The problem with sentiment surveys is, as I am becoming a broken record, that they don’t often mean what they are taken to mean. At best, they are relative measures of changes and potentially, if captured and refigured just right, inflections. With innumerable problems encapsulated into not just their construction but the idea of a PMI in the first place, I would highly caution of ever making any declarative proclamations from one alone.

China’s factory activity shrank more than initially estimated in July, contracting the most in two years as new orders fell and dashing hopes that the world’s second-largest economy may be steadying, a private survey showed on Monday.

That’s awfully sure about what is taking place in China, and from a twice-removed, soft measure of not even direct “activity.” This interpretation further belies everything that was so certain about China from just two weeks ago.

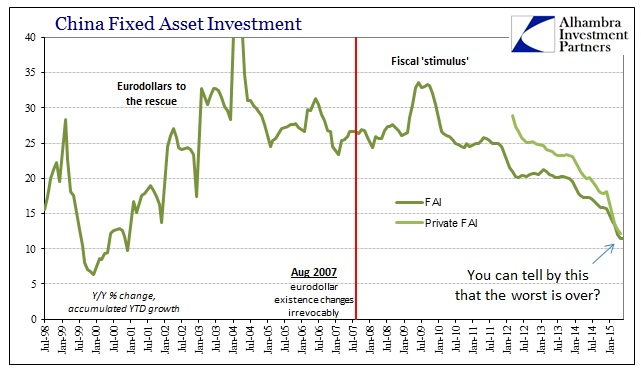

The result buoys prospects for Premier Li Keqiang’s 2015 growth target of about 7 percent and the outlook for the world economy, with China stabilizing and the U.S. forecast to accelerate. Much like last year, a sluggish start spurred more stimulus as the government orchestrated a debt swap for provinces and the central bank accelerated monetary easing.

“Downside risks are getting smaller,” said Ding Shuang, chief China economist at Standard Chartered Plc in Hong Kong. “A modest recovery is expected in the second half.”

There are, of course, different interpretations of the same data but mainstream media outlets very infrequently countenance alternative views. The ideas about China are as monolithic as they are about the US. All weakness is “unexpected” and the future is far brighter than any “transitory” dimming that somehow has become quite regular and typical.

The report followed a downbeat official survey on Saturday which showed growth at manufacturing firms unexpectedly stalled, reinforcing views that the struggling economyneeds more stimulus even as it faces fresh risks from a stock market slump…

The final, private Caixin/Markit China Manufacturing Purchasing Managers’ Index (PMI) dropped to 47.8 in July, the lowest since July 2013, from 49.4 in June.

That was worse than a preliminary reading of 48.2 and marked the fifth straight month of contraction.

New orders contracted after growing in June, while factory output shrank for the third consecutive month to hit a trough of 47.1, a level not seen in more than 3-1/2 years.

Deteriorating conditions forced companies to cut staffing for the 21st straight month, and factories had to reduce selling prices to a six-month low due to increasing competition.

Yet some economists warned against reading too much into the gloomy July data, arguing that the factory weakness may be transitory. For one, summer storms in the manufacturing hubs of Zhejiang and Guangdong may have dented output, they said.

Apparently, weather is a problem everywhere; as is clearly context. Economists will have to be bludgeoned by recession and even then it is doubtful they will entertain its possibilities until long after it has fully transpired (again). That is why there will be this endless game of “unexpected” weakness followed immediately by unequivocal exclamations about how “stimulus is finally working.” And so it goes, one following the other where, if absent any actual context, you would actually get the impression the economy (and this goes for anywhere; China, US, Europe, Japan, etc., wherever central banking is encouraging of orthodox prediction) has been nowhere near an obvious and easy-to-observe downward trajectory the entire time.

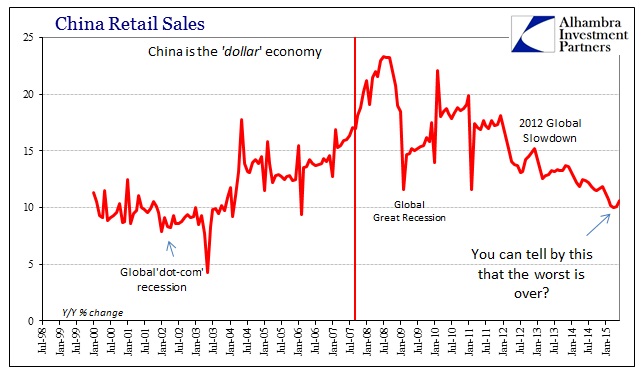

While economists were eager to talk about summer storms in specific parts of China, also this weekend automakers were out with projections for declining car sales – and thus car-making. Ford sees a full-year decline in its sales for the first time in almost twenty-years while VW, which had been heavily investing in Chinese production, just reported its first ever 6-month sales decline.

“Declining car sales are definitely a warning sign for the Chinese economy,” said Paul Gao, McKinsey & Co.’s Shanghai-based head of automotive practice in Asia. “It’s a reflection of consumer confidence.”

New car sales fell in June for the first time in more than two years. Ford projects the market at as small as 23 million units this year, compared with 23.5 million vehicles sold last year. Hyundai Motor Co. has also said its deliveries have fallen.

The small decline actually understates the problem of Chinese “demand”, as the real measure is not absolute changes but rather how far short of prior projections these levels might be – none of this was ever thought possible and such a downside was never forecast by any extrapolation taken from mainstream economists. So they blame the stock market instead, which is odd since the crash really didn’t happen until right at the end of six-month period.

The China Automobile Dealers Association last week warned that nationwide sales could drop for the first time in more than 17 years, if the country’s stock-market rout continues. The slump in equities hurts buyer sentiment, Luo Lei, deputy secretary-general of the industry trade group, said Friday.

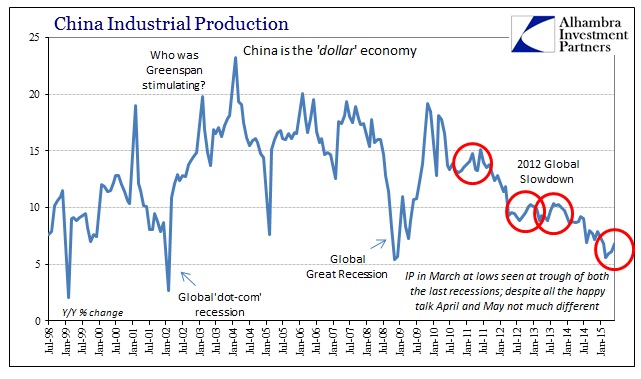

It’s almost Occam’s Razor at this point, which, in this context, is just global recession. China’s industrial production growth rate entering 2012 was almost 13%; last year when that “slump” was likewise pronounced over, victory of monetarism again, it was 9.2%. Earlier this year it had sunk to just 5.6%, rebounding only to 6.8% more recently. It doesn’t take much effort to see the connection, ignoring the “transitory” rebounds that are always here and there, especially as it spans almost four years.

It isn’t the scary low PMI that is the problem; it is the fact that such a sentiment number fits all-too-well in line with everything else that has stretched “transitory” to some new definition and meaning. So long as the eurodollar system is bent on decay, there was and is only one possible destination. It was, after all, the “dollar” that over a year ago that predicted all this. Unfortunately, it seems as if the “dollar” is predicting another wave perhaps even more serious. On the one side, there are winter snows in the US, summer storms in China, a port strike in between them both, and nothing more than raw emotions surrounding monetary “stimulus.” On the other, there is the actual trajectory beyond the ultra-short attention of a month or two, and the global financial regime that long ago pronounced a verdict on where this was all headed.

That would suggest any PMI’s usefulness is limited to how far along in the process. It seems as if the yuan is already in that mode.

Stay In Touch