Commodity prices have been pressured lower in recent months, further suggesting that demand in the global economy is moving in the opposite direction of most mainstream commentary. The lack of price action, while ultimately good for consumers, is a big problem when such “deflation” is not driven by productivity. There is a world of difference between a lack of demand and successful implementation of radical and revolutionary innovation. I highly doubt we are currently experiencing an innovation-driven boom, hidden very well beneath obvious dysfunction.

However, it is not only commodity prices that are decelerating. Producer prices across the spectrum are not behaving as intended by monetary policy.

While there is a large energy component even in the “Finished Goods” segment, even stripping away food and energy prices shows a weakening pricing environment.

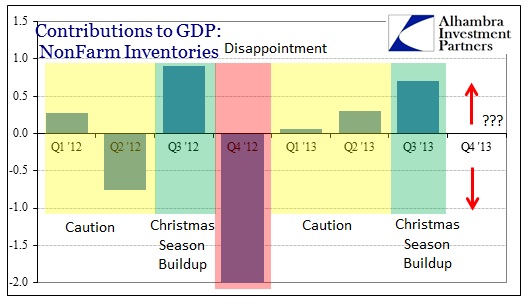

The last eighteen months or so of overall producer prices emulates the inventory cycling the US economy has been moving through. The highlighted portion of the chart immediately below looks very much like the inventory component of GDP.

Producer prices grew faster in the inventory building seasons, then decelerated quickly after holiday sales failed to materialized (as “promised” by the FOMC). The latest trend in producer prices suggests what WalMart was saying back in September is coming to fruition – too much inventory and thus little additional demand as the inventory cycle winds down again.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch