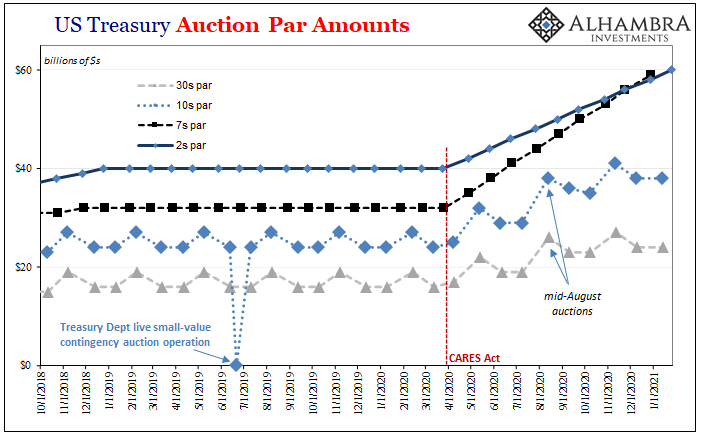

On August 1, 2018, the Treasury Department announced that it was introducing the 8-week T-bill. With deficits up and going higher due mostly to December 2017’s Tax Cut and Jobs Act (TCJA), the government was becoming creative in how it would deal with its trickier funding needs. Not only the new bill maturity, note auctions were going to be bumped higher (par) over the following months, too.

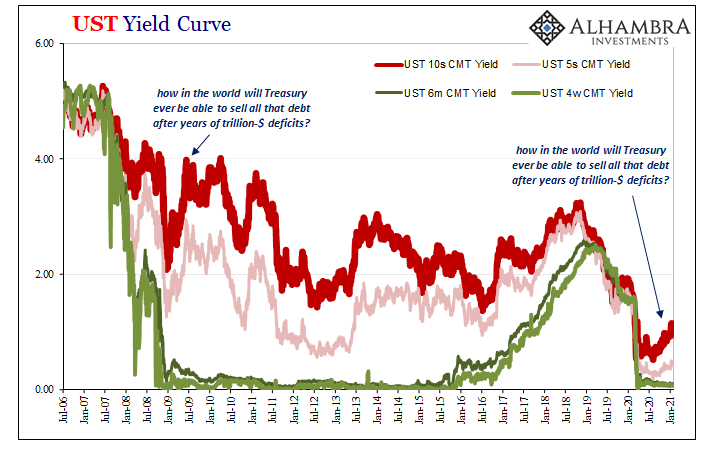

Having heard all year before then about “too many” Treasuries, including from policymakers at the Federal Reserve, at the time cutting back in their own purchases of the same instruments (QT), it seemed the perfect storm. Confirmation, they said, the bond bubble must have been in its final hours.

Mere days later, JP Morgan CEO Jamie Dimon would mutter his market-shattering guarantee for sharply higher interest rates. Triggered by what he saw as ugly supply needs running into sharply lower demand, according to Dimon speaking for all the Bond Kings and Economists, there was no turning back with the economy setting sail off into the sunset of an accelerating inflationary recovery for the first time following the Great “Recession.”

Again, it wasn’t just JP Morgan’s top guy – who happens to be a trained Economist. This view was widely shared across mainstream commentary, and with nominal yields surpassing the “magic” line of 3.00% (for the 10-year UST) the projected certainty behind this view was sold even harder.

Rising federal borrowing, while not entirely a surprise, rekindled some concerns about its effect on the bond market, lifting the 10-year Treasury yield to 3 percent for the first time since mid-June.

“Some of the selling in the bond market can be attributed to the auction sizes continuing to increase,” said John Canavan, market strategist at Stone & McCarthy Research Associates in New York.

Economists like strategists were convinced. Were they convincing?

“We still have a little ways to go,” to reach that record [Nancy Vanden Houten, senior U.S. economist at Oxford Economics] said. But it is unusual for the government to be borrowing so much in a period the economy is doing so well.

“We’re moving in the direction [of the record] with the passage of the tax cut last year and the spending bill this year. The outlook for debt issuance is upwards,” Van Houten said. [emphasis added]

While that had been the dominant narrative, it was never actually much accepted in the bond market itself. Economists are always talking about what they are sure the Treasury market will do when finally forced to see what the DSGE models calculate (from subjective assumptions), while carefully avoiding discussion about why it hadn’t ever done these things up to that point (the error risk when using self-dealing subjective assumptions). Rising interest rates are always future tense.

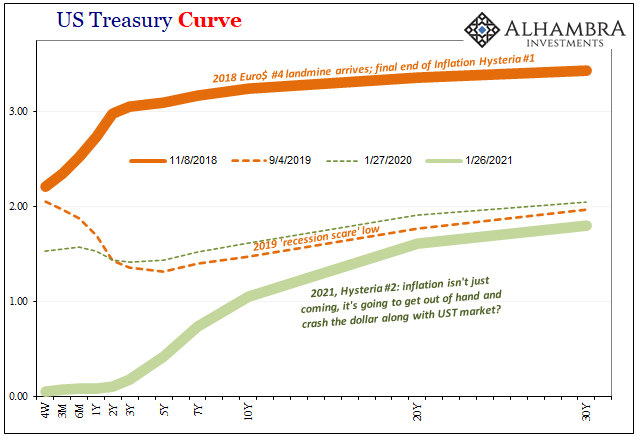

This was true even throughout the middle of 2018 when rates were, in fact, rising. But – and there’s always the qualification – they weren’t rising much, instead flattening the curve as Treasury participants more and more vehemently disagreed with the Bond Kings, Economists, and Jay Powell’s out-of-the-gate hawkishness. If nominals were up, it was mostly minor reflation ginned up by sharply reduced short-long spreads being cut back as the Fed raised its own short-term proxies.

Flat curve, then inverted, not the twists they were thinking.

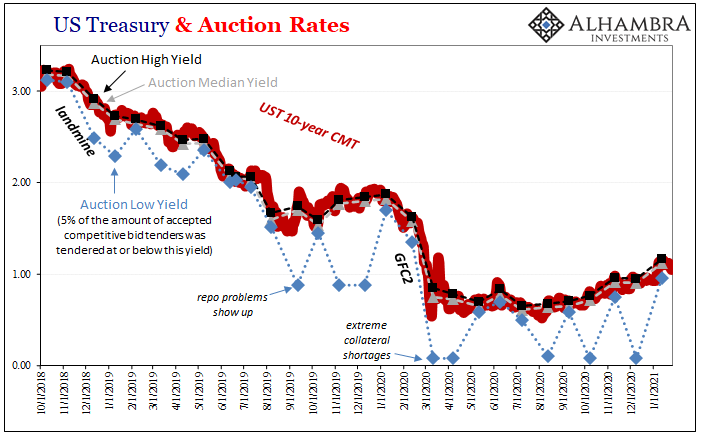

Even though the all-important benchmark 10s had crossed 3% – which was supposed to have been a huge signal – it all came to a head in the fourth quarter of 2018 when, “unexpectedly”, demand for the most liquid, highest quality assets absolutely surged.

Supply didn’t matter one bit as this overeager market absorbed every penny; and then, judging by auction prices and conditions, kept demanding even more auction after auction, month after month (turning to years).

Quite simply, the economy was never good and then it became clear it was getting worse to the point that even Jay Powell’s reliance on bad statistical models would easily get overtaken by the looming (globally synchronized) downturn and its deflationary (Euro$ #4) re-imposition.

All this long before COVID.

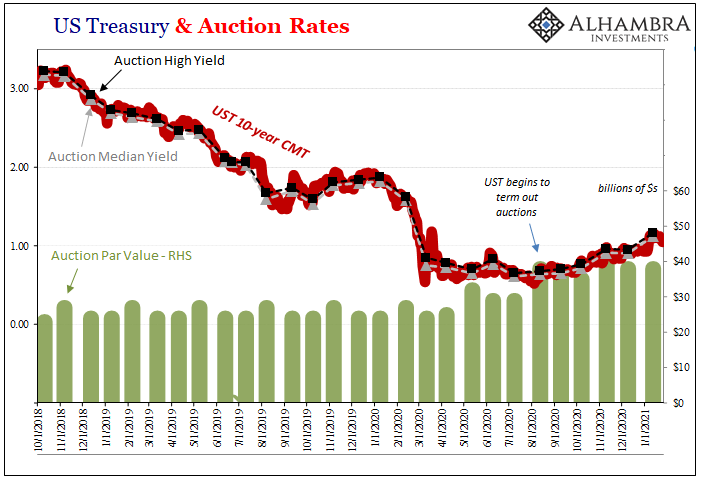

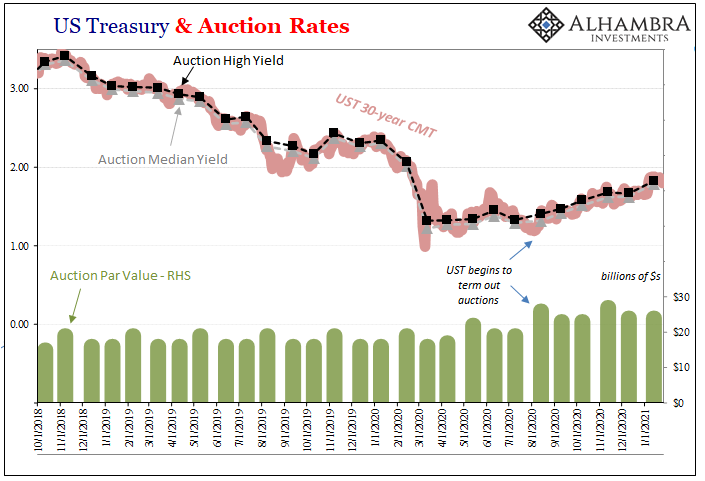

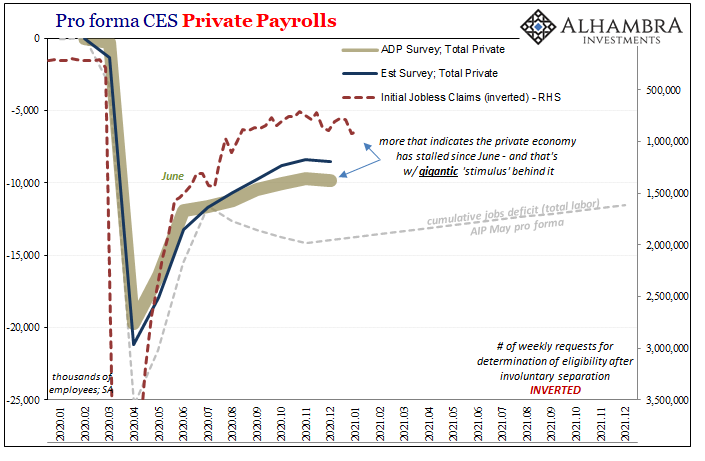

Last year’s emergency CARES Act has made the TCJA’s effects on the fiscal deficit seem laughably quaint by comparison. Almost immediately after its passage, the Treasury Department issued hundreds of billions in bills (which the private market, not the Fed, scooped up), while boosting shorter maturity notes more carefully. Over time, more notes and bonds will be sold as the federal government prudently terms-out its debt structure.

As it does so, the same questions of supply versus demand have predictably resurfaced; once again, “too many” Treasuries. Bond Kings as well as Jamie Dimon have re-squawked and Economists join with them all for their shared disdain. The feds have to sell a crapload more debt, and are doing so, just as demand for these things will be cut back because, you know, inflation and growth.

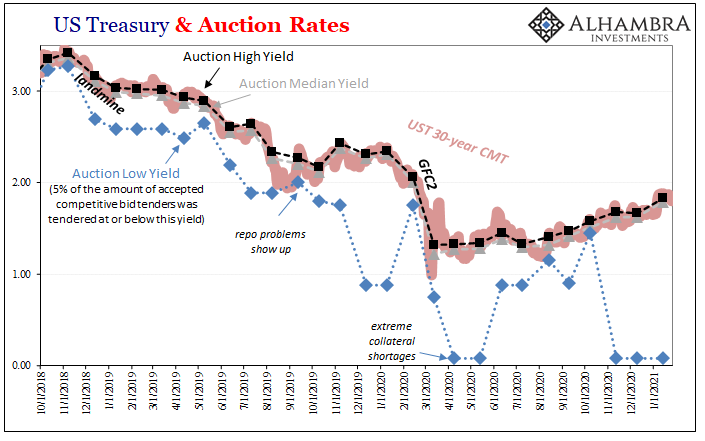

When we look at some of these note instruments, there does seem to be (like 2018) perhaps something to this. For example, in the benchmark 10s the Treasury Department began to shift its auctioning weight for that segment of the curve back in August. It does appear consistent in that 10-year yields (and 30s) bottomed out just beforehand (early August) and have been rising somewhat steadily ever since.

Have we finally reached the threshold for too many?

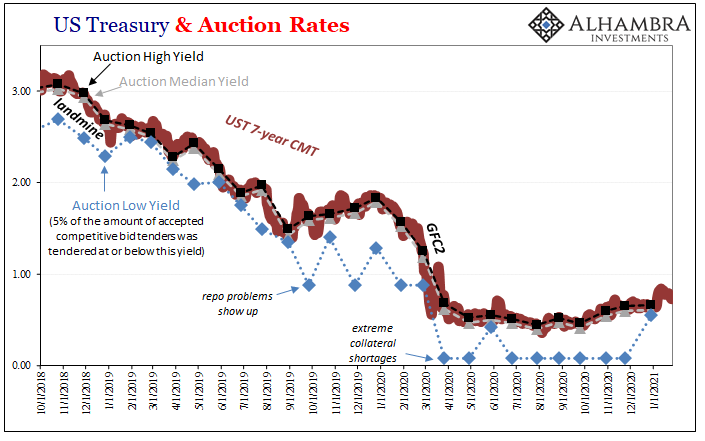

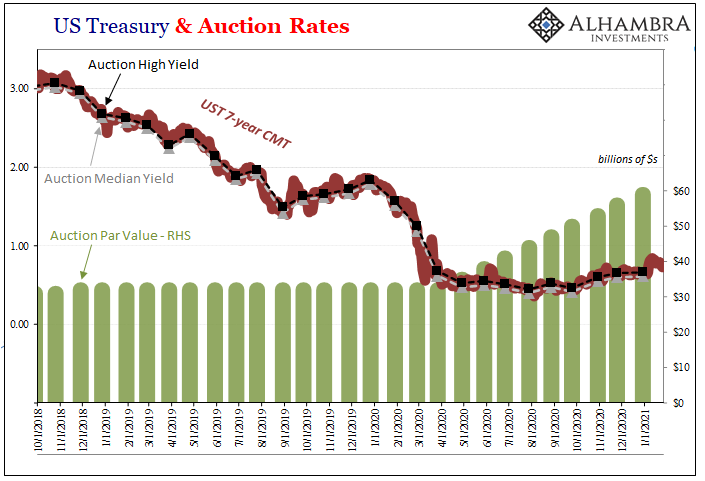

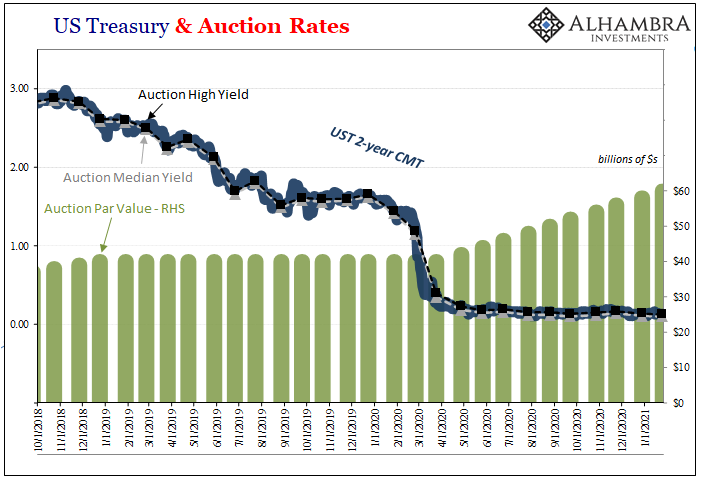

If that has been the case, then why hasn’t the same imbalance overtaken more of the note tenors? You’d think there’d be an even bigger recoil response in the 7s and 2s, for example, because the Treasury Department has vastly enlarged the coupon amounts sold off in those maturity buckets when compared to the rather minimal increases in size of 10s and 30s auctions.

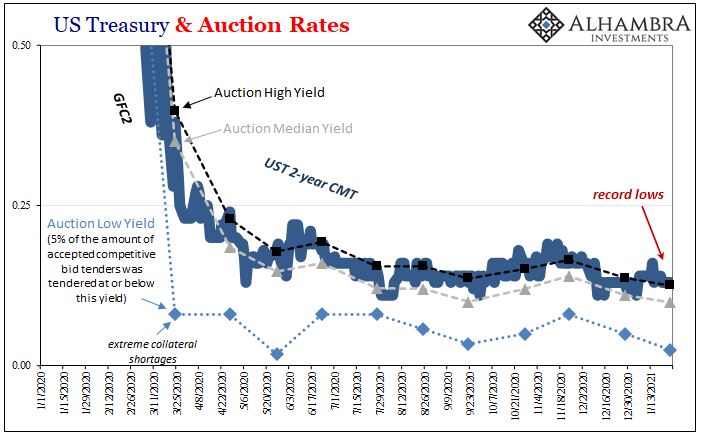

The 7-year UST nominal rate hasn’t moved up nearly as much as the longer end, while the 2-year rate continues to decline. As to the latter, Treasury auctioned (to the public) an enormous $60 billion just yesterday at record low yields.

Where there has been truly a lot more supply, as usual, more than enough demand.

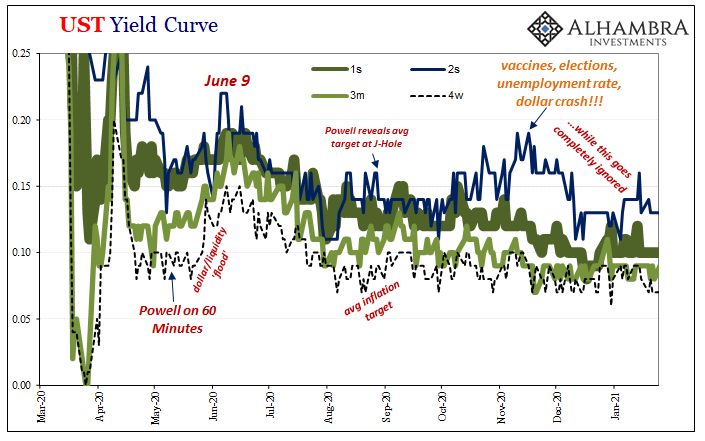

What these show – along with bills – is that the pricing structure of the yield curve isn’t being determined one bit by supply fears. And its not really much about demand running for cover, either. Rather, with short-term rates, including the 2s, continuing to fall the yield curve has twisted itself mildly, very mildly, toward minor reflation down the road.

So mild, we have to ask why it hasn’t been so much more given just how much things, perhaps everything, (vaccines, election, more “stimulus”, etc.) are supposedly going the right way.

Yet, far more modest reflation than even 2018 (the latest back up in longer yields, 10s and 30s, still barely qualifies as a market fluctuation).

No accelerating inflation, certainly nothing on the short run horizon, instead the ongoing presence of, and appreciation for, material risks that Economists, Bond Kings, and, oh boy, Jamie Dimon keep minimizing as they cheerlead for Jay Powell’s same exact viewpoint. Rates are substantially lower than the magical 3% line, but nothing’s changed so far as how economic and financial conditions around the world are narrated.

Like inflation itself, the lack of Treasury market breakdown isn’t really about the Treasury market or interest rates. It’s what this all says as it really must be in the real state of the world as being told to you by those inside the monetary system closest to it. Those who don’t use subjective models because they are inside already where the models only wish they could calculate.

Stay In Touch