For several weeks now, the Federal Reserve has launched one bazooka after another. Officials there keep reassuring the markets, and the public, they’ve got an unlimited toolkit. However, the fact that they feel it necessary to keep showing you is a warning sign, especially how quickly each one is forgotten and overshadowed by the latest Big New Thing.

The reason why is simple: they are all the same thing just with different letters and bigger numbers. Central bankers can explore infinity along an X-axis not realizing they live in at least two dimensions with also a Y-axis to consider.

When the level of bank reserves starts to rise and accelerate, that’s supposed to be a good thing. It’s not. All that balance tells you is what the Fed is doing, not how successful it might be at its one-dimensional masturbation.

And when it comes to judging such success, the public is already at a huge disadvantage. As I wrote two weeks ago, the appearance of low rates, including low money rates, can be misleading. It is easy to connect the one with the other; the Fed expanding its balance sheet, creating hundreds of billions if not trillions more in bank reserves, and at the same time observing a decline in short-term rates.

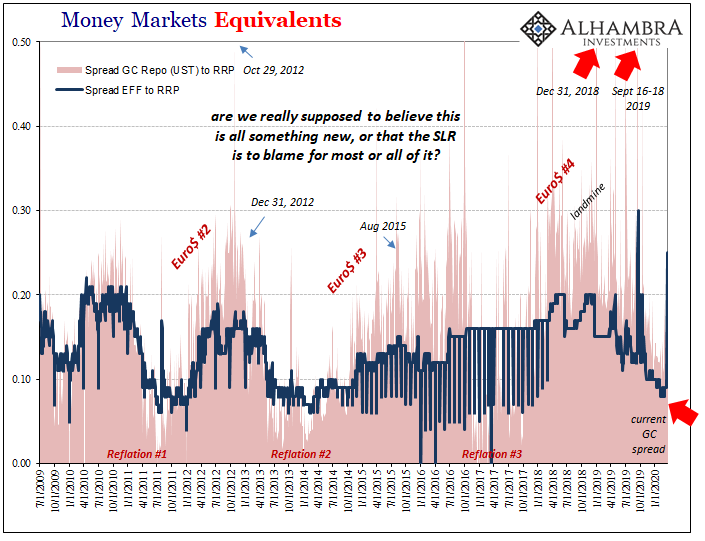

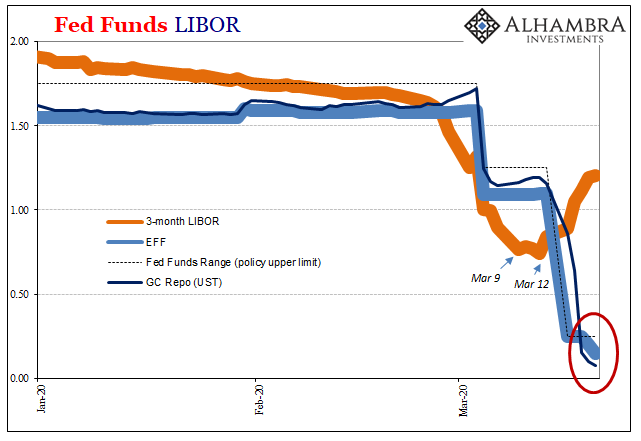

This is, in fact, what we can see right now. Repo rates are falling, as is the effective federal funds rate. The GC repo rate for UST collateral was down to just 7.4 bps (DTCC) Friday, the lowest spread to RRP since September 2017 right at the first eruption of what would become Euro$ #4.

Congratulations, Jay Powell?

Oh no. Quite the opposite. The ongoing strain even intensifying of inelasticity now seems to have taken on the worst elements of a crisis including counterparty risk. Here’s part of what I wrote on March 10, pertaining to the repo rate:

Imagine you are a cash-rich bank while chaos rages all around you. Risk averse, absolutely, therefore you want the highest, best possible security for your cash. The best quality collateral, that is.

What if no one has any?

In other words, you’ve got spare cash and don’t mind carefully parceling it out but you can’t find any takers. Not for lack of willingness, mind you; it’s a crisis, after all, and the line is out the door. Counterparties would love to borrow every last nickel you’d offer, but they can’t because you’ll only accept the highest quality collateral in return which they don’t have and can’t get.

If your usual clients don’t have any collateral, then you’ll lend your cash to anyone else who does – discounting the return down to whatever market-clearing rate. And that’s just what we’ve seen over the last three trading days (through last Friday) despite the Fed’s increasingly sizable numbers.

What about other markets?

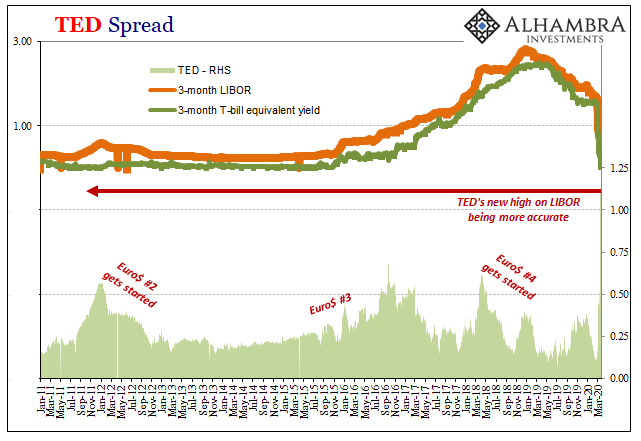

As I’ve documented before, policymakers around the world hate LIBOR because it had been the one rate which was true to its mission during GFC1. Contrast that with fed funds which would often plunge to low levels. LIBOR was straightforward in demonstrating pressure and distress; fed funds, on the other hand, was at least confusing if not mistakenly reassuring.

If you are a central banker, of course you’d prefer the latter.

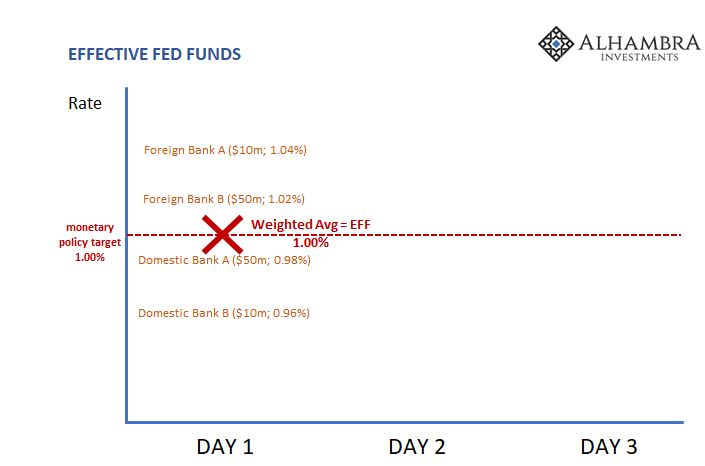

Let’s go through a short exercise to illustrate what I mean. To begin with, the federal funds market is a true market; there’s no single rate at which real-world transactions take place. The effective fed funds rate (EFF; or EFFR as denoted at FRBNY) is the weighted average of all the unsecured trades that happen throughout the entire daily session.

The argument for fed funds, and against LIBOR, is that the former is based on deals that actually do happen. The latter rate, LIBOR, is put together from a survey of banks in the eurodollar market which asks them at what rate they would lend given the circumstances of that day. It’s been called a fake money rate for that reason.

And yet, LIBOR is absolutely superior, meaning more useful, at times like these – as you’ll see in a minute.

For the sake of simplicity, on Day 1 we’ll assume under normal conditions that they are four banks borrowing a total of $120mm at the different individual rates shown above. The combination of those four transactions puts the weighted average, EFF, right at 1%.

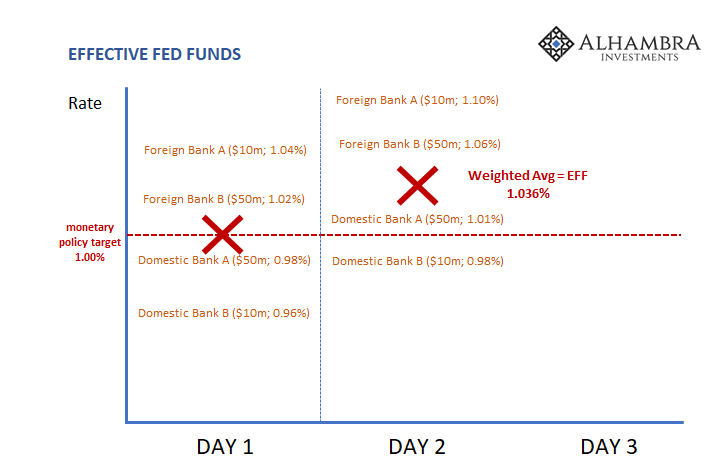

On Day 2, something happens which causes cash suppliers (dealers) to demand a higher return. Call it a supply shock (risk perceptions), where the same $120mm gets lent out but at higher rates across-the-board. EFF rises as a consequence, in exactly the way you’d picture a monetary disruption like this.

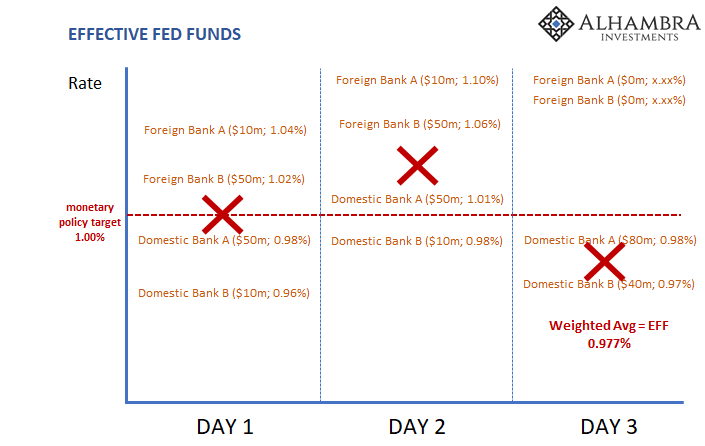

But what happens on Day 3 shows that a lower rate doesn’t necessarily mean things are getting better. In fact, in this situation the reduction in the average is dangerously deceptive.

Because cash suppliers have grown even more risk averse, they begin to differentiate among individual opportunities (counterparty risk). They might simply avoid lending even a single dime to entire groups of counterparties, such as perhaps the foreign institutions in our example. And they might even avoid them at any interest rate (a partial but perfect inelasticity).

They still have spare cash to lend, so they’ll compete with other dealers to lend the surplus only among a much smaller cohort.

That means Domestic Bank A & B are offered even more cash, which they’ll likely take on given the crisis circumstances, while Foreign Bank A & B are left with nothing.

Overall, however, the same $120mm is sent into the hypothetical fed funds marketplace only on Day 3 the weighted average, EFF, is now less than it was on either Day 2 or Day 1; less than the policy target. Because fed funds only takes into account the funding transactions that happened, and ignores those that disappeared, when the weighted average declines it does so distorting and masking the clear distress behind that decline.

What’s important in this case isn’t what happened but what didn’t. The rate signals monetary excess and that’s true but for only a part of the overall system.

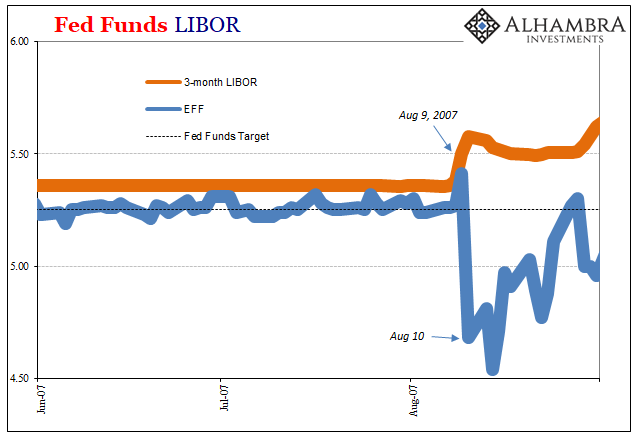

While the numbers are simplified and the example merely a stylized one, this is, in fact, what did take place during the early days of GFC1 (as well as at crucial points throughout the rest of it). Fed funds like LIBOR shot up on August 9, 2007, just like Day2, and then on August 10 the results were an extreme form of Day 3.

EFF therefore “benefited” from counterparty shunning as well as the dumping of spare liquidity (in this one market as well as among a narrowed group of acceptable borrowers) at the expense of the rest of the system. Whereas LIBOR jumped – and remained high – because banks were being more accurate when asked at what rates they would lend if they had to; even if they weren’t actually lending on that day.

The idea that actual transactions gives you a better sense of market conditions isn’t always a logical assumption. On some days, the funding trades that aren’t made are the more relevant bits of information.

Thus, when you see rates like fed funds or repo start to fall in a crisis situation, it may instead be a signal that things are really going wrong in the shadows.

Rather than suggesting the Fed is gaining ground on the crisis with its balance sheet expansions and huge increase in bank reserves, these low rates actually indicate the opposite. The central bank is, like before, falling further and further behind no matter how big the LSAP, “repo” operation, or what other ’08 program central bankers dust off and resurrect.

The central bank hasn’t found the “magic number” for QE and whatnot, rather the market knows that QE is little more than a puppet show. As I wrote before, all last year, money now…or else.

That is what has to change, effective elasticity, given the central bank is not right now in the money business. In a strange twist many people aren’t prepared for and haven’t been properly equipped to grasp, that’s just what these low rates are signaling. Like GFC1, more and more of GFC2.

UPDATE for 3-23 close: DTCC puts the GC repo (UST) rate in today’s trading lower still, down to 6.8 bps. Is that because things are getting better, the liquidations dissipating?

Stay In Touch