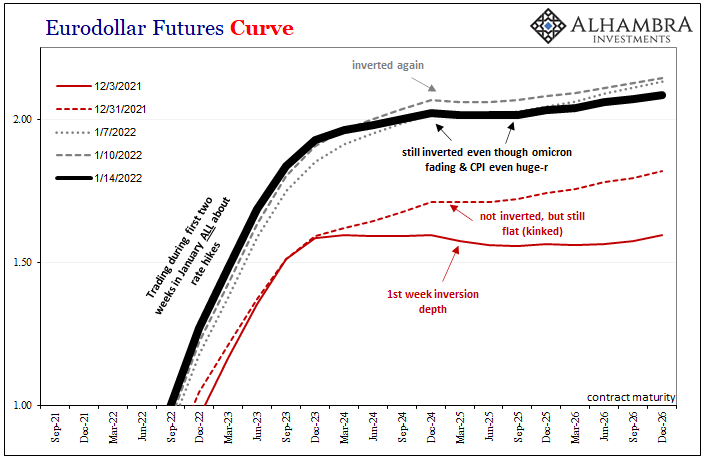

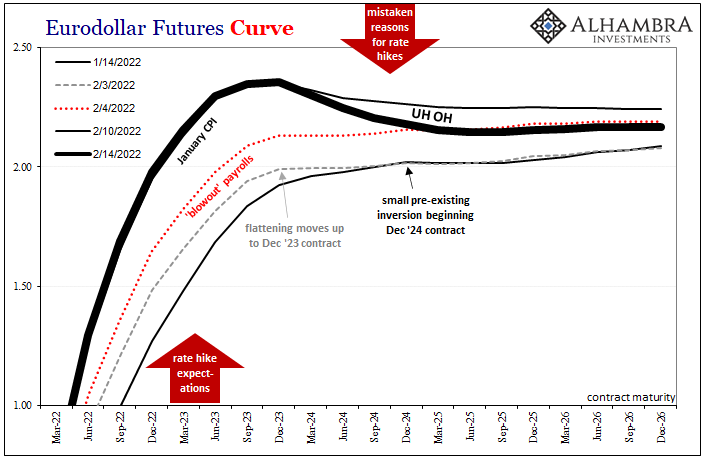

I’ve said since it first showed up on December 1 to keep the eurodollar futures curve in the back of your mind. It wasn’t likely to change all that much in its first stage of minor inversion. The mere fact it had gone upside down at all regardless of where on the curve or by how much was already a huge (and negative) development. Even if it didn’t expand over the interim, the important thing initially was whether or not this small bit of upside down would stick around

It did.

At some point, either the curve would “heal” and revert back to the beauty of its prior unbroken upward slope (not likely), a position it hadn’t taken since late October; or, the situation would escalate and the curve becomes even more ugly and distorted.

By escalate, what we mean is that “whatever” it is that must be bothering so many traders they are willing to hedge against it by betting on a wholesale change in the future rate trajectory, they might eventually double and triple down on the same concern(s). Inversion doesn’t go away, it spreads.

This isn’t something easy or, obviously, normal. To get the curve to warp and disfigure even a few bps is an enormous undertaking. This literally means that as more bet against the mainstream (unbroken gently upward sloping curve) there must be an absence of those willing to take the other side of that trade – those who would bet on the mainstream to push the curve back into its ideal shape.

It can only be a growing consensus of negativity the more the curve alters its shape away from normal.

As straightforward an interpretation as this is, the simple message being sent has been intentionally distorted because of the uncomfortable implications which naturally come along with it – and just who it is the market is outright betting against.

There are a whole bunch of Bill Dudley quotes from the GFC1 era that belong in the Hall of Fame. Not for any good or intelligent reasons, but for all the ways they easily demonstrate and establish how central bankers are not central bankers. Sorry, they just aren’t. These people cannot be for how little they comprehend the system any real central banker would be required to know.

One of those references pertains specifically to eurodollar futures and their curve. You have to admire the sheer ignorance or rationalizing that must’ve gone into saying something like this out loud in this particular setting. This was March 2007, after all:

MR. DUDLEY. Well, another explanation is that the economists who make the dealer forecasts are not the traders who execute the Eurodollar futures positions. So that’s a possible alternative explanation. Generally, there’s a disequilibrium. A number of people that I’ve talked to in the markets have said that this is what they thought was going on, and they advised me not to take what was going on in the Eurodollar futures markets literally because they felt that some of them were putting on these positions in case of a bad scenario that led to significant reductions in shortterm interest rates. [emphasis added]

Yeah, that’s the whole darn point!

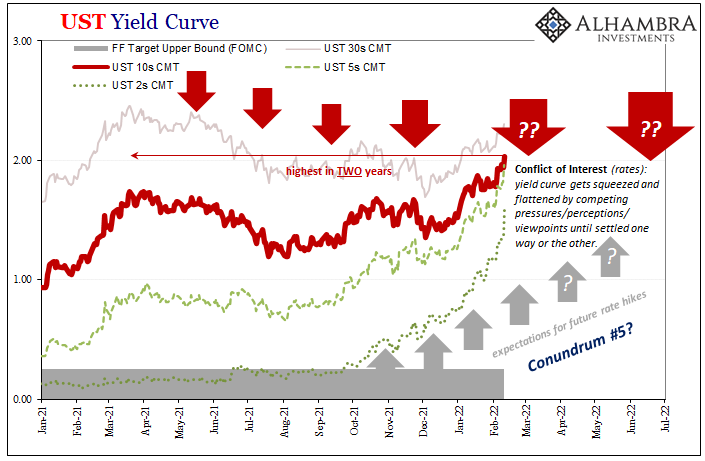

To policymakers who somehow believed they were in control of everything, this deep, sophisticated marketplace betting with more and more certainty against their position was confusing; another conundrum, you might say. Rather than heed the disagreement and what was directly implied by it, they reached for any stupid justification for why they should “not take what was going on in the Eurodollar futures markets literally.”

To the entire world’s detriment and still skyrocketing costs, yes, they definitely should have take the eurodollar curve’s inversion literally (not that it would’ve done them much good; the Fed still wasn’t a central bank but at least they wouldn’t have been so dumbstruck that it all went down).

I last left off with the eurodollar futures curve in mid-January. At that point, I had checked back in on it and, yes, it was still mildly inverted by the tiniest sliver. And that was enough, bad news because, again, in this first stage that’s all you’re going to get; the fact the very small inversion had stuck around by then six full weeks was enough to indicate serious problems.

Inversion actually takes its shape from two dimensions; there is its depth along with its breadth. Depth is easy enough; just how much vertically calendar spreads move upside down from each other.

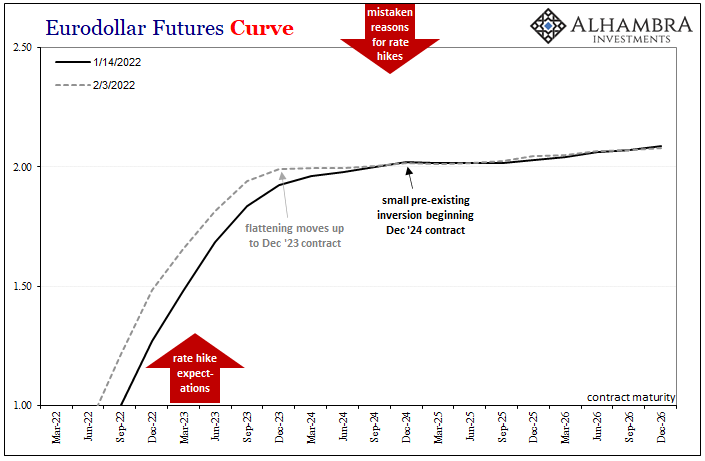

Breadth refers to the number of contracts in succession which might find themselves in this situation. Over the last half of January 2022 from when I last wrote about the curve to early February, depth didn’t change but breadth had (above). Inversion once centered on the December 2024 contract, and mostly contained to the few contracts following it (to the right).

By early February, the distortion moved to the left a whole color; it had pulled those to and including the December 2023 contract also into the upset.

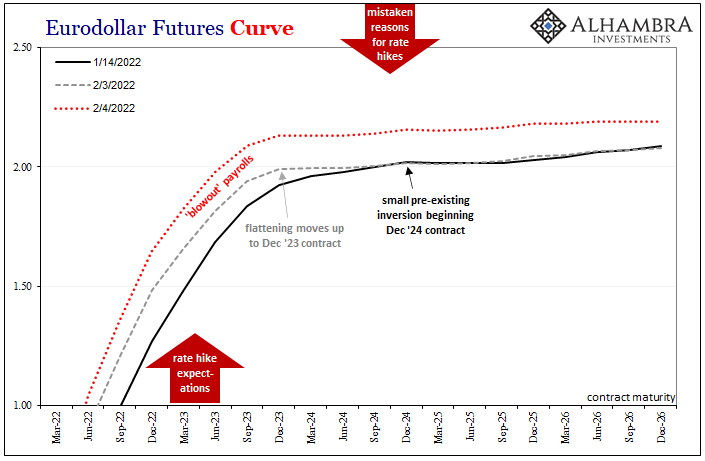

Then came the January ’22 BLS report for payrolls, February 4, the “blowout” number that wasn’t a blowout but did offer more of a statistical rationale to the Fed’s increasingly unfettered (and unhinged, by view of this curve and others like the yield curve) rate hike plans. None of the data would be enough to force policymakers to rethink their next step(s) given how little margin for change they’ve left for it.

The eurodollar curve steepened further to the front, rose in nominal terms all across, and, most important of all, maintained that same shape (above) where its malformation began at the December ’23 juncture; it kept both the expanded breadth to go along with the tiniest depth.

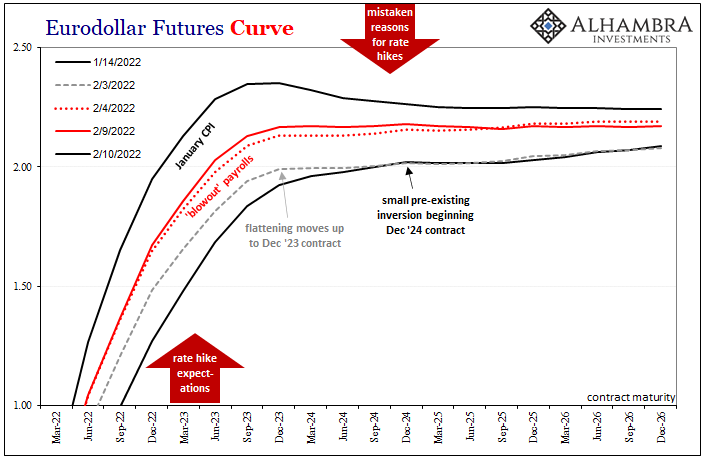

Then last week’s CPI:

You can clearly see the big change, how the curve has moved (potentially) into what is likely to be its second more serious stage. The market expectations for rate hikes obviously changed with the CPI estimates for the same reasons as payrolls; the FOMC will use the headline rate to become even more “hawkish.”

The implication of the CPI (not any additional rate hikes) is an economy finding itself more and more in trouble – and not of the inflationary variety. Unless you are willing to believe a few rate hikes of the federal funds range, maybe even as many as seven or more, are enough to choke off Great Inflation 2.0, the curve is instead telling you the economic situation is increasingly at odds with these Fed justifications.

One of those is payrolls; rather, the actual employment situation in the real economy.

The sad part is she partly believes this because thats what we've been told. We've all heard everyone at the Fed running around connecting unemployment rate with "inflation."

— Jeffrey P. Snider (@JeffSnider_AIP) February 14, 2022

Fantastic *job*, Economics. No wonder Euro$ curve is now 20bps inverted; this passes for informed. https://t.co/z31dbwBQqB

Rate hikes and taper are based on two theories, the first expectations (which I’ll go back to later) and the other the unemployment rate. If the unemployment rate dropping as far and as fast as it has was in any way representative of the true underlying economic situation, we would not be seeing any curves let alone eurodollar futures distort in this manner.

A truly robust labor market brimming with real inflation potential would instead push expectations for future money rates (including 3-month LIBOR) further upward both front and back, keeping the whole thing steep if not steepening more; not downward from the back into even more upside down. The inversion is the market basically rejecting the unemployment rate as flawed (again); the Fed is going to be hiking rates at the same time real weakness in the economy comes out more and more.

It’s a position that has been driven home – and then some – over the two subsequent sessions since last Thursday’s (2/10) CPI. As of today, the curve inversion (depth) has increased to a truly unlovely -21 bps from the Dec ’23 all the way out to the Sept ’25.

This is a substantial expansion both depth and breadth since the middle of last month.

Yes, Mr. Dudley, this means that the rest of this huge marketplace is refusing to take what should be an easy profit opportunity betting against some worrywart hedgers because more and more who might otherwise do it are more seriously considering if maybe there really is something to all these worries.

In fact, as this inversion spreads in both dimensions, it can only mean more have joined the dissenters while fewer bet with confidence on the FOMC’s side.

Stay In Touch