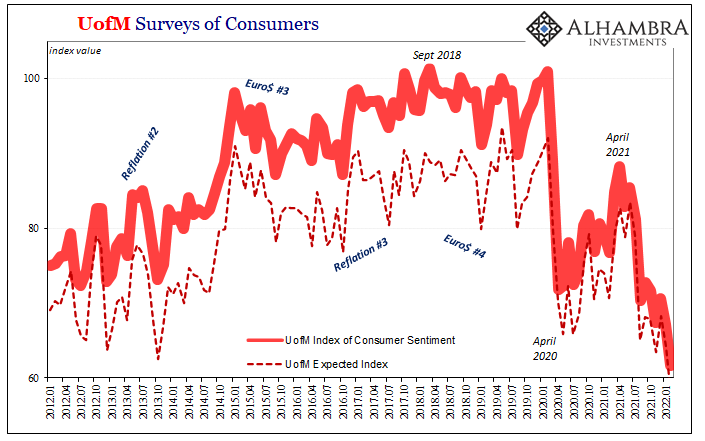

The way it was told, the US and worldwide economy in 2017 and for most of 2018 was absolutely on fire. Booming. They even came up with a name for it, calling the period “globally synchronized growth.” This was so good it was, everyone claimed, in danger of becoming too good.

Inflation.

To stay ahead of that monster, to keep the consumer price genie in the bottle, the Federal Reserve began to hike (resumed, really) interest rates while also running off assets from its balance sheet that had accumulated during its prior four QEs (yes, four). In Europe, the ECB was tapering to terminate its own QE, while over in Japan the BoJ was seriously talking about doing the same.

This much synchronized for sure. Central bankers all over considered how they needed to slam on the brakes to keep inflation in check.

Then it all just disappeared; not the inflation, mind you, that whole globally synchronized growth thing. It had up and vanished.

Why?

In literal terms, a globally synchronized downturn even recession by the end of 2019. But where had it come from? To this day, some claim “trade wars” (though even Economists knew tariffs and restrictions alone could not possibly account for the global reversal, so they then conjured up “trade war sentiment” as an avatar for what they couldn’t explain).

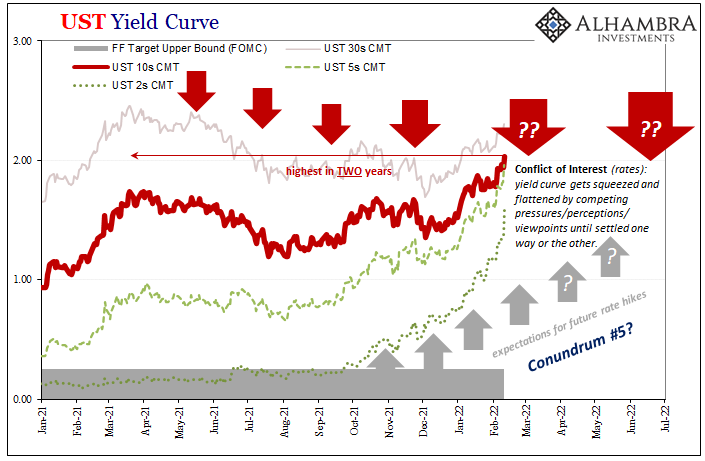

The right answer is Euro$ #4 which had presented itself all throughout that period, in any number of consistent and coherent ways, having already been priced as the dominant probability into the bond market (flattening curves) from the very beginning of that period in 2017.

This is not what most people believe, however, since mainstream Economics dominates the public description. And Economics demands total fealty to the central bank (whichever one). So, if an economy is rip-roaring one day but careening toward recession seemingly the next, the first (and last) place you’re supposed to look for answers is in the direction of monetary policy (even though there’s no money in it).

And the answer insofar as 2018 was concerned seemed pretty obvious – those darn rate hikes! Fearing inflation because of the unemployment rate and that synchronized macro state, the FOMC – in particular – simply went too far tapping the economic brakes; policymakers raised rates too high, they overshot.

This is what’s known as the “policy error.”

Standard stuff for the Fed Cult. Anyone as a member will question no further than this because it instantly sounds plausible on top of the fact everyone says this is what had to have happened since everyone just assumes central bankers are central bankers who therefore must know what they are doing when it comes to money, finance, and economy.

Science!

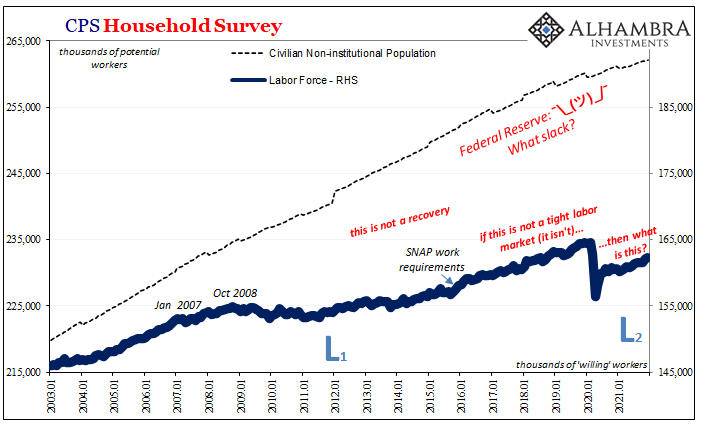

It all begins to unravel, though, immediately upon second thought or any deeper reflection. The economy was absolutely booming, the labor market (in the US) as tight as it had been since the 60s according to the unemployment rate. We hadn’t seen it this good in forever, allegedly.

Yet, the FOMC only voted for carefully spaced, minimally implemented rate hikes and QT (the balance sheet runoff opposite of QE). For as much as Fed officials talked huge and hawkish, they acted out of enormous care and caution. Ben Bernanke had bequeathed the institution more than just the idea of a “false dawn”, rather several of them in reality before that point.

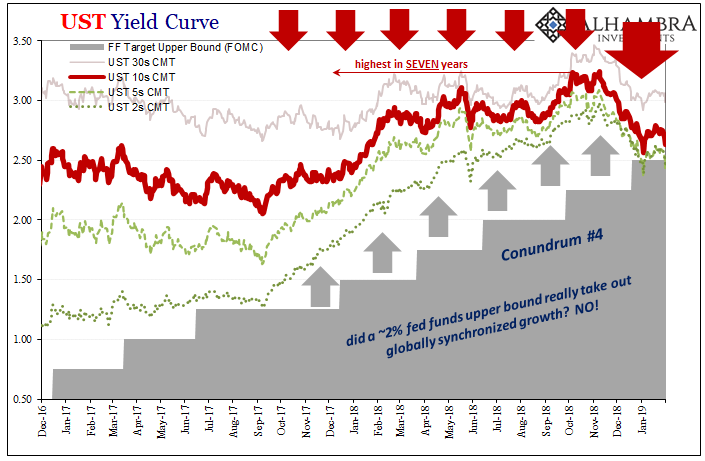

As a result, the top end of the federal funds target range – the primary communicating tool for the FOMC – only ever got as high as 2.50%. That’s it. Truly underwhelming (like the thin evidence for QE making any impact whatsoever).

And the upper bound didn’t make it that far until the final rate hike in December 2018 when it was already clear (outside the Fed’s conference room and the mainstream media) the whole economic situation was falling apart. These things don’t just reverse in an instant, which means if policy error was its cause, then the error must have been first triggered at, what, 1.75%?

Are we really supposed to believe that the biggest boom in recent memory was interrupted in 2018 by ~2% federal funds range?

Yes, yes we absolutely are supposed to believe this even though it is plainly obvious nonsense. If this explanation was in any way in the neighborhood of valid, and rate hikes that much of an imposition (never mind how those rate hikes didn’t actually translate much into longer-run interest rates which the bond market sets rather than the Fed), then the kind of economic boom it really must have been to fall apart near, at, or only slightly above 2% isn’t really a boom.

At its highest point, the benchmark 10-year UST yield was barely 3.25% and only for a few days.

The R* people at the central bank and elsewhere calculate R* [an econometric variable attempting to describe the “natural” interest rate usable in a DSGE model] largely based on these false dawns; they claim that, yes, the economy is in such a bad way because of its stunted long run potential (blaming you and me for this, the labor force which Economists claim is ruined by drug addiction as much as it is riddled with laziness) therefore it actually cannot withstand even moderately higher interest rates whether due to the Fed or any other reason.

None of this passes the smell test; we don’t even need to misuse Occam’s Razor.

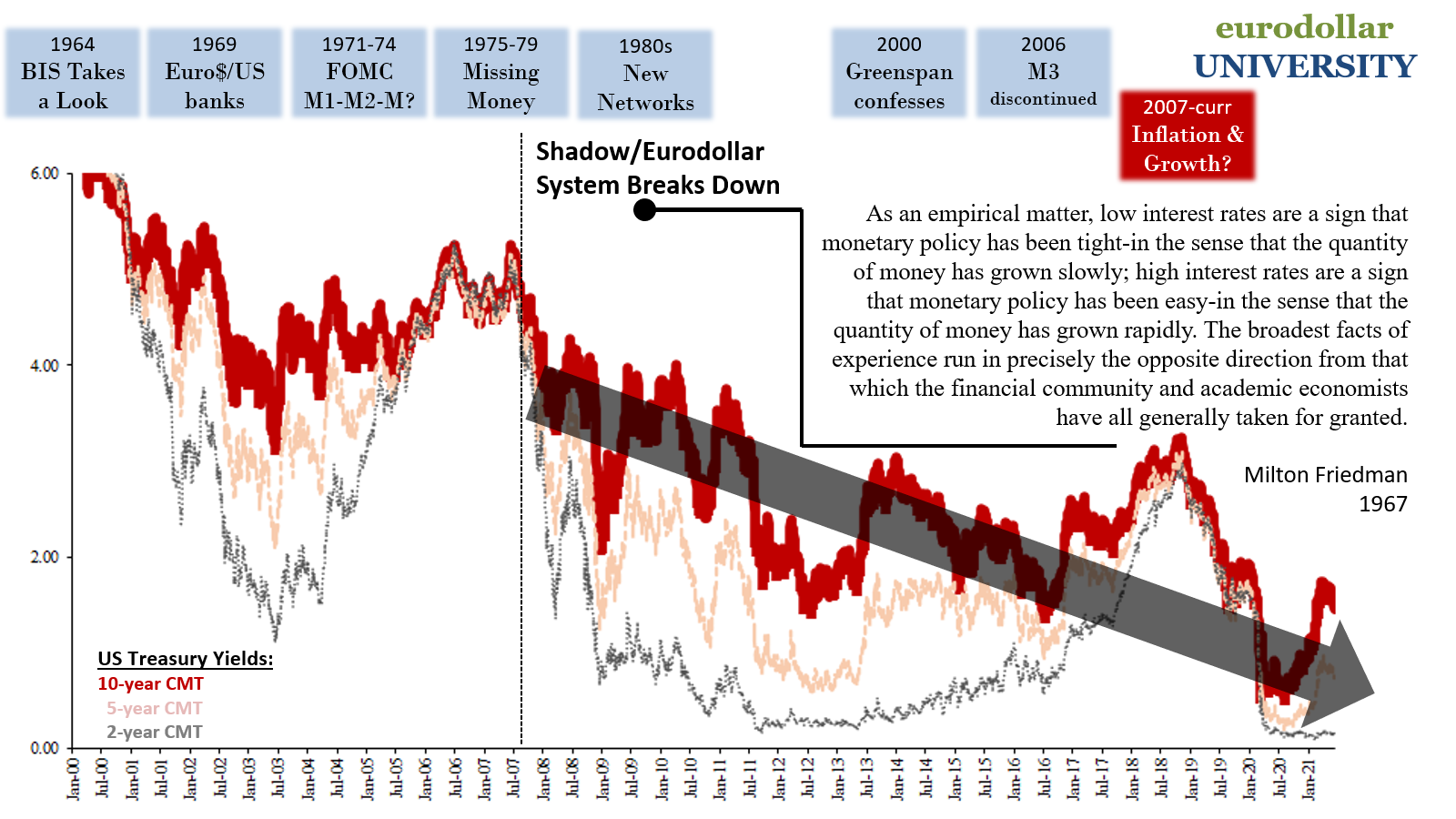

It begins with the interest rate fallacy in two crucial aspects.

First, rising rates don’t actually put the brakes on any economy, they would be – as proved continuously by reflation yield behavior including that whole “taper tantrum” episode – the very thing we are desperate to someday see. If the yield curve ever does end up massively steeper and nominal rates rising in leaps and bounds curve-wide, with longer-term rates going up much faster than those at the short end, this fire-sale of safe and liquid instruments will indeed represent a global carnival of realistic upward growth and inflation expectations for the whole world.

Celebration, not tantrum.

Second, historical comparison – any historical comparison. Start with the last time the US economy was legit booming on its own without the crutch of a massive, all-time credit bubble (disqualifying the mid-2000s). Back in the roaring nineties, interest rates front to back during that boom were way, way more than at any point since 2008.

Nobody operating in it had been stifled. Quite the contrary.

The fact that the economy was falling apart in 2018 with interest rates not being able to much surpass 3% thereabouts was a grossly misunderstood yet powerful testimony about the true underlying state of the world – not just the US portion of the system. Those low “terminal” rates didn’t cause the economy to fall apart, however, they were the warning sign that it almost certainly would!

The problem with R*, therefore, is not in its implication but its explanation.

The economy must have been weak rather than truly booming, in the sense of prior false dawns for reasons that have to do with constant underlying deflationary potential: the true dark side of low rates, the low part (tight money) of the rate fallacy.

It hadn’t been rates at all which halted globally synchronized growth globally, it had been the indicated probability priced all along that “something” would eventually inhibit any and all growth potential and send the whole global system synchronized careening back down in the opposite way toward downturn and recession all over again. Yet another false dawn.

Euro$ #4.

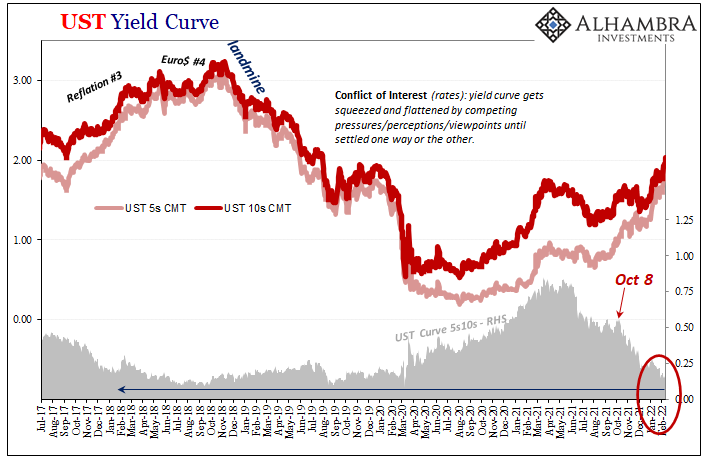

There are parts of the yield curve that just yesterday are even flatter now than at any point during this 2017-19 debacle. As alarming as that should be, you also have to consider just where it is in terms of nominal levels that this ultra-flattening is taking this shape. Use several of our yield curve criteria to evaluation the situation.

ST yields keep rising, LT UST yields not so much. Something's off.

— Jeffrey P. Snider (@JeffSnider_AIP) February 10, 2022

Spread btw 7s & 10s is down to just 2 bps. Yep, two. Spread btw 5s & 10s is down to only 12 bps.

What does all this mean? Time to review the yield curve warning.

Euro$ University Ep 184.https://t.co/IsYoBi5qcJ

Totally understandable why the public has trouble with the yield curve; Economics isn't any help esp. since it tells you low rates are stimulus when they indicate the opposite.

— Jeffrey P. Snider (@JeffSnider_AIP) January 29, 2022

How to interpret the yield curve in 3 easy steps.

Euro$ University Ep 180bhttps://t.co/KSriRockQX

Today, and for quite a while beforehand, we appear to be hitting the yield curve wall, so to speak, at around 2% this time rather than what had been ugly low 3% the previous time (and at 5% during the 2005-06 “conundrum”).

Furthermore, this all before the first rate hike in 2022 has even been done! So many inconsistencies.

As my podcast co-host Emil Kalinowski has predicted several times recently, the policy error will be blamed if it all continues to go in this same way. The mainstream explanation will certainly be rising (not high, because they’re not currently expected to go far) rates did their job choking off inflation before then repeating 2018 by perhaps taking it too far choking off the boom, too.

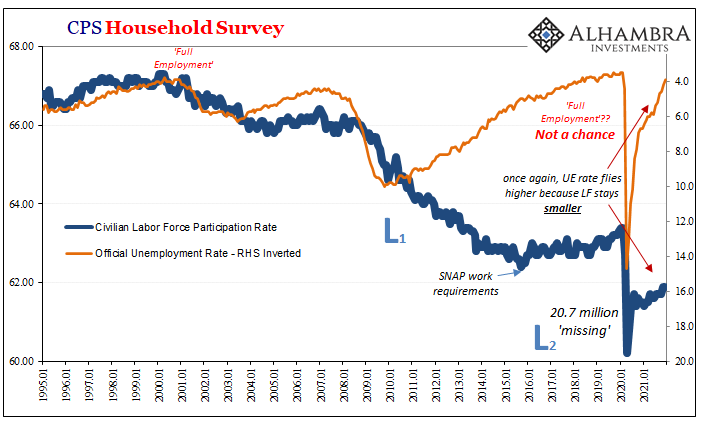

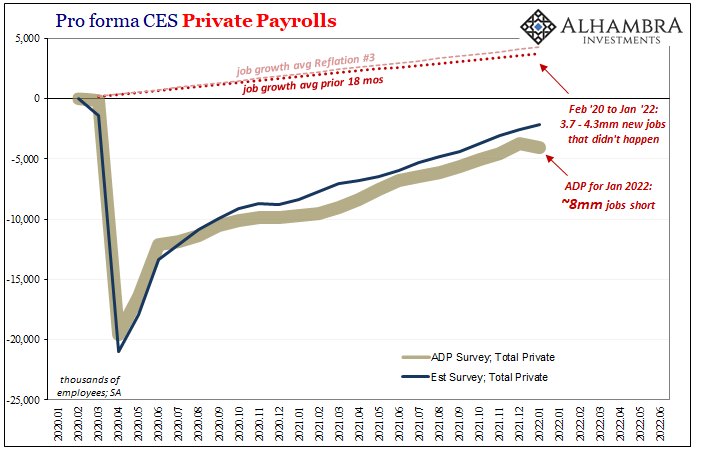

Once more we’ll be asked to believe that a historically tiny rise in rates, whether bond yields or fed funds range, is responsible for interrupting the Great Inflation 2.0 or just taking down another epically tight labor market with a repeated sub-4% unemployment rate.

Common sense again takes precedence.

Maybe the curve changes from here on out in 2022, but having already gone this flat this fast and at around just the 2% nominal level, not even 3%, probabilities of this happening have dwindled down to trivialities. Perhaps the economy of 2021 was never that good at any point, either; in fact, so much indicates it in relatively worse shape than it had been in 2018 (see: below).

There are plenty of reasons to suspect this has already been the case, and then on top we add last year’s “inflation” pain lingering on into this year to pound a weak labor market still several million jobs short of February 2020, let alone the missing even more millions of jobs that never happened over the last two years.

The problem is or was never that the Fed pulled back its “accommodations” too far or too fast on any of these occasions; the real issue is that the Fed doesn’t offer any to begin with. Neither it nor its global counterparts are a central bank, so attempting to explain reality as if it is leads to repeated confusion and the inability to understand the true gravity, and risks, of this or any macro situation.

From questions about inflation to deflation potential and all in between, mind your curves and don’t commit the policy-error error.

Stay In Touch