Color them confused. They just can’t figure out why the world is going the wrong way, and in so many places. An upheaval here or political modification there, that’s the world as it always has been. Everywhere, though? There are no safe places anymore.

There are populists all over the global, rising in between reborn strongmen. The liberal order appears to be on the ropes. Globalization was supposed to have brought humanity together, the spirit of cooperation infecting the whole works not just global trade. This isn’t the stuff of illuminati, a new world order, it is basic human evolution.

Robert Kagan is one of those who can’t make heads nor tails of all this. He checks all the right boxes: Harvard and Yale, doctorate from American University; former State Department official, speechwriter for Secretary of State George Shultz; Washington Post columnist; and, of course, a scholarly fellow at the Brookings Institute.

Writing for the Post last week, Dr. Kagan pens a very lengthy essay titled The Strongmen Strike Back. No spoilers are required on my part, save one:

Authoritarianism has emerged as the greatest challenge facing the liberal democratic world . . . with strong nations such as China and Russia championing anti-liberalism as an alternative to a teetering liberal hegemony. It has returned as an ideological force . . . and just at the moment when the liberal world is suffering its greatest crisis of confidence since the 1930s.

Why is the liberal world “suffering its greatest crisis of confidence since the 1930’s”, though? That particular decade brings up certain images, not just those of Adolf Hitler’s rising Germany.

But Dr. Kagan never once mentions the words “Great Recession.” It’s as if 2008 was just some minor market fluctuation, not worth material consideration, some trivial historical curiosity like the Crash of ’87. Instead, this is all the fault, supposedly, of human beings reverting to their mean. Authoritarianism doesn’t need a reason, we suck.

If you don’t have a subscription to the Washington Post and want to save yourself the fee, and your time, Kagan had written essentially the same thing but shorter back in January for Foreign Policy magazine (online). Pretty much the same title, Springtime For Strongmen, and very much the same puzzle.

Finally, autocrats are on the march because even Americans are not so sure how they feel about democracy. U.S. politics are polarized. Congress is stalemated. Bureaucrats are incompetent. While the rest of the world has been taking the United States to the cleaners, Americans are starting to notice: Look how efficient the Chinese are! Look what a strong leader Vladimir Putin is! Maybe what the world needs, maybe what America needs, is a strongman who can cut through all the nonsense and just get things done. This widespread sentiment was among the factors that led to the rise of Adolf Hitler in Germany, made Benito Mussolini popular in Italy and abroad, and is now being revived around the world as faith in democracy recedes.

It’s not faith in democracy that has vanished. It is trust in those we vote for who don’t, or can’t, recognize there is even a problem. Brookings is where former Federal Reserve Chairman go to retire, both Ben Bernanke and Janet Yellen, and they take with them their glowing assessments of their own handiwork. Pedigree, not honest results, rules the game.

In the US, neither Democrats nor Republicans at least those “in the middle” will challenge the mainstream economic narrative set in these places. Instead, it was left for those more extreme; Bernie Sanders on the left, and Donald Trump on the right. Both men once said the unemployment rate is false, only one now does.

The election of 2020 is moving naturally back toward the center, or getting crazier by the day, by the hour?

But if you are Dr. Robert Kagan or those like him and who listen to him, and Jay Powell says the unemployment rate is the correct view of the economy, “Americans are not so sure how they feel about democracy.” The rest of us must be the barbarians motivated by only base instinct to lash out in envy.

This is instead the true, barbarous legacy of QE:

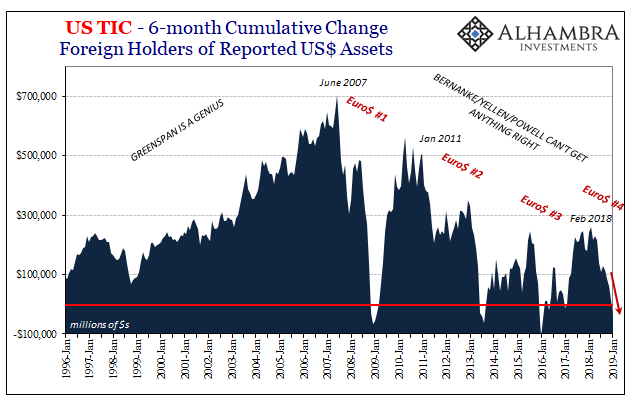

The downside of QE is the only practical effect; it proved central bankers as the frauds they always were. The trappings of institutional government were the same thing as Bernie Madoff’s accounting system. So long as the eurodollar system kept expanding the economy kept growing and the myth would perpetuate especially as Greenspan et alia kept acting like they were steering the whole time. Know eurodollar, know economy; no eurodollar, no economy.

Maybe the illusion is “more real” to economists because the real economy only draws further and further from health and function; a kind of material delusion of disbelief. The costs in lost opportunity are now literally unimaginable. As noted yesterday, you cannot conceive of $10 trillion in “missing” global trade; the best you can do is understand how much disruption and turmoil such a calculation would easily explain. The people are skeptical of economics because economists have given them every reason to be. We can no longer live in their naked world of implied central bank ability; we now have to contend with an economy where the lie is the only revealed truth that matters. It’s a decidedly ugly place no matter how many times Abe, Yellen, Draghi, and the rest remark of its beauty and majesty.

I wrote that almost three years ago, about a month before the Brexit vote, hoping that if by chance one of the barbarians (let alone all of them) were to break through it would be sufficient shock to wake these people from their intellectual slumber. Something must be really, really wrong here, guys.

Quite predictably, as Dr. Kagan exemplifies in 2019, they’ll blame you and me until the very end.

There are two major problems, huge hurdles that have to be overcome. One is simply the scale; it is incomprehensible. Sideways, as I’ve been calling it lately, means non-linear contraction which over enough time, a standard surpassed long, long ago, leads to absolutely mind-boggling numbers.

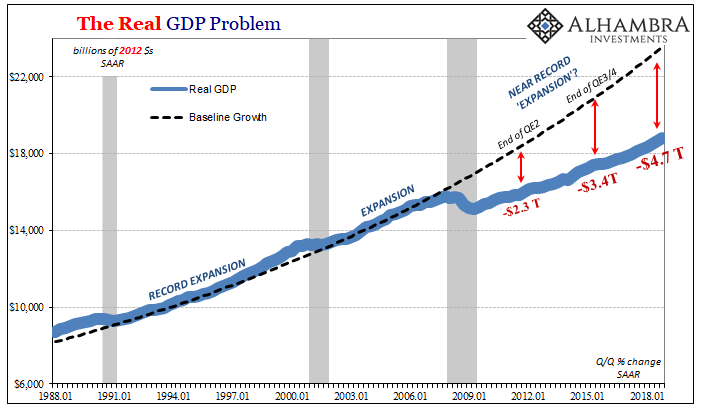

I’ll just stick to US GDP here: if the contraction in 2008-09 had been a recession, real GDP would’ve been $23.5 trillion (2012 $s) last quarter. It was instead just $18.8 trillion. How does anyone imagine or comprehend the $4.7 trillion that is “missing?” Let alone, the $4.5 trillion missing the year before, during the so-called boom. And the trillions the year before, and the year before, and so on eleven years later.

But GDP was 4% once during 2018!!!

Whether we can imagine it or not, it is missing nonetheless and we, the whole world clearly misses it. Economists will continue to, but we should not and cannot ignore how the only thing that really goes up is the calculation of how far behind the economy keeps falling.

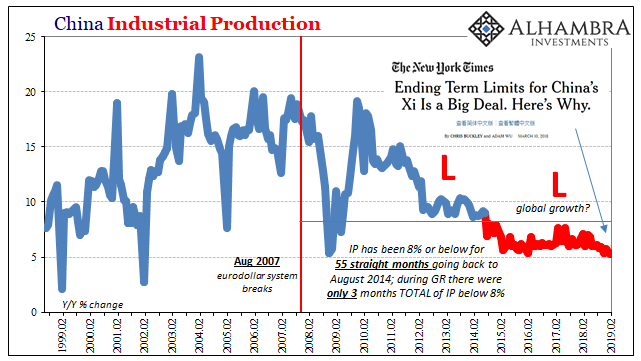

And then, the bigger challenge. Why it’s all missing.

This is one key factor as to why our economic problems are so hard to overcome; how in the world the global economy can lose an entire decade and be one-tenth of the way into another. You start by saying the central bank isn’t central and already people are at best skeptical if not completely turned off. And then you tell them, the few who are left, if you really want any chance at legitimate economic recovery Goldman Sachs needs to make more money, a lot more, in its bond trading business. And if you don’t want Goldman to thrive in FICC, then the whole global monetary system must be completely revamped from the ground up.

Oh, and by the way, we’ve been operating under a clandestine global monetary system predicated on the world’s biggest banks who aren’t really banks working in the shadows for half a century already.

It’s way, way too much to grasp, especially all at once.

I wrote, a lot, during 2015 and 2016 how I hoped that maybe during one of these “unexpected” downturns enough people would finally demand answers, no longer willing to just accept birth rates and drug addicts as excuses for the unemployment rate and what they clearly miss in their daily lives. There are too many on the wrong side of the economic divide, way, way too many who wouldn’t be if real GDP had been able to keep to its prior schedule.

And this is just those in the United States. It’s a global deficiency, top to bottom.

That was Euro$ #3. We’ve now got Euro$ #4. In between three and four, a whole lot of very clear social and political instability, far, far more than what arose between two and three. Even establishment types can finally see that. What will it take for them to go back and re-reckon their take on the world economy? What happens between four and five if they don’t?

It’s not a very good baseline, but it doesn’t have to end so badly. For the most part, the world is still up and running, the eurodollar even in decay keeps the lights on – minimally. This doesn’t have to end with guns, ammo, and doomsday. It doesn’t really have to be the thirties all over again. The great unknown isn’t actually the economy or the monetary system, it’s where the social breaking point lies.

But to avoid the forties, we need to stop talking about economic booms as if they are consistent with strongmen. Only one of those two is real. It’s not people’s faith in democracy that has been shaken; it is much more basic, and closer to home, than all that.

Stay In Touch