What do you do if you are China? As that question pertains to the “dollar”, they have been asking themselves as well as the rest of the world since the panic. In various ways, the Chinese have been positioning as if for the end of the dollar system, which has given critics (economists) cause to dismiss it as nothing more than geopolitical posturing and global power politics. Far be it for me to defend the Chinese, and reluctantly do I do so, but since the eurodollar’s reversal in 2007 they have been stuck.

So tightly gripped are they on both sides, a new currency regime is about the only answer for them. As much as the Chinese have tried, CNY will not work as a global reserve. China’s economy had advanced enormously but so much of it was tied to the eurodollar itself that it is as unstable a platform as the currency system needing replacement. There have been other trial balloons floating an international currency such as the IMF’s SDR system, but that is more of an acknowledgement of how bad the current framework functions than a realistic option (the fact that the IMF and others first developed SDR’s in the late 1960’s as an intended replacement for Bretton Woods, only to be “beaten” to the task by the eurodollar, tells you all you need to know about the current “dollar” regime and how far down the toilet it has been flushed). Even if it were a realistic option, it would still have to overcome economists and central bankers (redundant), many of whom are perfectly content thinking the dollar of 1955.

Without an end to the “dollar’s” interminable squeeze, there is nothing that can be done for or from China. As I wrote last month, the “evil” is all over their monetary balance sheet. It is CNY’s original modern sin, taking the “easy” way and acting very much like the rest of the world; nobody complained about the “dollar” on the way up, least of all the Chinese. To the PBOC as Western economists, the monetary debauchery of the 1990’s and 2000’s were easily conflated with actual wealth and economic stability drawn from financial stability.

No one envisioned that the credit-based global currency system would ever run so afoul of regular order. Even in March 2009 when Governor Zhou was pleading for Western authorities to actually understand the world’s monetary arrangements he wasn’t at that time doing so with the expectation that the eurodollar, wholesale format was no longer workable; Zhou just wanted a more stable eurodollar…it wasn’t until September 2011 that it became clear any such hope was a futile one (though it wasn’t until 2013, it appears, that Chinese authorities finally realized it; which still puts the Communists so many years ahead of the “free market” West in terms of figuring out what is actually going on).

The Chinese can no more shed the “dollar” as we might in the United States; the world is stuck to it. Not only would the Chinese be shut out of a great many import markets (inbound raw materials) the PBOC’s balance sheet would be gutted overnight. It is such a catastrophic move to contemplate that there is no alternative except to deal with the current limitations of the “rising dollar” as best as possible in the hope that somehow, some way it just starts working again. This is the Chinese variation of the global “fingers crossed” strategy that has yet, unsurprisingly, to birth an actual recovery.

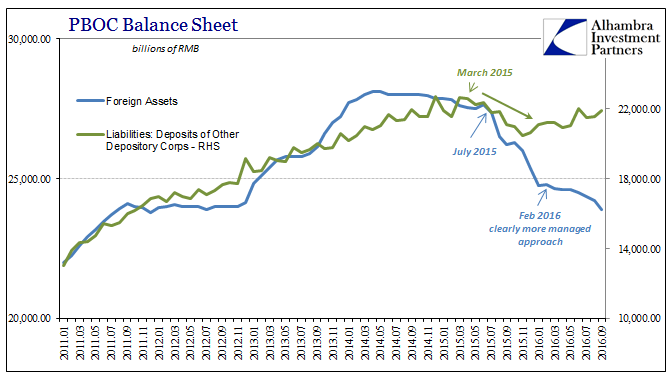

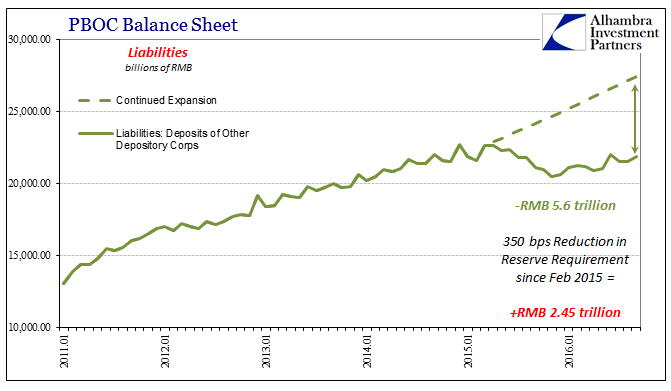

With “dollar” trouble baked right into the asset side, China’s central bank figures for September are still surprising in a couple of ways. According to SAFE, as noted earlier today, China’s “outflows” were about $19 billion in September; a negative number that in the past would have been positive where CNY had been so artificially stable. On the PBOC’s balance sheet, forex assets, which still make up more than 70% of total assets, fell by RMB 313 billion in September, almost two and a half times more than what was reported by SAFE. It suggests, again, the enormous “expenditure” (whose ultimate cost and efficiency can only be evaluated second- and third-hand since we don’t know exactly what the PBOC has been doing) just to keep CNY stable through last month.

Obviously, it didn’t work even though it was twice the pace of forex “disposal” as August, and the third straight month of more than RMB 150 billion to arrest CNY’s prior descent through July.

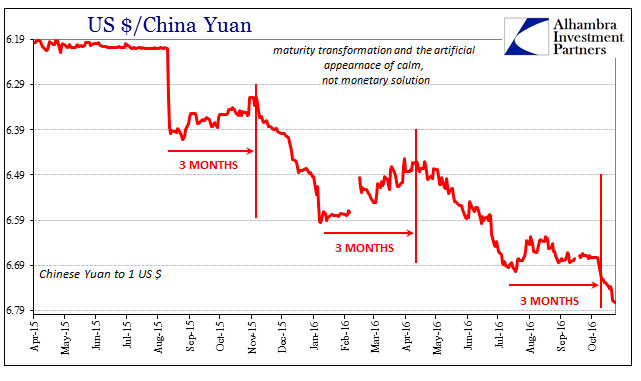

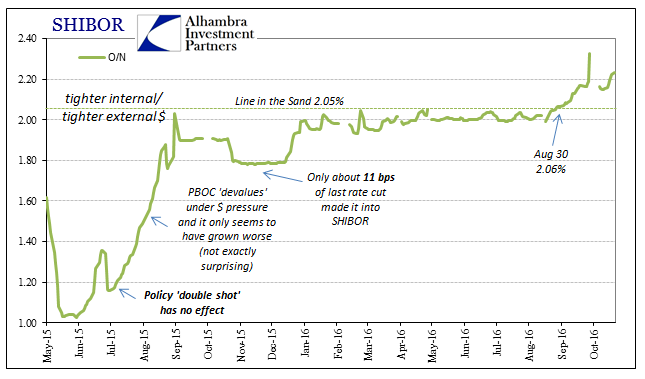

What is more interesting is that despite such apparently heavier lifting surrounding the exchange rate (the price at which Chinese banks are able to bid for “dollars”), the trouble it created for RMB was not left unattended; far from it. In the usual tradeoff between the PBOC choosing either SHIBOR (internal RMB liquidity) or CNY (external “dollar” liquidity), as the Chinese central bank focused on a stable CNY throughout August and especially September (as shown above) SHIBOR blew past what was once a policy redline indicating radically abnormal RMB illiquidity. By the end of September, the overnight rate had surged to 2.32% (and remains still above 2.20%).

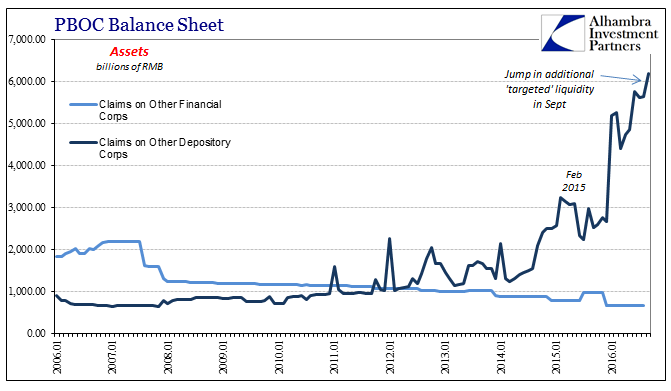

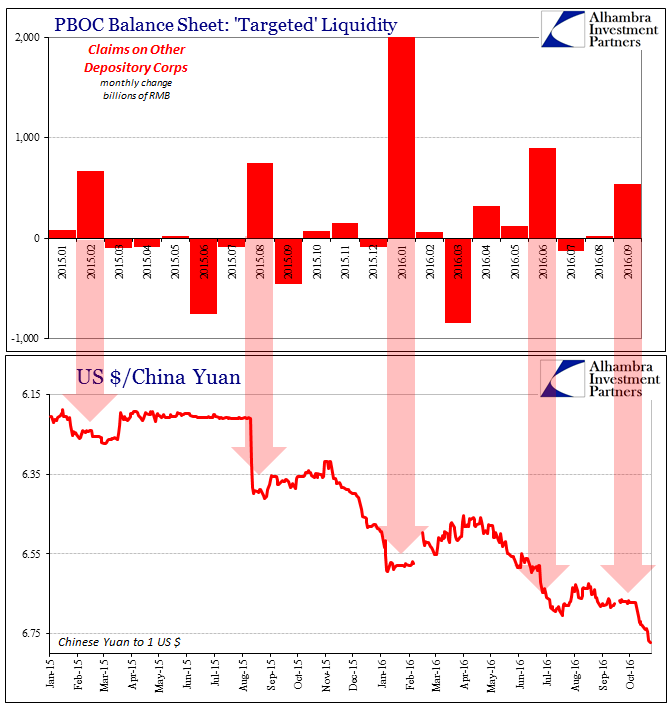

As it got that far, the PBOC had been adding additional RMB liquidity in the form of its “targeted” liquidity measures like the SLF or MLF. In September, the central bank reports a rather large RMB 537 billion increase in Claims On Other Depository Institutions.

In the past, these RMB measures have been deployed near the bottom of each CNY drop (meaning “dollar” run) at the point where the PBOC would switch to stabilizing CNY via its “dollar” methods. In other words, the central bank, keenly aware of how that would impede its 2.05% SHIBOR directive, made sure that there was a large dose of RMB liquidity to accompany its “dollar” attention which has always increased RMB pressure directly. What is (importantly) different in September is that the PBOC added an unusually high RMB amount through its “targeted” channels but that obviously had little stabilizing effect in terms of SHIBOR.

It was those RMB boosts that gave the PBOC enough internal margin to tackle the external funding problems in greater size and strength. In September, however, despite the fact that through the increase in Claims On Other Depository Institutions the PBOC’s balance sheet rose slightly overall, that plus lower government deposit balances allowed Chinese bank reserves to have actually expanded last month to the highest amount since June. It is not a perfect relationship between bank reserves and overall liquidity or SHIBOR specifically, but there has been a solid correlation in the past especially last year (bank reserves down, SHIBOR up; reserves up, SHIBOR steady).

“Something” was very different in September on both sides of the monetary tradeoff. The PBOC emphasized stable CNY, but all the statistics suggest that though the exchange rate was the rest of the system underneath was not. Then, as the PBOC attempted to address the RMB shortfall that its CNY focus would inevitably create, it’s as if it never happened; like QE and the Fed, there is just no trace of it. I am absolutely stunned that they added so much RMB liquidity and SHIBOR surged anyway. Given the behavior of both CNY (and CNH) as well as SHIBOR in October, it might be that the PBOC is, too.

Prior to August 29, the PBOC had been quite predictable especially about SHIBOR and 2.05%. The fact that China’s monetary authorities let that go indicated very strongly that “something” had changed. The September balance sheet update further confirms the theory, though in much stronger terms than even I had expected. Is it a sign of the “rising dollar’s” further progression (meaning devolution) that what used to work at least for a temporary spell no longer seems to “accomplish” even that? What do you do if you are China?

Stay In Touch