Continued from Part 1

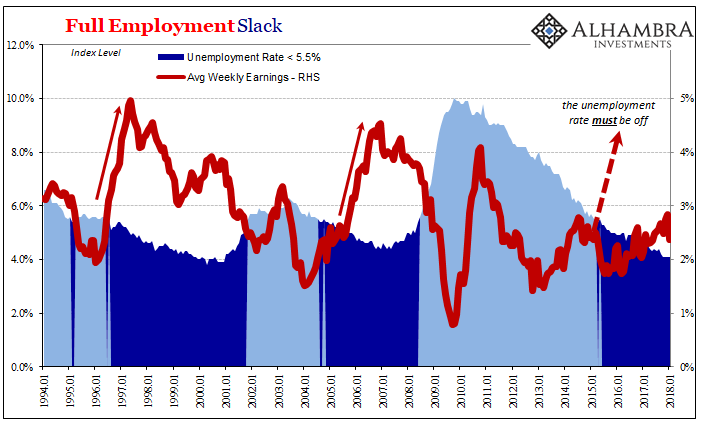

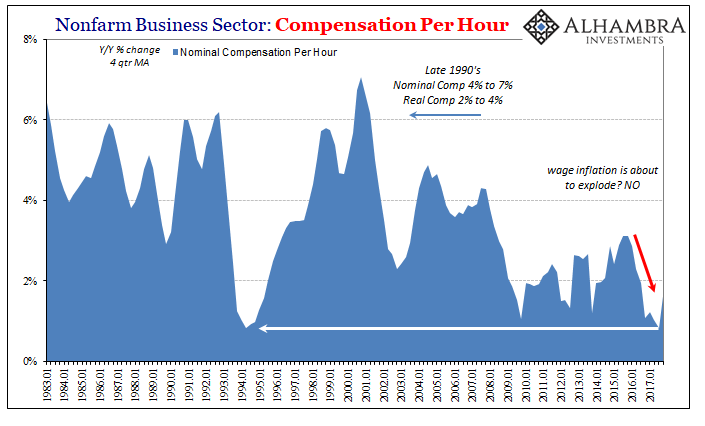

What these unusually weak productivity estimates lean toward is, quite simply, the possibility the BLS has been overstating jobs gains for years. In early 2018, there is already the hint of just that problem in a 4.1% unemployment that doesn’t lead to any acceleration in wages and labor income. What it does suggest is that something (or several somethings) in these estimates is off somewhere.

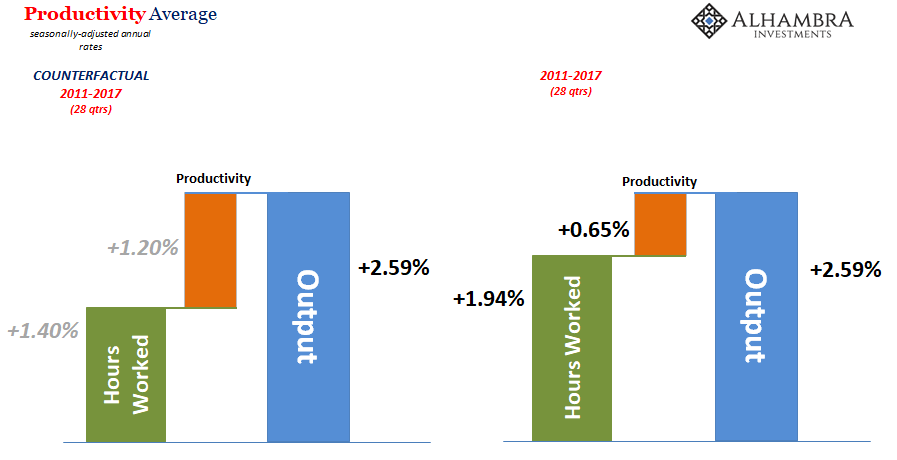

For the unemployment rate, that already includes the participation problem in its denominator, but, again, that is not mutually exclusive of problems in the numerator (the increase in the number of payrolls). As nothing more than a rhetorical exercise utilizing nothing more than back-of-the-envelope counterfactuals (so take it in that spirit), if productivity had been more balanced and thus more consistent with how an economy actually works over the intermediate and long terms (not transitory), that would have meant by simple arithmetic either output was much higher or labor input much lower.

The Household Survey gained 1.44% per year during those same years, a lower rate than total hours worked reflecting the increase in full-time jobs as some part-time positions were converted back to the former pre-crisis status. Reducing the total gain in hours worked by more than a third (as shown above) would have lowered the increase in the Household Survey by more than 5.2 million at the end of 2017, leaving out how in every likelihood the reduction would have been more severe factoring less part-time jobs conversions.

Assuming the labor force increased by the same rate as it has (which isn’t unreasonable given that it hasn’t increased by all that much in the current estimates), that would give us an unemployment rate around 7.4% rather than 4.1%. And if growth in the labor force was overstated in somewhat the same way as suggested in the Household Survey (with the Establishment Survey far worse), then the unemployment rate would be a little lower than that, somewhere around 6.5% (give or take).

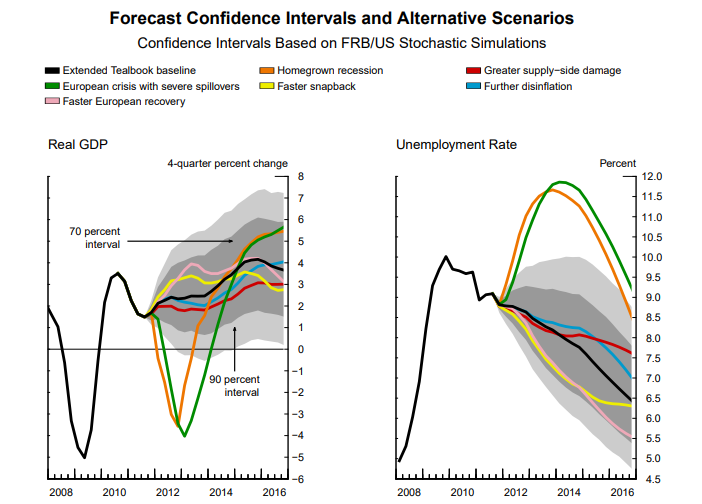

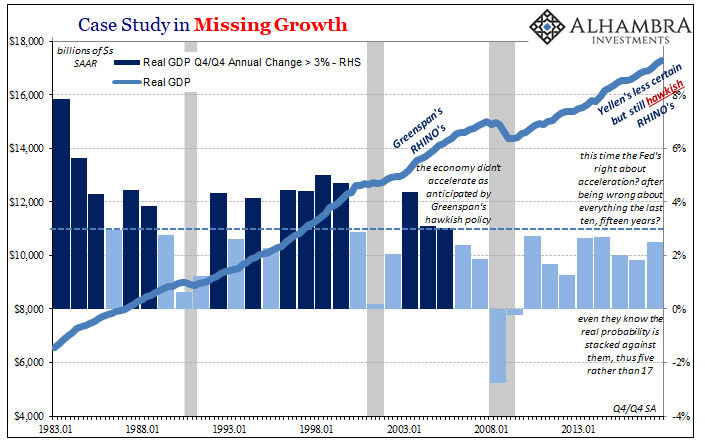

That’s actually far closer to what the Federal Reserve’s Greenbook calculations were predicting back toward the trough of the Great “Recession.” The simulations run for the December 2011 Greenbook (shown above) figure a baseline recovery scenario that included significant and sustained acceleration in output (left side) starting in 2014 that would have by the end of 2016 brought the unemployment rate down to 6.5%.

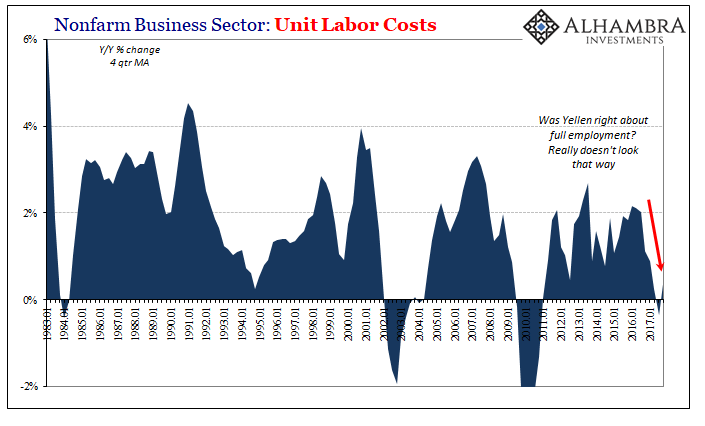

What really happened, according to the current figures, is the output acceleration never occurred but somehow the unemployment rate fell farther and faster anyway. What? At the end of 2016, the BLS calculated 4.7% despite the enormous imbalance in productivity it forced and the fact that nothing consistent with a 4.7% (now 4.1%) unemployment rate can be found in any related economic accounts.

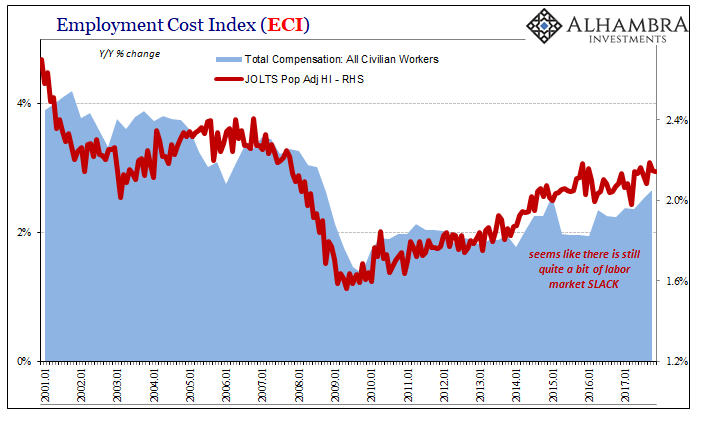

Instead, the wage and inflation mystery, or its non-transitory transitory state, is itself inculpatory evidence of this inconsistent result.

There simply is no wage inflation, which there would be, to the point it wouldn’t be debatable, at a true 4.1% unemployment rate.

The US and global economy is presented with all kinds of economic challenges right now, morphing further and further beyond the economy, but the almost certain skew (both numerator as well as denominator) of the unemployment rate is directing inquiries in the wrong directions. That’s when there are questions at all, which instead policymakers like Jerome Powell, as Janet Yellen, prefer to point to the unemployment rate to avoid them. It has allowed them to skate by as if this low rate means that tomorrow everything will start to make sense again. Just you wait.

There is no rational basis to believe that is anything more than fingers crossed hope, the same kind of policy that’s been in place, and been wholly ineffective, since Ben Bernanke said the word “contained.” In early 2007 he may as well have said “subprime is transitory.”

A more realistic assessment of the labor market would show grave and prolonged weakness, a condition far more consistent with everything else we see around us – including a yield curve that continues to refuse the inflation scenario with very good reason. The only evidence for it is the word of Economists like Janet Yellen and Jerome Powell who have to strain the English language for it to sound the slightest bit plausible.

Stay In Touch