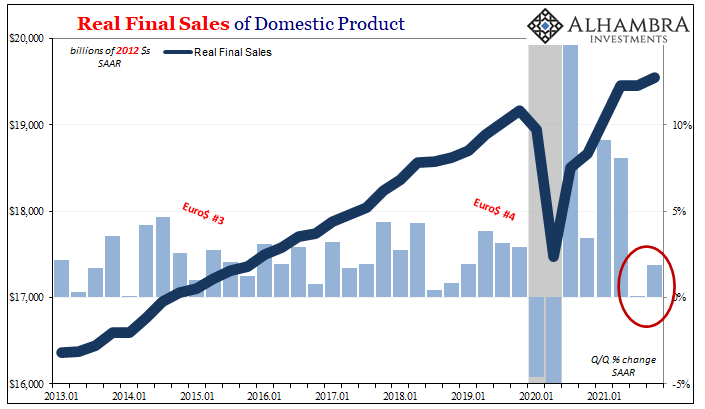

This will be written off as a temporary setback, and only then will anyone care if it follows in Friday’s payroll report. Just when the FOMC was counting on corroboration among all labor market data for its taper/balance sheet runoff/rate hike justification, this morning ADP threw a whole sack of wrenches in those plans.

In the wake of the sack, analysts across Wall Street have already been busy further downgrading their expectations for the headline BLS coming up.

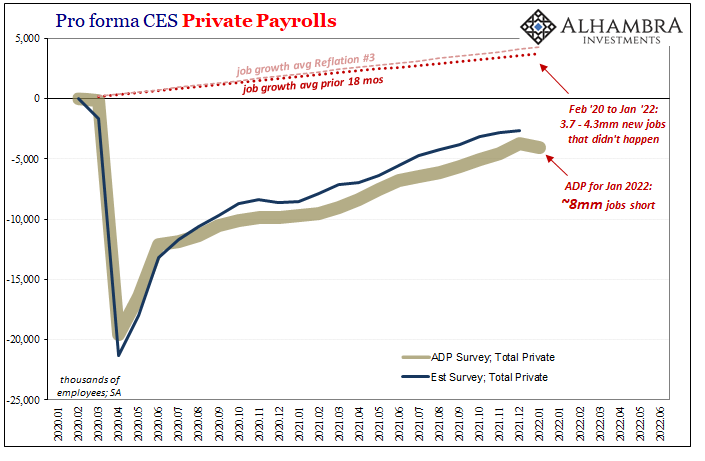

The private payroll processor ADP said that total private employment in the US economy fell sharply during January 2022. Thinking ahead to how the pandemic would create a negative impact, analysts had predicted this number would come in around +200,000. That would have been considerably less than the final few months of last year.

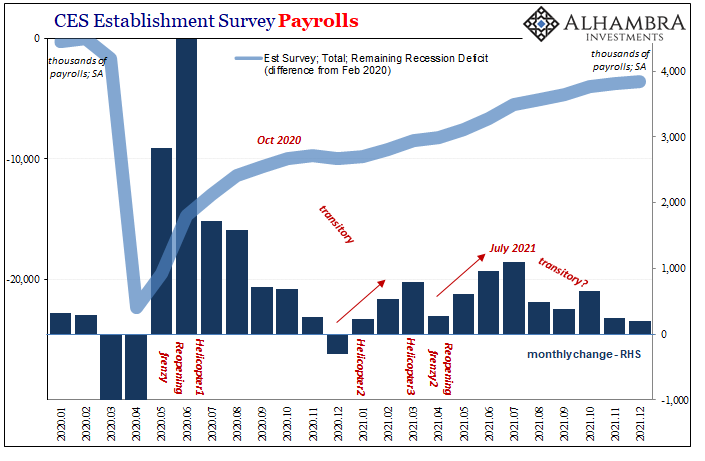

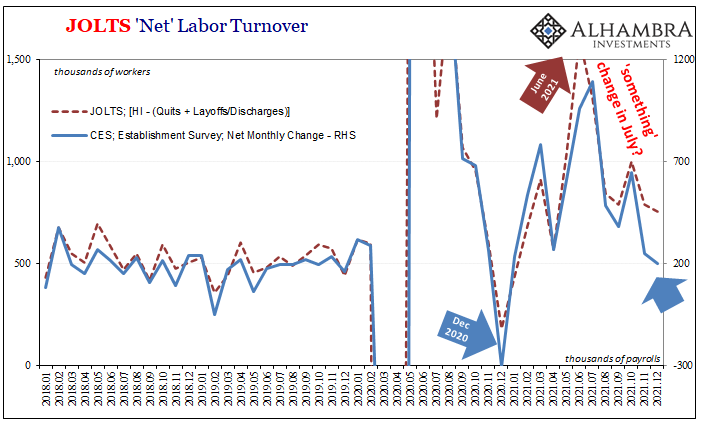

Instead, to begin this year employment may have declined by a bit more than 300,000 private jobs. This is the first drop since December 2020 and the steepest, by far, going back to the 2020 recession itself.

Is it really omicron?

That’s how the weakness will be characterized, assuming it isn’t completely forgotten by Friday depending on how the BLS surveys get chopped up (I still wonder, as I said yesterday with the colder JOLTS, if it won’t be a blowout). Assuming they come in weaker than already figured by analysts (yesterday the “consensus” was for the same as December, not good, and today the majority opinion has moved substantially lower still), then the latest pandemic variant (and the diseases’ obvious seasonality) will be all over the explanations.

After all, ADP’s resident Economist outright stated the pandemic was the reason:

“The labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth,” said Nela Richardson, chief economist, ADP.

The company’s underlying figures might at first seem consistent with this interpretation of them. Half the presumed job losses hit the leisure and hospitality industry, the ever-holding target of government pandemic strictures.

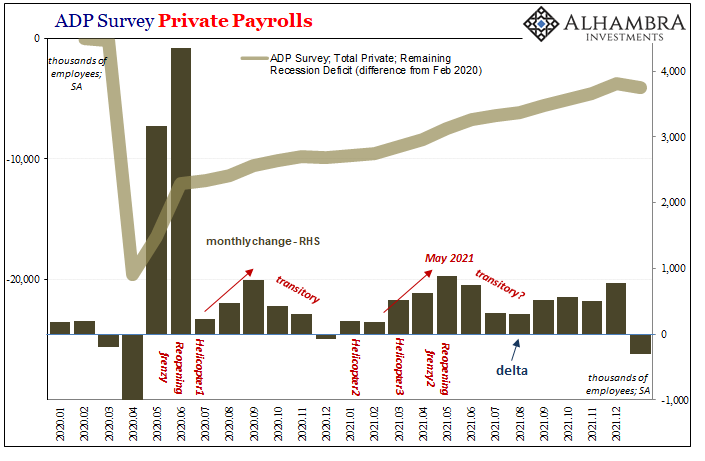

But those weren’t nearly as strict or widespread during January 2022 as they had been back at the height of the delta wave, or back in December 2020. So far as interruptive interference goes, delta’s were far and away more disruptive. Yet, ADP’s employment data shows only a slowdown last July and August, nothing at all like -300k. Even December 2020’s (unemployment cliff) change was “just” -75k (whereas the BLS’s Establishment Survey was itself -306k the same month).

Leisure and hospitality businesses, across all business sizes, weren’t laying off workers because of renewed lockdowns. And if they were experiencing a drop off in business as fewer people (in Northern states) traveled or sought vacation, given the purported labor shortage as well as how those same businesses are uniquely accustomed to the temporary effects of these pandemic waves, why didn’t they hold on to their employees and just wait out omicron (less disruptive than delta) given how hard, most claim, it is to find help?

But this same general pattern was repeated across most industries. One-fifth of the monthly job losses were thought to have been in trade, transportation, and utilities – though unclear (they don’t release that level of detail) how much might have been just trade given the disappointment at the end of the pushed-forward Christmas shopping season.

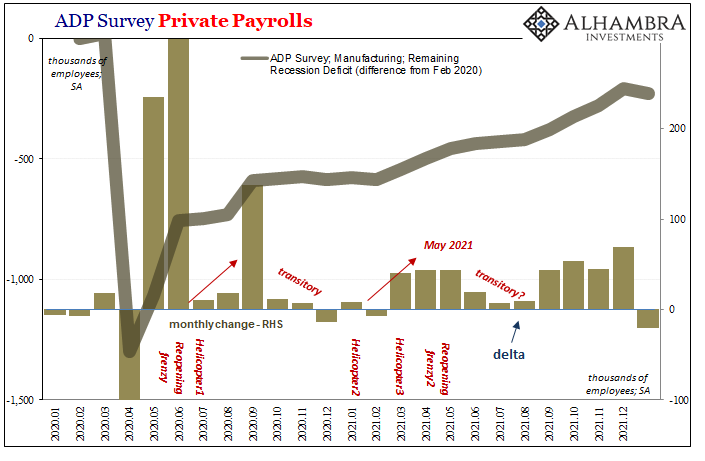

Manufacturer’s, for example, apparently cut 21,000 payrolls (total employment across all goods producing industries declined by 27,000) last month. This was the first decline since last February and also the steepest going back to April 2020. Why would omicron have been so much more disruptive to manufacturing (or trade) than delta or the serious weakness (pre-Helicopter #2) back in December 2020?

Several explanations are possible, beginning with vaccine policies and/or mandates. Another is that the economy really did soften though maybe a bit too much the last half of last year (inventory, too). Perhaps a combination of the two.

The latter would better explain why the low in ADP for January 2022 was so much lower than August or the prior December; omicron had some negative effect, but that does not account for the entire depth, or maybe even as much of it.

The pandemic alone just cannot explain why a “likely temporary” disruption showing up during a purportedly epic labor shortage would lead to such widespread, “significant” declines to general private employment. It will be interesting how the BLS sees it on Friday.

Either way, it’s another frigid dose of employment data for the FOMC almost completely depending upon an overheating labor situation.

Stay In Touch