Eurodollar University’s Making Sense; Episode 99, Part 1: What’s Really Killing The Economy’s Potential?

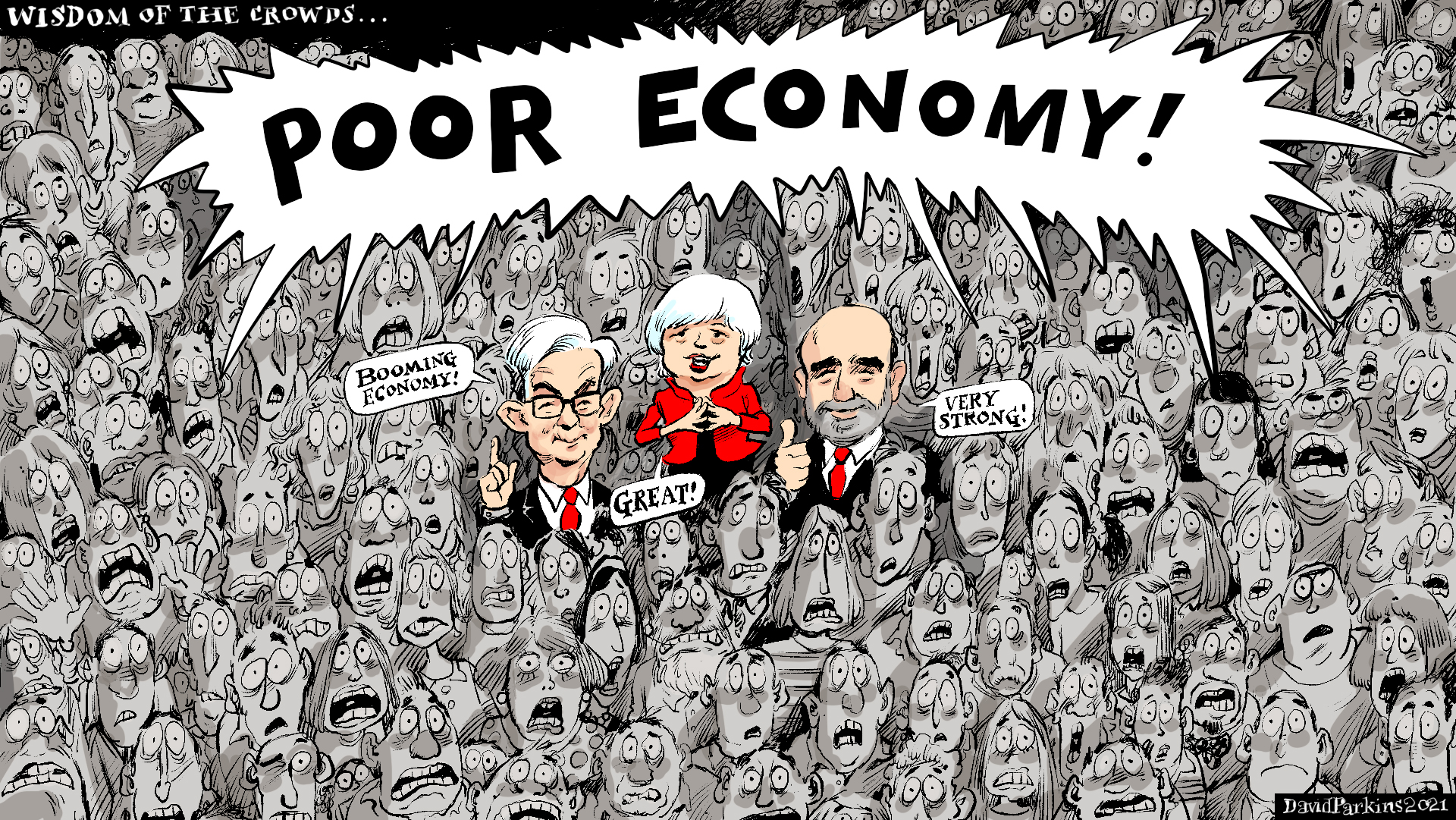

99.1 What's Killing Labor Force Participation in the USA? ———Ep 99.1 Summary———'Maybe the economy isn't in as good a condition as you economists / academics / technocrats think it is,' says the labor force participation rate. 'The economy is in fantastic shape,' says the unemployment rate. Which one is correct? ———See It——— Twitter: https://twitter.com/JeffSnider_AIPTwitter: https://twitter.com/EmilKalinowskiAlhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisLArt: https://davidparkins.com/ ———Hear It——— Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr ———Ep 99.1 [...]

Stay In Touch