Is Mexico about to go down the same road as China, Brazil, and so many others have the past few years? The more interesting question may be what took so long, if they are. Mexico’s central bank has been forced into action again, after interjecting itself last month supplying dollars directly to Mexican banks, as well as the same in February last year (at the bottom of the global liquidations, it needs to be pointed out).

This time, however, Banxico is taking the derivative rout. The central bank is being cheered by all the usual suspects on Wall Street for a method that has proved somewhere between ineffective and disastrous everywhere else it has been tried. It has been claimed that because these are non-deliverable currency hedges rather than strictly currency FX, it is to Mexico’s added benefit to where the country can avoid the further danger of drawing down its so-called reserves.

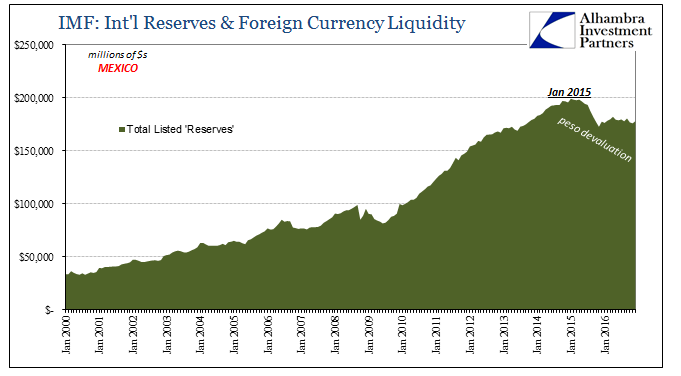

According to the IMF’s latest figures through December, there should be no such danger at all. Like Brazil or China, Mexico sports an enormous quantity of claimed “reserves” of all kinds. At $178 billion, there are $97 billion in securities, $70 billion in currency balances held with banks outside Mexico, including $7 billion with either foreign central banks, the IMF, or the BIS, and another $10 billion in assorted leftovers including SDR’s and gold. Not only that, the official data records $90.6 billion in Undrawn, Unconditional Credit Lines, of which $83 billion is the backstop of the IMF itself.

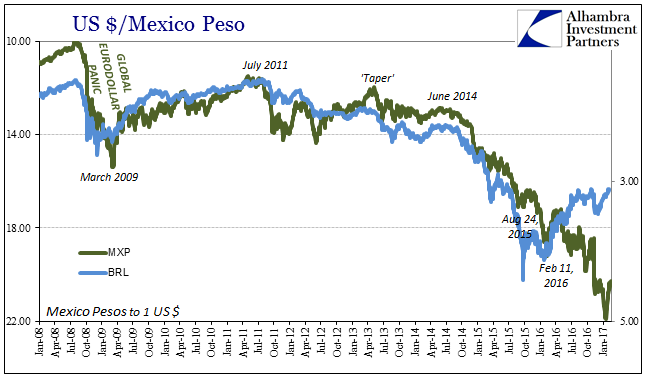

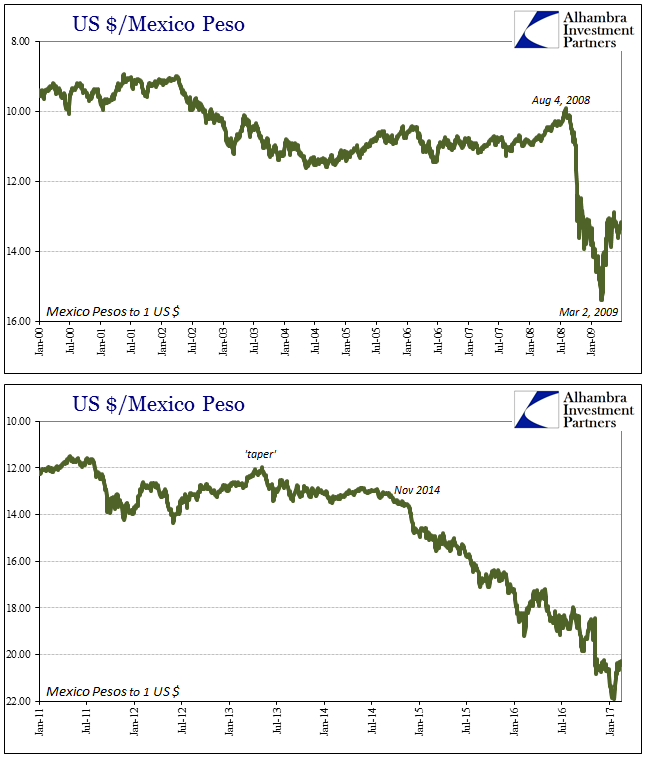

And despite all that which is perfectly consistent with the lessons gleaned by convention from the Asian flu episode of the late 1990’s, the peso has been flushed anyway. The incongruous result is left up to fantasy to reconcile:

Similar to non-deliverable forwards, the foreign-exchange hedge was announced as the peso took a beating following Donald Trump’s victory in U.S. presidential elections. His threats to renegotiate or scrap a free trade deal with Mexico caused the currency to plunge to record lows before reversing some of its losses in recent weeks.

This is nonsense masquerading as analysis, for anyone can clearly see the peso’ problems have nothing at all to do with walls. They are instead very easily traced to eurodollars, in sympathy with much of the rest of the world and the global economy.

The difference between Mexico and, say, Brazil is that Brazil appears to have obtained foreign “dollars” from somewhere else in March last year while Mexico and, say, China have not. Maybe that narrow difference is Trump related, but I highly doubt it.

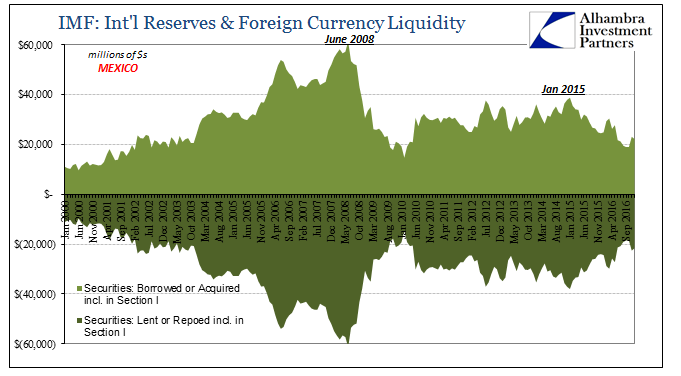

What we find instead beneath all the surface data is the same lacking banking capacity that we find everywhere else, either directly or implied. In the case of Mexico’s IMF report, there is a direct relationship between the amount of those securities offered on either side of repo transactions and the stability (or lack thereof) of the peso.

Right around both July 2008 as well as January 2015 did Mexico’s currency crash. What is indicated by the repo figures is the hoarding of cash in whatever forex form by Mexican banks, or their side of an acute “dollar” shortage.

All of which leaves Mexico in position to be Brazil 2013 or China 2014 all over again – even after the peso’s huge fall so far. In other words, even though the forex hedges are settled in peso’s they are designed so as to get Mexican banks to short (synthetically) even more “dollars” during a trend where being short is already a massive problem. As with Brazil’s cupom cambial, it doesn’t matter how it is done for what will is what it all accomplishes. It doesn’t solve Mexico’s “dollar” problem, but it has all the potential to make it that much worse (but at least put on a regular schedule, I suppose).

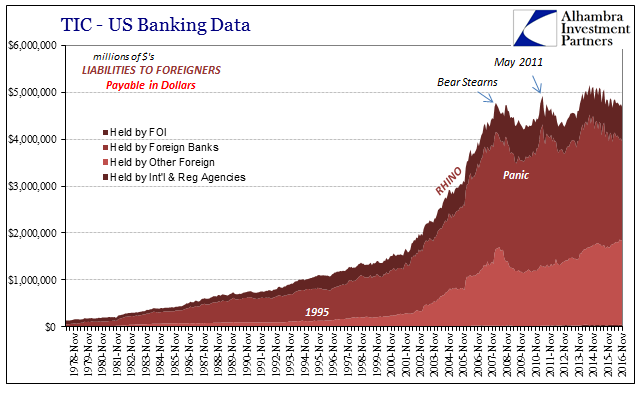

It is another geographical corollary of the nightmare scenario, where the issue with the “dollar short” is more the short than the “dollar.” Central banks fail to realize this part because orthodox textbooks don’t include the eurodollar anywhere within their pages. Like Medieval doctors, these monetary doctors are leaching their patients to a slow death. I wrote on January 6, 2016 of China’s similar tactics:

In specific terms of China in the latter months of 2015 and the first week of 2016, the PBOC has already put its “reserves” “on the line (to defend the yuan)” over and over and over again. It just hasn’t done so in the way that reflects upon the 1950’s view of the global currency exchange. Instead, the PBOC has undoubtedly been highly active in deploying wholesale functions – which is entirely the problem. It is the great trap from which they cannot escape, and, in fact, it can only get worse the more they struggle. Using forwards and swaps inside a “dollar” run is only digging a deeper grave in which you’ll be placed into that much sooner.

Or in August 2013 when I regrettably but correctly declared Brazil to be already “toast”:

The second problem with this textbook approach is that those swaps do not remain off the books for long. The swap/forwards have a maturity, usually three to six months. So, at best, you’re only attempting to buy time for conditions to normalize. But they won’t because you’ve given speculators the very ammunition they need to attack your currency further…

So in a few months’ time, there will be about $100 billion in swaps maturing and hitting the books where the central bank will have to come up with dollars – meaning they will have to sell a massive amount of dollar-denominated securities or try to roll over the swaps without disrupting markets further.

Banco do Basil let them roll off (what else could they do?), and the real and Brazil’s economy sank into deep depression from which three and a half years later its poor people may have yet to see the bottom.

The “rising dollar” has been a euphemism for this “dollar” shortage becoming more acute for the offshore part, especially, since the middle of 2014. This fact has been marked in any number of ways, like the global economy’s “unexpected” non-transitory weakness. Perhaps the most apt declaration is made by the growing catalog of central banks falling victim to it. That list appears ready to add another name, and it isn’t Trump. Tick tick tick.

Stay In Touch