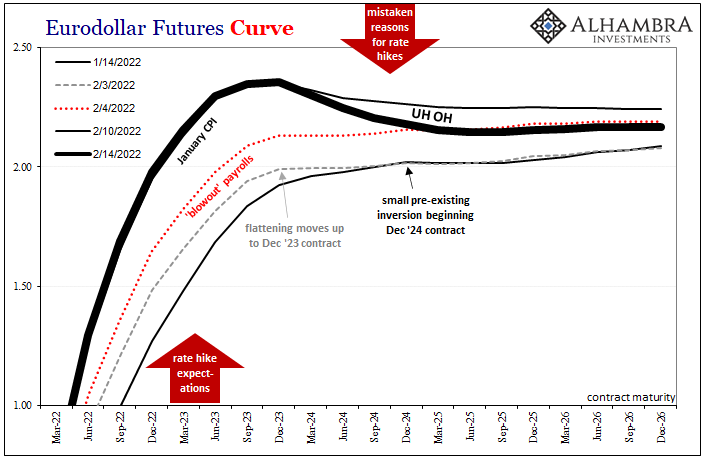

The FOMC is going to hike rates maybe even aggressively. There’s not much dispute on this assumption. Why the Committee might be doing so, that’s a whole detailed debate. The Treasury yield curve is building toward inversion while the crucial (and leading) Euro$ futures curve is already substantially upside down.

Both are increasingly confident market bets against the FOMC’s position(s).

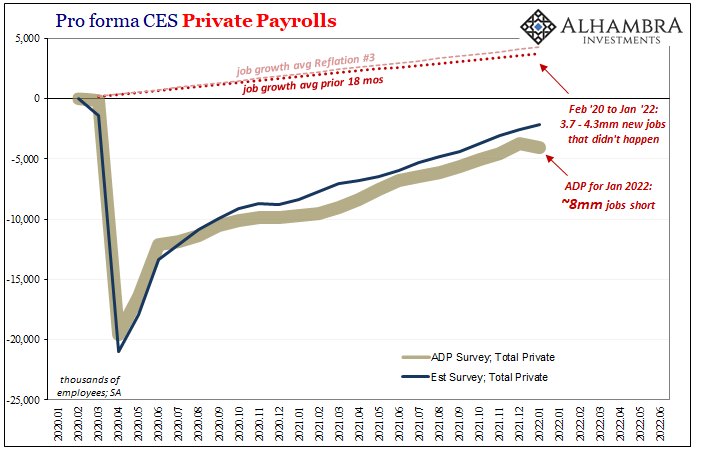

Jay Powell and his group are justifying their public stance and likely future actions based on two theories. The first, as discussed earlier, the unemployment rate as it drops into the 3s for the second time in as many years (forgetting, of course, that it didn’t work out the last time for the FOMC’s inflation theory).

The sad part is she partly believes this because thats what we've been told. We've all heard everyone at the Fed running around connecting unemployment rate with "inflation."

— Jeffrey P. Snider (@JeffSnider_AIP) February 14, 2022

Fantastic *job*, Economics. No wonder Euro$ curve is now 20bps inverted; this passes for informed. https://t.co/z31dbwBQqB

A tight labor market, we’re constantly told, supposedly leads to inflationary pressures via wages. Those higher input costs are passed along to consumers, therefore CPI.

Again, the Euro$ futures curve is not at all buying this – to the point today where more of it is outright betting against the “tight” labor market interpretation. Weak employment situation therefore economy rather than anything else (as any rational analysis if where perhaps seven or eight million jobs remain missing).

The curve is also not buying inflation expectations. For very good reason(s), it turns out.

Since the Federal Reserve is not a central bank because it doesn’t study, monitor or even much understand the monetary system, given how inflation is actually a monetary phenomenon, policymakers have to reverse engineer inflation from another angle.

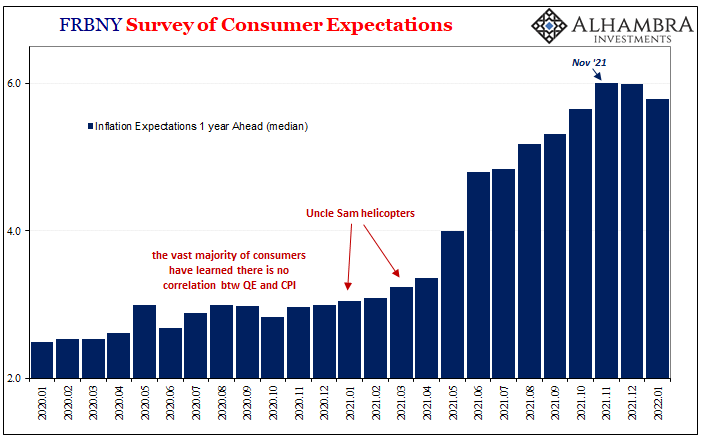

So, over the years they’ve conjured up this idea how consumer expectations maybe, possibly could play a key role in consumer price behavior – even though there is no actual evidence for this presumption. But, if you don’t do money, you have to come up with something to try to ground non-money monetary policy as it might plausibly pertain to consumer prices.

Expectations sounds like a believable idea (which is their real point).

In short, those at the FOMC are worried Americans will become normalized to the high rates of CPI advances over the last year. Inflation expectations might become unanchored, and then there’ll be trouble unless Powell’s company does something about it first.

Rate hikes. The more potentially unanchored, the more aggressive the rate hikes.

Even though there is no indication for any connection between expectations and CPIs, let’s assume for a minute there could be. And if we assume it’s possible, what about evidence for expectations becoming unanchored?

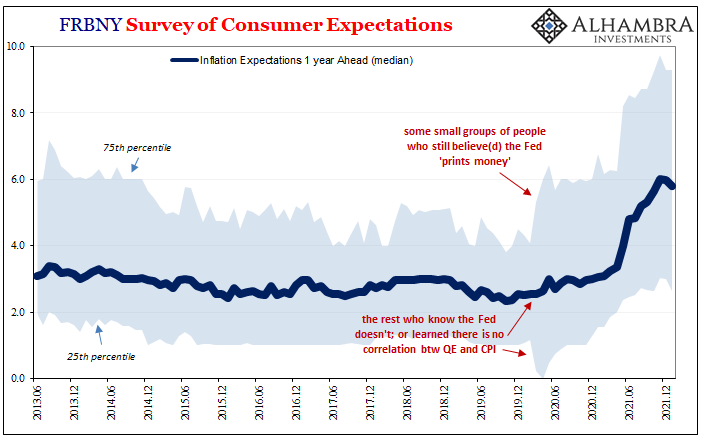

To figure this out, we’ll even use the Federal Reserve’s own data, a comprehensive consumer survey gathered at its New York branch (FRBNY). To put it bluntly, the latest Fed inflation expectation figures released just today for the month of January (the very same month the CPI accelerated even more to 7.5% y/y) indicate the opposite of what everyone is supposed to be worried about.

Yes, opposite.

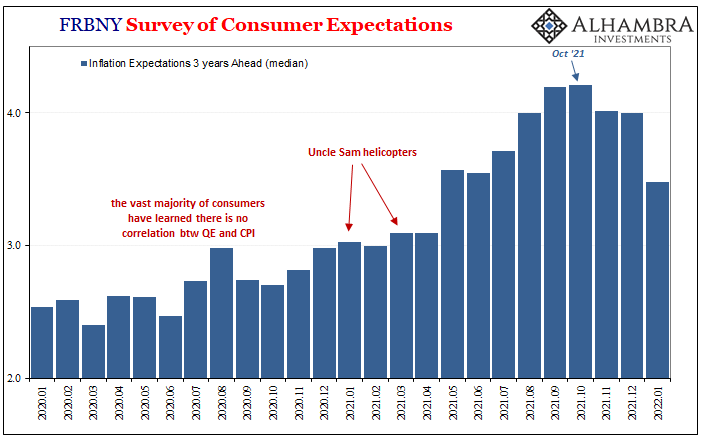

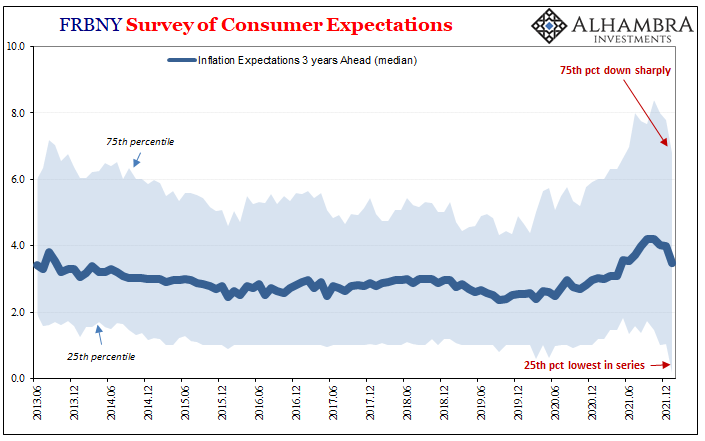

Surveyed inflation expectations have been dropping, especially those for the longer run (3 years).

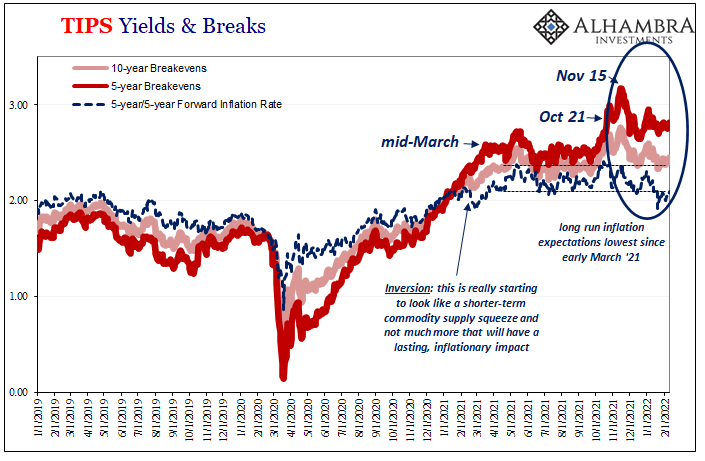

We’ve seen this elsewhere, too; the TIPS market, for example, where inflation expectations topped out also back in late October. In other words, by market-based measures to go along with FRBNY’s estimates, there appears to be a growing sense of the downside to transitory “inflation.”

And that downside ties back – in timing as well as intensity – to both the yield and eurodollar futures curves.

The details of the consumer survey results are even more compelling. For one thing, in the longer run series (3 years) there was an even more substantial drop in the median result. It began with a sharp decline in the 75th percentile, the Fed-prints-money-group, but more so what is now the lowest level for the 25th percentile in the history of the data (going back to June 2013). Even lower than the disinflation of the 2010’s.

Furthermore, you can see how consumers making up the bottom of the range have a more grounded view of consumer prices than those at the upper end who have been led incorrectly to believe inflation is a product of QE (illustrated most clearly by the 75th percentile of the 1 year ahead inflation expectation).

If consumers at the lower and middle tiers are thinking longer run inflation probabilities are sinking fast and to that low, at the very least there can’t be much danger whatsoever of consumer inflation expectations becoming 70s style unanchored – on the contrary, why are expectations dropping like this?

And, remember, these results have been gathered during the past few months when current inflation statistics like the CPI – along with exhaustive media coverage of it – have accelerated further beyond the already-high rates in the middle of last year.

This strongly suggests, along with TIPS, that a substantial group of consumers operating in the real economy are seeing and thinking the same as more complicated financial sectors like eurodollar futures. In fact, that market – along with the Treasury yield curve – is pricing more and more as if the Fed begins to hike rates but then has to abruptly stop because the economy, like actual inflation probabilities, is nothing like what the mainstream view says right now.

Hardly anything new, this is consistent with any number of cycles such as 2018 or 2005, even the year 2000 when the FOMC in May of that year voted for a double-hike, a fifty, even though the yield curve and eurodollar futures were already inverted by that point.

Recession rather than inflation followed.

Policymakers screw up on inflation all the time. It’s baked into their modern DNA. The reason is simple: they aren’t central bankers because they have no idea about money, and since money is inflation therefore they’re going to commit error after error after error.

It’s already showing up in their own data!

And, as noted last week, this isn’t a burgeoning policy error – the Fed-centric idea rate hikes themselves are the reason for the eventual economic and inflation dropoff – it is a policy-error error where the market increasingly and more vehemently (eurodollar futures) disagrees with why the Fed is hiking rates in the first place.

In 2022, the unemployment rate is no solid basis of interpreting the economic situation; we just did this three years ago. And then, even if we thought there was some link between consumer expectations and actual economic inflation potential, and that expectations could be unanchoring, the Fed data is moving contrary to any of that anyway.

Given what FRBNY continues to uncover, policymakers should instead be increasingly worried about putting all these pieces together, trying to figure out just why all these indications have uniformly turned down and against their case going back to late last year even as CPIs continued to go up.

Weak global economy being hard hit by transitory supply shock “inflation.” This rather than Great Inflation 2.0 (or even just a recovery) is the only way to explain all the markets and data continuing to pile up against the Fed.

Stay In Touch