You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s. If none handy, then just read what officials and central bankers write about their own programs (or those of their close and affectionate counterparts).

After nearly a decade of Abenomics in Japan, the latest Japanese Prime Minister Fumio Kishida is publicly expressing his desire to move on from it. Run away at all speed. Of its purported three arrows, the Bank of Japan’s QQE was by far its biggest – in theory. So much “money printing”, even Paul Krugman had been impressed.

In practice, it always ends up with something different. Kishida is only somewhat guarded in his criticism, unusual for Japanese politicians particularly from the same party (Abe resigned a year ago for “health reasons”). Speaking with the Financial Times just last week, the new leader wants little to do with QQE and the rest, because it worked out well?

No.

Japan’s new prime minister has pledged to move the country away from neoliberalism as he lambasted his own party’s failure to deliver broad-based growth under the Abenomics programme that defined the economy for almost a decade…Kishida stressed his new economic approach — involving tax incentives for companies to raise wages and pay increases for nurses and care workers — would attempt to reverse the failures of the “trickle-down” theories and market-led reforms that have guided Japanese policymaking from the mid-2000s.

Kishida claims QQE and Abenomics achieved something for the real economy, though not much “trickled down” beyond certainly stocks moving up, leaving the vast majority with questions. Where’s the full recovery inflation, he didn’t need to ask.

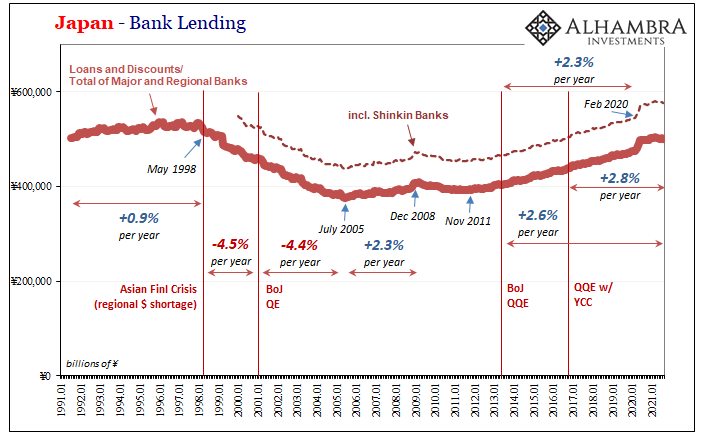

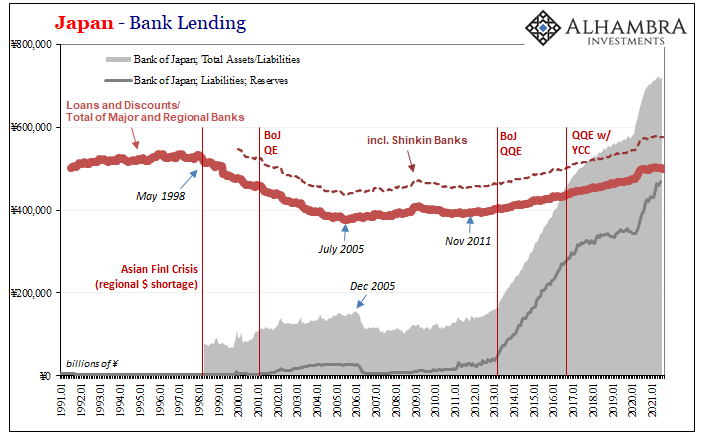

QE is thought to work in a combination of the three ways money would influence if money was to be introduced: portfolio rebalancing, lowering interest rates, and emotional manipulation. The first, rebalancing, refers to buying bonds or other assets from banks forcing them to replace what was purchased by the central bank with other risky activities, in particular lending.

Nope. Japan is the perfect, absolutely perfect example of how this channel consistently fails (though US and European banks are no slouches when destroying the rebalancing theory, either).

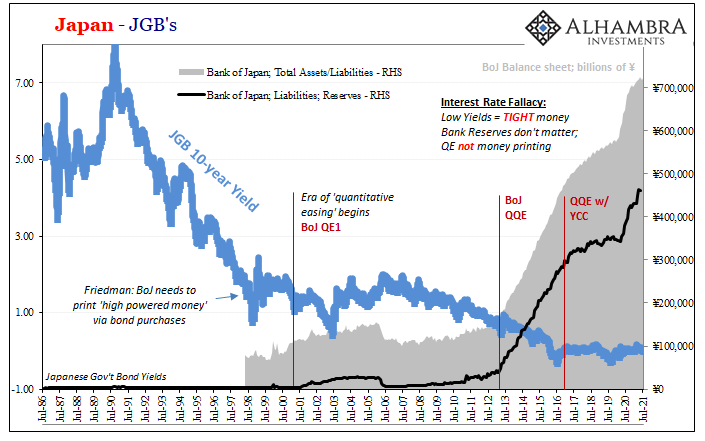

How about interest rates? Nothing here, either. Again, just pull out a rate chart in any jurisdiction where QE bond buying is active and then not. More often than not, yields behave in the opposite way from how they “should.”

The market, not QE, always sets rates no matter how many bonds are purchased by the central bank for however long. Low interest rates don’t even mean what the theory proposes (interest rate fallacy).

Sentiment? Nothing here, either. A recent screed written up at the Federal Reserve Bank of New York, flagged expertly by Emil Kalinowski, simply categorizes and attempts to compartmentalize what we already know.

Most notably, we find that the view that large-scale purchases of sovereign debt cause unmanageable inflationary pressures is not supported by the experiences of foreign advanced economies. As a matter of fact, despite the extent and duration of the quantitative easing programs in those economies, central banks faced challenges in achieving their inflation objectives.

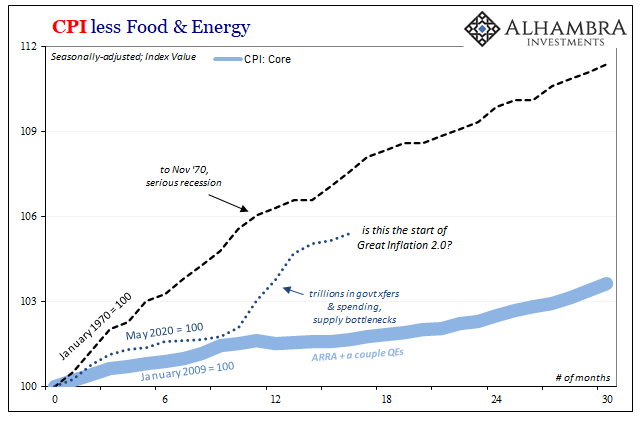

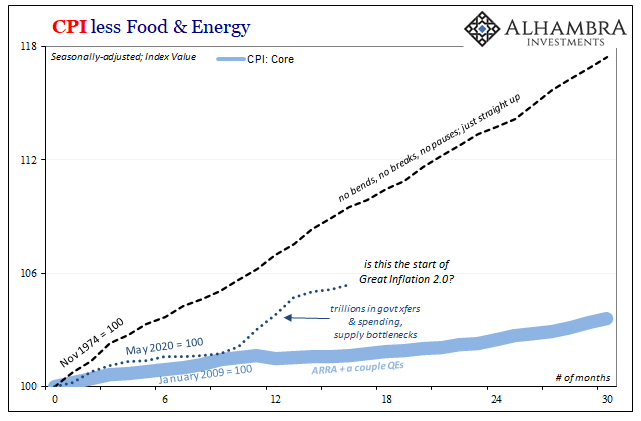

Translation: don’t worry about 1970’s style Great Inflation beginning 2022, whenever central banks do QE no matter how big or how long these things can barely if ever achieve even small levels of inflation.

The data and evidence overwhelming, central bankers themselves and now politicians having to concede on all three grounds.

Where I can help is in deconstructing how and why QE fails. It begins with a fatal conceit (same FRBNY post):

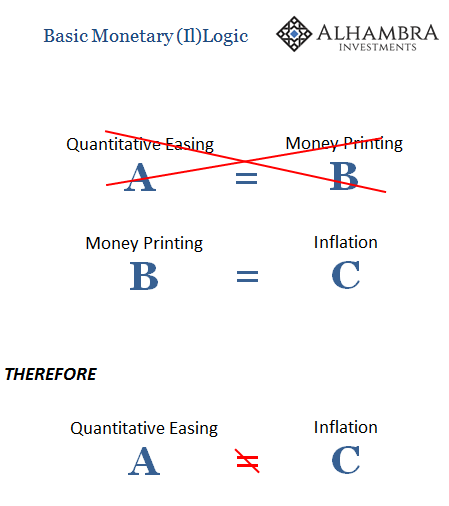

Specifically, does rapid central bank money creation resulting from large-scale purchases of government securities fuel inflationary spending by households and firms?

There’s a single word buried in that question which just doesn’t belong.

Friedman said and history proves it over and over: inflation is always and everywhere a monetary phenomenon. QE doesn’t ever lead to inflation (or much by way of growth), it can’t even achieve tangible action through even a single of its channels, therefore…

We can safely eliminate central bank “money printing” from the “inflation” of 2021, and you don’t have to take my word for it. Expect these types of refutations to increase in number and noise (it only took twenty years).

This can only mean consumer prices this year have been affected by non-inflation factors, such as these. And if it is non-economic, non-monetary, it isn’t inflation therefore it can’t continue nor spiral into some Great Inflation 2.0 or, for some, Weimar 2.0 and the long-predicted dollar wipeout.

On the contrary, the world’s real money is – right now – being unusually unambiguous about something else entirely.

Stay In Touch