You could say that SunTrust dodged a bullet. The Georgia bank was itself an amalgam of smaller banks cobbled together during the deregulation of the 1980’s. On the one side were the Florida subsidiaries based in Orlando, what came to be known as the Sun Bank. On the other was the Trust Company of Georgia, both coming together in 1985 but maintaining largely separate existence until ten years later.

It was in the middle 1990’s, and the year 1995 pops out in far too many of these stories, that things took a turn. The Southeast was Ground Zero for the coming housing boom, and it was at times a mad scramble among financial firms to jockey for the best position. Consolidation was rife throughout that decade, and it would only become more intense during the first part of the next one.

In 2001, SunTrust had its sights set on Wachovia as a means to expand northward. The Carolinas were a white hot area of what had already been turned into a bubble. The Charlotte-based bank was to that point a mid-sized but respectable lender of traditional form. It made it a perfect candidate for being swallowed up by the more ambitious.

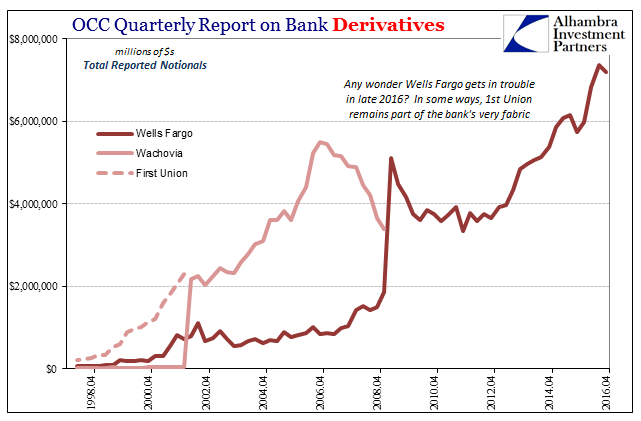

First Union Bank also of Charlotte was just such an institution. It was an early adopter of the wholesale approach, first taking advantage like SunTrust of 1980’s regulatory relaxation before getting involved in the dark side of balance sheets. By the early 2000’s, First Union was actually one of the largest derivative players in the entire world. According to figures compiled by the Office of Comptroller of the Currency (OCC), in Q2 1998 First Union reported $215 billion in gross notional derivatives. Two years later, in Q3 2000, its book had expanded fivefold to more than $1 trillion. Gramm-Leach-Bliley perfectly defined.

In a 1995 interview, CEO Ed Crutchfield, who was at the time nicknamed Fast Eddie, correctly identified the nature of the transformation then just getting started. The timing of his statement is practically cosmic given that it was 1995 when all these things truly started to explode.

I’m an unapologetic believer that banks and certain other industries are going to have to get big or be very small. The middle-sized guy is in trouble.

It was absolutely true though for reasons that more than two decades later most policymakers appear completely unaware of. He was speaking inside the conversion of banking into the “golden” age of eurodollars – get big or get run over. The way you got big was in risk, meaning funding balance sheets in ways never before thought possible, and a great many that nobody really understood too well until it was too late.

By 2001, First Union had completed an impressive 56 interstate bank mergers, that along with experimental balance sheet expansion made it a player. But it didn’t arrive in that status wholly unscathed; management made several mistakes that were piling up in at least reputation. In March 1998, the company bought The Money Store, a last resort lender to highly questionable borrowers, for an announced $2.1 billion. Barely two years later, it was shutting the acquisition down and taking an initial $2.8 billion charge.

It was this period where all the pieces really came together for “banking” as opposed to banking. The era of Glass-Steagall was finally over, which really had very little to do with how it was outwardly presented. As I wrote last year:

In the latter half of the 1990’s when banks agitated for an end to Depression-era legislation, Gramm-Leach-Bliley was the result of wholesale intentions rather than how it was sold to the public. From what the industry said, and what was debated publicly in Congress, banks simply wanted to be able to offer their customers a one-stop shop for all financial products; to sell mutual funds and life insurance inside bank branches because people wanted to be able to get all their services in one place. It was the happy talk of synergy and lower costs to the public.

As usual, the real motivation was nothing like that. Citigroup in 1998 practically dared Congress to act on repealing Glass-Steagall by purchasing Traveler’s Insurance on a two-year compliance waiver from the Federal Reserve. Though I don’t want to completely set aside Citi’s profit motive of selling Traveler’s insurance products directly to Citi’s depositor base, in truth what Citi really sought was a greater blend in the whole bank’s overall funding portfolio; to be more and more free from the vertical money multiplier to be able to purse avenues of horizontal balance sheet expansion. Every other major bank followed suit because they all wanted the shadow bank model as the marginal avenue for expansion and all the far greater (eurodollar) profit opportunities that would open up as a result.

Just as Fast Eddie said, there was no more middle ground for banks which increasingly meant little would be left of actual banking. The entire global system primarily and exponentially turned toward and into the shadows.

For First Union in 2001, it meant an odd arrangement to keep pushing ever upward. They would buy Wachovia but then unusually take the acquisition’s name. They tried to sell it as a merger of equals, but what became Wachovia in early 2002 was truly First Union if in a spiffier jacket.

SunTrust, however, wanted it, too. It advanced a hostile bid and even sued to try to stop the First Union takeover, alleging coercion on the part of the intended acquirer as part of a breakup provision that would leave First Union with a nearly 20% stake. It may seem strange to today’s environment, but at that time the hottest properties were not newly constructed McMansions along the US Atlantic coast but rather the firms best positioned to finance them. It is why European banks were suddenly smitten with any ability to obtain “dollars” (nothing at all like a “global savings glut”).

First Union succeeded, leaving SunTrust to actually survive the housing debacle. Maybe it would have turned out differently had the Florida-Georgia bank won out, but we will never know.

We do know much of the rest, for Wachovia, really First Union, would become one of the infamous. It may not rate in memory as Lehman or Bear, but Wachovia deserves its place among their ranks. There was no risk too far, and the combined derivative book shows that preference. The purchased bank was no (derivative) prude by any means, but in the quarter before the combination was completed, the old Wachovia reported just $42 billion in gross notional derivatives while the former First Union was by that point up to $2.3 trillion – the fourth largest derivative book among all US commercial banks.

The combined story of demand and derivatives gives us a more solid understanding of these balance sheets in reality (as opposed to their presentation according to ancient accounting rules) and what they might tell us about the state of global money. In truth, gross notional amounts aren’t all that revealing about a bank’s actual risk exposure. By totaling well into the trillions and now tens of trillions, the naked exposure of the biggest dealers might seem truly frightening. But that isn’t really what we are after here, as gross notionals are a window into bank behavior rather than credit or loss exposure.

As they expanded often just that quickly, it corresponded with the sort of activity exemplified by Fast Eddie and even the more reserved among his peers. I related a few months ago the same sort of behavior observed in perhaps the stodgiest of the stodgy banks, HSBC. There was no more middle ground as Eddie said, only the binary option as he described it fittingly in 1995; take the wholesale plunge or get gobbled up. HSBC’s derivative book would explode, too, as around the same time that firm paid handsomely for the waiting disaster in Household International.

The reported derivative books of each bank describe its deep liquidity preferences. In the pre-crisis era, especially the middle 2000’s, there was every reason to disgorge balance sheet capacity, which is truly what derivatives actually reflect. In order to achieve the ethos of getting bigger there was no other way. And most banks, like HSBC and First Union, eagerly went along with it because there seemed to be no risk in succeeding at it.

British economist John Maynard Keynes had long before described liquidity preferences for among consumers; the reasons why they might hold (really hoard) money rather that spend it. During depressions, this was a dominating feature; the greater the liquidity preference, the worse the economic condition as commerce would only dwindle. Of the three reasons he gave for them, the third is what applies in this context – opportunity. Consumers, Keynes’ reasoned, would hold cash today waiting for a better opportunity tomorrow.

In terms of bank evolution of the 1990’s and 2000’s, the world was awash in financial opportunity and at seemingly low risk. Thus, balance sheets were leveraged in every way imaginable to points often beyond clear comprehension (for policymakers, none of this ever happened so basic comprehension is still Step 1 for them). Even if you did run into some trouble, you could just expand your way out of it. Derivatives have been a picture of the eurodollar’s very soul.

It’s what makes the clear inflection in 2008, really August 9, 2007, such a monumental event. Practically all at once these dealers began to finally see and appreciate all these contradictions, for they are nothing other than that. A guy named Fast Eddie running one of the world’s largest derivative dealers? Perfectly consistent, however, as an apt description of an age and conditions that just no longer apply.

In terms of gross notionals, what we find is liquidity preferences but moving in the aggregate in the opposite direction. But they haven’t done so all at once, meaning there is still some story left to be written out of interest rate swaps, CDS, and forex basis.

Part 2 is here.

Stay In Touch