Maybe the problem is the slogans, though I seriously doubt it. There are, admittedly, way too many and perhaps there is something lost in the translation. Going from Chinese to English can be notoriously tricky, and by sheer number of official catchphrases odds are a few are going to be miscast at the very least.

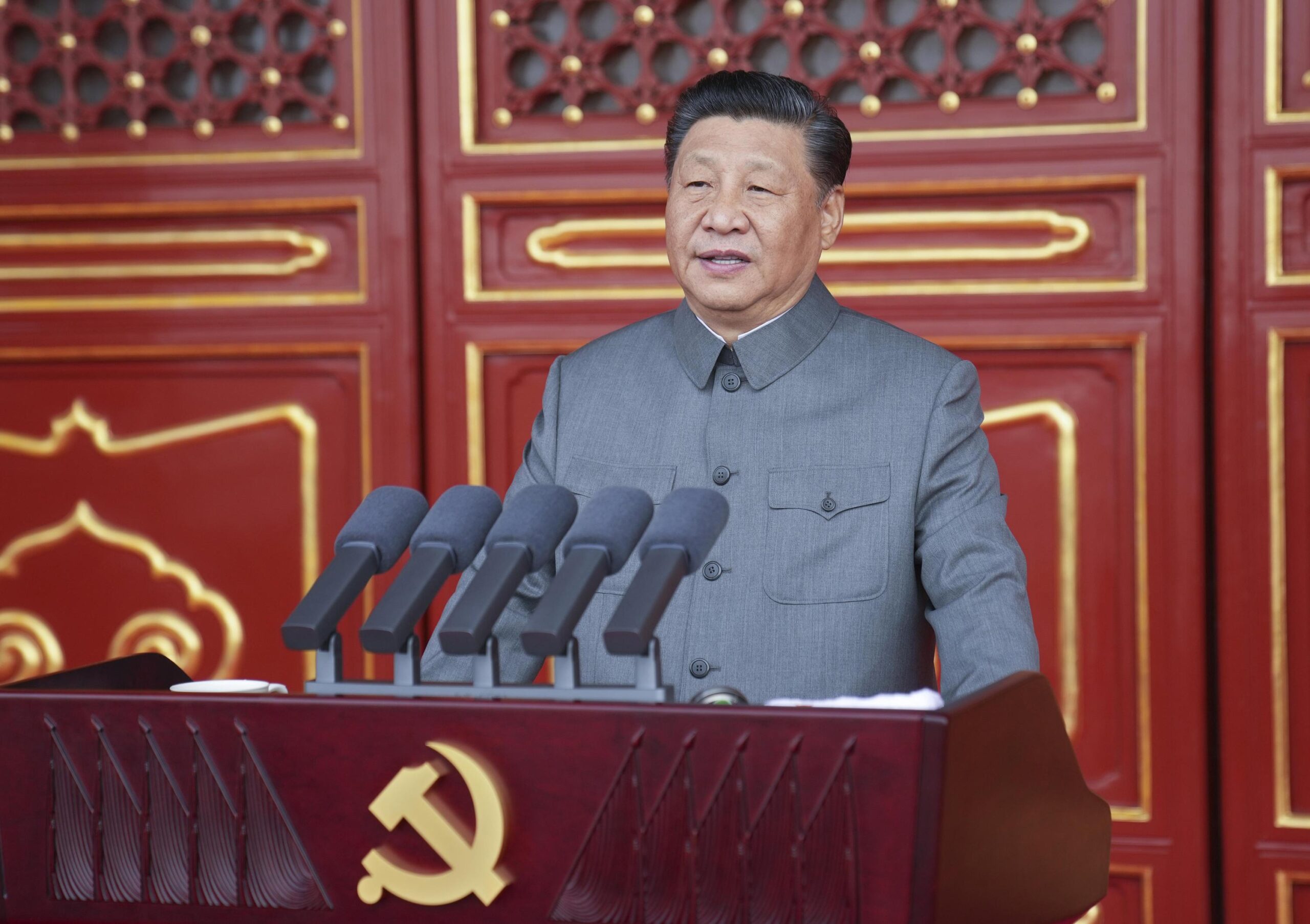

Rebalancing. Rejuvenation. Dual Circulation. No Sharp Turns. Nowadays what Xi Jinping and the rest are calling Common Prosperity.

It doesn’t take much to filter each via the mainstream lens of neo-Keynesian beliefs, thereby making the further assumption that China’s authorities are absolutely committed to restarting an anemic economy.

Actually, anemic was 2018 and 2019; this is, “somehow” and “unexpectedly”, even worse than even those years.

It would seem quite reasonable, from the conventional viewpoint, how this new batch of government ditties must each stand for “stimulus” like always. The Chinese economy is clearly in trouble, wildly underperforming (Western inflationary expectations, anyway), so it must just be a matter of time before the fiscal and monetary calvary arrive to get things going sharply again.

Understanding Xi’s true program, however, means also understanding what’s really going on. I wrote it four years ago from tomorrow, and every single thing that’s happened over those years in between has validated this view:

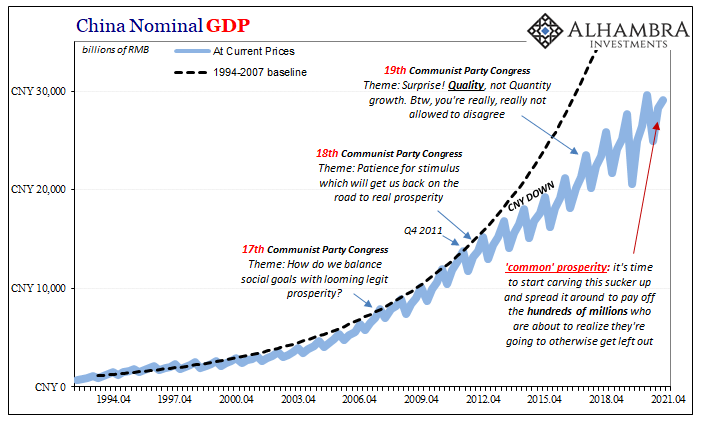

Xi Jinping’s three-and-a-half-hour speech covered a lot of ground, but more than anything “rejuvenation” along these lines is their only choice. The NBS numbers leave little doubt on that account, certainly proved enough for Communist officials that a no-growth world was just announced, I believe, as China’s official baseline doctrine.

A more appropriate translation of whatever today’s slogans might follow would have been less globally inspiring: “Make China OK with not Great just doesn’t have quite the emotional emphasis to really do that, but that’s what is being labeled rejuvenation.”

From Deng Xiaoping to Hu Jintao, Xi’s immediate predecessor, the Chinese government prioritized economic growth above every other consideration, including Socialism. In fact, they purposefully rewrote Socialism with Chinese Characteristics into three decades of a quasi-capitalist phase which didn’t have an explicit termination date. To put it simply and bluntly, they rode the eurodollar’s rise (globalism) as far as it would take them, to unbelievable levels of sophistication and achievement, if only to have avoided the Soviet fate.

This was never going to be permanent (Jiang Zemin’s Three Represents).

It took a few years following the first Global Financial Crisis to understand the situation, but Hu transitioned to Xi having figured out quasi-capitalism was done, the eurodollar’s massive boost on the wane permanently from then on.

Xi came in appearing to be a reformer; and he was, just not that kind (neo-liberal). On the contrary, very slowly and deliberately the Communists in China are transitioning China back to its Maoist version of Socialism. The economy will no longer take priority; in fact, at times, it won’t be considered at all in the same way.

That, not stimulus, is what these slogans are all about. Quality growth. Making China OK with Not Great. Common Prosperity.

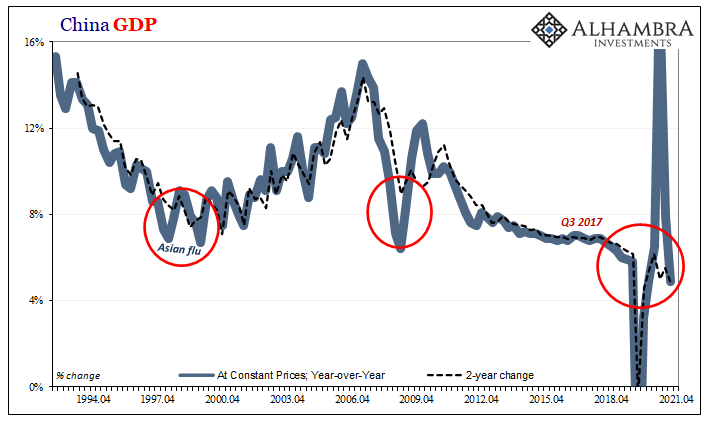

China’s economy for the entire year of 2021 has consistently displayed these parameters. Delta COVID, supply shocks, etc., yes, they’ve all hampered the situation but they can’t explain why for the entire year Chinese growth has simply vanished. It’s not just a Q3 slowdown, it is an everything-after-2020-downturn.

Common Prosperity therefore means it is what it is and Xi has accepted what this is regardless if Western Economists, central bankers and the media catch on now – or later (as the last time we did this, it took all the above from 2017 into 2019 before they would). There won’t be any “stimulus” to boost to get things back on track.

China’s NBS, like it had in October 2017, earlier today (last night) released another set of what would be sobering economic numbers if Economics was anything like an honest and actual scientific process. From GDP to retail sales to FAI and IP, none of it was good, “somehow” closer to 2020 than even the off 2019.

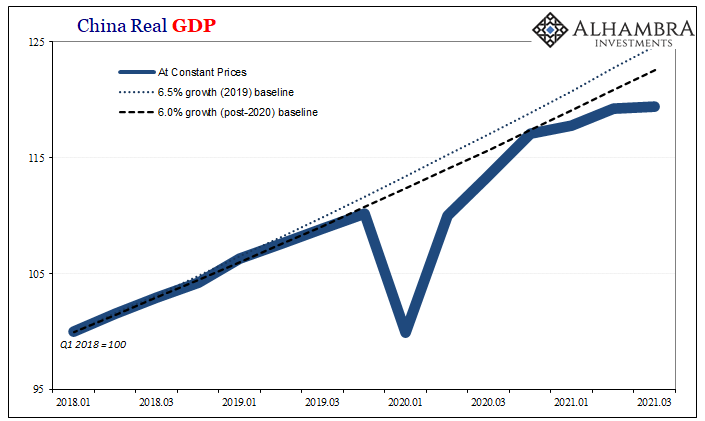

Nominal GDP for Q3 2021 was less than 10% better than Q3 2020, leaving real GDP to gain less than 5% year-over-year, practically unchanged quarter-over-quarter. In real terms, output the entire three-quarters of 2021 has been a washout however you might wish to excuse various individual periods during it.

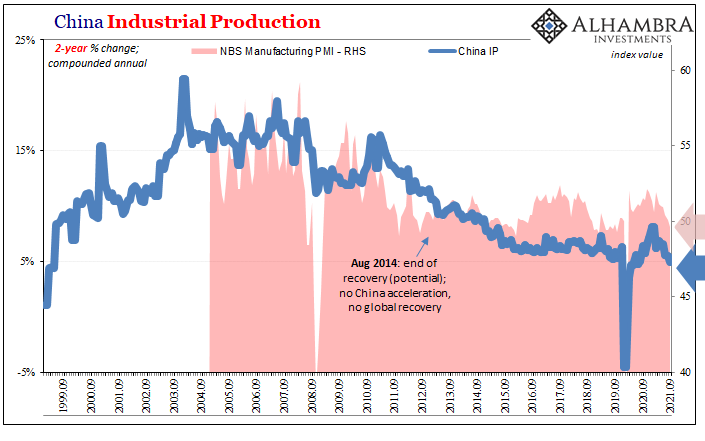

Industrial Production was up only 3.1% year-over-year in September, less than half the growth rate of last September, thereby increasing just 4.9% (annualized) for the two-year period. This among the lowest in modern Chinese history, blamed, of course, on supply problems along with pollution controls (Xi no longer cares what effect these might have on economic conditions).

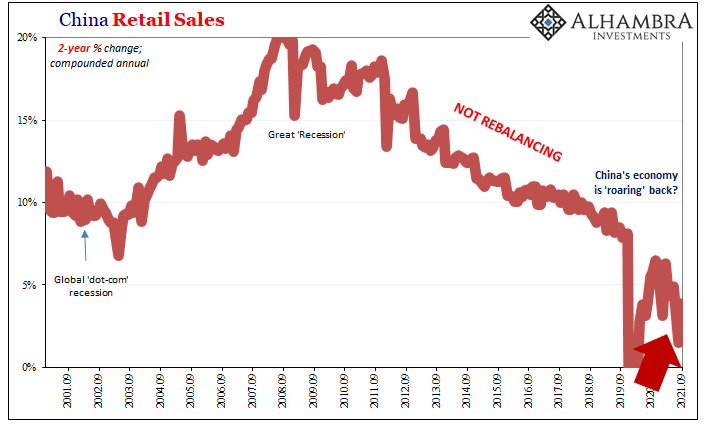

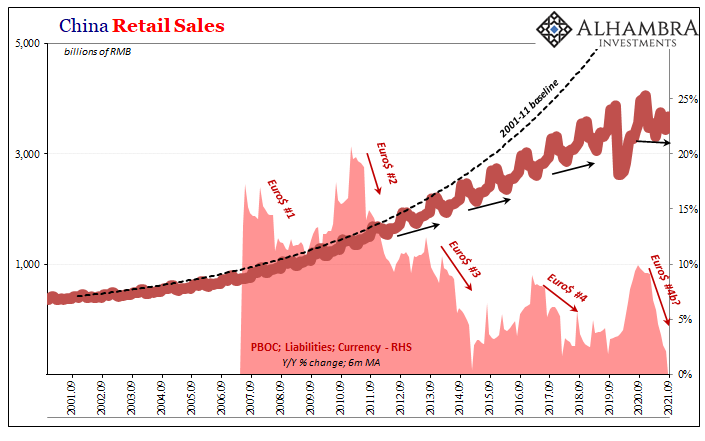

Supply problems aren’t nor have they been a problem for Chinese consumers, yet consumers throughout China aren’t buying goods. The big miss in August, just 2.5% y/y and +1.5% 2-year annualized, had been attributed to delta COVID, yet retail sales in September were only a bit better (+3.8% 2y) and about the same low number as July (+3.6% 2y).

Maybe coronavirus restrictions do explain the small difference in August from July and September, but what about the fact that July, September, and all the other months are still so much less than even 2018 and 2019?

Despite all of this, again Xi’s government is doing nothing about it. On the contrary, the Communists are looking elsewhere to other factors regardless of the lack of recovery in China’s economy; not just pollution or electricity rationing, top-down this year is conspicuous for policy changes that align with non-economic priorities.

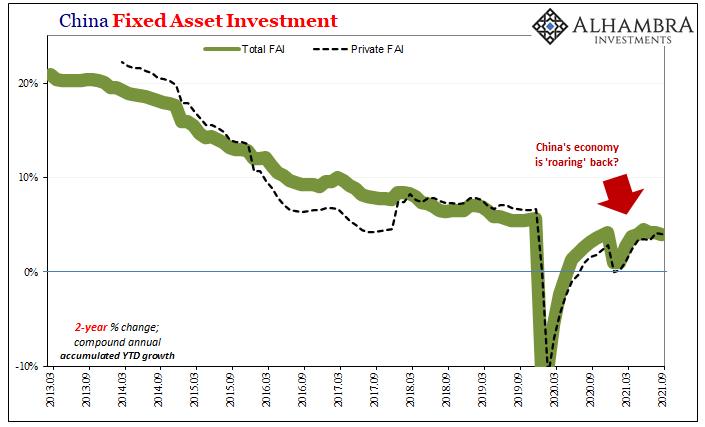

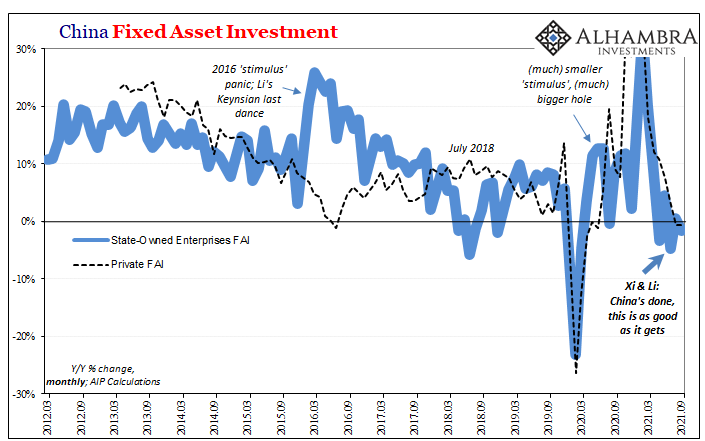

Public sector Fixed Asset Investment, for example, the very statistic where fiscal “stimulus” shows up shows us today instead that authorities are curbing what little support had been offered last year. It doesn’t matter that growth (real GDP) has been nearly flat the entirety of 2021 so far, the government continues to wind it down anyway.

This doesn’t just point to a “growth scare”, rather it strongly and persistently indicates a growth reversion when from China on down the global economy – after it more and more shakes off the temporary effects of Uncle Sam and others earlier in the year – is revealed to have been significantly worse off for the 2020 experience.

It had already been trending this way in China, anyway.

This has serious implications, of course, beginning with timing. In terms of trying to invest in such an environment, you have to first understand that while you and I may accept these facts and straightforwardly interpret them in the same way hardly anyone else has or will for quite some time.

Just four years ago, it had been easy to see globally synchronized growth was DOA already by October 2017 when Xi Jinping nailed the last in its coffin; yet, it wasn’t until the middle of 2019 that the reverse had become so obvious and unavoidable Jay Powell reversed and the mainstream finally admitted to a “soft patch” or full-on downturn.

And even now, there are multitudes who have been left with the impression nothing interesting happened during 2018 and 2019; it was an outright economic boom, according to them.

Even “real” markets take some time to adjust, caught between what “everyone” says (and everyone always says inflation) and at first more ambiguous contradictions. Quite simply, there’s a lot of wiggle room transiting between reflation and not; and it gets messy and a touch more volatile.

This is why, looking ahead from what I certainly believe is a more realistic and pragmatic approach, there can be drastic differences between more immediate investment considerations and elucidations of reality which might at first seem completely contrary. It’s a very good thing to better understand the true shape of the world, but if everyone still believes the world’s shape is something else then that presents a world of challenges to bridge the time between today and that point when reality finally intrudes on all the rest.

My colleague Joe Calhoun put it best here (and I urge you to read his thoughts and descriptions of these serious challenges). We’re not just trying to figure out the way the world really is, but also when everyone else might figure this out, too. There’s an often wide and long window in between.

To put this back in context of China/global growth: the Chinese economy has been highly impaired, has consistently exhibited worrisome deflationary signs, even more than the past few years pre-COVID, and every last political indication uniformly describes how Socialism with Chinese Characteristics no longer cares about any of that.

Yet, despite all this and what’s publicly available, the vast majority of the world’s populace, certainly those in the US, are being led to believe the very opposite of all those things; that China is experiencing an awesomely powerful recovery and should it take even the slightest misstep the equally powerful CCP will step right in and fix it using the Western neo-Keynesian playbook the Party’s always used.

More to the problem, people are investing and will continue to invest as if this other fairy tale is true even though each of the past four times it wasn’t and the fact it wasn’t had been equally available to honest evaluation the entire time. Economics has confused the entire world – and much of it has been intentional.

Yes, the Communists have been far more honest about everything this whole time.

Stay In Touch