It’s always a balance of probabilities tug-of-war. Markets (not stocks) are continuously trying to discern risk since everything is really converted to some kind of risk-adjusted basis. And if the perceived weight of those tilts downward thinking forward, then it may not matter much or at all what’s going on right now.

What’s going on right now is, according to everyone, massive inflation. A soaring nominal economy not just in the US, also purportedly worldwide. Therefore, consumer prices are anticipated, by this account, to continue their torrid pace if not further accelerate (which would also accelerate consumer pain).

Not so, according to the world’s “bond” markets (that include a whole bunch more than sovereign bonds traded). On the contrary, the balance of probabilities is slanted – heavily – in the direction of downside risks.

Sour, not soar.

For many months now, curves have taken on that same pessimistic shape-shifting we saw only a few years ago.

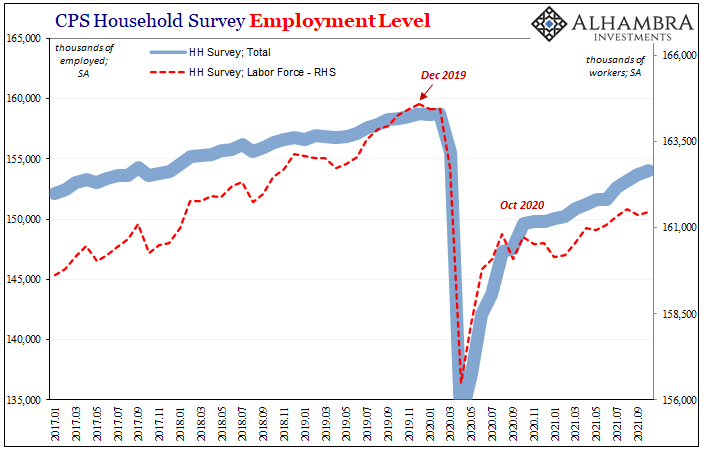

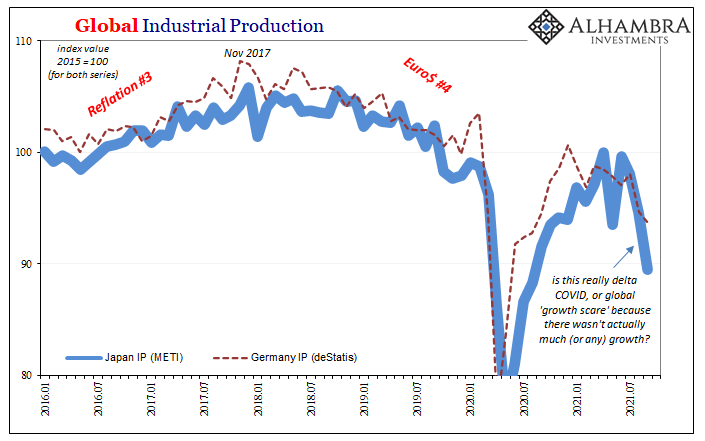

One key reason why is the real economy apart from the US government’s intervention in that specific space really isn’t doing all that well; both in terms of how much it has actually rebounded from last year’s recession, not really coming off the bottom that forcefully in the private economy, while also slowing down noticeably since at least mid-summer.

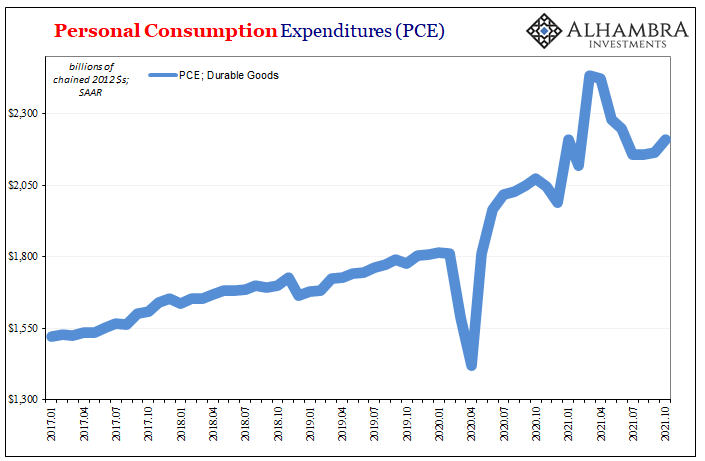

The outlier to the sour viewpoint is American consumer spending on goods. According to the Census Bureau’s last retail sales report, yep, October had been another hyper month of sales.

The Bureau of Economic Analysis, the government’s agency responsible for the GDP estimates, agrees; to an extent. When accounting for price changes, the two do match (“real” retail sales were up 0.7% in October from September, while “real” PCE increased by the same month-over-month).

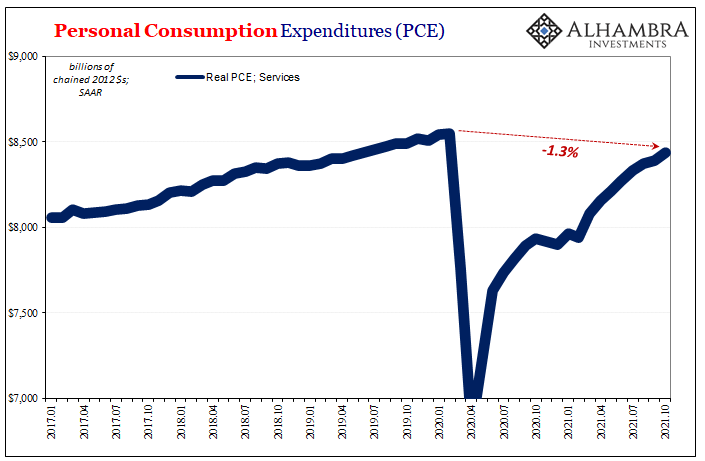

These recent increases, however, disguise some real and serious remaining deficiencies outside of demand for especially durable goods. The BEA estimates that spending on services has increased a bit lately, too, yet unlike goods it remains substantially lower than the pre-recession peak, therefore lower still than where consumer spending on services “should” be if in actual recovery.

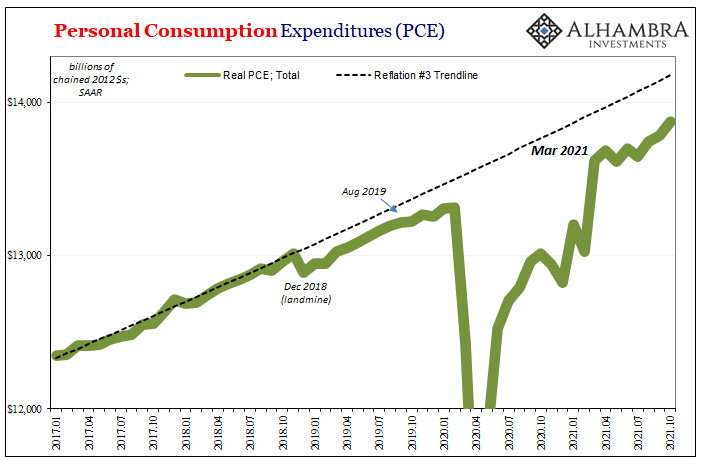

Combined, total PCE, however, isn’t up in the stratosphere like the narrower retail sales, rather substantially below the recovery-line (for the 2020 recession; forget recovery from 2008) even after a year and a half and trillions in “stimulus”; which doesn’t quite match the tone of the mainstream economic conversation. We’re led to believe the economy is robust and therefore robustly inflationary when, not ignoring services, the overall consumer condition remains quite sour and not really turning toward soaring as much as it might seem by less-complete economic accounts.

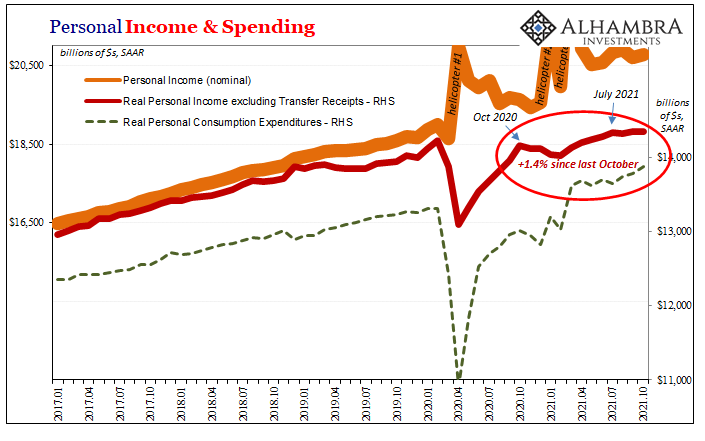

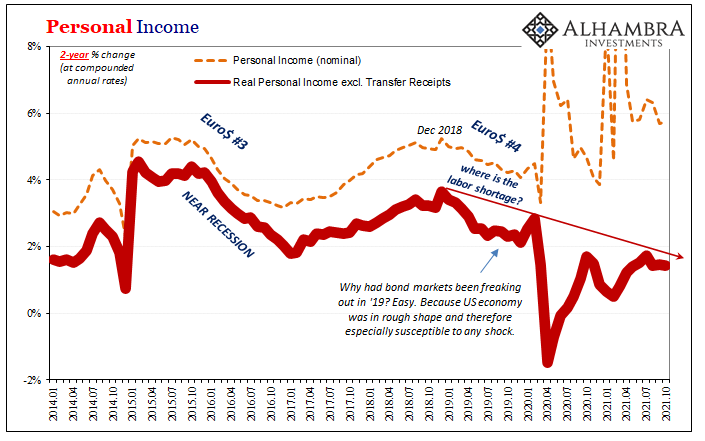

The primary reason why overall PCE continues to be weak is that, overall, the labor market has been, too. Again, deceptive mainstream rhetoric predicated on the unemployment rate fails to match a wide variety of other data including BEA’s measure of private economy personal income (excluding transfer receipts).

Even as the last six months of the series were revised upward in last week’s update, the new figures don’t change their impression of the situation. By either nominal estimates (SAAR) or by annual rates of change – particularly 2-year changes to eliminate base effects – the private economy and specifically the labor market haven’t been anything like soaring.

There was some initial rebound last year in 2020, but ever since last October it’s been a full year of sour. More recently, it has soured even more going back to the earliest parts of disappointing Q3.

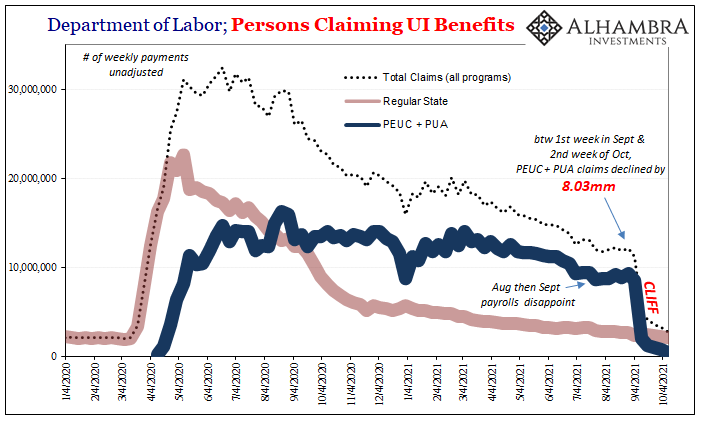

Private income growth seems to have renewed its (post-revision) struggles in and after July, which is already consistent with other labor data including unemployment claims (before the cliff above).

The only reason for the spending frenzy has been Uncle Sam’s helicopters.

That’s not the basis for a sustained, soaring recovery, hardly a reason to consider a balance of probabilities favoring the more optimistic future nominal upside, especially as the vast majority of the data for all-important income and labor remains as it has. And the longer it goes like this, the higher the risks some kind of minor negative pressure could more thoroughly push a downside reality.

Growth “scare.”

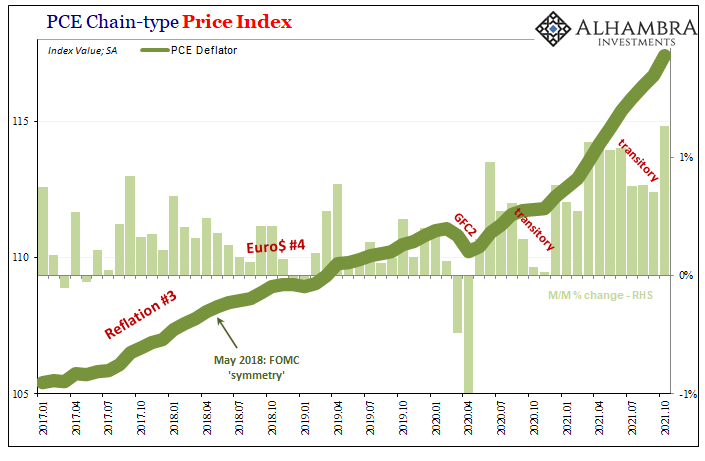

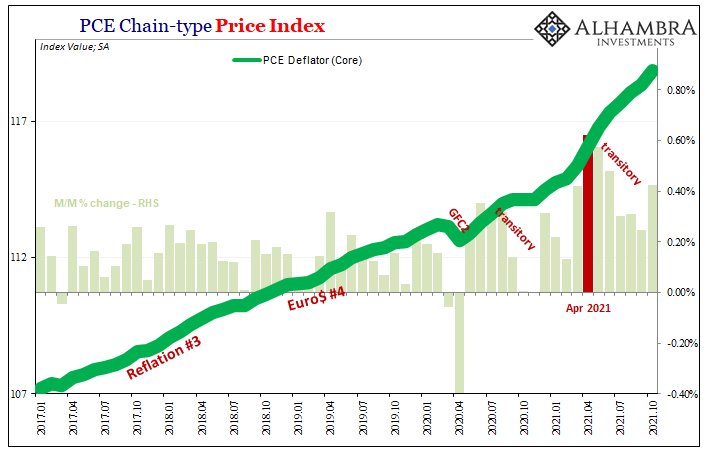

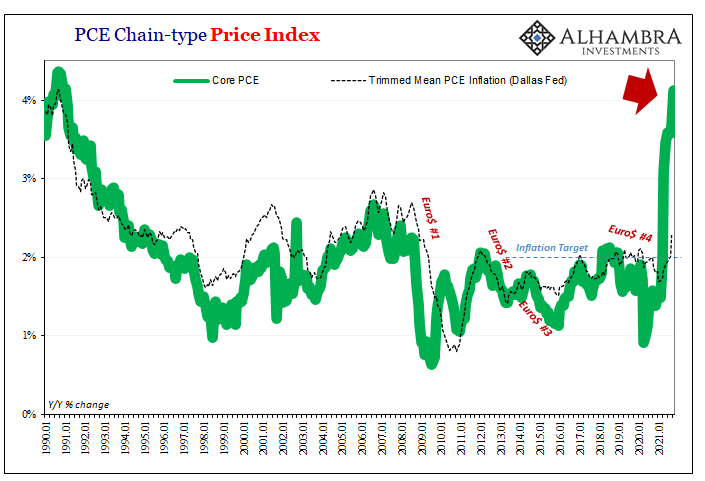

Given this underlying if obscured (by the constant hyping of the unemployment rate and shouting about a LABOR SHORTAGE!!!!) baseline economic experience, October’s re-acceleration of consumer price changes (already previewed by the CPI) in the PCE Deflator ends up being old news in more ways than one.

The annual rates of change continue to be among the highest in decades, and not just due to generous base effects. Consumer prices absolutely increased by an unusually high general amount earlier in the year. They then took a few months off coinciding with the emergent “growth scare” around the world – even before July.

A healthy dose of gasoline prices in October to go along with used cars and early Christmas demand, but what comes next in November, December, and on into early 2022?

If “growth scare”, we’d expect the re-acceleration of consumer prices here and elsewhere around the world to de-accelerate like they had earlier in 2021.

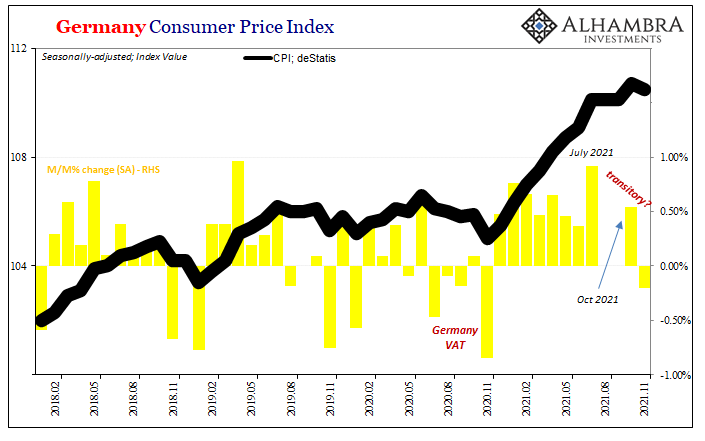

So far, in the earliest data, that’s what we are seeing in other places. Germany, for example, a leading-economy we keep going back to (like 2018) which already displays all these factors in front of the global system. Like US consumers, German consumers were pounded by an especially harsh October increase as especially harsh energy prices bit into them, yet initial estimates for November, released today by deStatis, show that consumer prices retreated.

In the context of the last half of this year, you can plainly see (above) in Germany’s consumer price buckets how it matches “growth scare” results we’ve documented in forward-looking German data like trade and production levels (IP). Since early summer, “something” changed even if there was an upward blip in their CPI during October.

It may be, and continues to appear more likely as the year wears down, that Germany’s rebound like America’s has seen its best days long behind. Having not soared much or at all even during them, the risks since around mid-year might be characterized more properly as the balance of probabilities leaning decidedly toward sour.

All that was before the whispers of omicron. Thus, would it really take much to trigger market anxieties if the market was, for every good reason and evidence, already well within the sour camp?

Stay In Touch