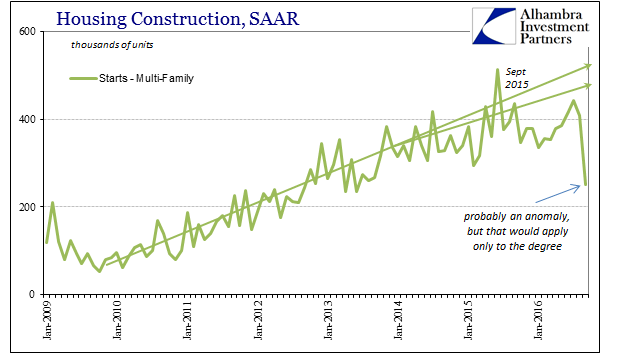

Housing starts unexpectedly fell sharply, for once justifying the use of the description without quotation marks. The decline was concentrated in the multi-family segment. Though apartment construction statistics are highly volatile, this is far beyond the usual wide variation. The seasonally-adjusted annual rate had been above 400k each of the prior three months, so to suddenly tank to just 250k raises some questions.

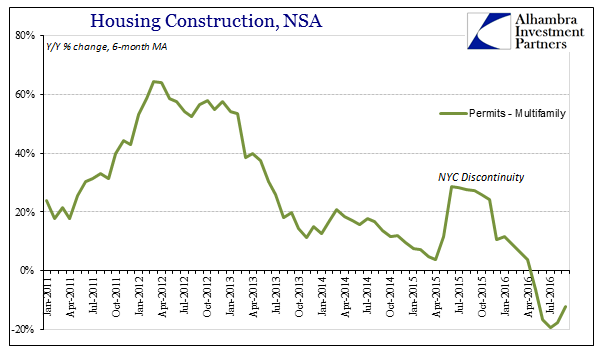

Those would have to begin with the statistics themselves, as clearly there is a good possibility that this is a true anomaly. Whether it is or is not, however, doesn’t actually change the outlook for apartment construction all that much. The level of starts had broken above 380k (SAAR) as far back as November 2013. This construction segment has not experienced a whole lot of growth since then (confirmed by permits).

What is less questionable is that the pace of multi-family construction has clearly jumped off entirely from the prior slower trend into whatever is going on now. The 250k in starts in September may be part of that, but even if it is a statistical quirk to be erased next month by revision or rebound it isn’t going to change this clear deviation. You can make the case that the trend only slowed, again, around 2014 but it has done much more than that since last summer.

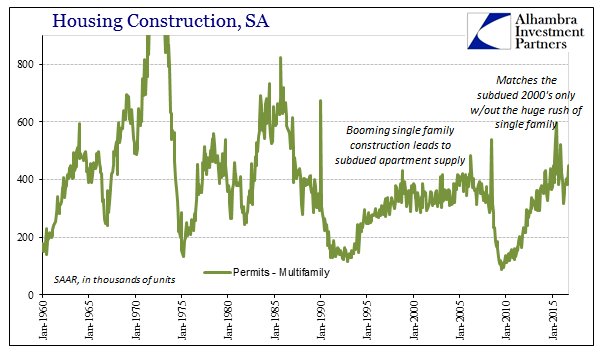

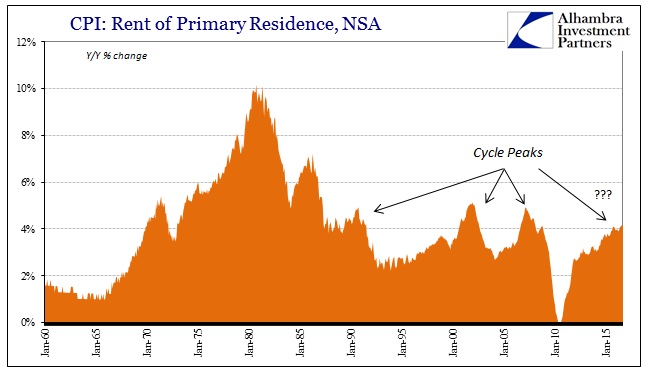

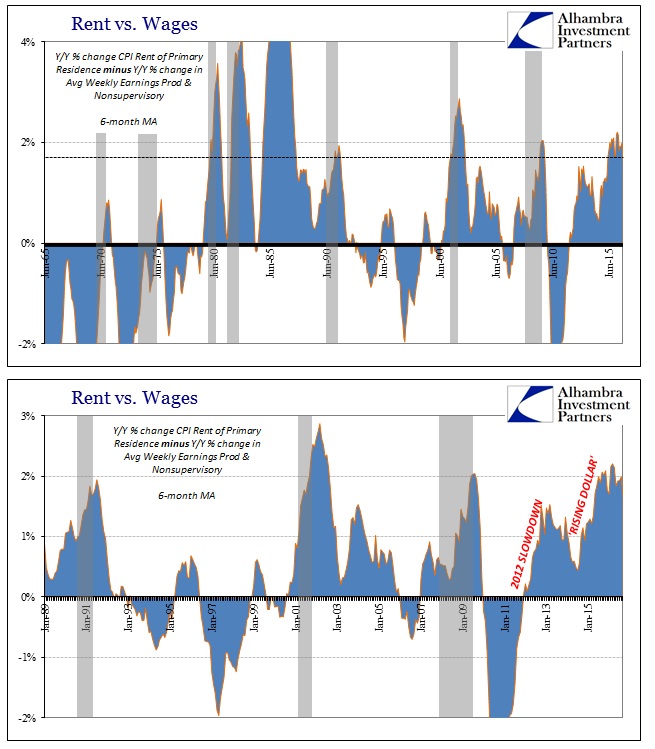

The prospect is further clouded by what the CPI data showed yesterday, meaning rents rising more robustly and in sustained fashion than they have at any time since 2007 (without requisite wage growth to support this). Something is clearly off. If rents were rising as a matter of increased demand obtained by a healthy economy, we should be seeing the opposite in construction. As single family housing, apartment construction should be booming given the lackluster pace of growth in the overall housing stock since the bust if rising rents were suggestive of restrained supply not meeting that demand.

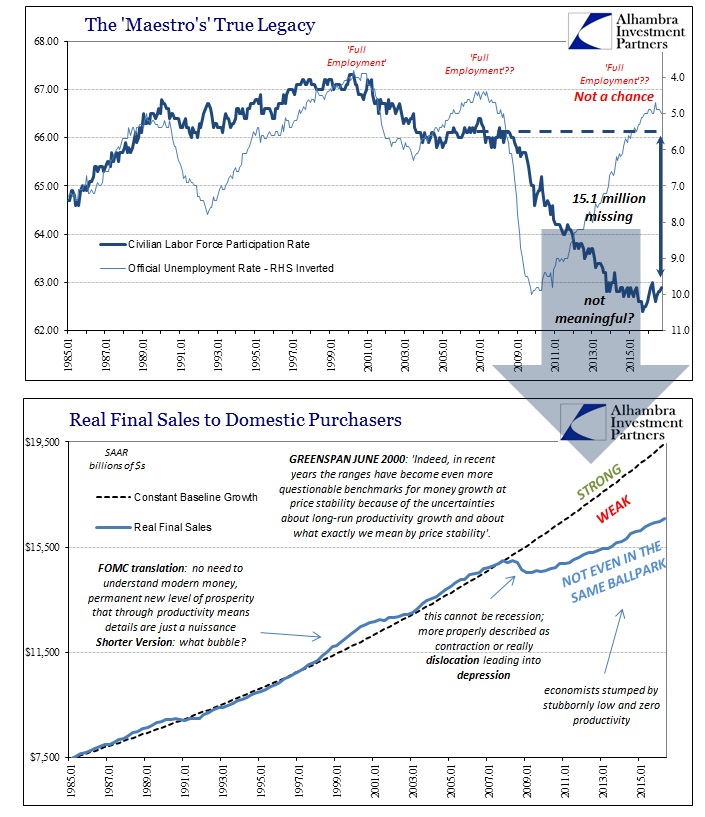

To me, this backward situation argues for non-economic causes clashing now with economic conditions. In other words, I think it far more likely that rising rents are tied to the financial terms that floated the 2011-2013 mini-bubble that greatly amplified the resurrection of construction. Having borrowed heavily, as the Fed wanted, these largely institutional investors have relatively narrow terms to live up to, and if volume growth doesn’t occur (which in apartments might mean higher vacancy rates than modeled and forecast back in and around 2012 when the full recovery was in the mainstream all but assured) leveraged positions have to raise revenue from somewhere, largely via prices.

Higher rents without wages, however, can only reduce demand from whatever relative level. Thus, cutting back further apartment supply would make sense given rising rents backward to basic economics.

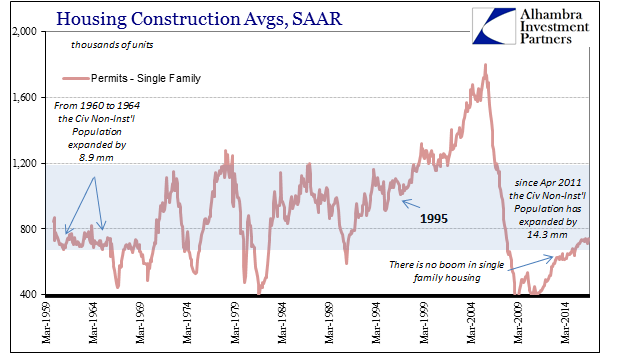

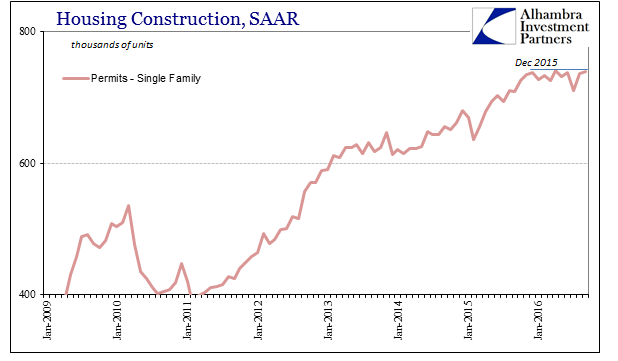

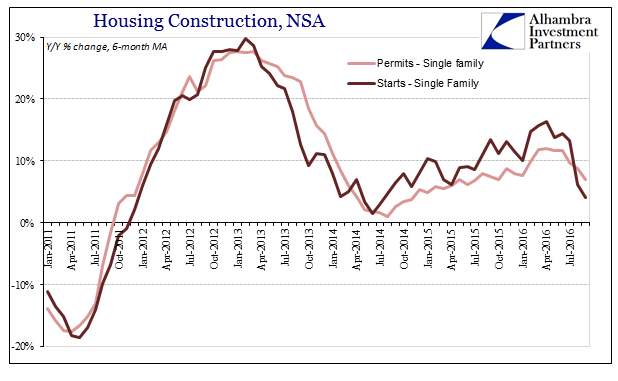

This imbalance in multi-family has not led to dramatic gains in single family, a segment of the housing stock that should, independent of what is going on in apartments, be already booming. Though there has been often seriously positive growth in construction, it remains highly subdued in historical terms but not to mention given the huge decline in activity during and since the bust. It has been a decade since the top in 2006, and despite population growth construction levels are just nowhere near keeping pace.

In a truly healthy economy a full decade after the end of overbuilding, you would expect that reversion would lead to home building at a pace closer to if not at the upper end of the historical range (not the bubble range from 1998 – 2006). This is an economic issue of income, or lack of it, just as what seems to be hobbling apartment construction.

And we find here that in addition to the suspiciously subdued pace given those factors, the trend has also fallen off, perhaps sharply, since last summer. What started out as stunted growth turned by 2013 into slow growth and is now no growth. It fits too well with the non-linear development of the overall US and global economy.

For the apartment segment especially, that would mean, again, past construction undertaken from assumptions that are proving especially dubious – the Fed’s “stimulus” once more showing that all it does is at best pull forward activity without producing any tangible economic benefit for having done so, just a further mess to clean up and a relatively weaker state from which to start doing so.

Stay In Touch