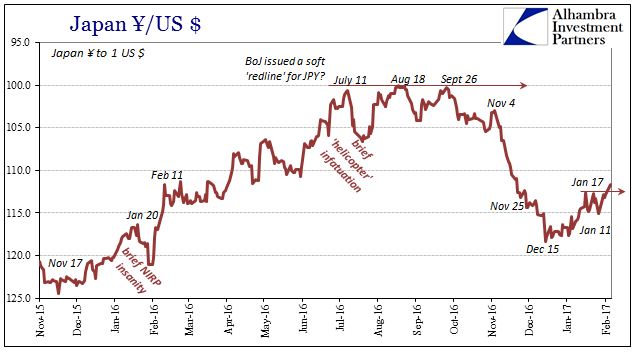

With JPY pushing above its recent resistance (for whatever might have caused it), it is useful to determine if that is an idiosyncratic change or whether there are other “dollar” indications that support a possible breakout. This is especially true given what I think is causing the move in JPY, namely that “reflation” had been initially predicated on ideas of “different” but as time marches on markets need more than that. In Japan, specifically, yield curve control hasn’t looked so good to that end, following up on “dollar” efforts that haven’t, either.

As BoJ falters, it makes sense that other markets could begin to reassess their commitments to “reflation”, or perhaps even begin to downgrade the perceived probabilities for it given so far lack of corroboration BoJ and beyond.

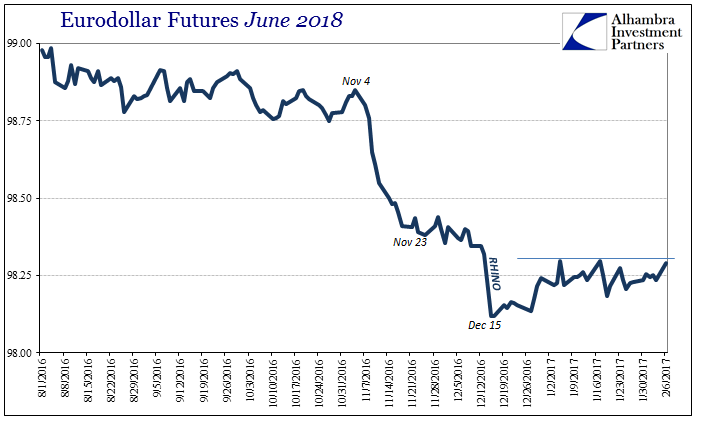

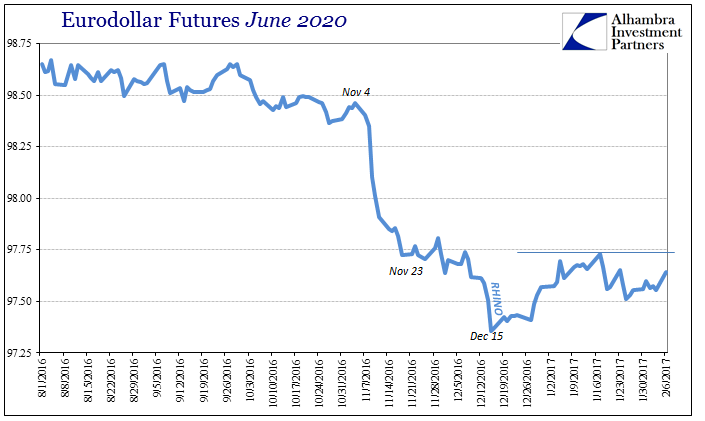

The US treasury market had a good day, with yields falling rather sharply down the curve. The 10s are nearly back to the 2.30%s again, which would signal a possible further departure from “reflation”, at least confirming the recent low yield on January 17. It will also by important if the long bond can get below 3.00% and remain there (psychology counts in the short run). In terms of eurodollar futures, where I believe the most important corroboration will be obtained for either direction, the front part of the curve is threatening again to retrace the whole of the last “rate hike.” Should that happen, and it was close today, I have to think full reassessment of future rate levels would occur up to the mid-November main event.

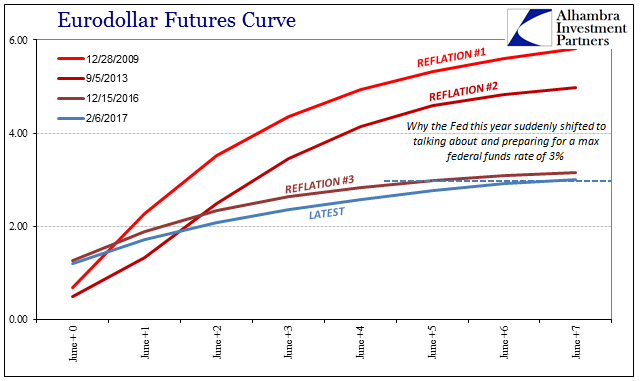

The outer parts of the eurodollar curve have a bit further to go in terms of breaking upward (in price), but that is already at a level past the last “rate hike” and equal to the tail end of the bond selloff/”reflation.” I think if both parts of the eurodollar futures curve break above those levels, there will be significant shifts in the whole “reflation” dynamic. It has been nearly two months for sideways to slightly higher (price) already, and there aren’t any blank slates left upon which to project non-specific hope (the French election I don’t think will be nearly as impactful as either Brexit, BoJ “differences”, or the US Presidential election).

We appear to be at or close to a point where these “reflation” hopes need to start becoming more than that. With BoJ leading the way, as it usually does, you can’t really blame these markets for trading slightly more carefully than carefree. Now with JPY perhaps breaking out, today’s market trading suggests a little more nervousness in that regard.

Stay In Touch