Predictive Value In/Of Low Yields

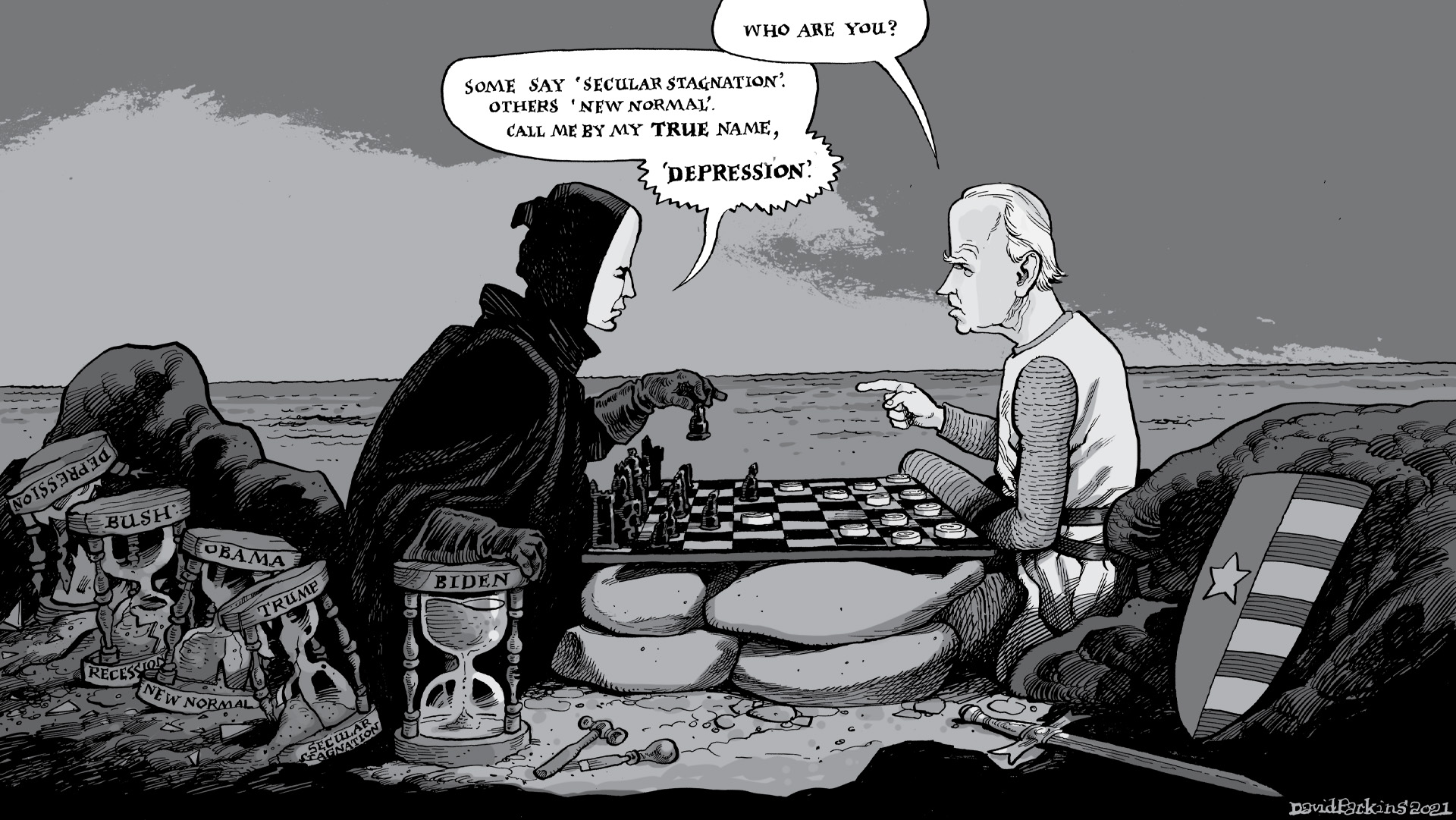

The US federal government is the brokest entity the dark side of humankind could have ever conceived. And while that’s certainly the case, it is simultaneously true that our out-of-control politicians have no trouble whatsoever selling this deepening debt to a deflationary marketplace only too willing to snap up whatever is offered as if it was somehow scarce. Count me [...]

Stay In Touch