It’s understandable to an extent. Central banks are omnipotent, central bankers therefore the nearest human equivalent of gods. That’s what we’re all taught, so if something happens somewhere to some market then we’re left to believe it was because one of the gods wanted it that way.

Taking this globally, the Fed made a bunch of money in the aftermath of GFC1, therefore there’s no other way to account for how China has behaved other than to assign all activity to the PBOC. Even better than the Fed, so far as the technocratic ideal is concerned, where the US central bank might have limitations the Chinese central bank is theoretically limited by none.

Authoritarian Communism, after all, can arbitrarily justify its arbitrary shifts to anyone however it likes.

Given the one’s stated hostility to the currency of the other, as I wrote yesterday, the only conclusion we’re presumably able to draw is this purposeful de-dollarizing:

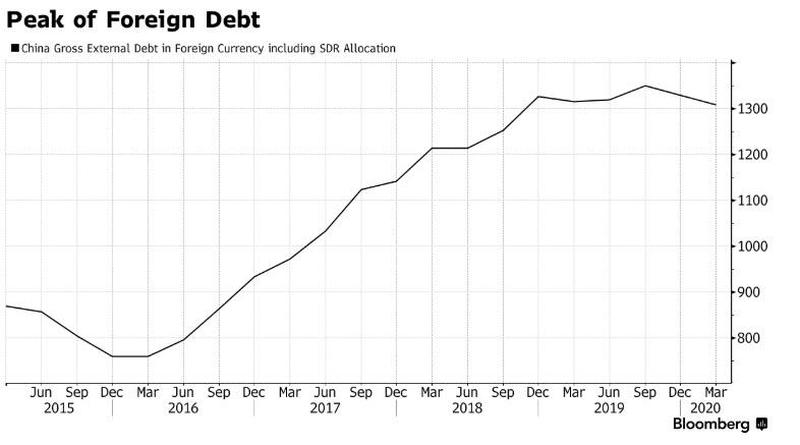

Going back to December 2018 (why is this time frame so familiar, you ask?), the amount of China’s external debt has been flat to falling. In our non-linear world, especially where Emerging Market economies like the Chinese are concerned, lack of growth is contraction.

Thus, we are told, the only way to read this situation is in the official language of unofficial actions telling a secretly official story.

Considering everything from the U.S.’s threat to delist Chinese companies, to moves to strip Hong Kong of its special status, it’s more than clear that China is starting its process of de-dollarization and furthering the internationalization of its own currency.

Again, no. Quite the contrary, really. There’s a huge difference between intentionally de-dollarizing and what’s shown above – being de-dollared by default.

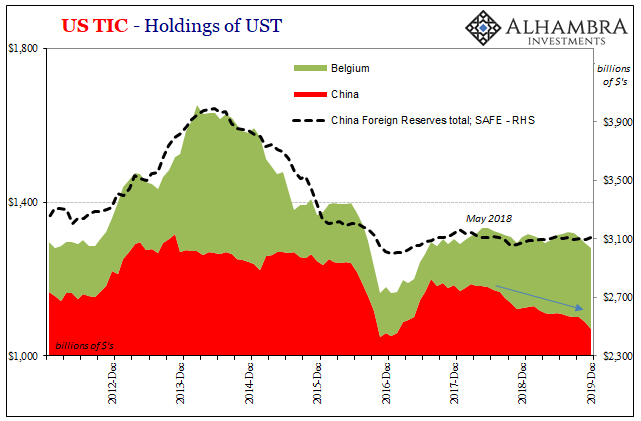

What’s often left unstated is that interim between 2015 and 2018; between Euro$ #3 and Euro$ #4. The Chinese were, back beginning in 2014, supposedly de-dollarizing then, too. Only that wasn’t the case even though from the very beginning of all of it, including falling CNY, it was constantly classified that way. Especially the epic amount of Treasuries that China sold (including through Belgium).

However, as I wrote contemporaneously six years ago in March 2014:

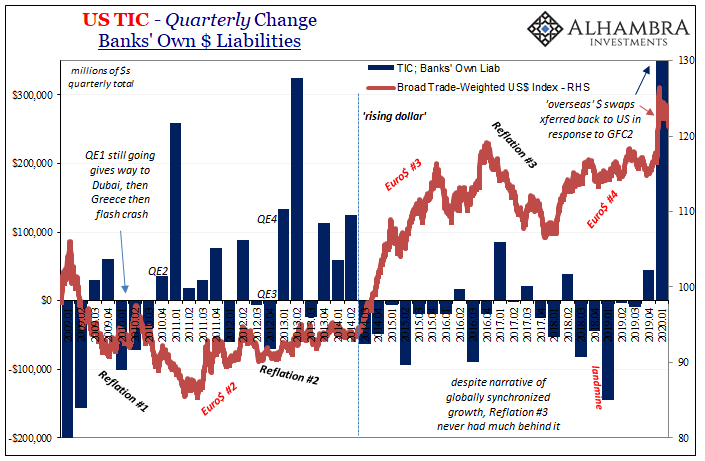

What all this data shows, as opposed to conjecture about the supernatural powers of central banks, is that yuan’s devaluation may be directly tied to dollar shortages. In fact, as I argue here, it is far more plausible that a dollar shortage (showing up as a rising dollar, or depreciating yuan) is forcing the PBOC to allow a wider band in order that Chinese banks can more “aggressively” obtain dollars they desperately need. Worse than that, the PBOC itself cannot meet that need with its own “reserve” actions without further upsetting the entire fragile system.

In other words, banks stop providing dollars to China (which can mean they just make them more expensive and harder to secure, another form of monetary “tightness”) which then forces the dollar up, CNY down, and the PBOC to react by selling reserves (UST’s). All of that would end up happening just the way I laid out.

And it resulted in a total mess because first of all the Fed never fixed the breaks in the system behind the first dollar shortage (Euro$ #1, also known as GFC1) and left the global eurodollar to deal with its own problems. Central banks aren’t directing things, they are being directed by them.

This also explains why, on the Bloomberg chart above, external Chinese lending contracted at the very same times as this particular dollar shortage – Euro$ #3 throughout 2015 until February 2016 – as well as the current one (Euro$ #4).

In between, as Reflation #3 took hold, suddenly the Chinese weren’t interested in de-dollarizing any longer? The level of external debt, almost all of which denominated in the dollar, rose like CNY under globally synchronized growth; not because of the PBOC’s dollar activities one way or the other, but because of that reflationary substance centered on 2017.

There were more dollars available (at more reasonable costs) relative to 2014-16. Like everyone else around the EM world, those like Argentina, China went on a borrowing binge.

So, going back to 2011 and Euro$ #2, every time there’s a renewed dollar shortage the media gets filled with stories about China de-dollarizing. Back in 2011 it was all about bilateral currency and trade deals which were sure to finish off King Dollar’s remarkable if too lengthy reign.

Only it never comes to fruition. A whole lot of talk, and a decade later an even longer stretch of time where it if was going to happen it would have long before now.

And then when reflation inevitably shows up in between those, the stories fall silent, the mainstream unable to reconcile why for a time it seemed like the Chinese (and everyone else) were ditching all dollars only to see them go back at them with both hands. Very confusing, this major inconsistency.

Once you take the central banks out of the equation, you have no such trouble understanding these ups and downs. Not purposefully de-dollarizing only occasionally, being forcefully, painfully, involuntarily de-dollared if intermittently.

Huge difference. This explains why the (euro)dollar remains, as well as why it remains a huge problem that gets bigger with ever return trip.

Stay In Touch