With survey after survey showing Americans are now firmly more concerned about the economy than the pandemic, the narrative reassurance program will be even more in demand than ever. The latest Axios-Ipsos poll suggests nine out of ten US citizens are today worried about economic disaster.

To counter the growing angst, Treasury Secretary Mnuchin declared over the weekend that his super-secret economic models say everything will be back to normal, if not better, starting around August. Nothing more than a painful memory by autumn.

Just in case, though, the White House is starting to consider another round of helicopter “stimulus.” Kevin Hassett, economic advisor to the President, told reporters today that a second issue of the Treasury paying currency to hardscrabble citizens rather than gainfully employed citizens forking over to the Treasury is “something we’re studying very carefully.” All those better-than-rosy “V” recovery shapes in the models, regular as well as super-secret, obviously not convincing enough.

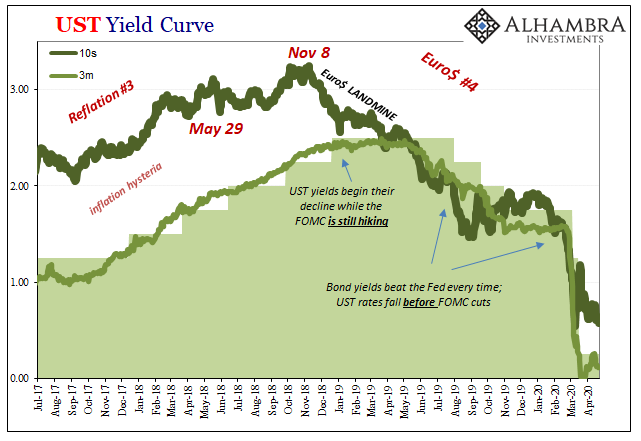

If officials are beginning to reflect upon the need for even more cash to flow in the wrong direction, what does that say? For bonds, investors demand the safest, most liquid instruments at any price and at any balance issued – and that’s the only way to get funds circulating into the hands of workers and businesses alike.

OH SH&% is right.

To me, it’s more confirmation of at least two of the three massive, probably historic model errors. The middle one, the pandemic’s deathly potential, we’ll leave out from today’s discussions. Instead, we’ve got some data speaking to its bookends: the economy in good to great shape from the start and then how being so strong and resilient it will bounce right back with determined vigor.

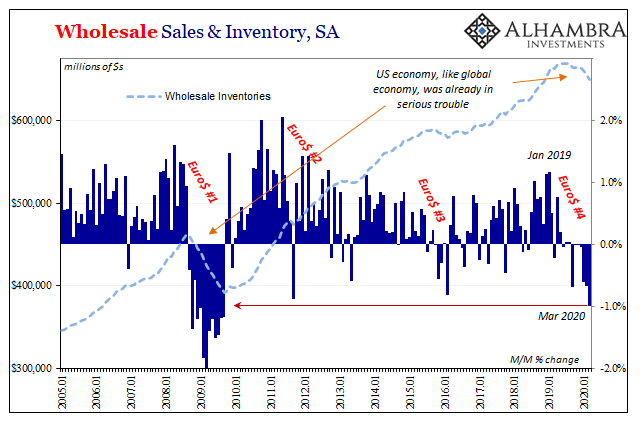

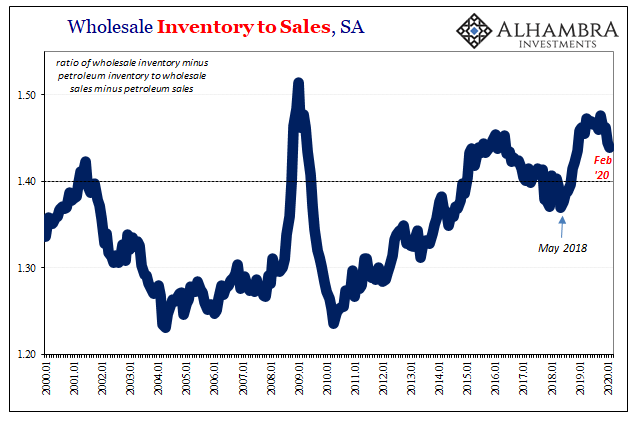

The Census Bureau reported today that wholesale inventories fell by 1% in March 2020 from the month before, February. While it doesn’t sound like all that much, this was the largest monthly decline since the Great “Recession.” Inventories unlike sales are at a bigger lag, therefore this data not really much about the coronavirus outbreak.

Instead, it further illustrates the shocking degree to which the first model error reached. As you can plainly see above, inventory contraction of this kind has only been associated with recession. Not the GFC2 depression upcoming, but Euro$ #4’s earlier stage which, for the US economy, clearly stretches back all the way to the end of 2018 (the bond market nailed that one, too).

This didn’t necessarily mean the US economy was already in recession when the second model error was made, and the shutdowns ordered, but it does provide substantial evidence it wasn’t far enough away from one, either. In the end, this is much more important; a fragile situation upon which to gamble everything.

And that means future problems on top of the current ones we’re desperately trying to work through. High levels of inventory combined with recessionary (or depression) instincts mean significant suppression of activity much further into the future.

During normal contractions, production must be brought down commensurate with sales at the same time sales are falling, too. This self-reinforcing inventory cycle is the very stuff of classic recession.

But what happens when falling sales are forced to fall so much farther because the burgeoning preexisting recession-like state is augmented with gross non-economic interference?

What I mean is, under that classic business cycle peak pattern a 1% monthly decline in wholesale inventories would be a very welcome result. We want inventories to drop in the short run so as to work through this inventory overhang as quickly as possible; to find a much reduced “equilibrium” whereby sales and inventory are acceptable to all levels of the supply chain.

Once that point is reached, we call it a recovery.

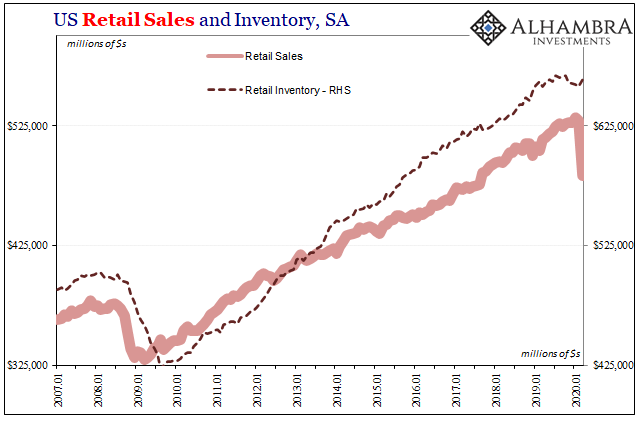

We don’t yet know how much wholesale sales declined in March; those estimates won’t be released for several weeks. But we do have them for retail sales (and now retail inventory).

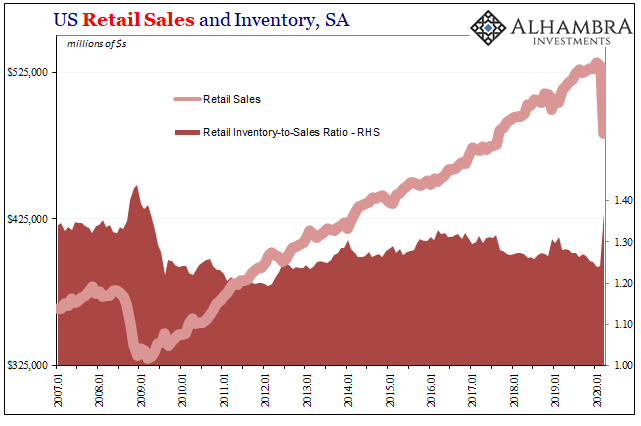

Retail inventories actually increased in March while sales utterly collapsed (taking out grocery stores and the Great TP Run of 2020, the decline was even more destructive than shown here). The inventory-to-sales ratio exploded upward to a high level we haven’t seen since early 2009. Just the first month of this GFC2.

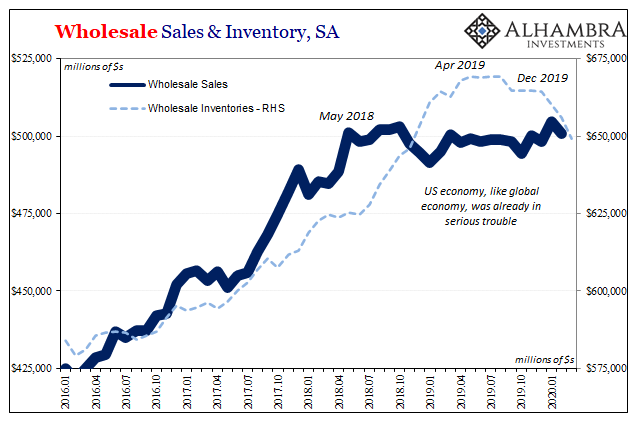

From that, we can infer a reasonably similar situation on the wholesale level. Though wholesale inventories fell sharply, wholesale sales in all likelihood dropped by a lot more.

Since wholesale inventories were already elevated, owing to Euro$ #4 producing a recessionary situation for over a year beforehand, the potential overhang in production in March is going to be epic. Almost certainly far above the worst point of 2008-09 (even when excluding petroleum).

What that proposes is an even longer period will be required to normalize inventory to sales, and we have to hope even that happens quickly enough in a dynamic environment where all the economic factors are stacking up on the downside (such as an energetic GFC2 which hasn’t expired despite all its obituaries published of late).

A quick and complete recovery by autumn was always whatever you might call something even more unrealistic than a long shot. A robust recovery at any length shouldn’t be considered the base case, either. Common sense as well as recent history are thoroughly devoid of the letter “V.”

Like the bond-man said, the economy was in serious trouble when all this started and it isn’t even beginning to work through those imbalances let alone these further imposed; fundamental economic disparities which we can’t even put in a ballpark reference right now.

Let alone reasonably presume what that might be considering second and third order effects (what happens after missed mortgage and rent payments, for example; credit being turned off, etc.) that haven’t even begun to manifest.

No wonder the government’s getting itchy about more backwards cash. When the only economic redistribution model that has any chance of working is the Treasury market, and only certain, conspicuous pieces of it at key times, you know nothing much is truly working – especially citizenry – and that can only point in the direction of a very long, and at times very painful, road ahead.

Stay In Touch