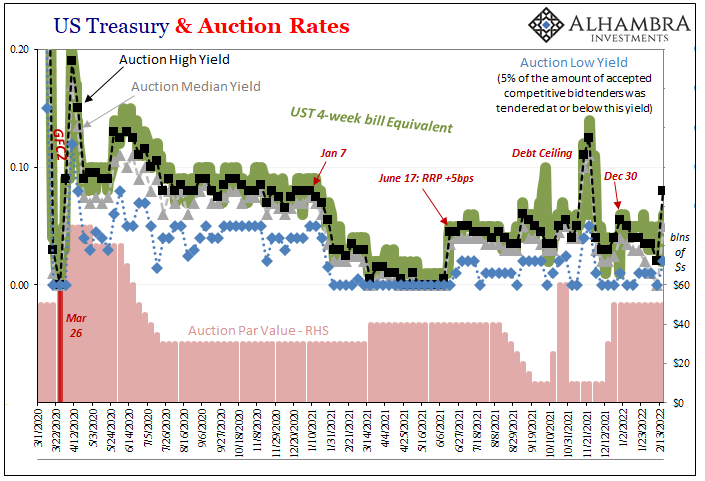

Today, Treasury auctioned its usual weekly allowance of 4- and 8-week Treasury bills. For the former, this was the first conducted given a maturity which goes past the March 2022 FOMC meeting; the initial all-but-guaranteed rate hike. Last week’s 4-week bill expires right on the first day of that meeting, so no rate hike had been considered auctioning off that one.

As a result of reaching the rate hike window, the 28-day bill (4w) stopped out at a high yield of 8 bps, the highest since the end of last year. What that might mean isn’t just the bill market adjusting to the change in frame of reference, really all rate hikes are, it means we won’t have as easy a time comparing this instrument’s equivalent rate to the RRP in order to judge collateral premiums.

The higher the premium paid, the likelier collateral scarcity and higher intensity of it, too.

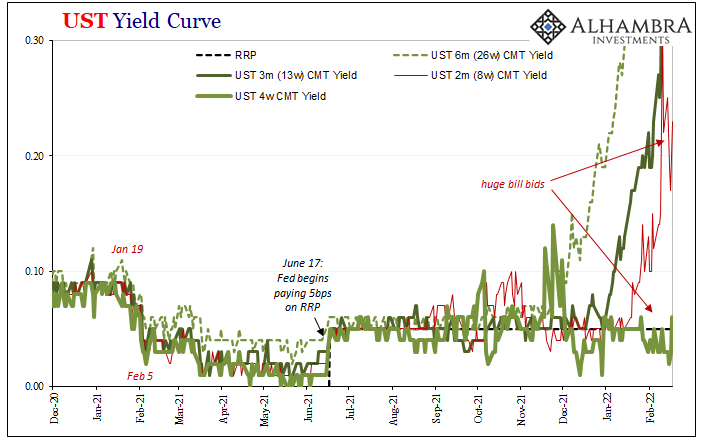

That is, unless the 4-week begins to trade like the 8-week has at times recently.

The high auction yield for the 56-day bill (8w) was 25 bps each of the last two. This week’s instrument matures in mid-April, and the FOMC meeting after March doesn’t begin until early May, so only the single rate hike opportunity to consider. But will it be 25 or 50?

Before today’s bill auctions, in the secondary market the 28-day has been well below RRP – as low as 2 bps just two days ago. Even today, the market settled at 6 bps despite the high yield at auction of 8 (the median was just 5 while the low 2).

The other one, however, despite firmly within range of the Fed’s next move, the secondary market rate for the 56-day bill has been wildly volatile; as high as 31 bps on February 10, only to drop down to just 17 bps yesterday. That’s eight less than the expected 25 bps top end fed funds range everyone believes four weeks from now.

The former you might regard as bill “panic” in case the FOMC surprises in March with a double hike fifty; that high yield registered the day the shock CPI for January was released, after all, but even as fifty fears subside yesterday’s 17bps only makes sense if there’s a price premium for “other” reasons.

In summation, yes, still collateral. Given the obvious escalation in other markets like eurodollar futures, however, the changing frame of reference means we can’t easily judge just how much collateral scarcity, or changes to it, might be playing a role in something like its expanded inversion (breadth and depth).

But that drop to 17bps for the 56-day like the low of 2bps for the 28-day, each this week, both suggesting there’s probably something to it.

Stay In Touch