April 15th was the two-week anniversary of the day my wife and I got our second Moderna shot. We have spent the last 13 months being very careful about the virus, limiting our contacts, social distancing, and generally doing anything that seemed helpful. I am certainly aware that others took a more liberal attitude as is their right. But, for a variety of reasons, we chose to act very conservatively about COVID. Needless to say, we were pretty exhausted with the whole routine by the time we finally reached full vaccination. We went out to dinner three consecutive nights that weekend. I rejoined the gym on Sunday and worked out properly for the first time since last March. I was gloriously sore the next day but I’ve resumed my routine of every other day workouts. And I already feel better than I have in months.

It is interesting to me though, that after that weekend of eating out, my wife and I both agreed that now we’ll go back to our previous custom of eating out once a week. That has been our ritual for many years and we put a lot of thought into those nights out but we spend the rest of our week cooking at home, another activity we enjoy doing together. Yes, we occasionally get some takeout but that is the exception, not the rule. Anyway, the point is that we were able to satisfy our pent-up demand in one weekend. Yes, we’re considering some short trips in the coming months – long weekends in places that are fairly close by – but we are not ready to resume international travel. We have tentatively discussed taking the trip to Scotland we had planned before the virus but have made no definite plans; maybe next year. We will also likely try to visit our daughter and her wife this summer in Connecticut – our daughter-in-law is headed to Yale Medical for her clinical psychology residency! – but going to New England in the summer isn’t special for us. And there will be some other activities we resume but the impact will be much more psychological than economic.

We do have some special circumstances when it comes to traveling that makes it more difficult right now. We have recently moved back to my home state of South Carolina after 30 years in South Florida so we are still settling in to our new home (actually it’s 120 years old but it’s new to us). We also have a house full of rescue animals so we require a house sitter when we travel and we haven’t yet found anyone to fill that very important job. So I get that we are maybe not typical when it comes to post-vaccination activities. But I don’t think we are that different and if I’m right about that, the boom everyone is expecting may not last all that long. Of course, that is just speculation and certainly isn’t anything on which to base investment decisions, but it is consistent with what we have seen in the bond markets recently. In short, bond traders don’t seem to think the economic resurgence will be anywhere near a boom.

Yes, things will look a lot better than last year but that is a pretty low bar to clear. And a lot of people seem to be forgetting that the economy wasn’t exactly ripping before the virus came along. Real GDP growth in 2019 was just 2.2% and the average yearly change in real GDP was just 2.3% from 2010 to 2019. That’s okay but it isn’t a boom. Considering that we just added a boatload of debt to that already slow-growing economy, I’d expect post-virus growth to actually be lower than before. But who knows? Maybe the key to economic growth really is as simple as the government writing checks. We seem determined to find out.

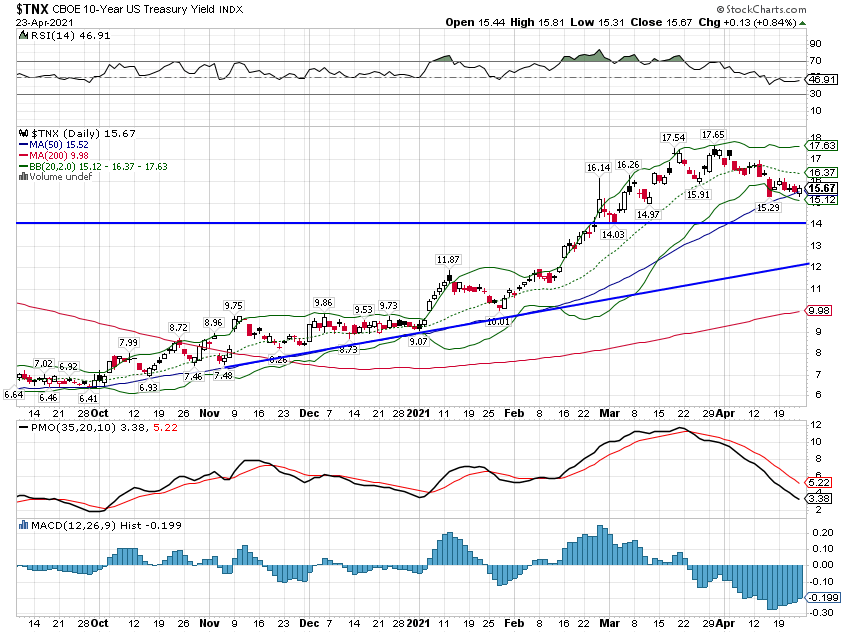

Bond yields peaked at the beginning of April and have fallen slowly but steadily since. The drop, however, isn’t sufficient to change the uptrend in rates that started last August. In fact, from a technical perspective the 10-year yield could fall all the way back to the 1.2 to 1.3% range and still not break the obvious uptrend line – not that I’m saying that will happen:

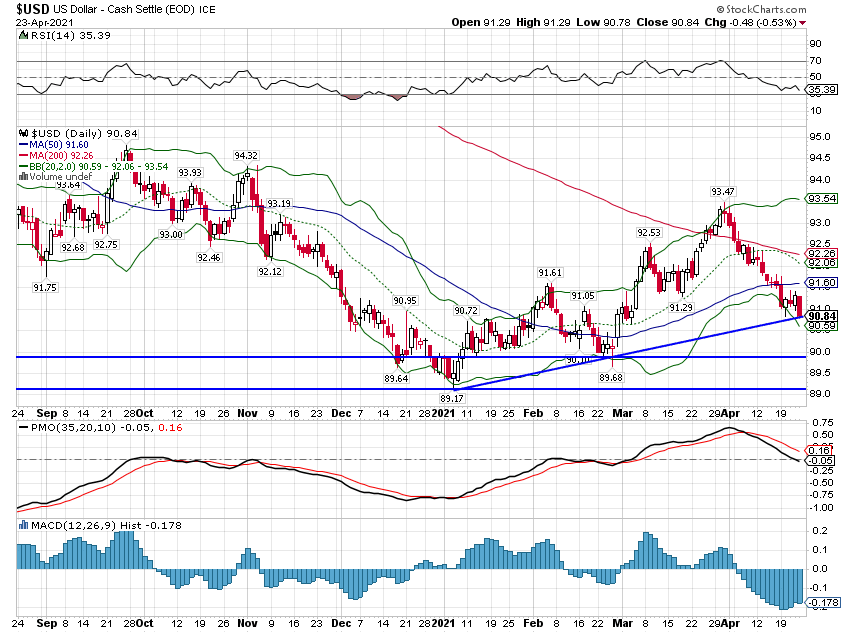

But falling rates – and it isn’t just the nominal 10-year; TIPS yields have declined too – are not consistent with the boom narrative that dominates most other markets – especially stocks – today. Neither, by the way, is the recent action in the dollar which looks a lot like the action in bond yields since the beginning of April:

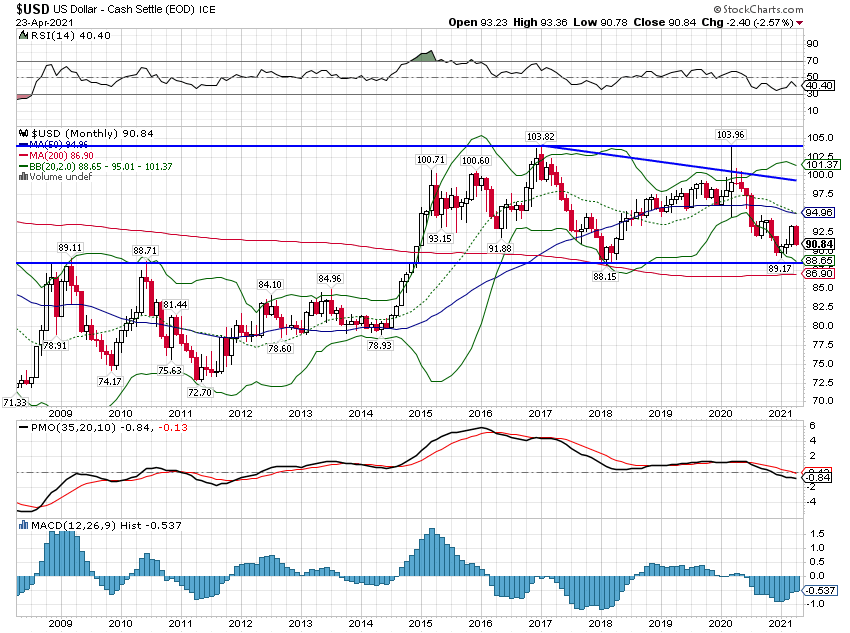

The longer-term picture for the dollar remains rangebound as it has since 2015. The dollar index has basically traded between 90 and 100 with two outlier moves to 103 and two minor forays below 90. Recent action puts it near the bottom of that range:

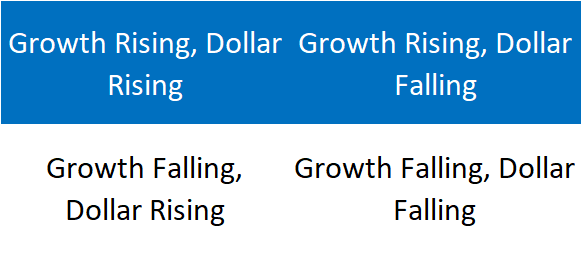

Current economic data is certainly strong – although not universally so – but the bond and currency markets may be pointing to some weakness ahead. It should be noted that the dollar moves are generally about relative growth and what may be going on here is a shift in the perception of growth abroad. The Chinese Yuan has recently strengthened some and other EM currencies also seem poised to move higher. The Aussie and Canadian dollars are still in uptrends while the pound and Euro are also acting well. The economic stats out of Europe recently have been better too. There are some virus hotspots that are not performing well, with India the obvious one and Japan maybe a bit surprising. The rest of the world has lagged the US in vaccinations but with the US well on the way to getting everyone a shot that wants one (whether that is enough to kill this virus is another question), it may be that the markets are starting to anticipate the rest of the world catching up. If the boom here has been fully anticipated, maybe it hasn’t been priced in yet outside the US, emphasis on maybe.

In any case, the current environment remains one of improving growth and a neutral dollar. I am not willing to call the dollar in a long-term downtrend yet and probably won’t unless it breaks the bottom of that range it’s been in for 6 years. And calling a short-term uptrend will require more than that feeble bounce that died at the beginning of April. I also don’t see any extreme positioning in currency futures that would warrant a change in stance. Overall, positioning looks pretty neutral to me.

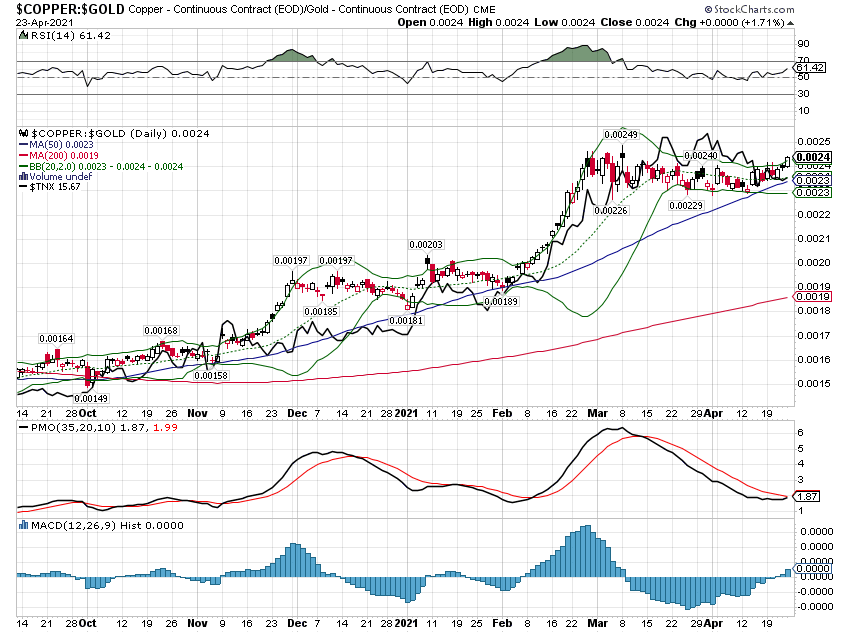

There are other markets that are pointing to the potential for a renewed uptrend in rates and further gains in economic activity. The copper to gold ratio which peaked in early March, leading bond yields by a full month, has recently resumed its uptrend. Momentum, which had waned during the sideways correction, has also recently turned higher. If this uptrend continues, rates will almost certainly do so as well.

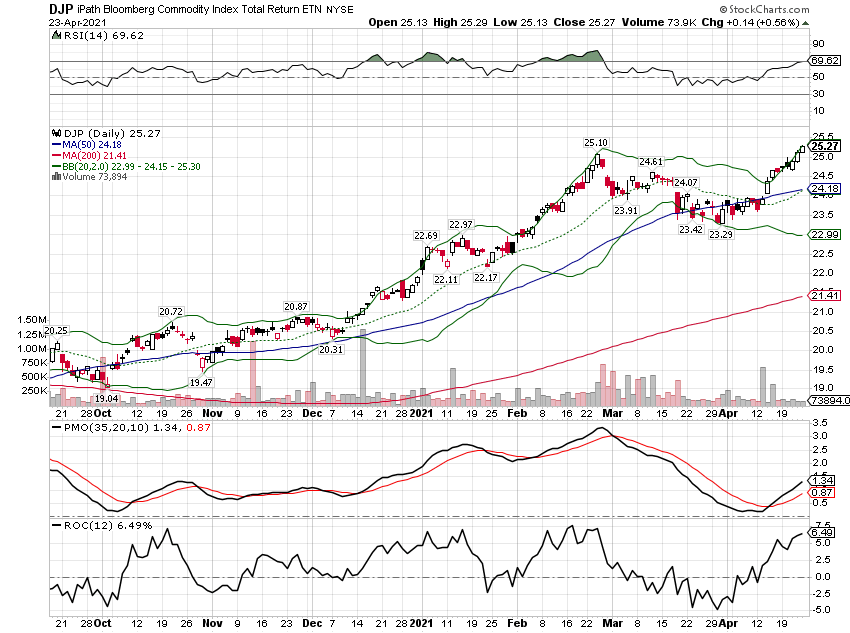

The commodity indexes have also resumed their uptrend with non-energy commodities taking the lead.

It is important to remember though that this was a supply shock-type recession. As the economy re-opens, demand will naturally rebound quicker than supply, raising prices. That is especially true of commodities which often come from emerging markets where the virus is still far from under control. The price hikes we see in commodities may well be transitory and if so, Powell may finally be right about something.

What we look for when managing portfolios is confirmation across markets. As I said last week, this happens when a consensus emerges about the future direction of the economy. That’s what is missing today where we have some markets telling us one thing and others telling us the opposite. I don’t know which markets will prove correct and it is generally not a good idea to base portfolio changes on guesses so for now, I’m not making any big changes.

That doesn’t mean I’m completely comfortable with the state of markets today. Speculation is, in my mind, out of hand in a number of markets. Cryptocurrency markets – I hesitate to even call them markets but that’s a conversation for another day – are just frankly nuts in my opinion. People appear to have lost their minds and I suspect there will be a lot of regret in the future about caution being thrown to the wind today. I ran across this tweet last week in a thread about cash out refinancing:

“Borrow money at a rate less than inflation? Yes, thank you! Just refi’d my house at 2.25 and took every last bit of equity out I could. It all went into crypto. Buy appreciating assets with depreciating dollars or HFSP!”

I’ve been around a long time. I bought my first stock in 1983 and was trading options before most of the “experts” on Twitter were born. I have speculated plenty in my career, but I have always adhered to a bit of advice I was given by an old commodity trader back when I first started doing this professionally. Never, he said, never, ever risk the milk money. That was his playful way of saying that you don’t risk important capital on speculations. I can’t think of anything that violates that rule more than refinancing your house and putting the proceeds into an asset that has essentially no value. Yeah, yeah, I know. I’m just an old fossil that doesn’t get it. I heard that back in 1999 too and again in 2006. I guess at least the old part is right this time, but I’m pretty sure I still understand how markets work. By the way, for those of you who don’t know, HFSP stands for Have Fun Staying Poor. Hodlers might want to ponder the consequences of showing hubris before the market Gods. They don’t like it much and it rarely goes unpunished.

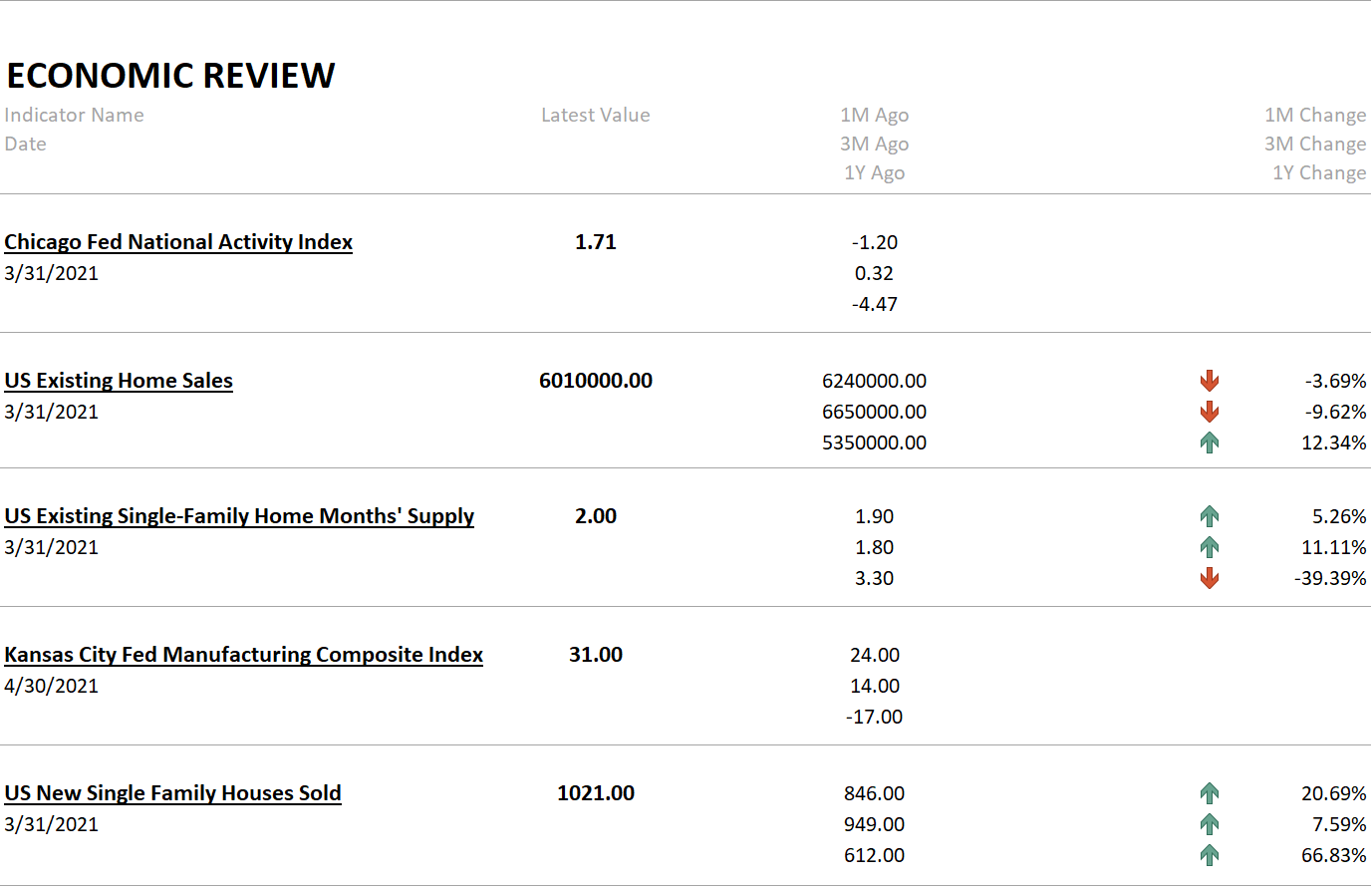

The economic data released last week was generally positive. The Chicago Fed National Activity Index rebounded to 1.7, more than fully negating last month’s -1.2. The 3-month average is now 0.54 showing the US economy growing slightly above trend. The other report of note was new home sales which rebounded to over 1 million units annualized. Sales are up nearly 67% from last year and inventory is non-existent in new or existing homes, prices acting as one might expect in that situation. The housing market is hot right now and it appears it will stay that way a bit longer. There are real fundamentals driving the housing market but eventually, things will balance out and cool off. When? I have no idea but I wouldn’t be in a hurry if I was a first-time home buyer.

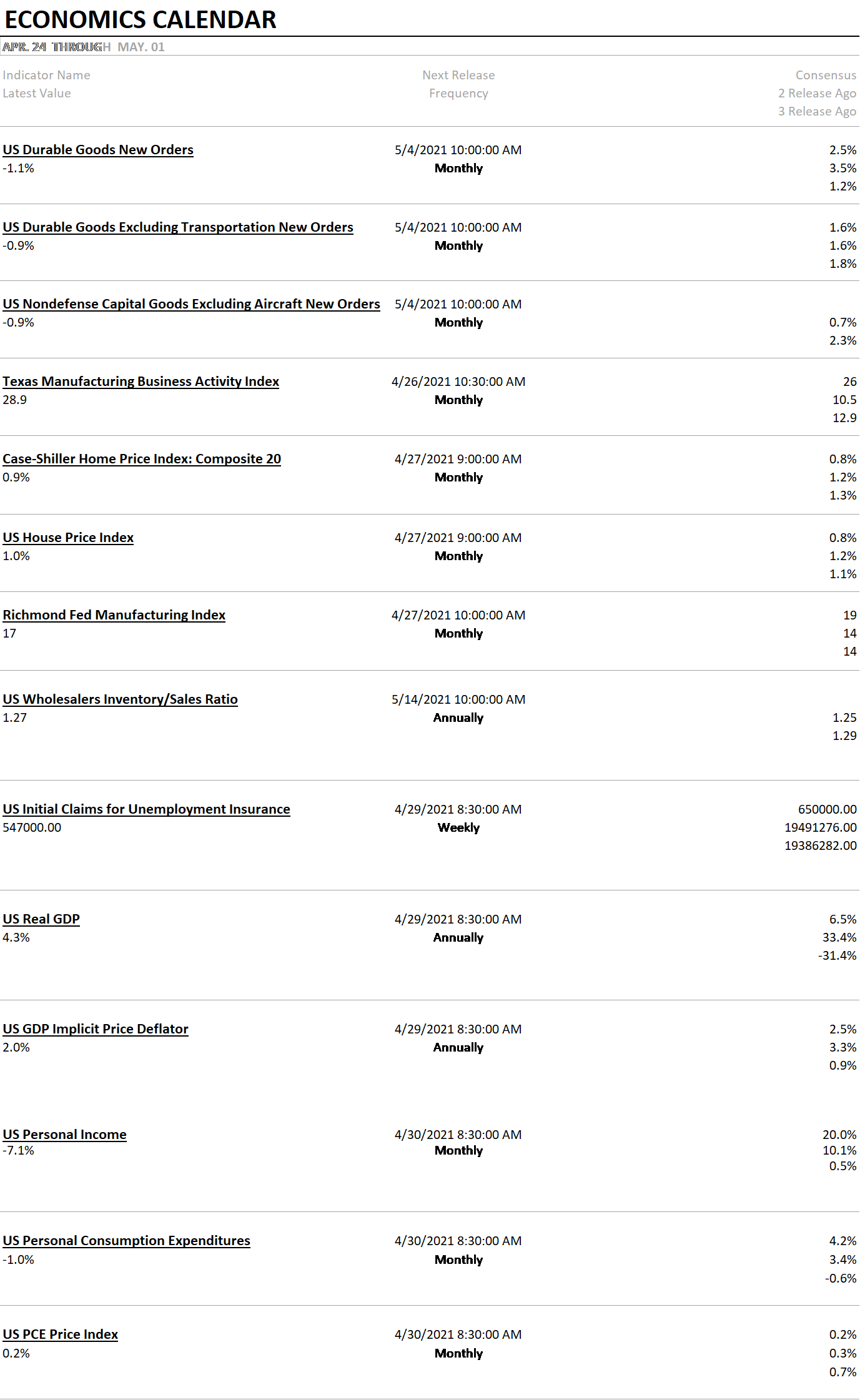

Next week brings some important reports including Durable Goods orders, Q1 GDP, and Personal income and consumption. All are expected to show healthy gains. The most interesting report next week may be the wholesale inventory report, one that most people ignore. The inventory/sales ratio ticked up slightly last month and it will be interesting to see if that continues.

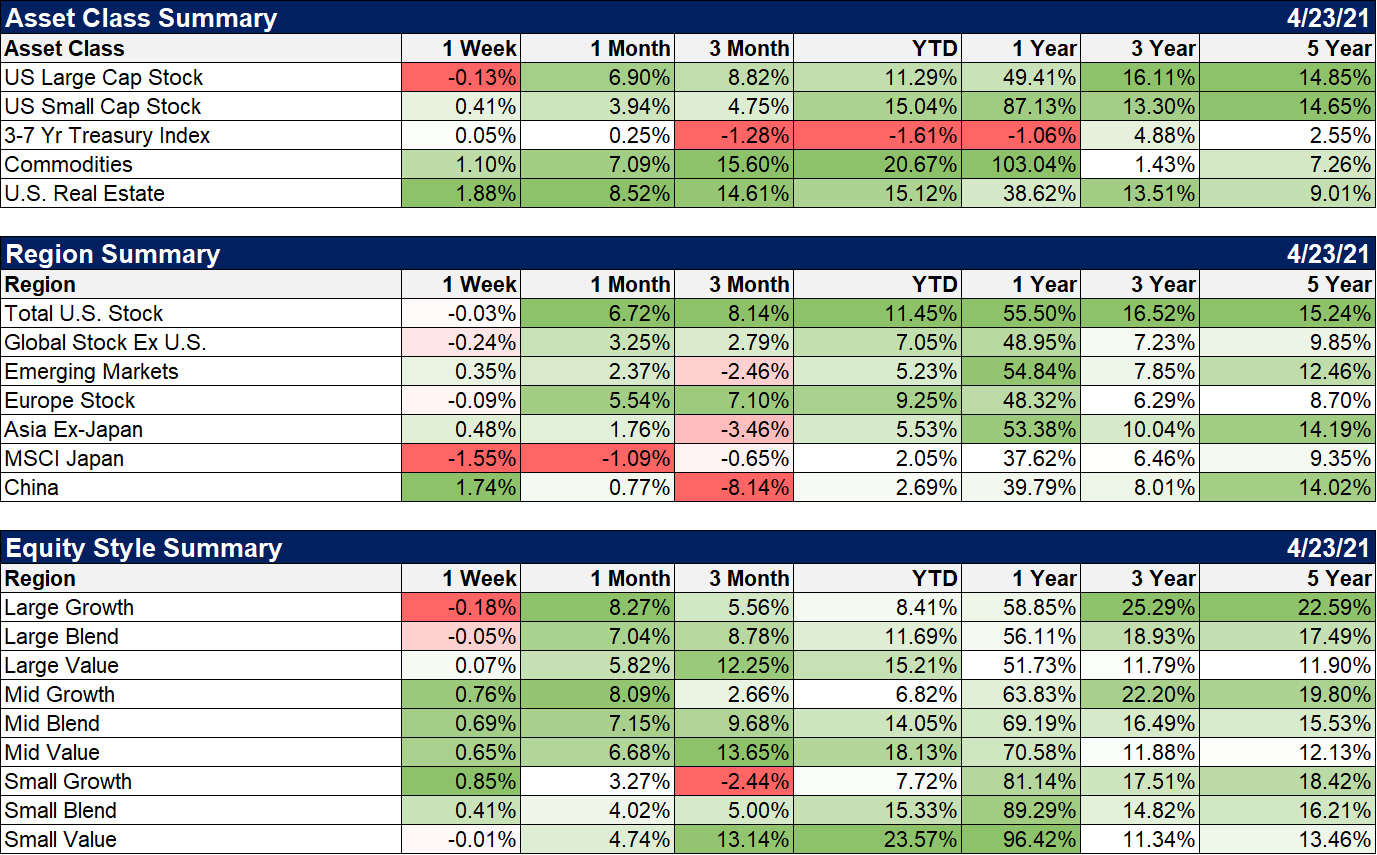

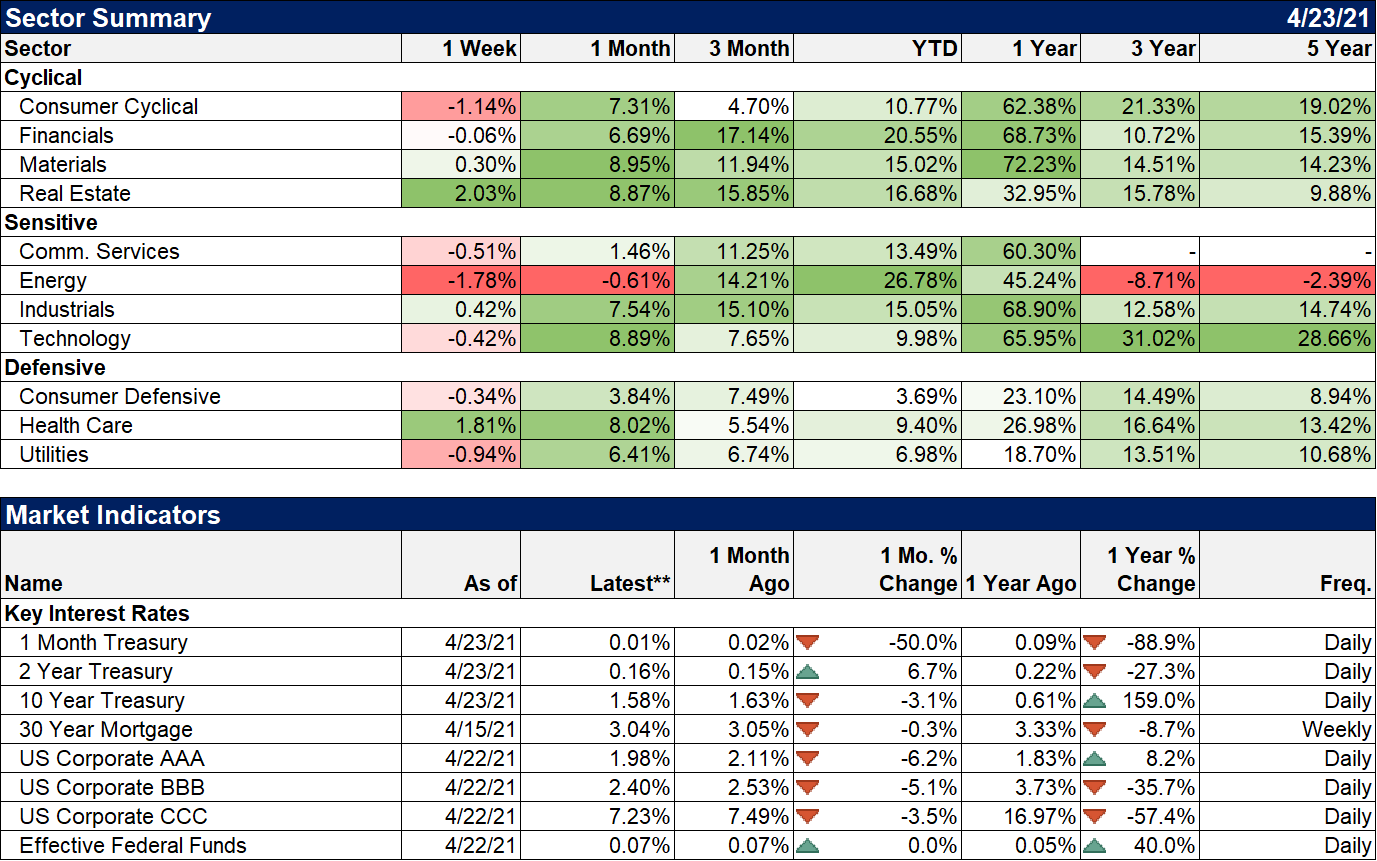

The S&P 500 fell slightly last week while most other markets showed gains. Small caps were higher but really haven’t made any progress since early February. Still, the downside during that consolidation period was very minor and momentum looks ready to turn positive again. The best-performing assets of the week were commodities and real estate, both of which have been strong recently. Real estate in particular is interesting and I think has more to go in relative performance versus the S&P 500. REITs have underperformed over the last year but are surging this year, now ahead of small caps YTD. International stocks were mixed but China was a notable exception and appears to be starting a recovery after a 19% correction that started in February. There wasn’t much performance difference between styles last week.

From a sector perspective, as I said above, Real Estate was the leader. Healthcare also had a pretty good week while energy lagged again as it has over the last month.

It may be that the recent pullback in bond yields is just a hiccup and that the expected boom materializes on schedule. I actually don’t expect bond yields to fall significantly from here – there is nothing that indicates we are headed back into recession – but we have added some duration to our bond portfolios over the last couple of months. It wasn’t a big change – as I said above there is nothing that indicates a big change is justified right now – but it seemed a logical one with bonds very oversold. Call it a slight hedge since our bond positioning has been very short-term since last summer. I also recently restored balance to our commodity positioning which had been overweight general commodities versus gold. And I also recently sold some satellite sector positions as my uncertainty level, like everyone’s, has increased recently. When that happens I tend to shrink the portfolio and stick to broader themes. I also recently took some profits out of our small cap position but we still retain a significant (for us) weighting.

A lot of those moves were based on what I see as a very speculative market that has priced in some very good things in the coming months. Whether I continue to reduce risk will depend largely on economic developments and how the markets react to them. If the dollar continues to fall it may mean shifting the portfolio to weak dollar beneficiaries but frankly there isn’t much on my cheap assets list right now. International markets are cheaper than the US but that doesn’t mean they are cheap. I recently reviewed a group of international value funds and found only one with an average P/E less than 15. Most of them held stocks with an average P/E in the high teens to low twenties. And these were value funds.

I don’t know what other people will do with their new-found vaccine freedom but the idea that the fiscal follies of the previous and current administrations has created the conditions for a sustained boom seems to me unlikely. If anything I would expect people to act more conservatively with their money after this is all over. More than anything, the virus revealed for many the fragility of their economic situation. And of course, we’ve probably seen the last of the checks from Uncle Sam for a while. Congress is about to go back to its old ways of doling out checks to the folks who really matter to them – the ones that fund their campaigns. To bastardize Shakespeare: “What’s in a name? That which we call infrastructure, by any other name would smell as sweet.” Well, if you’re in the right politician’s good graces that is.

Joe Calhoun

Stay In Touch