On February 7, the 3-month LIBOR rate (US$) fell sharply. Traders were, as various media outlets reported, stunned. All sorts of excuses were issued, the goal of them cumulatively to deny your lying eyes. Falling LIBOR couldn’t have been the market, especially eurodollar futures, anticipating a rate cut because these same people had been saying (and betting) for nearly two years how awesome the (global) economy was becoming.

Globally synchronized growth doesn’t lead to falling LIBOR, let alone rapidly falling.

The Overnight Index Swap (OIS) rate was given as evidence for this theory. Because OIS had been steady at the time, for people who take OIS seriously (god knows why) these market moves were not about panicky Jay Powell feverishly jamming the transmission into reverse.

OIS isn’t what it is made out to be, in the same way federal funds target floors and ceilings aren’t what they are made out to be. In the mainstream religious canon, OIS like federal funds is sacred. Yet, forward OIS especially post-crisis has proved about as reliable as IOER (the joke).

IOER has since been further revealed as preposterous as has OIS. Guess what all these markets are now screaming about? Rate cuts. The probability for more than one, actually several, has grown considerably over the past three weeks.

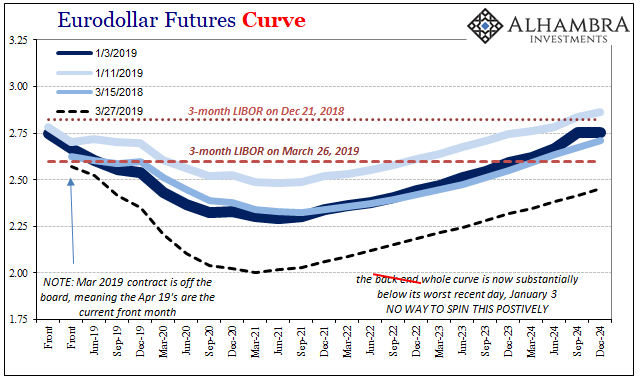

These curves tell us so much more than just a single factor; you have to consider the shape, their dimensions, everything about them.

Over these last six weeks, the eurodollar futures curve, as the UST curve, has contorted remarkably. I’ll isolate it for you below:

The back end fell sharply, which tells us something important about what’s going on now: whatever is unfolding, this crucial, deep market is projecting that it won’t be good. In fact, it could be of such severity that it actually impacts the intermediate and longer run trajectory of future money market rates (kind of like 2008 did).

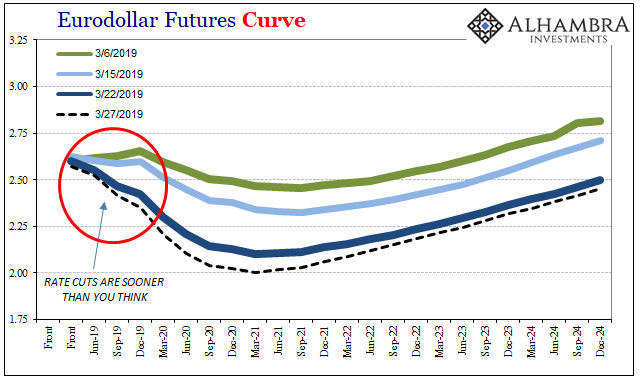

But we also see something very important in those front end contracts; or, what I’ve circled on that chart above. This isn’t something to worry about in 2020 or 2021. Exactly what I wrote on February 7:

What does it say about the state of the world when those hugely contradictory expectations [falling LIBOR] are being fulfilled? Rate cuts, official rate cuts, may be closer than you think.

There’s a lot of big stuff going on right now.

Realizing what this actually means, quite naturally you have to ask yourself, what would make Jay Powell turn around and go in reverse?

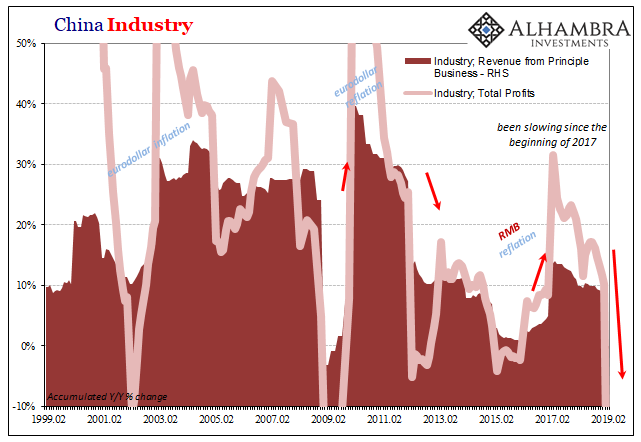

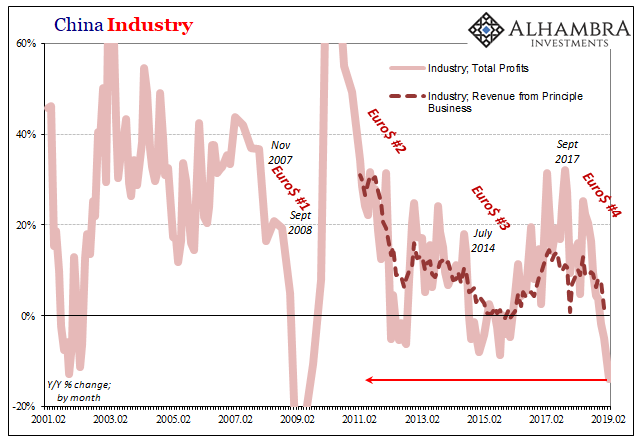

China’s National Bureau of Statistics reports today figures for Industrial Profits and Revenues which give us a partial answer.

On an accumulated basis, that is total profits for the entire YTD period, industrial firms booked bottom line growth of 10.3% for all of 2018. That was already concerning, about half the growth rate posted the year before in 2017. These same businesses have started out January and February 2019 with –14%.

Converting to a monthly basis, profits have been falling since November. However, -14% is a steep, steep drop unlike anything we’ve seen for a long time. It is, for Chinese industry, the worst hit to earnings since 2009. It’s already worse than 2015-16, a sharp global downturn which was for China’s economy a pretty sizable one especially in industry and manufacturing.

So, the industrial and manufacturing sectors in China, Germany, and Japan are already exhibiting the worst kinds of macro tendencies. And China’s hit is nearly two months old.

What is going to make Jay Powell begin cutting federal funds this year, perhaps earlier than especially mainstream analysis can possibly conceive?

Stay In Touch