What do American consumers know that Jay Powell and the FOMC apparently don’t? Certainly, those voting policymakers at the Federal Reserve are going to start raising their policy rates for political reasons under pressure from politicians facing deeper and deeper economic scrutiny for every dollar higher in crude oil. The Fed, however, can’t extract any additional supplies of black gold from the ground anymore than it can fabricate semiconductors Taiwan won’t.

Set aside all that, it’s also clear – because officials have made themselves very clear – that these Economists are likewise convinced the economy needs a dose of corrective medicine anyway. According to Mr. Powell only recently, households and businesses are doing well enough if not becoming too well.

Full employment and inflation expectations, therefore, risk, in the Committee’s publicized estimation, putting the whole system way over the top and piling rapid everyday price potential on top of last year’s transitory supply shock.

Throw some Eastern European geopolitics into the mix, and surely consumers have been shoved over to the dark side of inflation.

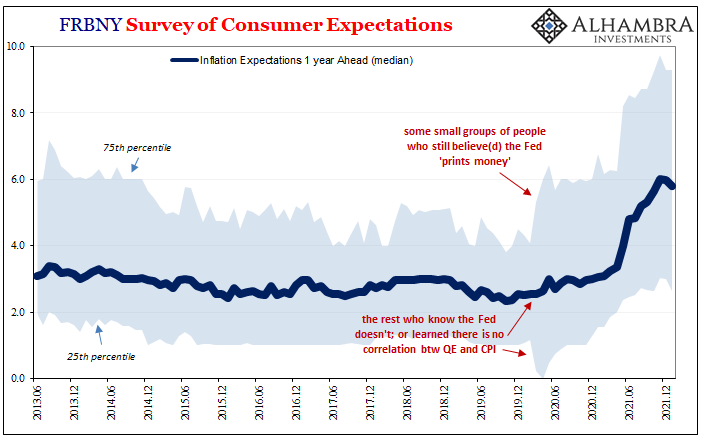

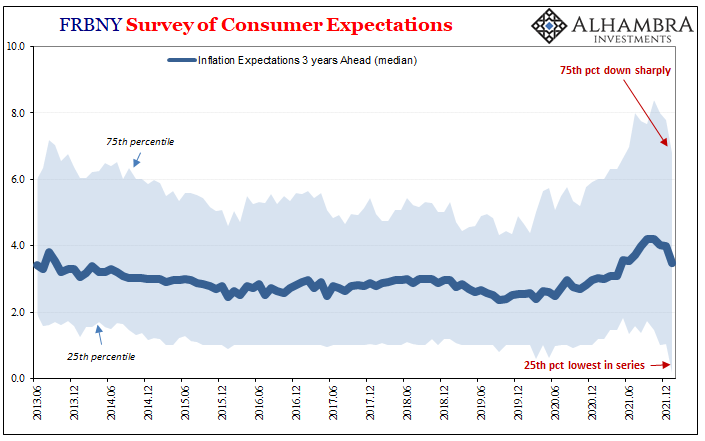

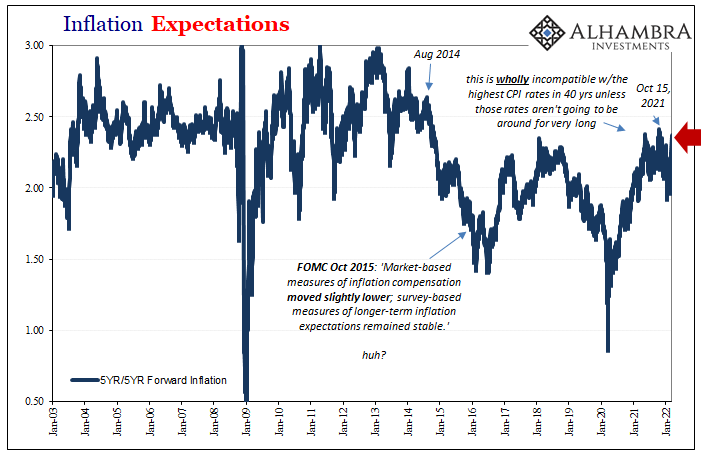

Yet, as detailed last month, not even the Fed’s (FRBNY) consumer surveys suggest as much; or anything of the sort. Inflation expectations in the short run are up, sure, but further out they remain suspiciously subdued.

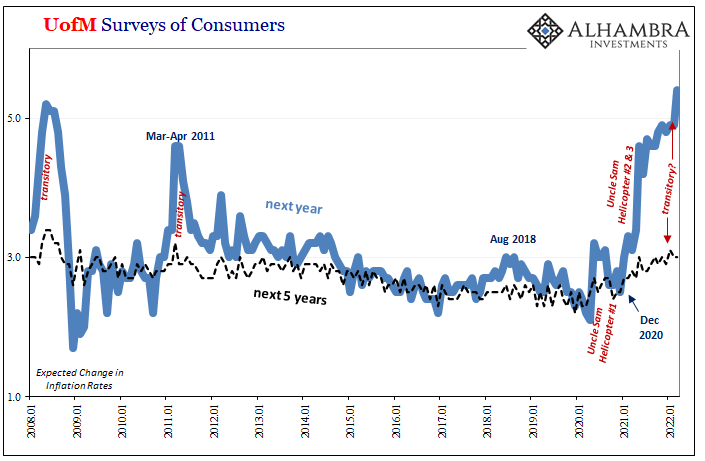

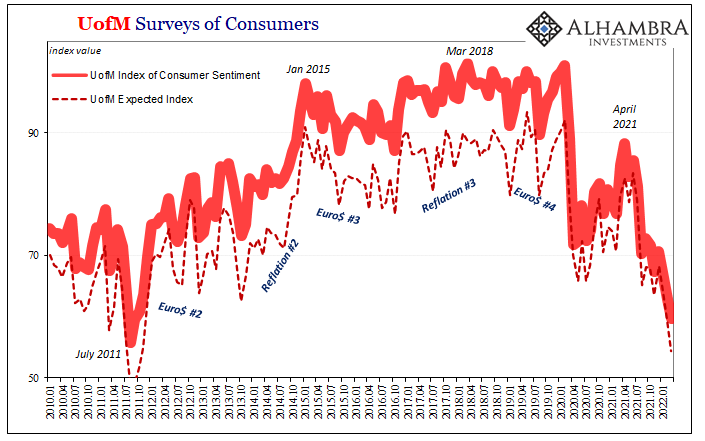

Powell’s New Yorkers aren’t the only outfit seeing this. The University of Michigan’s Surveys of Consumers backs up the FRBNY findings. According to the former’s latest estimates, price expectations one year forward surged in March along with Russian-provoked oil prices. These are now up to 5.4%, and like the latest CPI rate such is the highest in forty years for the survey.

However, further out, consumers are still saying they believe longer run price changes won’t be that much more of an issue. The 5-year projection stuck at just 3.0% yet again despite all the commodity fuss in the current day. Three percent isn’t any different from surveyed expectations from 2012 to 2014, for example.

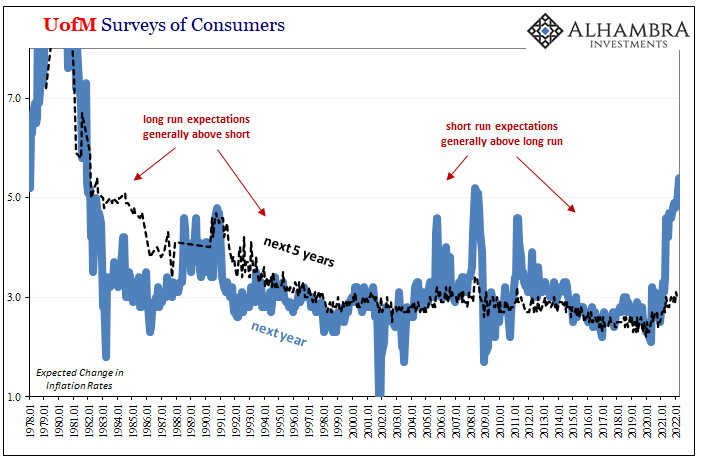

And, obviously, these results are upside-down. It used to be from just after the Great Inflation long run consumer expectations for price changes were higher than those of the short run. That makes perfect sense given, you know, the Great Inflation.

Regardless of 2021’s impressive (sort of) run into bottlenecks and goods transportation nonsense, short run expectations (the UofM’s, anyway) far outpace those looking much further out continuing the pattern of the last quarter century.

In other words, quite clearly no matter which survey, consumers aren’t convinced that consumer prices are going to stick higher year after year. They might menace their monthly bills for a time, yet over the longer-term consumers seem to have an idea of how this all likely ends.

Recall that the current CPI is around 8%, yet neither the UofM nor FRBNY’s short run expectation is close to that. Downward sloping already from the current month.

The rest of the UofM’s survey data might hold the answer as to why. While the FOMC frets about expectations, consumers seem to be expecting more and more going in the opposite direction. This sure looks like a high probability of bracing for demand destruction brought about by oil and grocery costs if not also the prior “growth scare” and very real prospects of a downturn predating the current mess.

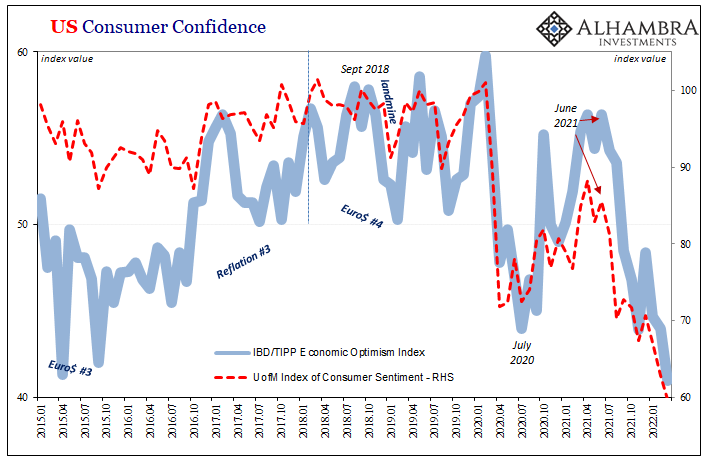

Like IBD’s sentiment indicator, these are some truly ugly numbers. Michigan’s overall consumer confidence index dipped below 60 while its economic expectations number plunged five full points to 54.4. Each was the lowest in over a decade, equal in awful potential with that volatile and disruptive summer of 2011 (you never want to find any kind of comparison with Euro$ #2).

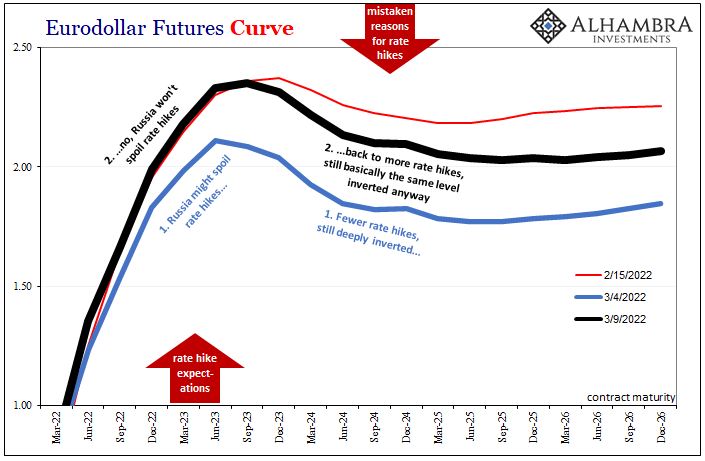

These surveyed results match only too well probabilities being priced out all over the bond market. Eurodollar futures like the odd-ishly flat Treasury yield curve are each the market side of consumer expectations; altogether expectations for demand destruction.

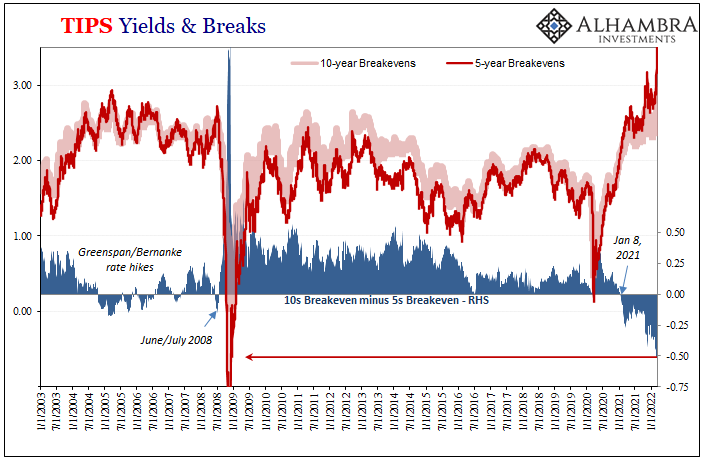

Insofar as inflation expectations go, TIPS prices reflect the same upside-down tendency of over-the-top short run CPI potential that is badly lagged further on in maturities – particularly the 10-year breakeven which keeps falling behind by a record amount below the 5-year. This TIPS “inversion” is stretched to historic levels.

The longer-term 5-year/5-year inflation forward today, even after its Russia rise, remains importantly subdued, too.

For all the bluster about inflation in danger of repeating the seventies, expectations and projections look absolutely nothing like that kind of potential. On the contrary, whether markets or large samples of consumers, the far greater threat more and more evident from both is certainly demand destruction not actual inflation.

Rate hikes anyway – for now.

Stay In Touch