There is a pocket of stability forming in US dollar funding markets after the “unexpected” weakness of the last Establishment Survey jobs report (particularly the large revision for July). It appears as if these dollar markets are a bit more sanguine about taper prospects, thinking that the Fed might blink next week.

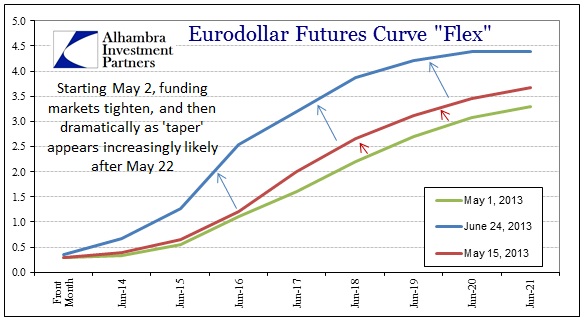

This would mark, if it holds, the fifth discrete episode of funding market trends this year:

1. There was stability (complacency) from the beginning of the year until May 1.

2. The big selloff to June 24 that really hit hard after the apparent taper confirmation from FOMC officials toward the end of May and into June.

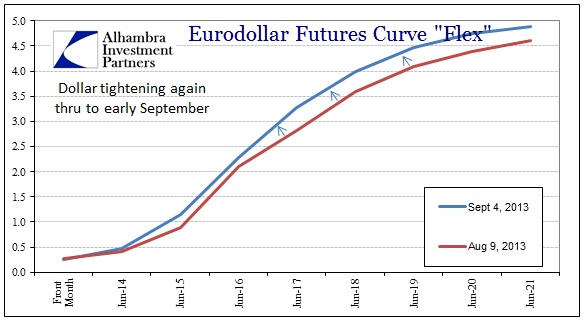

3. The first pause/stable period throughout July and into early August.

4. A second selloff, much more modest in scale than the May-June event.

5. The apparent beginning of another pause, assuming nothing changes next week to alter funding dynamics via perceptions of policy stance.

While it isn’t at all clear in the chart directly above, there is a very small downward shift in the funding curve, amounting to nothing more than a few basis points in the outer years. But that is enough to change the short run dynamics in many markets.

In the absence of a global gold exchange standard, the US dollar has taken the role of reserve currency in global trade. Countries have built up US dollar “reserves” as a means to project stability, but also as a store in case of persistent shortage. The movement of eurodollar rates shown above relate to exactly that – upward shift in the curve denotes dollar tightening, downward is looser dollar conditions. That tightening/loosening shift has global implications in dollar flow through the interconnected financing system.

Despite reserve positions in the BRICS, for example, the tightening of dollar liquidity in London has had an extreme effect. Despite the tendency to portray currency movements in the Indian rupee as relating to factors inside India, including actions by the Reserve Bank of India, the fact of the matter is that US dollar availability is the single largest driving factor this year. The reserve currency system ensures that primacy. Calling it the carry trade gives it a relatable spin, but the nuance goes beyond that and has much more extreme implications.

The behavior of the rupee relates exactly to the dollar tightening trends highlighted by eurodollars above. The local factors only alter the degree to which the dollar trend impacts local variables, but the trend is driven by dollar funding markets.

To show just how globally connected this system has become, look at a chart of the Italian 10-year bond. Italy is beset/plagued by its own set of factors which, you might believe, are the primary driving force in the Italian bond markets. There is also the ECB’s implicit OMT promise still relevant in the face of Mario Draghi.

Yet, for all those, Italian bonds are behaving in a manner consistent with eurodollar funding and the Indian rupee. The same is true for the Spanish bond market, which also shows that, like the rupee, local factors play a role in determining the degree to which trend movements eventually play out.

Just to add another element, we can include US treasury and swaps rates.

What is different about global markets post-May 1 becomes apparent here. Local factors are still important in analyzing and determining the behavior in those markets, but now we have a dollar issue to overlay all of those.

Mainstream commentary usually consists of noting that higher US interest rates are driving flows out of emerging markets to “take advantage” of the changing differential. That is utter hogwash. If foreign bond holders were suddenly interested in US bonds, the US bond market would not be selling off in near-perfect unison with all these other markets. The fact that the Indian rupee, Italian governments, Spanish governments, US governments and swaps (along with many more markets that I don’t have space to include) all correlate to this high degree with eurodollar futures shows that global credit markets are now caught in the vise of dollar availability.

This is a dramatic shift that cannot be overstated.

The Fed created a monster of leverage built on the premise dollar availability would be constant. Taper is destroying that narrative as dollar suppliers (global banks in wholesale markets) are far less sure of the leverage they have employed to buoy all these other markets, including those in the US. Uncertainty breeds tightening.

The episodic nature of the selloff is actually quite typical as financial agents constantly re-position according to incoming data. In this case, unequivocally, it is all about monetary policy. The Fed itself is between a rock and hard place, having painted policy into a corner. QE cannot continue to disrupt collateral markets without significant negative consequences; at the same time if it withdraws QE dollar availability goes with it as banks recoil from what they perceive as a broken promise. The end result of both paths is actually the same place – growing illiquidity.

It was a nice run for cover until the August jobs report called the Fed’s bluff. The Establishment Survey had given the FOMC enough of a plausible explanation, they believed, to try to talk markets into thinking the economy was actually improving, offsetting much of this dollar tightening through improving fundamental perceptions. That seems to have ended as funding markets, and the follow-on effects in these other connected markets, seem to be betting now that taper is really tied to economic fortunes in the US. They might be shocked to find out it isn’t.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch