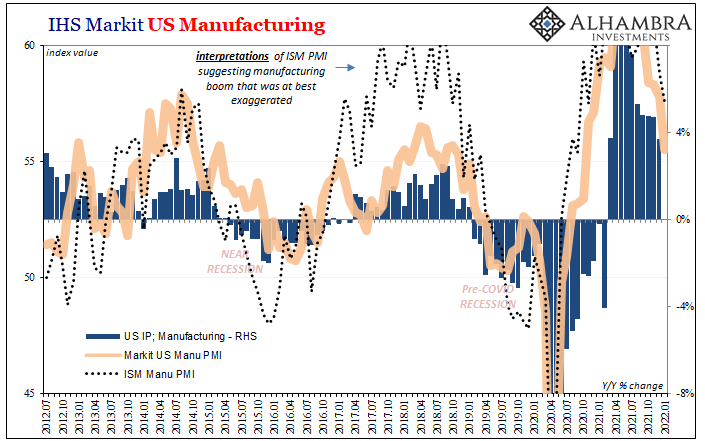

By no means are any of these PMI numbers terrible. In the vacuum of mainstream Economics’ ceteris paribus fantasy, these might all be mildly pleasing. There is no such thing, however, and despite where they now are these are verging closer to comparisons which could be, several already have been, concerning. As such, the direction and trend being established as the US (and global) economy behaves in the same way we’ve seen four times (since 2007) already should be the focus.

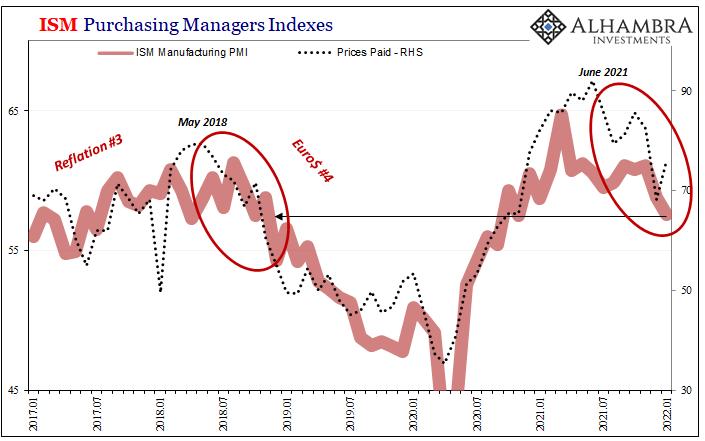

Start with the ISM, the grandaddy of the bunch. The Institute for Supply Management reported earlier today a headline of 57.6 for the month of January 2022. That was down 1.2 pts from December 2021’s 58.8, though mid-high fifties doesn’t seem like much of an issue. After all, the economy was bound to slow down from its frenetic earlier 2021 pace.

Yet, 57.6 places the top index in the same boat with October 2018’s 57.5, hardly a good comparison (or November 2014, if you want to go one Euro$ cycle further back in time). And like three years ago, the trend has been pretty established and not basic month-to-month statistical noise; the peak had been set all the way back last March.

Since we’re following the inventory story, the ISM’s for New Orders dropped to 57.9 last month from 61.0 the previous one. Again, not a terrible number but the scale of the decline along with the ongoing persistence. This means for January the lowest indicated number of survey respondents reporting increased orders since June 2020.

Even the Prices Paid component, which rebounded from December’s drop, regained only a relatively small amount (even as oil prices surged).

The ISM’s rash of data is the best of them, too.

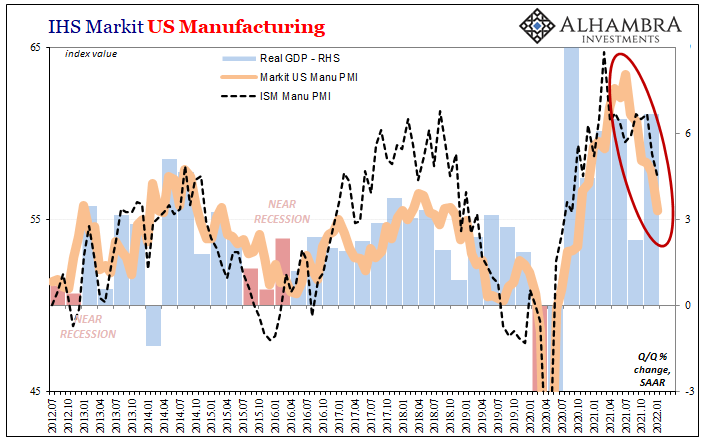

IHS Markit had already published its flash sentiment indicator for manufacturing, today revising that up to 55.5 from the earlier 55.0. This level is, like the ISM, equal to October 2018 with Markit claiming its subindex for new orders had sunk to its lowest level since September 2020.

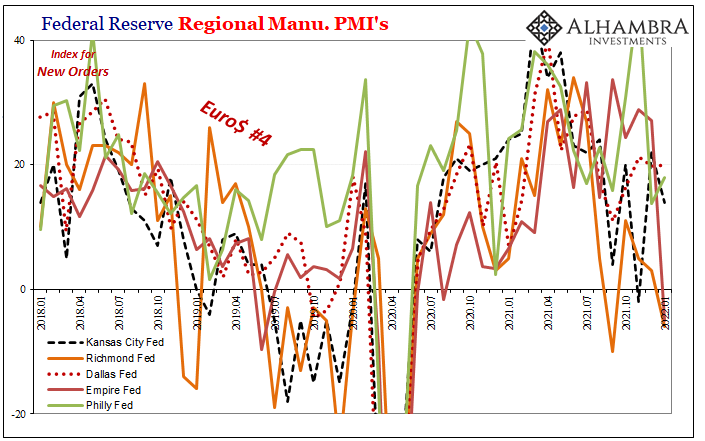

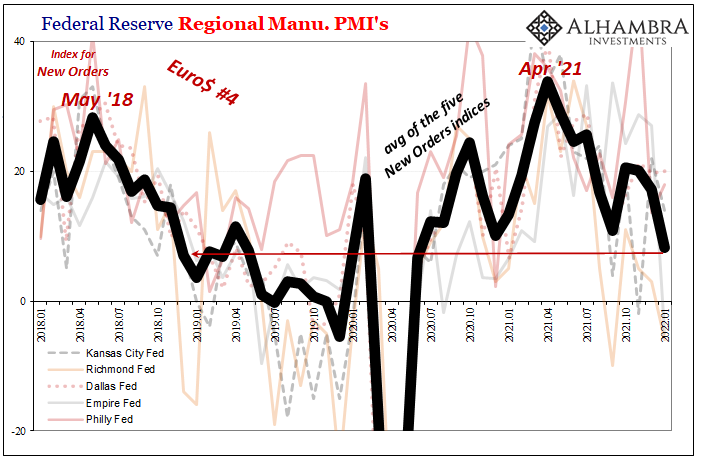

The Federal Reserve’s regional manufacturing surveys suggest this economic sector might be faring slightly worse still. According to last month’s data in each – specifically new orders – there was the usual noise of a mixed bag across regions.

The Empire Survey’s collapsed last month, as previously pointed out, while Philly’s recovered a small amount January from December. Dallas’ kept steady, KC’s dropped by a full eight, while new orders in Richmond ended up quite a few points below zero (-6).

Altogether, the average here declined from 17.12 in December to just 8.18 for January. Once again, like the others, that’s the same as December 2018 (or November 2014) and as those prior times the direction from here seems pretty set.

Again, none of these are abysmal numbers. It’s what they potentially suggest about the next phase of the economy which should raise suspicions. At very least (or maybe best), it’s a clear slowdown. Combine that probability with what we’ve seen so far as inventory built up during Q4 last year, along with how this has repeatedly played out over and over again, it’s not at all unreasonable to suspect more serious than a slowdown.

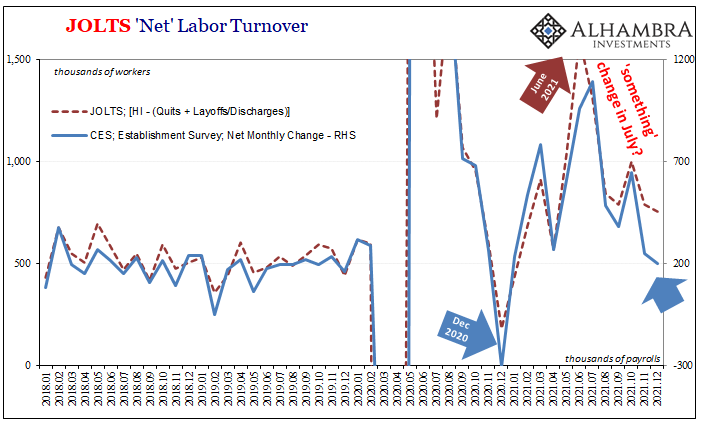

Put that together with questionable labor market data of late and how resolute long-term yields are being in the face of ultra-hawkishness combined with the near-term end of QE therefore the Fed buying LT USTs (which, we’ve been persistently told, has supposedly been the reason why rates have remained so low), there’s a whole range of solid evidence why so much skepticism (along with history) about the reasons behind the FOMC’s policy change.

Not so for Economists working at one Wall Street firm, as Mr. Tateo pointed out, a few days ago they upped their inflation-fear, Fed-love forecasting seven rate hikes this year.

Stay In Touch