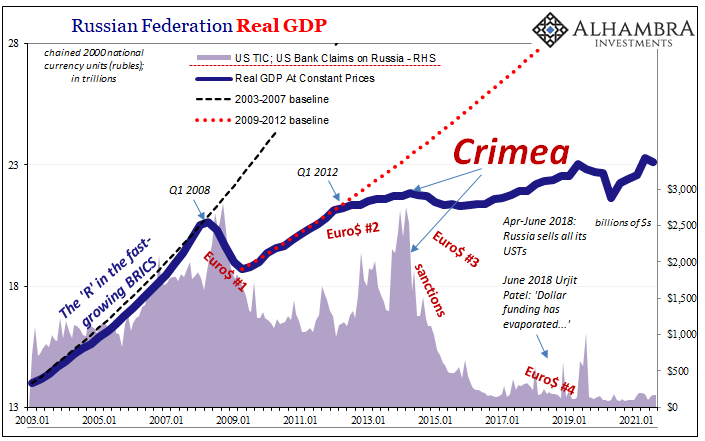

You look at the two charts below, and immediately you see how something doesn’t add up. On the one side, US banks haven’t lent dollars to Russia since the first time the Russians ended up in Ukraine back around February 2014. The US government declared domestic firms wouldn’t do business with Russian banks and they really haven’t.

Score a victory for Uncle Sam, I suppose.

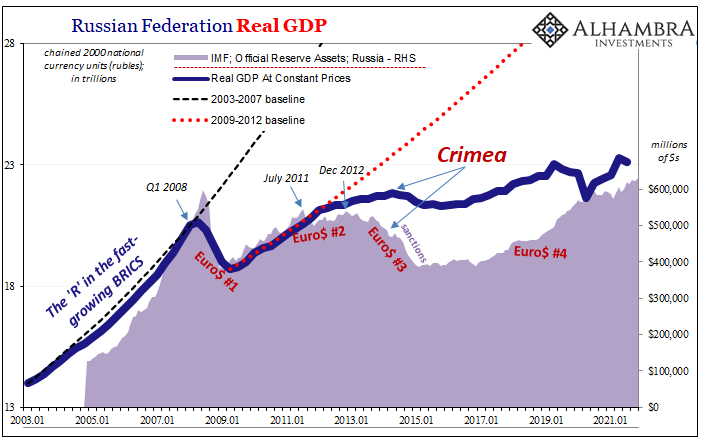

Even though US institutions have steadfastly avoided Russia, the Russians appear to have been able to keep piling up reserve assets anyway (timed to 2017’s “globally synchronized growth”, no less). Furthermore, those reserves are predicated upon US dollar-based trade of oil and natural gas, regardless of what authorities in Russia might do with the proceeds once exchanged.

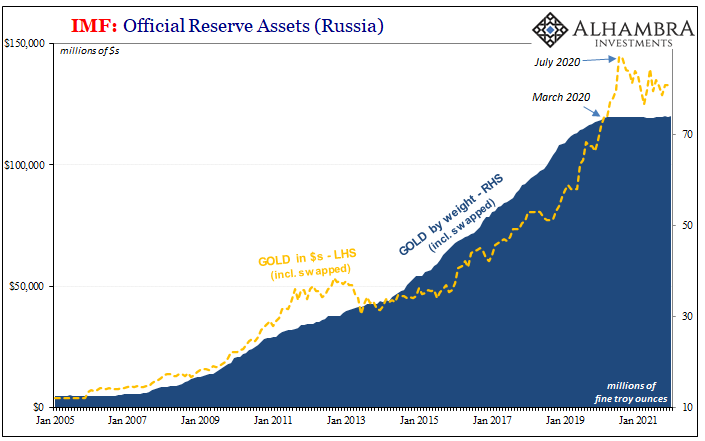

In other words, the Russians intermediate through the eurodollar system, in dollars, and then choose various outlets as a store of value for its national reserves. Up to 2020, that was mostly gold, a choice that reserve managers obviously began to regret right around that whole March 2020 stuff.

Liquidity and elasticity, not politics.

The point being, not a sniff of US banks and yet Russia had been comfortably (compared to the geopolitical rhetoric) mediating through the “dollar” system despite America’s demanded absence – because the world isn’t run on a US dollar reserve currency subject to the political whims of whichever topic du jour.

No American banks, no problem. Plenty of others around the world who will continue to operate the eurodollar system without need for them; global banks dominate here rather than representatives in any place.

Political authorities will do whatever they can when they can, and they will make a huge, public spectacle about it, too. While much of the current theatre is aimed at the Russians, I suppose, as much if not more is actually targeted at Western, even US audiences who continue to believe American politicians run the American currency which runs the world.

But then, what happened to “cut off?” The original White House statement regarding Russian sanctions read:

First, we commit to ensuring that selected Russian banks are removed from the SWIFT messaging system. This will ensure that these banks are disconnected from the international financial system and harm their ability to operate globally. [emphasis added]

That was February 26. Now six weeks or so later, “disconnected” suddenly transformed into “impede”:

These designations will further impede Russia’s access to western technology and the international financial system. [emphasis added]

Big difference; the eurodollar makes it more a game of whack-a-mole than you’d been led to believe. Give the man some credit, at least US Secretary of State Blinken was being more honest about what can be done. If they can find some accounts, fine, they’ll shut them off and freeze whatever.

The flow of money via eurodollar corridors? Very different reality.

Like the nonsense over the so-called petrodollar (which never existed), this is another perfect illustration of what is a global bank-centered system that oftentimes has nothing whatsoever to do with American banks or America. Doesn’t matter the dollar denomination, it’s the eurodollar what delivers (or doesn’t).

Both the petrodollar fiction like this idea of “disconnected” Russians, each of those are supposed to reinforce the fantasy of politicians in charge; and if they are in charge, then we presume they can just change something whenever it suits. Whether sanctions or, according to what’s most often behind the petrodollar façade, the whole reserve system.

And this mistake, believe it or not, might just be a good thing.

Please don’t (ever) take what I write for an endorsement; don’t shoot the messenger here. For as much as I write and spend time on the eurodollar system, I’ve hardly been a proponent when it appeared to work let alone now as it doesn’t. The system has displayed some positive attributes (flexibility, reserve-less ledger concept), sure, including how it first wrestled away the world’s monetary roles without anyone knowing it!

Let’s repeat that specific part of it. A powerful clue to a possible future design implementation?

The problem with the eurodollar was that power was left up to the world’s banks who, inevitably, would squander their shot. Sure enough, they did (revealed on August 9, 2007, at least to those not buying the Fed Myths).

Politicians the world over will try, but I doubt they’ll ever get it back – and that’s the best, maybe only really good part. While the governments screw around in the theater, mostly unaware of all these things, the door has been left wide open which no one can figure out (focused instead on “money printing” of central banks that aren’t central banks):

On the other hand, since we’re already on a distributed ledger money system, the eurodollar, and have been for more than half a century, digital currencies just might hold some legit promise possibly even as an overlay to existing methods; as a more widely distributed ledger which doesn’t require specialized businesses like banks to keep track of transactions on our behalf (that’s all modern-day banks really are, glorified bookkeepers).

Bookkeeping is easily replaced. Blockchain.

Every additional day authorities keep up the pretense of “cutting off” someone from SWIFT (most people who say it don’t even know what SWIFT is or what it actually does) or getting caught up in the petrodollar fairy tale, that’s one more day of potential progress made before they all even realize what happened and what hit them.

What went wrong with the monetary system in the shadows? Is there a way to fix it? What the hell is an algorithmic stablecoin?

— Jeffrey P. Snider (@JeffSnider_AIP) March 31, 2022

Can these fit into money creation, intermediation and whether they'd be units of account, stores of wealth and/or mediums.https://t.co/slWcs8yH6Q

In other words, exactly how the eurodollar itself began. Given enough space, and time, incubating in the shadows like the eurodollar once did, whatever it might be – decentralized and out of the hands of governments and banks alike – a private currency which accomplishes and fills the roles of a reserve currency in a way the private market needs and demands, that is when the new era dawns.

Has nothing to do with oil. Never did. Not Russia nor China, either. Not even America’s choice.

Once the new era happens, the only option at that point, if you’re in a government, is to do what your predecessors did before, just accept it – even if you don’t really know what it is (let’s face it, you’re in government so you won’t). The more authorities pretend they’re on top of a system they are nowhere near, paying all their effort trying to keep the illusion together, perhaps counterintuitively the better off we all might be in the long run.

The long shadows of unregulated banking once built the eurodollar, so the template’s established for the distributed ledger form. Most of the public is already long-acquainted with that form even if hardly anyone knows it! What do you think paying with your phone via Google Pay, or even just using a credit card has been?

A narrowly distributed ledger system.

The problem was banks rather than the ledger or the shadows. Maybe, just maybe what comes out of them next works a whole lot better if this time, should we get lucky, it goes without governments and banks.

Stay In Touch