I said a couple of years ago that I thought that once all the distortions were past, we’d be back to where we started prior to COVID, but with more debt. The decade from 2010 to 2020 was the slowest decade of nominal GDP growth since WWII and the prospect of another decade of that wasn’t all that appealing but it seemed the most logical outcome. I’m starting to wonder if I may have been too pessimistic – which I think was an easy thing to do in the midst of a global pandemic.

We know the things that drive real economic growth – workforce growth and productivity growth – and neither of those looked likely to change and thus, we’d go back to the plodding growth of the decade prior to COVID. The Bureau of Labor Statistics puts the expected growth of the workforce over the next decade at 0.4% and absent some big change in our immigration policies, that is probably a pretty good estimate. If anything, we might get reform that includes less immigration, not more. So, if we want better economic growth, it probably isn’t coming from an expanded workforce.

Could we get better productivity growth? I speculated last week that Artificial Intelligence might provide a boost and that is certainly possible. I don’t actually know if AI is the game changer so many seem to think but thankfully it isn’t our one shot at improving productivity. We never know how or why productivity will improve but it has been happening, in fits and starts, since the industrial revolution started some 300 years ago.

And since the technological revolution started, it has been feared. The Luddites of 19th-century England may have been the first to oppose technological improvements, willing to sacrifice a better future for a more secure present, but they surely weren’t the last. They clung to an idealized past that didn’t exist, a present that wasn’t very good but was known, rather than face the uncertainty of change. But technological change marched on without them, putting some people out of work – temporarily – while creating entirely new types of work that were previously inconceivable and freeing people from the daily drudge of survival to allow human creativity and ingenuity to flourish further.

The investment industry has its own version of the Luddites, prophets of doom who constantly preach of bad days to come. These gurus also cling to the past, always looking backward, claiming that past crises have yet to be solved and will certainly return to recreate the havoc of the past. There’s a video circulating out there right now from one of these doomsters, saying that the underlying problems of 2008 have not been resolved, that another crisis is on our doorstep. I have no doubt that if this were 2003 rather than 2023, he’d be telling everyone that the underlying problems that caused the S&L crisis 15 years before have not been resolved.

Pessimism continues to sell newsletters and entice investors with illusions of untold profits of misery. Actually profiting from the end of the world as we know it, however, remains elusive. Just this weekend, the Wall Street Journal published an article on Carl Icahn’s bad bet on “The Big Short 2.0“, his wager that bricks and mortar retail was doomed by the likes of Amazon, a modern-day Luddite tale of destruction wrought by technology. The only problem is that it hasn’t happened because it turns out that people do actually like to get off their couches occasionally and go down to the mall. Turns out shopping has a social aspect to it; who knew?

The “dying retail sector” described by Icahn and others like him doesn’t exist. Retail currently has the lowest vacancy rate among all commercial real estate sectors. Like all good vendors of despair, Icahn blames his lack of success with this trade on sinister forces who’ve rigged the market against him. Conspiracy theories are very popular among the doomsday prepper wing of the investment business. There’s always a central bank or secret hedge fund or mysterious trader thwarting their predictions. Or maybe – and I’m just thinking out loud here – they were just plain wrong.

There are a lot of very smart people today warning about the potential apocalyptic perils of Artificial Intelligence. They talk of dire threats, AI of the future run amok, threatening the very survival of the human race, a cyberpunk novel come to real life. They claim that the government must regulate this new technology in the name of protecting all of humankind. And who’s behind this scaremongering? Well, that would be the existing companies with investments in AI. Why? It’s called regulatory capture; it’s so much easier to strangle your competition in the crib with regulations designed by people on your payroll.

I am not Pollyannaish about the future or, more specifically, technology; it is not without its faults. One of the most profound technological changes ever, the internet, made it possible for anyone to reach a global audience. But it didn’t come with competent editors or fact-checkers. Back in the olden days before the pixels took over, the doom-mongers were relegated to the classified section of financial publications. Their audience was limited because their reach was limited. Now, any fool with a laptop can spew whatever nonsense he wants – economic and otherwise – and attract an audience of millions. That is the price we pay for the positive aspects of this new media.

There is a tremendous amount of innovation happening right now. New drug developments like Ozempic and other weight loss drugs could have huge consequences for not only health but also wealth. CRISPR technology will soon have its first approved drug. mRNA technology is advancing vaccine knowledge rapidly. The large language AI models are being refined and applied to new areas of life and business. Robotics and automation are intersecting with AI. A long list of energy storage techniques are being researched. Computing power continues to expand and 5G and 6G infrastructure will literally put that power in our hands. And that’s just what I thought of off the top of my head.

There is a lot to be optimistic about right now. But you won’t see it if you spend your time worrying about the past rather than imagining the future.

Environment

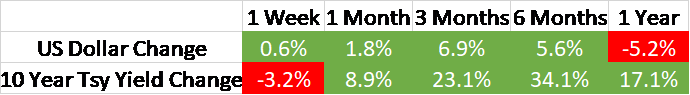

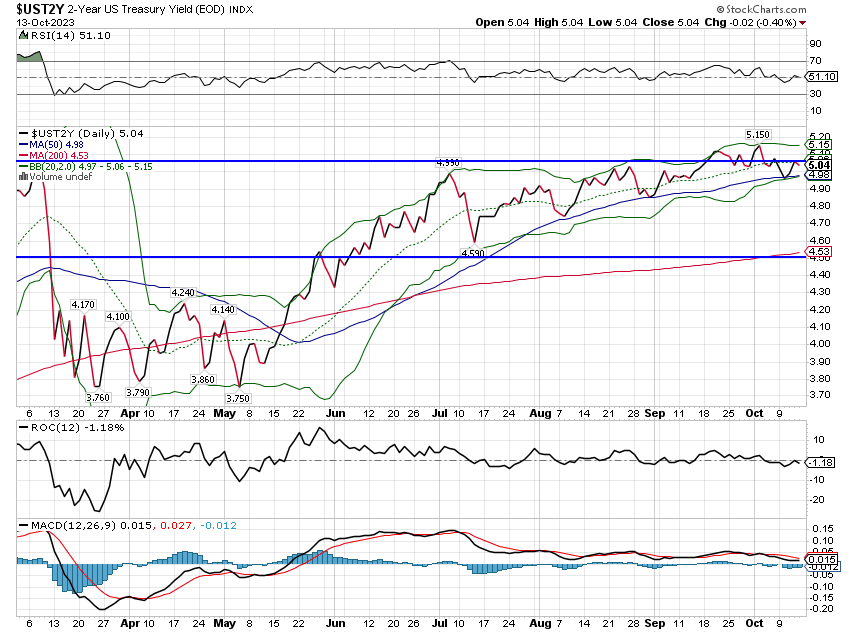

The dollar had a big rally on Thursday last week, likely as a precaution based on the threats of terrorist actions on Friday, but the dollar’s short-term uptrend is faltering. The short-term uptrend line was broken early in the week and the late-week rally allowed for an up week but there will need to be some follow-through to the upside this week to bolster the short-term trend. For now, the short-term trend is still up, intermediate is neutral and long-term is up.

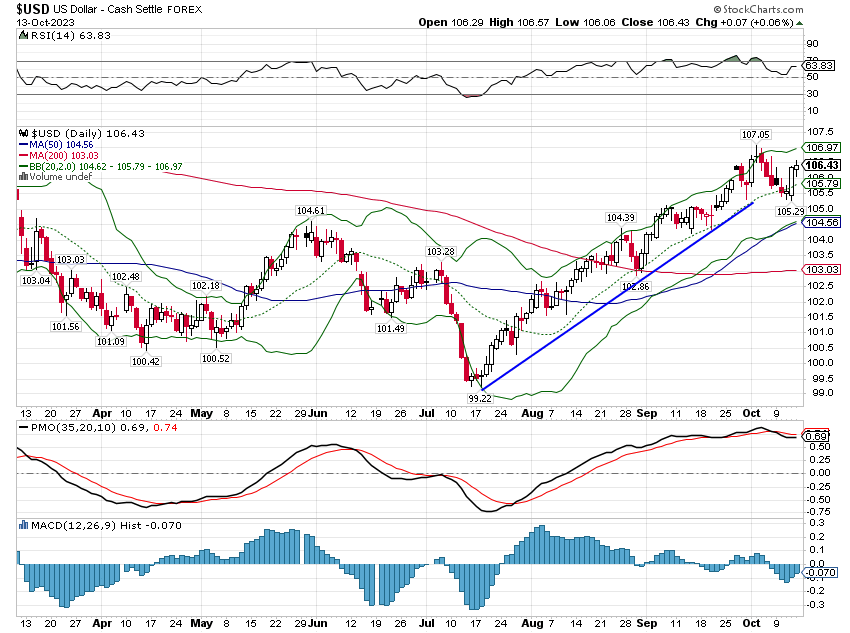

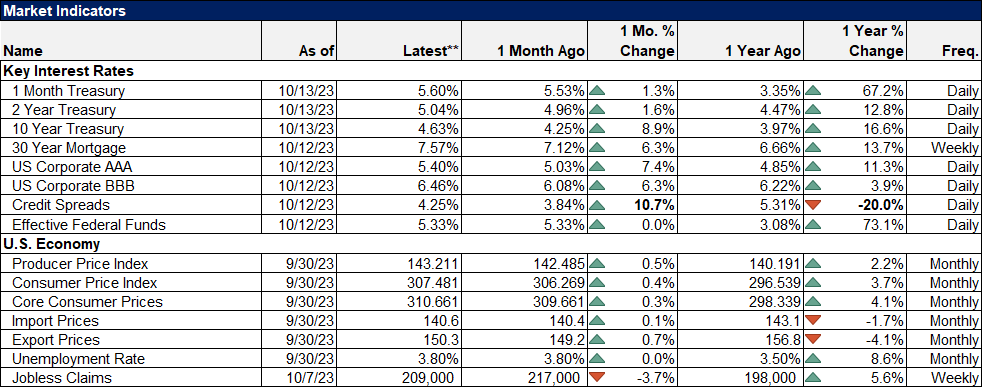

Bond yields have been on a rollercoaster the last two weeks. After peaking intraday at almost 4.89%, the 10-year yield fell a quick 35 basis points, hitting a low of 4.53% early Thursday before rocketing higher to 4.73% later that day. That 20 basis point move from low to high was a very big move that came with little news. The CPI report didn’t seem to have much impact with rates little changed an hour after the report but bond selling was persistent all day. A poor Treasury auction in the afternoon didn’t help the mood and rates closed near the highs of the day. Still, with bonds rallying on Friday, the yield fell 15 basis points for the week.

I’ve written over the last few weeks that I thought rates were at or near a peak and the volatility we saw last week is typical of turning points so I have no reason to alter that view. For a short-term target, I think the low 4s is reasonable.

But there’s still a lot of money pouring into the long end of the curve, looking for that turning point into recession and much lower rates. A few weeks ago, there was a slight outflow from TLT (20+ year Treasury ETF) but that lasted all of a week and now we’re seeing big inflows again. There are still way too many bond bulls out there for a big rally. So absent a big change in the economic trends, a short-term rally is all I’d expect.

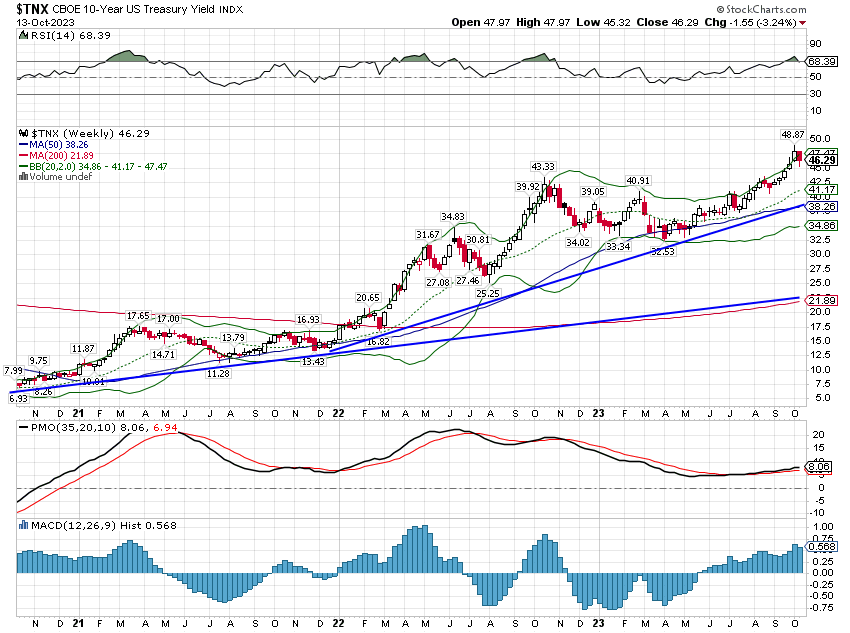

The short end of the curve remains flat, the 2-year rate no higher today than in March. The short end believes the Fed is done and they may be right, but as Doug Terry points out in this post, inflation is proving sticky and we don’t think that is going to change. That doesn’t mean we think it is going to run away to the upside but further improvements over the next year may prove difficult. I think the Fed is on hold for the next meeting – the speeches last week certainly leaned that way – but they may not be done.

We think we are in the midst of a secular change in the trend for inflation and interest rates. The downtrend in rates that started in the early 80s appears to be over. That doesn’t mean we’re headed – necessarily – for 1970s-style inflation and interest rates. But a return to more normal levels of interest rates for an extended period of time? Yes, we think so. And that isn’t bad news for investors by the way.

We’ve suffered through two years of normalizing rates but we’re at a point now where interest payments are high enough to offset some further rise in rates. The pivot point is around a 5-year duration, where if rates rise by 1% over the next year, the interest payments would offset the loss in the price of the bond. So, it still makes sense for conservative investors to stay in the short to intermediate part of the curve but at least you get paid now and you don’t have to worry much if rates do have some more upside. That’s a big change from two years ago and very welcome.

Markets

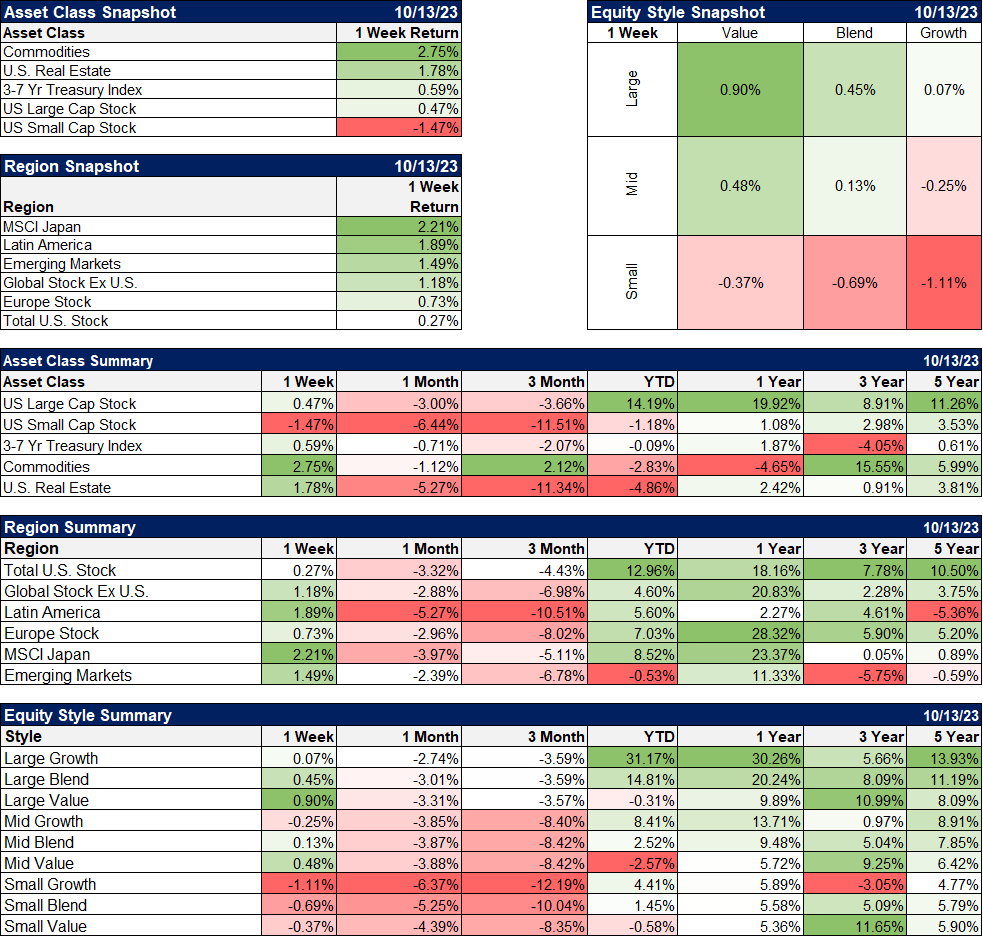

With interest rates coming down, real estate finally had a small recovery. They’re still down a little year-over-year but the move last week shows how much this asset class can move if rates stop rising. Over the longer term, REITs are actually more correlated with dollar movements so that’s really the important factor, but in the short run interest rates are dominant. Obviously, the direction of the dollar and interest rates are related but not as much as you might think. So, while steadier rates are welcome, a more stable dollar would be even more so.

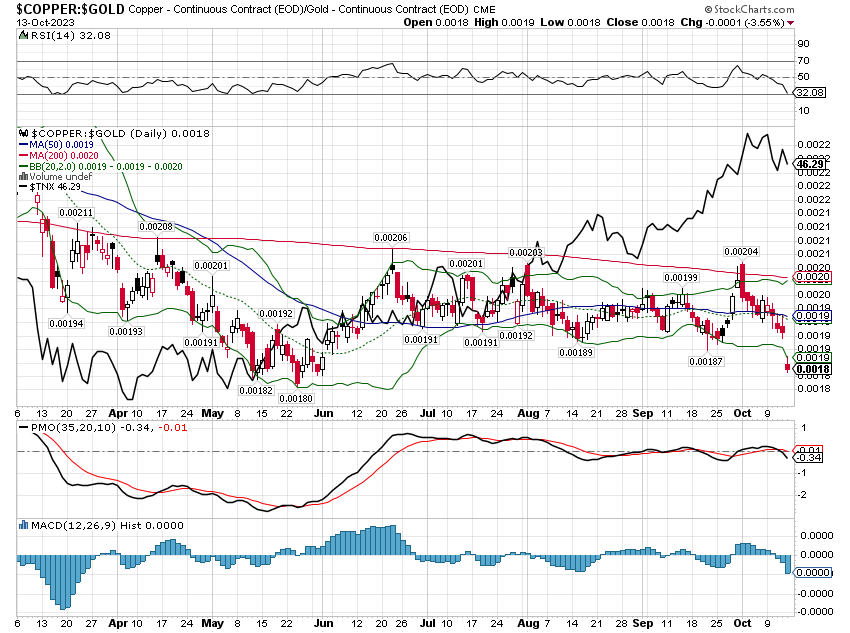

Commodities had a good week on the back of a nearly 6% rise in crude oil and a 5.2% rise in gold. Outside of crude though, most of the complex was down. Copper was down and the copper/gold ratio was way down, over 6% which bolsters the case for a peak in rates. This ratio tends to track well with the 10-year Treasury rate and as you can see below (the solid black line is the 10-year rate) they’ve parted company recently. Either this ratio is going to rise – indicating an improving economy – or rates are going to come down. The truth as with so many things will likely be found in the middle, the ratio rising some and rates falling some.

Stocks were mixed with large and mid caps higher, small caps lower and value outperforming across all. Non-US stocks also outperformed as they have over the last year. The outperformance of large-cap growth stocks – and the S&P 500 which is dominated by those stocks – is not, in my opinion, a trend investors should chase. The S&P 500 is, by our valuation methodology, still overvalued, although not as egregiously as some of the more bearish commentators claim, because earnings are growing again.

Q2 2023 earnings were 17% higher than Q2 2022 so when you hear people say earnings are down year over year you need to know what they mean. Again, maybe this is part of the negativity I talked about above, but people who say this are looking at earnings in the most negative light they can find.

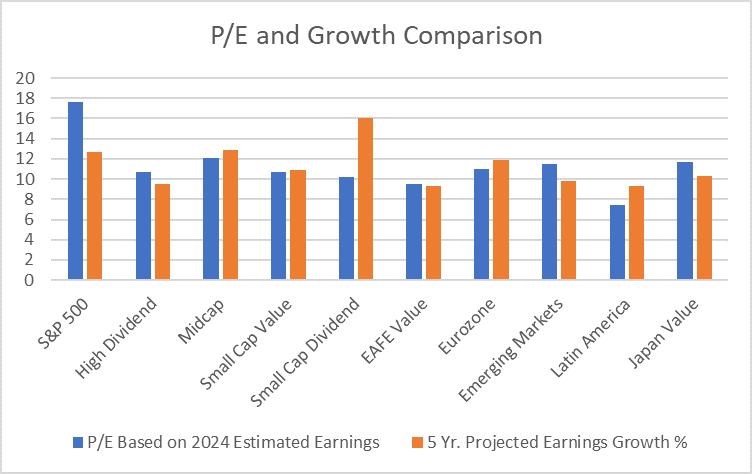

I did a video this week about how we see valuations right now which you can see here. The short story is that US large cap is still overvalued but High Dividend, Midcap, Small Cap Value, International Value, and Europe are all very reasonably valued relative to their expected growth rates.

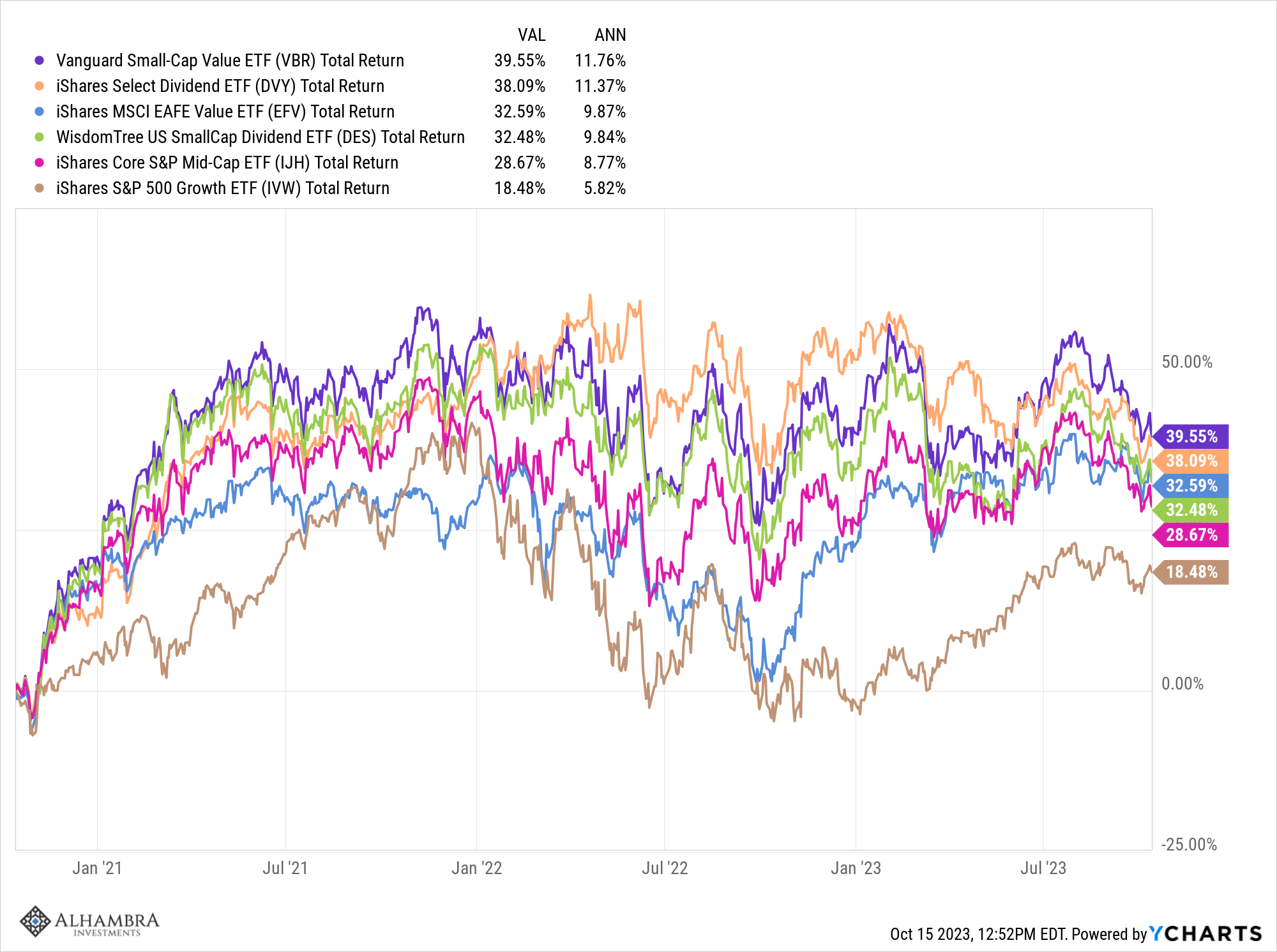

The more important issue is that even after this year’s outperformance, large-cap growth stocks have drastically underperformed over the last three years. High Dividend, Midcap, Small Cap Value, Small Cap Dividend, and International Value have all outperformed Large Cap Growth over the last 3 years. And based on valuations we think that is likely to continue even if it hasn’t this year.

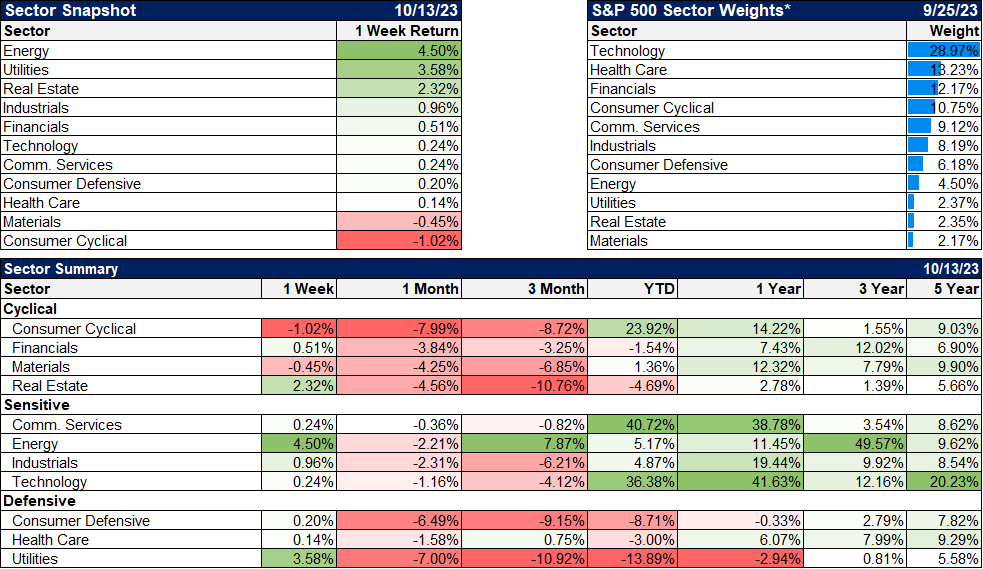

Energy stocks were the obvious sector leaders with oil prices up on Middle East tension.

Utilities finally had an uptick after a brutal performance over the last year. From 9/12/22 to 10/2/23, the utility index dropped over 25%, a full-blown bear market in one of the most defensive sectors of the market. It fell over 18% this year until 10/2/23 but has since come back to be down “just” about 14% YTD. Utilities is an interesting sector with electricity usage rising but I think you need to be choosy. The index still trades for 14 times earnings with expected earnings growth in the single digits.

The inflation data last week wasn’t really very good but it wasn’t that bad either. There’s still a downtrend in the rate and we’ll probably see the rent component come down a little more as the lag in home prices starts to kick in. But as I’ve said previously and Doug Terry reiterated earlier in the week, unless rents and house prices start falling again, their positive impact on inflation will prove short-lived. Energy prices don’t seem likely to help either and I think that would be true regardless of what is going on in the Middle East.

Import and export prices were both higher in September and that is not great news for Q3 GDP. Last quarter’s GDP growth rate was higher than expected but a big reason for that was a low inflation reading in the GDP deflator. And a big part of the reason for that was a drop in import and export prices for all three months of that quarter. This quarter, those prices have been higher all three months. Import prices were up 0.9% in Q3 and export prices rose 2.24% and no those aren’t annualized. Don’t be surprised if GDP surprises to the downside in Q3 while the inflation component does the opposite.

The only thing to point out in the market indicators below is credit spreads which are almost 11% higher over the last month. That is something we’re watching very closely because if it continues, it might represent the beginnings of an economic downturn. For now, these spreads are still below the long-term average and 20% below a year ago so it isn’t urgent.

Economic growth is about investment and innovation, not the design of the monetary system or whatever the doom and gloom crowd is worried about this week. Technological advancement and other supply-side factors are what drives growth and far outweigh demand-side factors. Economic policy should focus on fostering that investment and innovation without dictating its course. But even when government is heavy-handed, private innovation and investment still drive growth.

And believe it or not, the US has been investing. The average annual change in Real Gross Private Domestic Investment was 0.0% in the decade from 2000 to 2009. Given that reality, I don’t find the weak growth of the last decade very surprising. But the US has been investing again over the last decade, with the average gain in investment from 2010 to 2019 at 6.2%. And so far in the 2020s we’re averaging 6.9%.

I can’t say what will come from those investments but I am encouraged that, despite all the current negativity, they were made at all. They won’t prevent the periodic recession but recessions are normal and don’t usually end in crisis. Stopped clocks may be right twice a day but that doesn’t mean they are useful. Neither are the prophets of doom.

Joe Calhoun

Stay In Touch