One of the most significant pieces of legislation ever argued and turned into law was the Banking Act of 1935. Maybe even more than the Emergency Banking Act of 1933, the legislative basis for Executive Order 6102 and the end of gold inside the United States, the 1935 law codified what were in 1933 more properly observed as experiments. The recovery from the crash was sufficiently advanced, they believed, so that they could render some hard judgments about not just what appeared to have worked but also what went wrong.

The Federal Reserve was given a massive theoretical as well as operational overhaul. There was to be more coordination and a centralized structure with the Board in DC rather than the individual branches (which emphasized NYC). Further, the Act settled a philosophical debate which had been ongoing almost since the founding of the institution in 1913.

The guiding principle from the outset was depression as derived from bank panics; the two were practically synonymous as the former always, it seemed, followed from the latter. The idea of currency elasticity sounds easy enough in principle, but in practice is quite messy and muddy. How much is the right amount of currency so as to ward off any looming panic? But currency elasticity also swings in the other direction, meaning that if there is to be “enough” currency on the way down there must also be consideration as to the “right” amount of currency during regular growth.

Initially, the Fed bound itself to a form of the real bills doctrine, an idea that had been around for some time that the “right” amount (or near enough to it) of money and currency could be determined by the amount of demand for certain monetary factors. It was thought that inflation would be properly leveled if the marginal amount of new money went specifically to finance actual economic rather than speculative purposes. From this policy perspective, things like bankers’ acceptances would be readily accepted in whatever quantity because they monetarily financed actual trade.

In the Federal Reserve’s Tenth Annual Report, put together so as to encode the lessons of the 1920 depression, it declared, “There will be little danger that the credit created and contributed by the Federal reserve banks will be in excessive volume if restricted to productive uses.” But, again, how does a central bank define “productive uses?” Acceptances were one thing, but there were other forms of rediscounting at that time in addition to contemplating how monetary and credit facilities might evolve as the economy and global monetary system did. After all, the world was on a hard gold standard when the Fed was founded, but still almost completely off of it by the Tenth Annual Report.

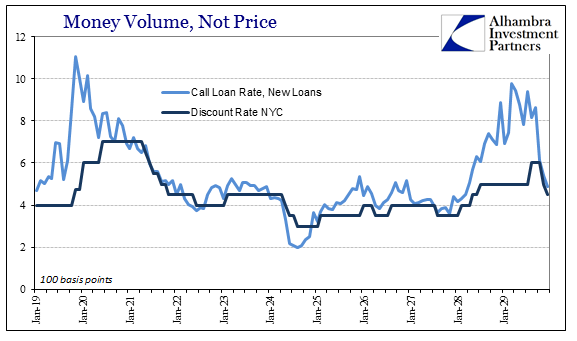

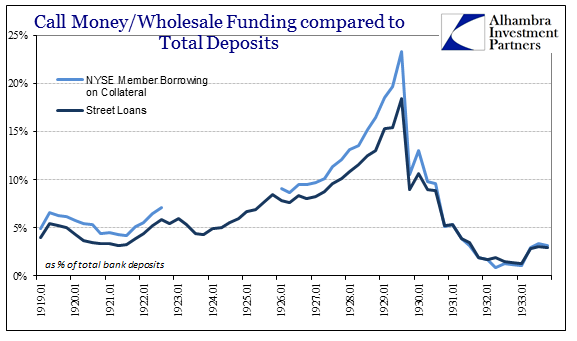

In simplified terms, money supplied (by the Fed) in the aid of real bills, including acceptances, would be used to aid a genuine business transaction, whereas the use of open market operations to buy government bonds from dealers was much less certain (and was believed at the time to be a direct link to stock speculation). There was a good deal of empirical evidence that this was true, with Boston Fed President William PG Harding saying in 1928, “the proceeds of acceptances filter into the market more slowly than the proceeds of government securities.”

On the other side were powerfully influential people like FRBNY head Benjamin Strong. Because credit was fungible where in a true real bills doctrine money might not be, Strong argued it could very well be the case that banks and their customers could finance speculative activities using real bills, while also using speculative instruments such as stocks, bonds, and mortgages to finance productive investments. Both sides would continue to argue as to whether the type of collateral was a very good indicator of the eventual use of borrowed funds.

That point never truly was settled, though real bills doctrine died out as a consequence of the 1935 Act. What was less contentions was that real bills was pro-cyclical; that the Reserve system as a group of twelve different banks does not necessarily care about the overall environment in which it finds itself, rather it should merely adjust itself to conditions of that environment. If an economic downturn should develop, that would mean a lower level of acceptances and rediscounting as an economic factor rather than a monetary one of “tight” money. Under real bills doctrine, even depressions are useful for liquidating prior imbalances of whatever level and ultimate intensity.

It was this philosophical position which by the mid-1930’s meant it was untenable in the growing orthodox consensus about what went wrong. The devastation of the collapse particularly after the autumn of 1930 (the first crash in 1929 could have been consistent with real bills liquidations, but afterward it was a much harder case to make) convinced a majority who might have been on the fence in the 1920’s that pro-cyclicality was a huge part of the disaster. The Banking Act of 1935 put that shift into regulation, instructing the Fed to use open market operations (buying/selling of government bonds rather than changes to rediscount and acceptances volume by price) in first consideration of “the general credit situation of the country.”

Monetary policy was moved from strictly policy about money alone to now the more aggregate stance of overall credit, if still using money conditions as the means to that end. That meant a counter-cyclical approach where there is, to this view, no such thing as a necessary recession.

The logical conclusion of that ideological shift is more obvious in how it was treated in study about the Great Depression. From the dominant counter-cyclical view, history of it starts on Black Thursday October 24, 1929; nothing before that date is interesting or noteworthy to this “modern” credit doctrine. That perspective has only been hardened in the decades since, particularly with the advent of rational expectations theory which is the basis for the efficient market hypothesis. By the 1980’s, policymakers were sure that the 1920’s were fantastic because markets were efficient and therefore what they did in the decade before the crash was perfectly “efficient” and proper.

The cause of the crash, then, as described in subsequent orthodox study, including a great deal by scholars such as Milton Friedman and Ben Bernanke, was the Fed’s “backward” real bills doctrine and its acceptance of pro-cyclicality. One way to put it would be to suggest that markets were in the 1920’s correctly expecting a new permanent level of prosperity but unable to properly discount the risks of disastrously bad monetary policy in response to it. This excuse has been revived since 2008, with minor adjustments for our own time.

I have been at times accused of being a kooky Austrian, at others a damned monetarist, while also being called an economist for my trouble (it is only that last one that I truly can’t stand). In truth, I don’t see myself as any one in particular. Ideology, to me, is far too rigid to be useful in determining what I am really after – what the hell has been going on all this time. In my own study I have found that there are merits of a quite many ideological perspectives, where adhering to a single one alone would have had the effect of instilling intentional blindness.

Take the Austrian case, for instance, where its business cycle theory provokes an unhealthy emotional response from the orthodoxy. The concept of malinvestment is practically common sense, but to those devoted to rational expectations and efficient (perfect or near-perfect) markets it just cannot be. There is no way that markets could make such huge and lingering mistakes, yet our own personal experience leaves no such doubt as to the existence of asset bubbles.

On the flipside, the Austrians believe (I am oversimplifying) that malinvestment alone would be sufficient or nearly so to describe the lack of recovery after 1929 or 2009. The monetary case for both is far more explanatory than a stubborn allocation problem; nine years is more than enough time for liquidations and the start of recovery. Further, the marginal changes in the intensity of downward economic pressure after each crash times perfectly with purely monetary factors; in the 1930’s that was more of those new powers granted to the Fed in the Banking Act of 1935, which by 1937 caused sharp recession within depression; in the current depression there were obvious downturns (though not recessions) in 2012 and 2015 that followed equally obvious “dollar” events in 2011 and 2014.

From my own view, there is merit on both sides; where malinvestment clearly played a role in the conditions from before 2008 as well as after, but also where monetary theory would have been, properly grounded and applied to “dollars” rather than bank reserves, more useful and comprehensive in explaining what we have witnessed throughout.

Given all this, I fully believe we also have to consider how these two seemingly at odds philosophies may actually need to be combined. To give you a simple example, malinvestment was not strictly related to the building of far too many houses in the United States. The massive housing-related imbalance also pushed great distortions within wholesale money itself. In the repo market prior to August 2007, MBS formed a greater part of the collateral stream than even UST’s. One reason for that was a huge proportion of MBS was believed almost “risk-free”, at least close enough where the GSE’s were involved (as opposed to private-label MBS which became more popular in the later years of the bubble). That supply of MBS as collateral was also much more fluid than UST’s.

In short, the housing bubble created its own supply of money via MBS-laden repo, almost like a real bills doctrine in practice not foreseen by the 21st century Fed still stuck in a 1960’s view of 1930’s money. And, as noted above, the reason for that inattention to wholesale money evolution was that monetary policy was made to emphasize credit rather than money. Paired with rational expectations theory, the vast expansion of mortgage finance was thought to be by economists and policymakers the “right” amount consistent with that level of economic growth – even though it was creating enormous monetary as well as economic distortions.

Those alterations were revealed even before August 9, 2007, as MBS as collateral underwent first haircut adjustments and then increasing rejection. Mortgage bonds that were before 2007 easily fluid in interbank markets with a high degree of accepted rehypothecation at UST-like haircuts were suddenly negotiable at increasingly onerous terms; and then not negotiable in repo at all. I described some of the fallout here:

The danger of subprime in early 2007 wasn’t truly default – it was volatility knock-on effects in markets far and wide. Once liquidity started to drop purely in subprime, that created more volatile pricing which downstream models started to perceive. It didn’t matter that a particular MBS security had no subprime mortgages in the structure, what mattered was that 3-4% haircuts were now modeled as perhaps not enough safety in the overall MBS collateral segment. That is exactly what happened from 2007 through 2009.

According to ICMA, a prime, AAA-rated agency MBS traded at a 4% repo haircut in June 2007, just before the fatal shift in eurodollars. By June 2009, that same MBS would find instead a 10% haircut. That was a massive change, which caused selling to beget selling and so on and so on. For unrated agency MBS, again prime, the haircut that in June 2007 was 10% had moved to 30% or even 100% by 2009. And that was not the full extent of the collateral/liquidity problem, either, as certain strains of even prime MBS collateral became non-negotiable on any haircut terms.

The malinvestment of the housing bubble actually created a reflexive monetary contraction built right into the global monetary system! The Austrian term applies not to just the number of houses gratuitously constructed but also to a great deal of the “money” which financed that construction.

The modern theory of operations says that the Fed could have offset that pro-cyclical shift with open market operations buying up government bonds, which is exactly what they did starting in late 2008 known as quantitative easing. But, as Benjamin Strong noted decades ago, it was never so simple even where the monetary system was once far more simple.

In terms of MBS as collateral, it was a direct monetary shortage that was never alleviated – even after the panic. The hole in repo left behind by the repudiation of so much MBS cannot easily be considered let alone stated. That is especially the case since in Europe the rejection of MBS (in dollars or cross-funded by euros) led European banks to directly replace “toxic” waste with PIIGS; and so to move from one monetary contraction to another in short order. The European debt crisis was just another symptom of malinvestment meeting monetary theory.

The repo problem remains to this day. By 2013, as noted here, Fed officials were expressing concern over dealer banks “transforming” junk corporates (and I believe a lot of EM corporates, too) so as to be one possible collateral stream in order to meet the shortage of collateral (particularly since QE has the effect of further removing collateral from use). With unsecured interbank markets but a fraction of their former operations, the dependence on repo as a marginal monetary source was absolute.

The huge economic problem of malinvestment wasn’t just that too many houses were built and too many unqualified persons given mortgages and other forms of consumer debt they couldn’t manage, it was also a deep, vast monetary irregularity that helps explain the monetary changes and inflections (three so far; 2007, 2011, 2014) so obvious in the formation of depression since. From that we have to further consider that a strictly monetary solution, even one more attuned to money as it is, would be as futile as the open market bond buying of the QE’s already were.

In other words, we can’t just assume that the history of the Great “Recession” began on August 9, 2007, nor can we assume that this will all just work out on its own at some point. From the perspective of purely monetary theory, it would seem that resupplying the repo market with collateral or just adding “dollars” in general would be the answer. Taking that out of ideological isolation and pairing that with malinvestment, however, we find instead that the monetary system itself is, because of its pre-crisis imbalances, unsalvageable.

Stay In Touch