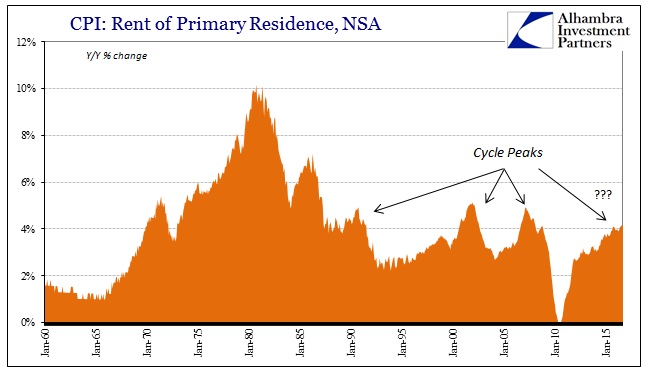

One last part of the CPI report that is worth mentioning is more directly economic than monetary. Rents have been rising for some time, though as I showed last month not wholly out of line with past periods. Before both the dot-com recession as well as Great “Recession” the rent component of the CPI surged upward. It peaked at just less than 5% in early 2007, and just over 5% throughout 2001 and that official recession.

The current CPI-rent is holding at around just 4%, having been steady at this level of change for over a year now. That doesn’t suggest (necessarily) the same cyclical processes as the prior two “recessions.”

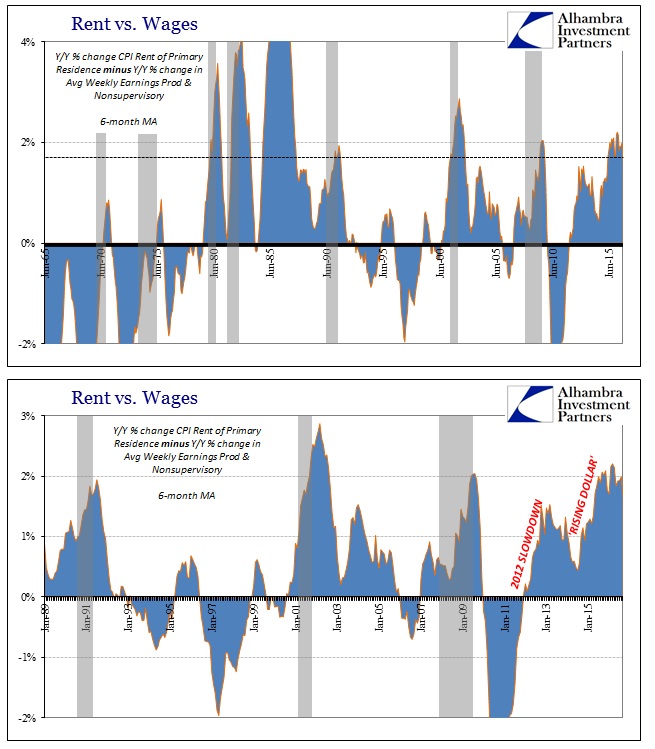

Instead, what is noteworthy and concerning is how that compares to wage and income growth. As pay has tended to decelerate in the BLS statistics, rents have been increasing at that painfully steady rate. The difference over the past two years has been at levels usually found during recessions.

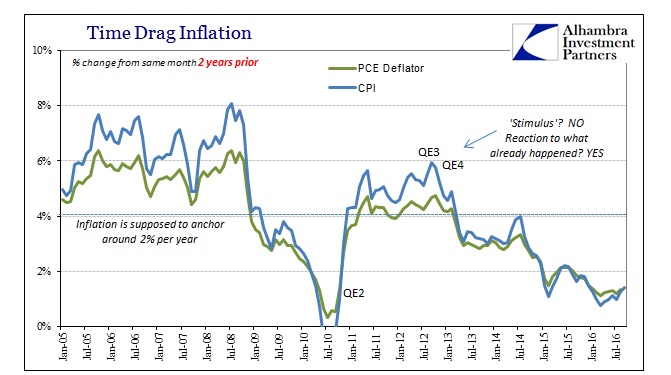

What is particularly troubling, and again indicative of “something” beyond recession, is that the income/wage gap to rent has remained high for far longer than any point in the past. It is a condition that I have called “attrition”, where these long, drawn-out negative economic imbalances are like recessions in every way but the time dimension. And it is time that makes it all the worse, not just for those caught in this trap of stagnation but for broad agreement about what is actually going on (the mainstream just assumes that because it isn’t typical recession all will be well – someday) and therefore what to do about it.

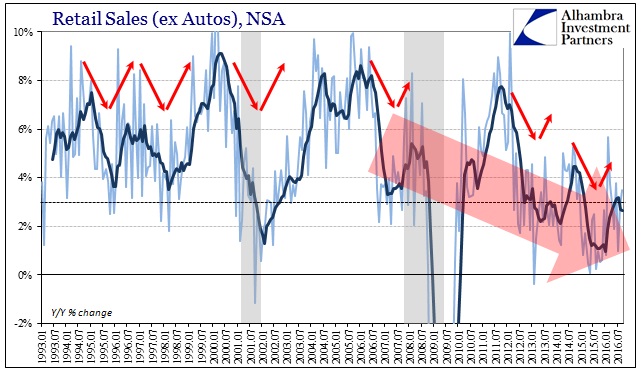

When looking at retail sales for August 2014 back that September, it was clear then that “something” was dimming economic prospects by the way in which retail sales failed to respond as they were expected to finally the absence of snow and Polar winds.

Slow attrition is still attrition, and since compounding is the most powerful force in the universe, a la Einstein, the time component of this pattern is perhaps the most destructive feature of this elongation. It would be far better to undertake a short but even very sharp downturn than to exist perpetually in alternation between shallow contraction and nothing more than its absence.

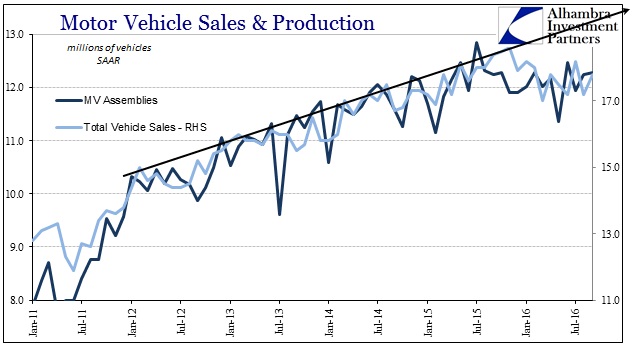

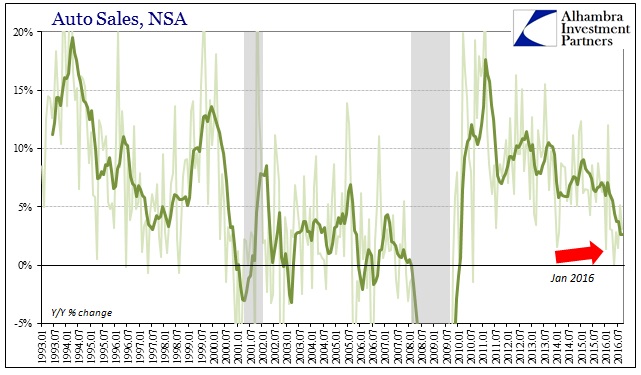

I think, more than two years later, that is still the case in still broadening fashion. This underlying, slow economic weakness is pervasive and sufficiently advanced such that areas once untouched by it, autos and housing most prominently, may no longer be so immune and finally falling to its inexorable approach. The disparity between wage growth and housing costs might be one of the primary mechanisms for this slowly spreading frailty.

Even cheap (by way of easy financing terms) autos are an overburden to households that can’t readily absorb increased rental costs. I think this is why and how this attrition seems to propagate not as a straight line, but rather as a series of negative steps; hits to the economy from which it doesn’t ever recover, leaving it susceptible to the next where in a truly healthy economy it wouldn’t much matter. Each time these occur, the ratcheting pressure of these imbalances “infects” a wider range of economic functions, not like a true cyclical recession bunched all at once but more so as just another marginal negative factor or pressure in a seemingly unending sea of them.

Where it may not (yet) be recession, it certainly feels like it to far too many, and it has for far, far too long.

Stay In Touch