When it’s all over with, I think we’re going to find out we’ve all been unnecessarily harmed by two stochastic models. And in the greatest tragic irony of them all, it was entirely predictable. These statistical constructions can’t predict a thing, subject as they all are to GIGO limitations (Garbage In, Garbage Out). It’s the math which gives them the glow and gloss of science, yet the math is merely the means.

Everyone had been panicked by the original modeled forecasts for COVID-19, including what’s being revealed as the ridiculous assumptions put together by the Imperial College of London. It had forecast something like 2 million deaths in the US and played a central role in scaring politicians and provoking such draconian responses around the world.

The latest estimates are nowhere near them (leaving academics to argue whether mitigation efforts can plausibly save their prior projections).

Every single one of these models relies entirely on the subjective assumptions governing their creation. The biggest one of all is randomness; as in, models assume that any errors therefore deviations from their forecasts can’t have been predicted. This is false; presuming any error in your elegant mathematics is unforeseeable is actually arrogance (chaos theory).

More likely than not, they aren’t random mistakes at all. The stochastic modelers just didn’t think some factor worthy of inclusion, or were unaware of it by some combination of stupidity and lack of sophistication, rendering their beautiful regressions plain garbage. Was 2008 really a tail risk, or was it because every mainstream econometric model failed to account for negative financial inputs of any size? This is a rhetorical question.

Having no idea how to define modern money isn’t exactly a random error should the monetary system suddenly go haywire (twice).

We’ve been led down a road into believing the math is king; that it can accomplish everything from putting together winning World Series rosters to figuring out how many people will stream the next big online sensation. And yet, the models left everyone blind to the dangers of GFC1, and then in its aftermath unprepared for the possibility of a repeat.

With the eruption of GFC2, it is R* that’s going to do so much damage. This was the mainstream acceptable idea that the economic stagnation we experienced in between GFC1 and GFC2 was somehow the best the economy could’ve achieved. Weakness was, due to R*, reclassified as strength; fragility painted over in the colors of “resilience” (something about Janet Yellen and no more crises).

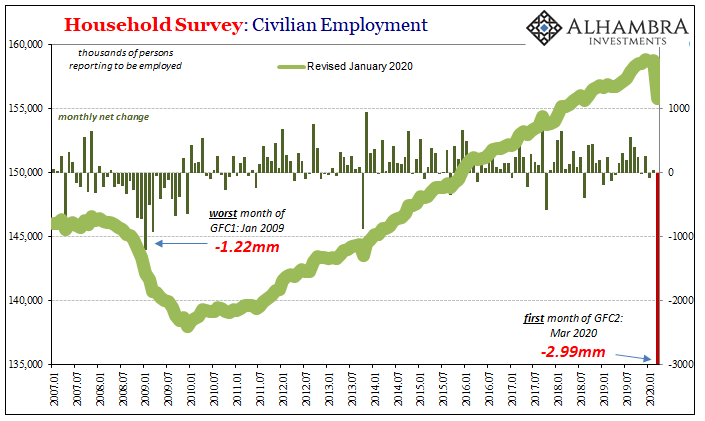

Led by the Imperial College and other similar models, they chose complete economic shutdown. Because of R*, governments around the world were led to believe that the global economy was in great shape heading into the pandemic and could therefore better afford such extreme caution.

But not only was the underlying economic baseline one of stagnation, it had been heading in the wrong direction for two years! Central bankers couldn’t (and didn’t) account for how 2019 had already turned out in exactly the opposite fashion the models had all predicted, but, sure, let’s listen to the central bankers interpret those same models so as to get an idea about where things stand in the crucial months of early 2020!

This is something governments are going to have to answer for down the road. When all is said and done, the massive costs tallied, I predict (without the need to regress any variables) the public’s faith in the mathematics of econometrics will be seriously strained – to the point of (righteous) anger.

That’s a good and, for once, healthy thing.

They’re already starting to feel the heat. This past weekend the President said:

You know, I had an expression, the cure can’t be worse than the problem itself. Right? I started by saying that and I continue to say it. The cure cannot be worse than the problem itself. We got to get our country open.

When you do get it open, the first order of business has to be to fire all those R* adherents at the Federal Reserve. It should’ve been done earlier in March when kitten Jay watched helpless as markets were liquidated in a seemingly endless loop (it wasn’t endless, just another calendar quirk), an unnecessary financial meltdown that shuts off a good part of the dollar redistribution mechanism the world needs for its globalized economy to run at any minimum level.

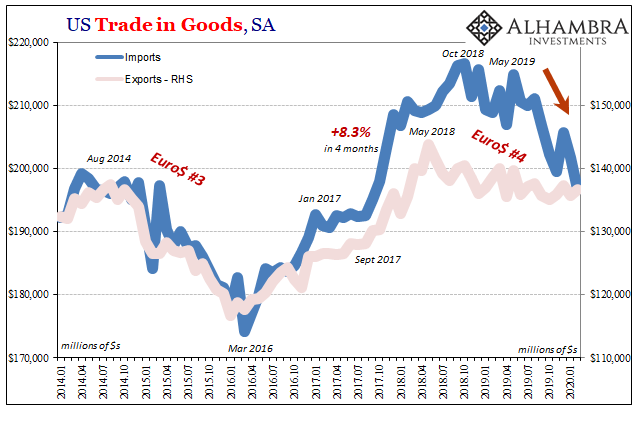

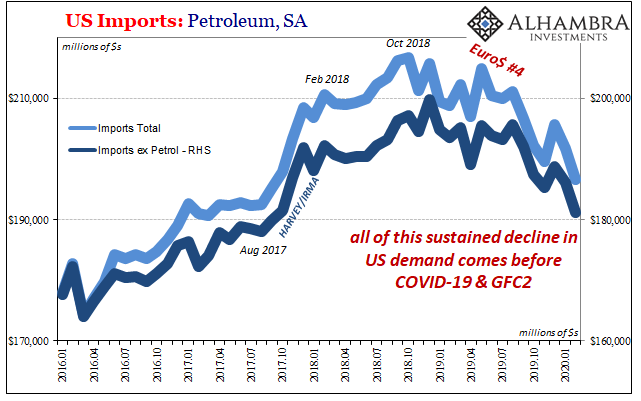

And now the mercantile hammer is about to be dropped. Once global trade grinds to a halt, neither goods nor dollars will be moving toward anywhere. This isn’t a new development; US demand for goods has been sinking fast for almost a year now.

The Census Bureau reports that US imports fell sharply in February – as the coronavirus countermeasures were just then beginning to have an effect and just before GFC2 erupted. In other words, most of the decline up to February 2020 was Euro$ #4 rather than its more extreme case in March.

The world really was in very rough shape in dollars as well as trade heading into March 2020. The global financial system was already reluctant to step in and provide those dollars lost to reduced trade when it was merely a synchronized downturn.

With trade set to collapse, and GFC2 upon us, no wonder there are eighty Argentinas.

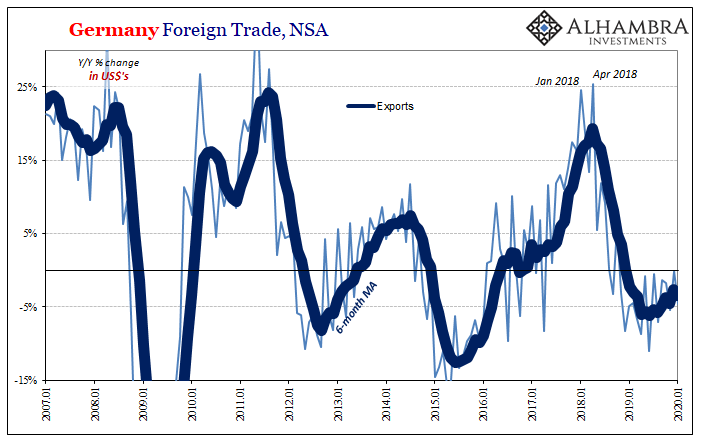

It’s not just US trade which transmits US dollars on the mercantile side. This is the reason why, for example, Germany’s deStatis breaks down the statistics it compiles for German exports and imports into US dollar currency. When Germany sells fewer goods on the world’s markets, and buys less for itself, even fewer dollars get redistributed.

The fact that banks were increasingly unwilling to make up the difference during the globally synchronized downturn of Euro$ #4, that’s what drove up the US$ exchange value, driving down currencies all over the place.

GFC2, in many ways, is the world’s marketplace (goods and money) beginning to think about what happens when Euro$ #4’s substantial and prolonged downturn becomes a cliff.

The risks are very real largely because of major mistakes in two faulty models. The COVID-19 pandemic left the world with no good options; it really was a no-win situation. But there is gradation even to a no-win; with the US and global economy in rough shape right from the start (and trending down) it definitely will make a difference.

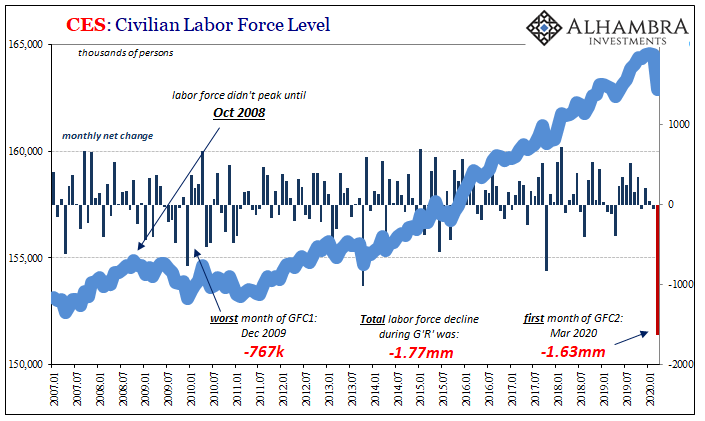

All we can do now is greet these stochastic monsters with even greater skepticism, as well as all those who continue to stick with them. Another lesson learned, perhaps, the skinniest of potential silver linings. Not that it will do much good for the world’s labor force.

Stay In Touch