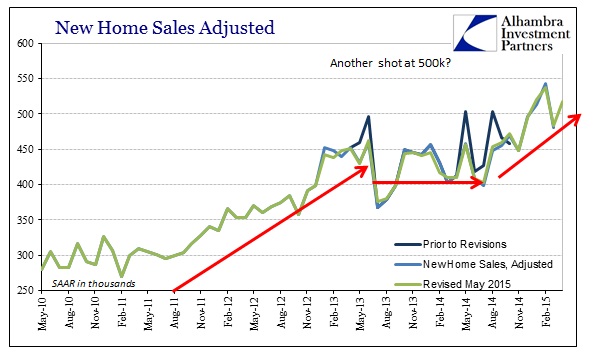

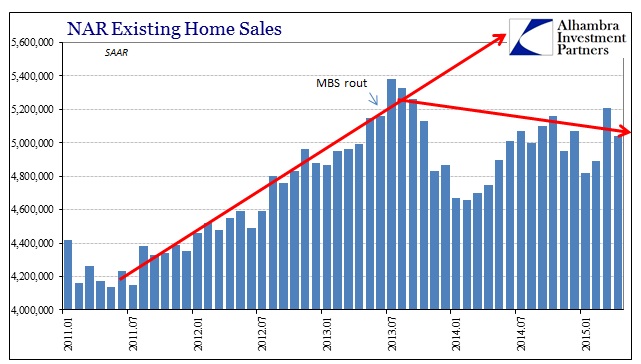

Recent real estate figures for new home sales and existing home sales do not seem to agree on where the real estate market is trending. The new home sales numbers from the Census Bureau have been moving upward since the middle of last year (with potential revisions in mind) while resale levels from the National Association of Realtors show stagnation or a slight decline. There isn’t any particular reason as to why the two data series would have to be tightly correlated, as it is possible that there might be cases where home buyers drastically favor new builds over existing structures (price discrepancies?).

The new home sales figures, though, also have diverged from levels of home construction. I offered a suggestion a few months ago that that might be due to builders under financial strain offering more incentives to move their own inventory – more sales, less building. It is, at this point, impossible to tell if that is indeed the underlying factor here, but the last few months in data do not disprove the theory.

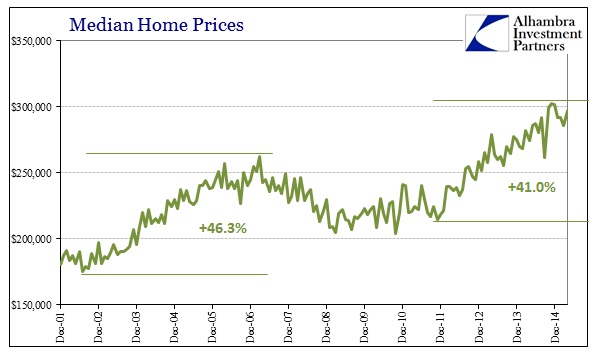

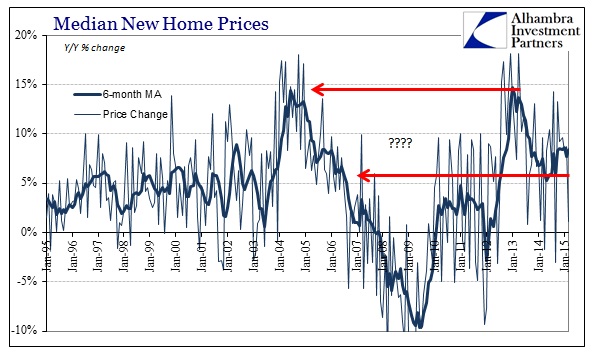

It is difficult to discern much in terms of prices other than the fact that they have been much more volatile since the “dollar” began to “rise.”

On the other hand, resales have clearly lagged meaning a departure from new home sales around October. The two series both show the mini-bubble building from 2011 into 2013, and then the “taper” interruption that lasted into 2014, but since then there is no consensus about the real estate market more recently. New home sales have climbed while resales have stalled.

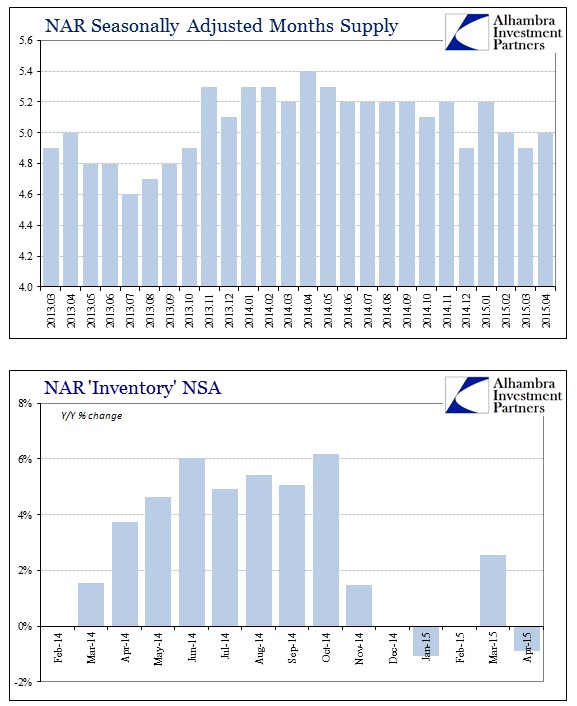

But what might be more significant is that the inventory of for-sale homes has changed dramatically right when new home sales purportedly took off again. For some reason, existing homeowners are less pre-disposed in 2015 to want to put their structures on the market. That has meant the overall inventory-to-sales ratio has been less consistent as the overall pace of sales has become more volatile and flattened out more generally.

The trailing tendency changed in November 2014 which was the same month that new home sales suddenly shot above 450k SAAR. That might suggest that, as noted above, new home sales are not moving in tandem with resales but as almost a zero-sum marketplace – new sales are coming at the expense of resales?

Competition is always good, of course, but in trying to figure out the general direction of the total housing market it makes for greater complexity. If that is actually the case, that new builds are one explanation for lower volume in resales, it would seem to indicate that the “buyer” side continues to be limited in terms of depth and resources. It might also suggest continued bifurcation, where most housing activity remains concentrated in the upper tiers.

If there are limitations on housing “demand” overall, then at some point new home sales would have to converge with home building activity. If builders were highly confident on the home market overall, it stands to reason that they would be greatly expanding their product base rather than sitting more idle. As that inventory is worked off in these higher sales figures for new builds, that might send more buying activity toward resales again, but why wouldn’t builders want to capture that if there were sustained levels of demand?

That is the biggest puzzle, as commitments in building don’t seem to match the pace of new home sales. Instead, construction looks very much like the ragged picture provided by the NAR. Then again, given the recent proclivities toward significant revisions, maybe none of this will survive the next benchmarking and at some point it will all make more consistent sense.

Stay In Touch