Toward the end of June, Chinese RMB money markets seemed like they had weathered the worst of it. One month earlier, in late May, regulators had seized Baoshang Bank Co. sending waves of uncertainty rippling through markets in China and around the world. Authorities were quick to declare “nothing to see here”, blaming the bank’s close relationship with absentee billionaire Xiao Jianhua; seemingly an idiosyncratic problem rather than the first inkling of a systemic one.

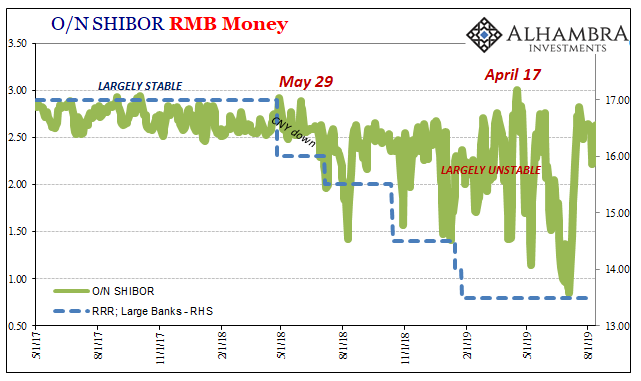

The overnight SHIBOR rate, the interest cost of lending unsecured RMB between banks for one day, had jumped to as high as 2.75% in the days before the government moved. Baoshang’s problems had been widely circulated before the action.

In China’s repo market, it was more of the aftermath. It would take until the middle and later weeks in June before repo would get back to normal. As the Wall Street Journal would then report:

Signs of funding stress in China’s money markets have abated after the country’s financial regulators urged banks and brokerages to restore calm, but the recent disruptions showed the financial system’s vulnerability to even small shocks.

That vulnerability, though, it keeps bubbling back up to surface. The overnight unsecured rate, SHIBOR, had collapsed through June and into July, hitting a multi-year low of 0.844% on July 4. Then the incredible volatility which has defined the RMB market for more than a year roared back in a hurry.

It took just eight sessions since that low for the liquidity rate to jump back above 2.70% again.

This instability, or vulnerability, is the product of several competing forces. On the one side, there is “stimulus” or at least what is classified as such. Going back to April 2018, banks have been allowed to use more of their reserve holdings as they might see fit. China’s required reserve ratio (RRR) has been reduced five times for large banks, seven times for smaller and medium banks.

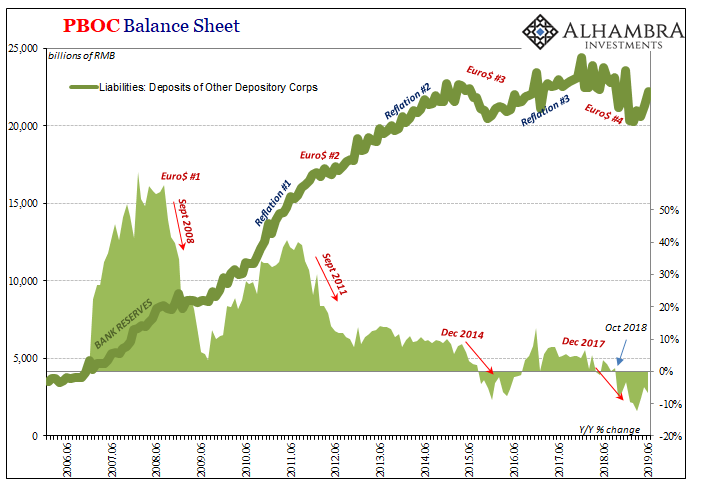

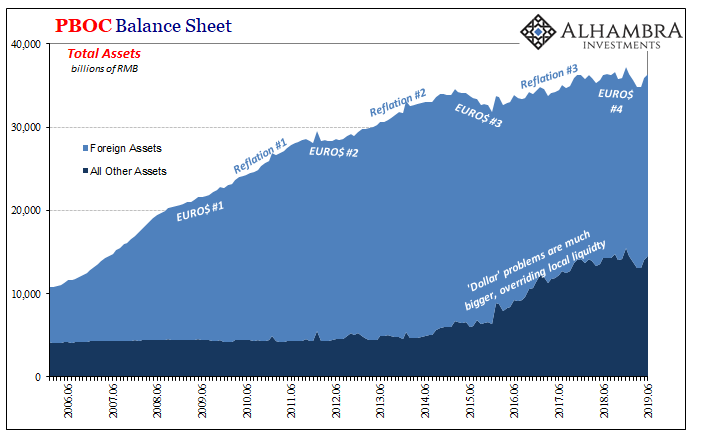

That’s considered as additional liquidity and usually where the mainstream leaves the discussion (ceteris paribus). But on the other side there is the PBOC which has been forced into its anti-printing press stance again. The reason for the RRR cuts is quite simple – the central bank is being made to scale back.

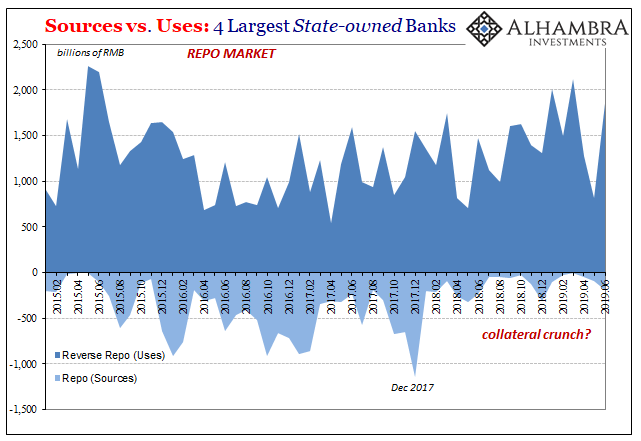

You can observe this difference playing out in China’s banking statistics. Beginning with the largest of the country’s state-owned banks, the so-called Big 4, the PBOC’s reduced liquidity footprint sets the stage. These giants are, or were, the pivotal redistribution point for vast majority of marginal PBOC changes.

In 2016, for example, the Chinese central bank had turned to these institutions hoping to rescue the economy from its Euro$ constrained potential hard landing. They didn’t quite respond as expected; the Big 4 mostly hoarded liquidity, and what wasn’t was instead offered back into the shadowy world of China’s shadow banking networks stoking bubble fears.

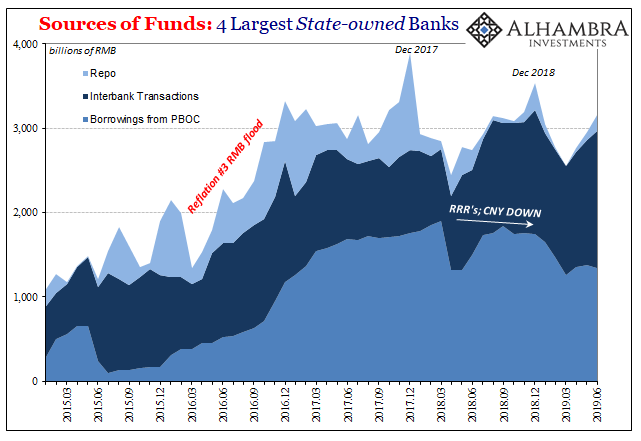

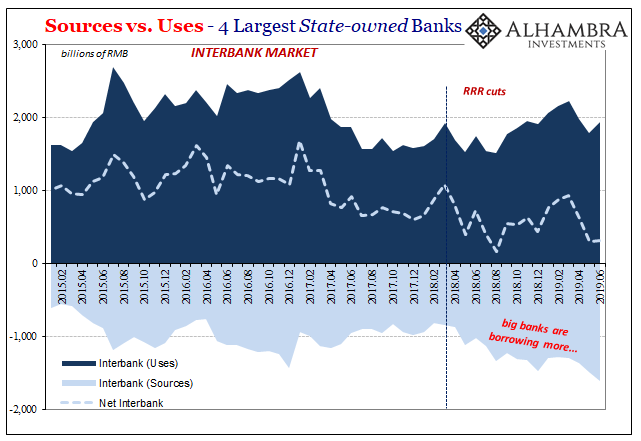

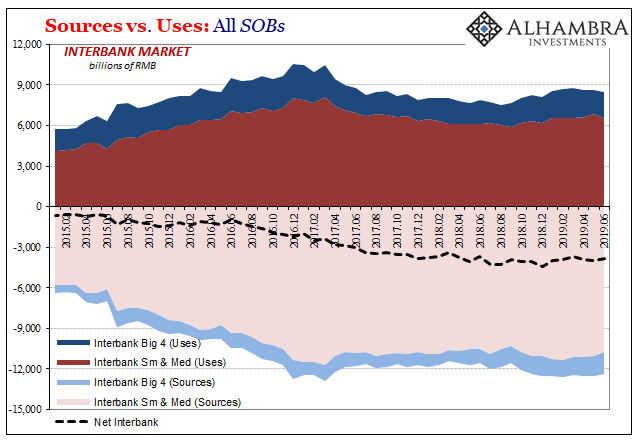

In response to the PBOC’s reverse, the Big 4 have turned to interbank borrowings at the margins. They are taking up more here therefore leaving less excess for all the other types of institutions operating in the RMB marketplace. This might account for the volatility in SHIBOR, but there remain other issues and questions.

For one, why unsecured interbank? It isn’t immediately clear why these firms have upped their marginal funding (sources) in unsecured rather than via the repo market. In fact, at the same time the Big 4 have borrowed more unsecured they’ve borrowed less, a lot less, from repo over the past year or so.

They’ve not been as shy about lending excess funds in repo, however. It raises the possibility that some of these firms may not be overflowing with collateral in their inventory; at least the most efficient and pristine forms of it. That would also raise questions about the systemic condition of collateral availability and redistribution.

It fits with last December’s curious introduction and support for “perpetual bonds.” Not only did these instruments increase bank capital, with the PBOC’s help they were coincidentally created as forms of collateral, too (you can read about them in more detail here).

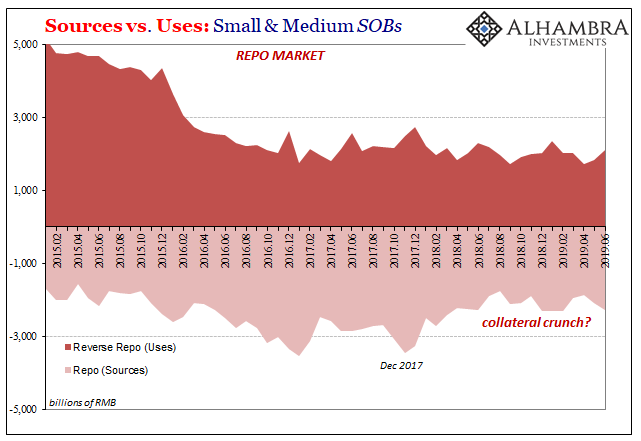

It’s not just the big banks, either. When we look at the category of Small and Medium SOB’s (state-owned banks), same thing.

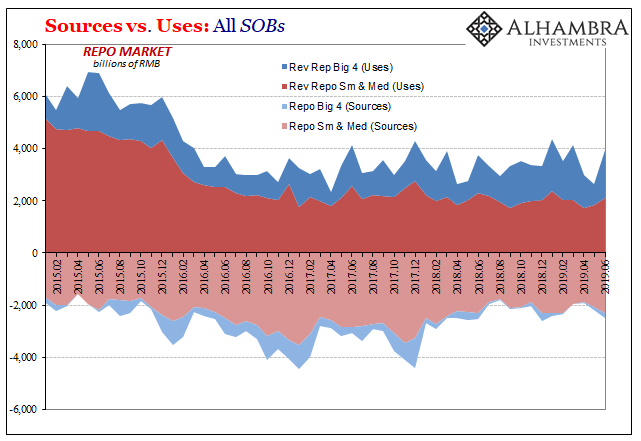

They are borrowing (sources) much less in repo than they had been before early 2018. Collectively, it’s as if all China’s SOB’s have been avoiding repo and therefore relying more so on unsecured interbank arrangements to fill out the last pieces of their balance sheets. Being SOB’s, they’re going to be given preference as unsecured counterparties.

Altogether, all forms of SOB’s are accessing repo at half the rate they were at the end of 2017.

But they are still lending into the market at about the same level. That would suggest demand maybe even trapped demand coming from the one section of China’s banking system not yet accounted for – the private financial firms which are those most responsible for the shadow system.

It’s as if the entire RMB system is being twisted under pressure; the SOB’s are increasingly preferred in unsecured (and may be preferring unsecured themselves given collateral constraints) which might suggest a form of still-developing risk aversion (on a counterparty level).

There hasn’t been a surge in demand for interbank funds, rather a sustained drain due to the state sectors during a period when the PBOC has been reducing its level of bank reserves. The SOB’s are taking up more of what’s offered here, leaving less of an excess for the rest of the private side including shadow conduits.

As a result, this may have herded or crowded out these others into repo using who-knows-what as collateral – which set the stage for Baoshang. Back to the WSJ:

Those worries then spread to the repo market. There, the recent spike in rates was likely a result of large banks tightening standards for collateral accepted, especially in transactions with nonbank borrowers, said Logan Wright, a Hong Kong-based analyst at research firm Rhodium Group.

To recap: the dollar squeeze on China has meant the PBOC has pulled back hoping the RRR cuts will offset its own reduced monetary footprint. That pressure has raised the temperature in unsecured lending, offset only somewhat by the RRR’s leading to the volatile mess you see in SHIBOR.

Normally we would expect especially SOB’s to move over to repo, but they aren’t or they can’t. Either changing preferences in unsecured or perhaps collateral actually is in short supply (a possibility further supported by the perpetual bond introduction), or both, the unsecured market is becoming solely a place for the most preferred types of counterparties (state-owned).

By being increasingly crowding out, what’s left for the rest of China’s banking system? Repo with questionable collateral at whatever terms anyone might be able to achieve. It would be a (cash and collateral) lender’s market at least up until there was reason to question all that questionable collateral.

The WSJ calls this “vulnerability” and that’s true. But it is originating at the top. The squeezing starts at the central bank and it seems to be working its way downward. This kind of monetary pressure isn’t constant nor is it predictable. And with CNY, meaning dollar shortage, still ticking away there’s bound to be more questions and more tests of vulnerability.

Maybe even a collateral bottleneck, Chinese style.

Stay In Touch