Hold all the congratulations. Jay Powell is, with a huge assist from the financial media, trying to pre-empt what comes next by taking a premature victory lap. The Fed isn’t just your central bank it is your friend. The amount of pure propaganda being put out lately is understandable if still disgusting.

March was a good month to include in the annals of central banking? Who knew?

Reuters writes today (thanks M. Simmons) about how the Federal Reserve is saving lives. Saving lives!

Three ways the Fed can affect you:

1. Subprime *is* contained.

2. The financial system *is* resilient.

3. What *is* repo collateral? https://t.co/g6FD6Dym47 pic.twitter.com/x9DUeTkKqY— Jeffrey P. Snider (@JeffSnider_AIP) April 15, 2020

Only slightly worse than the constant repetition of the word “stimulus” is what all the “experts” seek to do with it. The dollar can’t possibly rise, they say, not with all this money printing going on.

Citigroup Global Markets Japan Inc. says the yen stands to gain as the Federal Reserve’s massive monetary stimulus weighs on the greenback.

Backward not just once but twice all in the same sentence and on the same issue. When the yen starts rising, that’s not “stimulus” for anyone because it’s a pretty clear sign of the worst dollar case. The Fed is missing entirely from it.

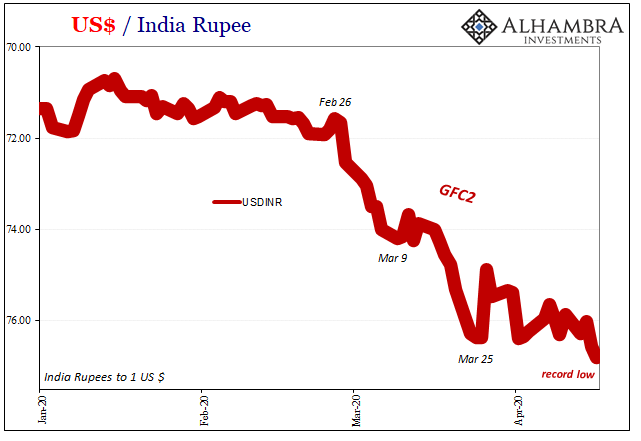

The dollar falling against the yen means it is almost guaranteed to be rising against everything else – that’s the wrecking ball which creates the damage that only then invites the US central bank to action. Mainstream convention sees it all from the wrong direction; the Fed doesn’t cap the dollar’s upward motion with its accommodative policies, the monetary shortage which produces a rising dollar induces the Fed to act with its futile gestures.

Calling it “stimulus” or “money printing” doesn’t re-arrange the order; which is why “strategists” have been calling for this “weaker” dollar for years as well as how interest rates have nowhere to go but up.

If the Fed was actually effective at, well, anything, sure. But, if interest rates only fall and the dollar only rises no matter what the Fed does…

That’s where mainstream thinking goes off into the abyss, unable to reconcile what actually happens with all the “expert” forecasts for what won’t. And why.

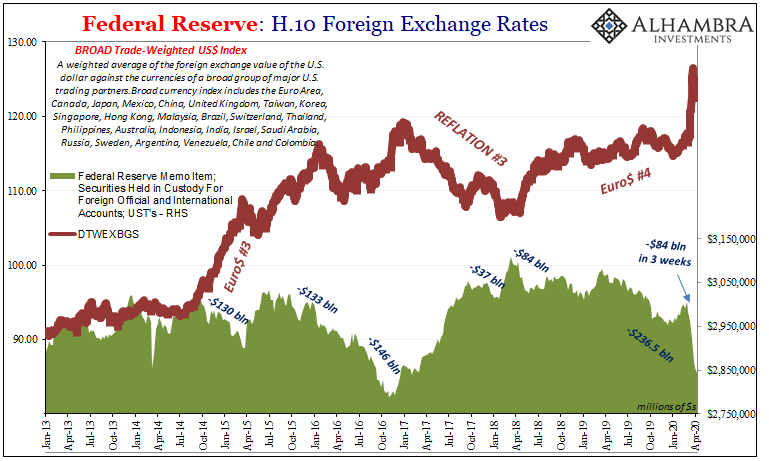

Not only is the dollar sticking around and resuming its upward trend against key currency crosses, there’s also the matter of US Treasury yields in general and those for T-bills specifically. The more they fall, and also the more foreign central banks “sell” the securities, the higher the dollar will go no matter what the strategists at any of the banks say.

Because the same thing is responsible for all three of those things (and a bunch more): global dollar shortage in the offshore eurodollar system. Starting with collateral.

You are probably aware that the US federal government has left all bounds of sanity and reason behind. They may all be Keynesians now but for any other purposes the amount of debt being issued boggles every mind, irritates every bit of common sense rationality.

So, where are the “too many” Treasuries people now? They’ll claim the Fed is buying and that’s what’s keeping interest rates so low, but we know that’s just not true; after all, interest rates didn’t just start falling only recently, they’ve been in a serious downward pattern for nearly a year and a half already.

The Fed only came in at the end. And even the emptier of the empty suits at the central bank were also aware of this discrepancy. One of them, Dallas branch President Richard Fisher, realized in 2014 when it came to UST buying via Operation Twist:

MR. FISHER. In summary, I want to mention that, as I said earlier, most of these variations that have been suggested are very un-Bagehot-like. And what I mean by that is, twisting entails purchasing assets that investors are fleeing toward, not assets that they are fleeing from.[emphasis added]

Not just Twist, all the QE’s including the current one are carried out in the same way. Too few, not too many.

There’s enormous demand for UST’s especially bills no matter how much the government rewrites the rules for fiscal responsibility.

Case in point:

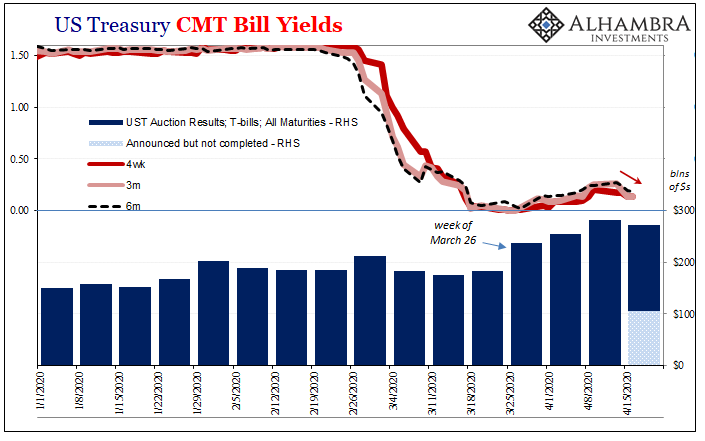

The chart above kind of understates the flood of T-bills that have rushed into the marketplace since the week of March 26. The totals are staggering; over the prior three weeks (not counting this week whose bill auctions have only been partially completed) $772 billion in T-bills have been issued (of all maturities).

During the first three weeks of 2020, $460 billion had been, an increase of 68%, and during the three weeks prior to March 26 $541 billion auctioned.

As you can see, as these bills hit the market equivalent yields at all short-term tenors backed up and away from the negative numbers which showed up (especially in after-hours as Asian markets would open) during the worst days of global fire sale liquidations. Again, the direct and easily observable relationship between: the collateral bottleneck, the collateral run on bills, gold slams, and finally some of the largest daily percentage declines in stock market history.

In short, despite an “excess” $230 to $310 billion of bills pushed into the market since late March, bill yields didn’t explode higher they meandered upward toward what was a less extreme position. The increase actually helped!

And now bill prices are jumping again, yields falling – as the dollar rises. Three quarters of a trillion of them already bought of late, and still not enough?

I talked about this on our last Making Sense podcast; increasing the stock of bills even through government profligacy is at best a short run stopgap. It does nothing, however, to cure the redistribution problem. If dealers end up hoarding all those additional securities, instead of lending them out and transforming other collateral as they had been, then we’re still confronting the possibility of another bottleneck situation.

Perhaps inevitable.

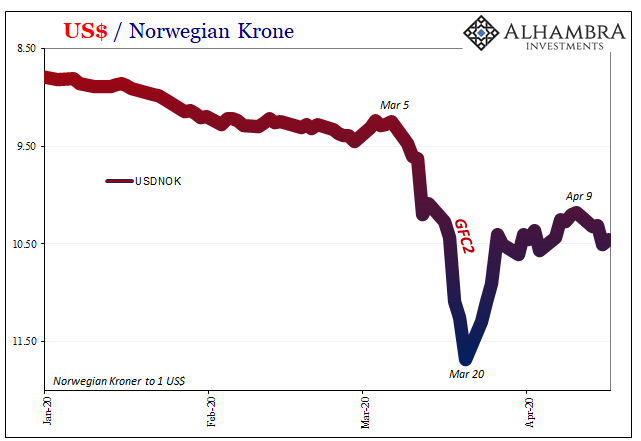

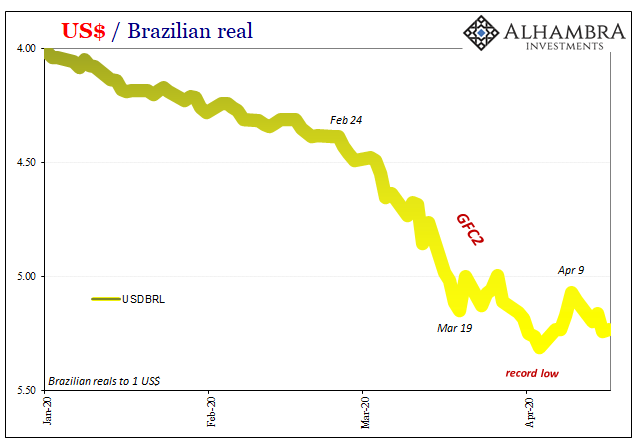

These markets are primed for another go at GFC2. Jay Powell’s victory lap, the complete catalog of his reassurances, and definitely this wave of propaganda, they are all entirely too premature.

Why? Because nothing has really changed since the worst days last month. The entire global monetary system remains in its same fragile state. There was enough destruction of leverage and risk-taking up to the mid-March calendar quirk low point to reach a quasi-equilibrium or short run settled state.

That’s all it was.

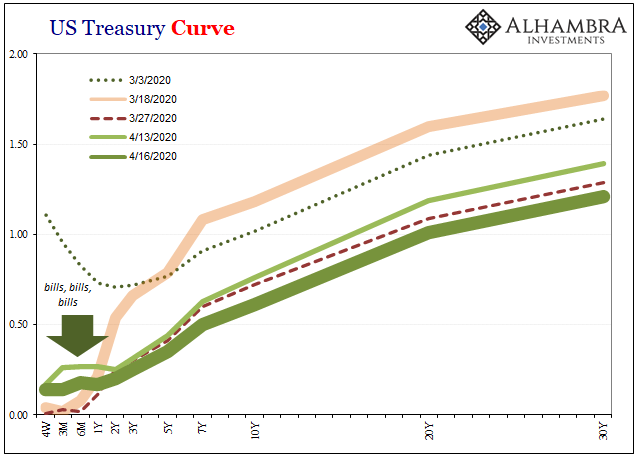

Just look at the yield curve (below). The (monetary) earthquake which struck severely weakened the structure, and though it is still standing it won’t take much of an aftershock to knock it down (more) completely.

While it is still upright, all the creaking and groaning, the structural members clearly under pressure as it tries to hold itself up, all those warning noises are being dismissed by the same people who see an effective Fed, a weaker dollar, and interest rates that have nowhere to go but up – even when all they do is hit record lows.

It’s a cult, not science or even rational analysis. Everyone says the word “stimulus” and thinks that way because everyone says the word “stimulus.” It doesn’t matter how many times or how thoroughly it gets disproven, the myth of the Greenspan “put” soldiers on aided solely by what the Fed actually does well: advertising.

Everyone thinks the Fed printed new money, and the world's markets were flooded with new "liquidity."

Nope.

What really happened was this: pic.twitter.com/m11VySKGo4

— Jeffrey P. Snider (@JeffSnider_AIP) April 7, 2020

Stay In Touch