Unlike the headline Establishment Survey, the rest of the economic data isn’t surging like it’s 2014 all over again. On the same day the BLS issues the next blowout payroll report, the Census Bureau suggests instead US demand, at least for goods produced overseas, continues to decline at a precipitous pace. Seasonally-adjusted, there had been something of a rebound in the month of December 2019, but that disappeared in these figures for January 2020.

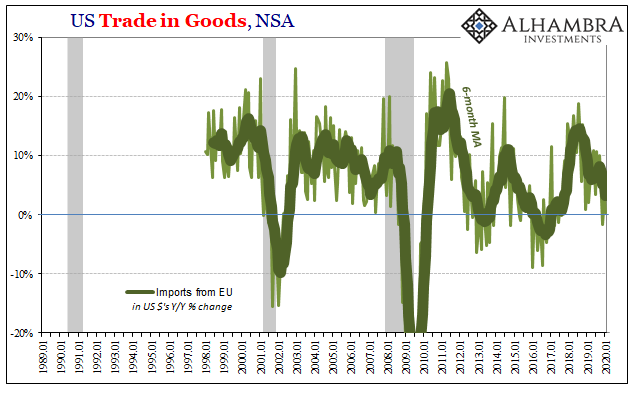

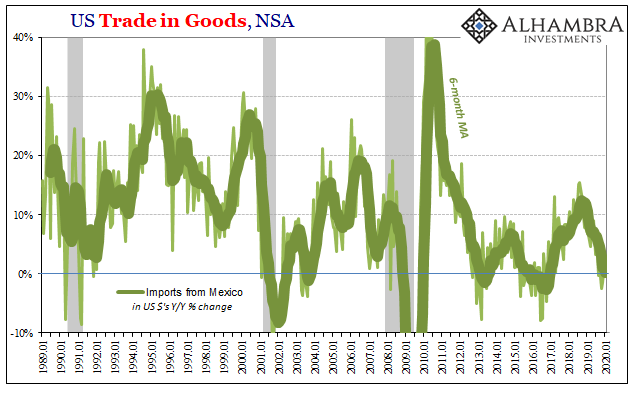

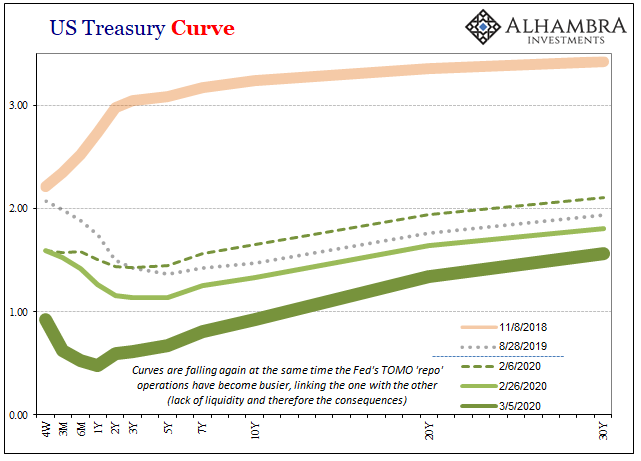

It obviously bears all the hallmarks of Euro$ #4, which continues to be, like Euro$ #3 had been, a prolonged period of trade retrenchment. These developments don’t by themselves advise us of the possible differences between recession (what’s being price in bond markets right now) or near recession (what ended up for #3), just that the original issues must certainly remain creating economic headwinds independent of the amount of time they do.

When it comes to US trade, imports have been showing the downturn dating back to the (first) landmine late in 2018. US exports have performed marginally better, in that the depth of the contraction isn’t as substantial, but still a consistent drag closing in on completing its second full year.

And only now are the concerns being taken seriously.

No one cares much about trade wars anymore, especially the Chinese. Still, the US policy of increased tariffs has definitely taken its toll. US imports from China continue to fall by 20% annual rates, more than was ever recorded during the Great “Recession.” For China, the coronavirus outbreak couldn’t have come at a more inopportune time.

But that’s largely the point for the rest of the world, too. Again, the downturn running most directly through global trade had already pushed the global economy to the brink, with some places and indications suggesting already past the brink, before February 2020’s pandemic panic.

The outbreak may be one too many serious headwinds, the final thin straw, perhaps, which finally breaks the back of the extremely ill global economic camel. This is why China’s trade war loss isn’t anyone else’s immediate gain.

From Europe to Mexico to Japan, the US isn’t doing them any favors. Because the US economy is weak, not soaring, contrary to the latest headline BLS assessment, the earlier economic virus has been spread far and wide for two years.

When we account for petroleum, we find that US imports haven’t been in this bad of a shape since 2009 (the number of sustained months declining at this degree of contraction). American demand for overseas goods other than crude oil is unusually, serious low and falling.

I’ll write it again; the reason bond markets are at DEFCON1 is that the economy was already in very rough shape to begin with. This was always the danger from the very beginning of Euro$ #4 – the longer the downturn went on without reversing, in fact rather than just narrative, the more likely it would become that some negative factor might finally push everything one level too far.

We don’t know yet that COVID-19 is that factor, but we do know that the economy receiving it is and has been sick enough and for a long enough time to make this a very realistic possibility. Even if the coronavirus outbreak by itself doesn’t amount to all the much disruption. The dollar virus had spread first and far, so that the already diseased camel can’t bear even the smallest added straw.

Stay In Touch