Written Monday Oct 26

If China and Europe provided any boost to mainline sentiment last week, everyone looks to Japan this week for perhaps disappointment, though there isn’t any good reason why. Perhaps as a fitting description of this current situation, one that I think appears more inevitable by the day and the week, the Bank of Japan apparently sits under less pressure now that the yen has moved for reasons totally unrelated to those the central bank proclaims as its aims. In other words, the sum total of monetary policy isn’t really actual progress but now just a moving number.

“As long as expectations for a U.S. interest rate hike keeps the yen weak, there is no need for BOJ Governor Kuroda to take action,” Hamada said.

That statement appears totally innocuous and in no way out of place for commentary such as this. In fact, this idea permeates the whole panel of expectations as if the yen were the primary object. And that is the whole problem with orthodox monetarism not just in trying to carry out any economic program, but really how it has infected economic thought all the way down.

Immediately, intellectually, the idea of “keeps the yen weak” should be challenged by “then what?” if not “so what?” It simply goes without saying as if, again, a weaker yen is the end result of all this monetary posturing (quadrillions now). It isn’t; the yen is but a secondary tool, assumed, to accomplish the primary economic objectives. In that complete view any such statements falling short of these full connections should not go unnoticed; Japan more so than anywhere else. The yen has already moved significantly since even the first whispers of QQE all the way back in late 2012, yet the Japanese economy hasn’t gained from it but only suffered greater and total impoverishment.

That disconnect explains a lot about the state of the global economy, and the inability or outright refusal by the media (and economists, though they are more ideologically committed and thus the narrowing of expectations and even intentions now) to come clean about it. Like China’s rate cuts and reserve requirements, the yen can pretty much move wherever and whenever and I doubt at this point it makes much, if any, difference. If two “devaluations” so far haven’t lived up to the promises and hype, the Bank of Japan is actually and fatefully disengaged and separated from all their attempts and channels (which is obvious when you consider re-recession in Japan, the second time in as many years, all while QQE is not only active but has actually increased!).

As elsewhere, if you actually study and recognize Abenomics for what it is the shift in “arrows” adds up to confirmation of just that failure. Prime Minister Abe’s three arrows now are completely different than the three that began this experiment. Yet, in changing between regimes nobody in the mainstream bothered to point out or ask where the prior three went or why. It is again emblematic of monetarism in 2015, when official economic authority in Japan might just change “arrows” as the monetary officials surely change their underwear.

The BOJ is set to cut its rosy inflation forecasts in a semi-annual report due out on Friday, but many BOJ officials prefer to hold off on expanding its already massive stimulus program, which has had limited success in accelerating inflation since being launched two-and-half years ago.

Of course, it would be folly to expect a full accounting and reckoning of any central bank, the Bank of Japan in particular. As one attempt after another fails, they simply move on as if nothing much had happened and what might be coming is somehow new and fresh and bursting with potential. The markets, at least where actual market forces are still evident, are, despite all the obfuscation at every level, appear to be catching on.

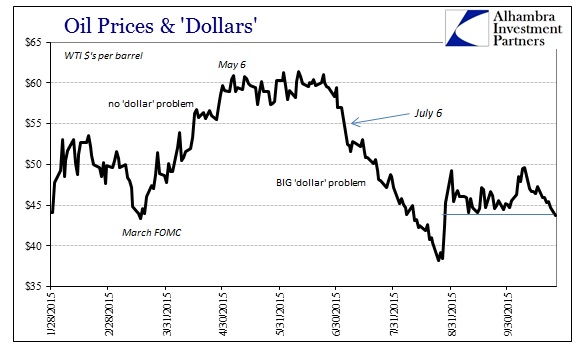

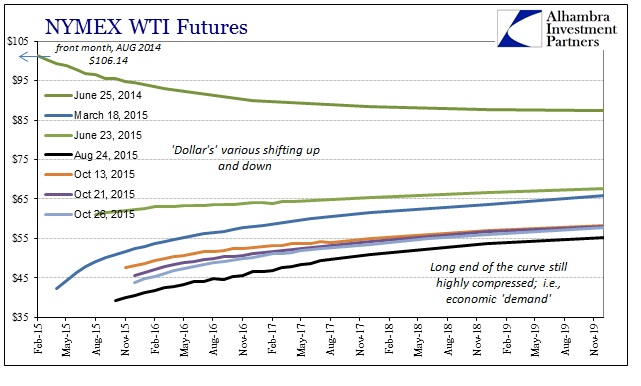

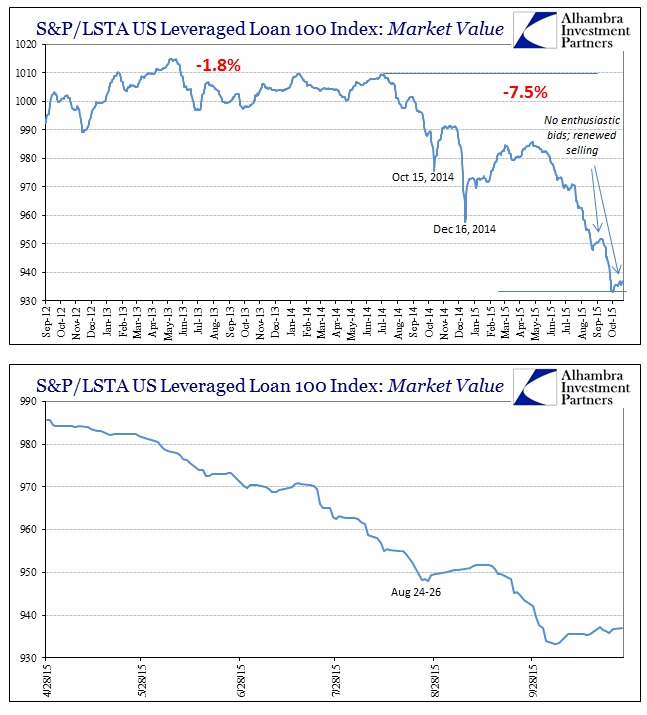

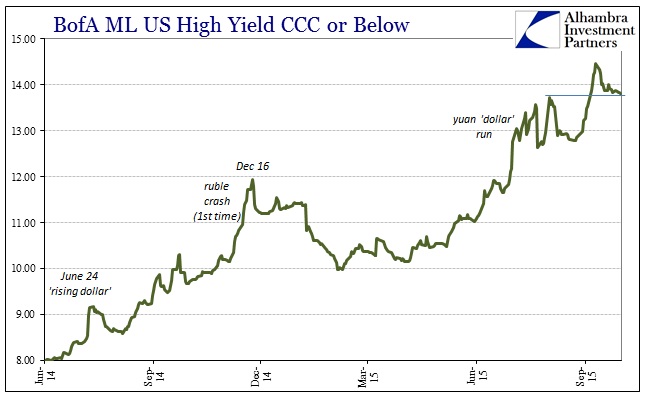

It may be a subtle shift, but trading bias, especially “dollar” bias, is no longer buoyant and always optimistic. What I mean by that is the great interims between bouts of heavy and sustained selling. For instance, in the aftermath of prior “dollar” outbreaks, market prices in anything from oil to the junk bubble would immediately and appreciably rebound. Think back to October 15 when global asset prices across-the-board took the serious decline and simply discarded it moving forward. Even in the junk bubble regurgitation of December 16, it did not take very long for those prices to rebound sharply and substantially.

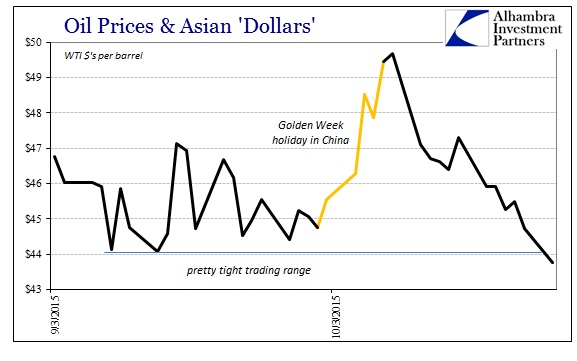

This period after the August liquidations, and really dating back to early July, is different. Stocks may have risen upon China’s golden week and kept going, but other prices and indications have not. That includes, where it all starts, eurodollars (where the trend is inverted; rising prices is bearish) and money markets which when without obvious pressure have taken to sort of meandering those interims.

That lack of conviction is replicated in related markets, including, as noted earlier today, the Asian “dollar” (if now hidden and buried by PBOC attempts at covering their unyielding “dollar” problem). Leveraged loan prices have likewise ambled about after the last serious liquidation that ran market prices down to 2011 crisis levels. Instead of retracing at least a good section of that heavy decline, junk prices here are trading sideways just as they did in September after the August events.

I think it fairly reasonable to attribute this to the eroding cover of monetarism despite all attempts to hide or misdirect it. Central banks keep promising more, but true risk and funding is no longer buying the fairy tale; if there is hope, it is faded and worn, attributable more so to any possible limit to the downside rather than the once dominant monetary upside (“transitory”). Again, I think it is in these moments where there is a distinct lack of absolute selling and open fear or disorder that is quite enlightening and suggestive in what would be a true paradigm shift. In many ways, it parallels the growing detachment in the real economy, as economists continue to suggest one that remains faithful to the QE and QQE legend but no longer much resembles what actual companies experience; and more so by the day and week.

Such a paradigm shift would not be unwelcome under the right circumstances, one with an actual and capitalist recovery in the wings, but these are not those circumstances. Central banks have done everything possible to suppress those instincts and to demand, to the point of the heaviest, global intrusions once thought not all that long ago pure lunacy, faithful obedience to nothing but financialism. And the commentary about it all remains as if there were nothing wrong with any of that – not the least of which is how, eight years later (25 and counting in Japan), central banks might “need” to get so heavily defensive yet again. Instead, if markets have indeed re-postured about monetary influence, that would mark the exact terrain of inevitability.

Stay In Touch